NEWS

Investors Eye Earnings As Stocks Stabilize

Global markets stabilized overnight and closed in the green despite some late-day selling. Economic data is light this week, so although macro worries remain, investors are paying close attention to company earnings. Let’s see what you missed. 👀

Today's issue covers additional context on yesterday’s volatility, Super Micro’s earnings slump, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with real estate (+2.21%) leading and healthcare (+0.46%) lagging.

And here are the closing prices:

S&P 500 | 5,240 | +1.04% |

Nasdaq | 16,367 | +1.03% |

Russell 2000 | 2,064 | +1.23% |

Dow Jones | 38,998 | +0.76% |

P.S. We’re experimenting with different formats to streamline your experience. Like something, don’t like something, hit me up. I want to hear from you. 👍

EARNINGS

Market Catches Its Breath After Historic Slump

Monday’s historic move in volatility was followed by another historic move, this time in the opposite direction. The Volatility Index ($VIX) went from a high of 68 yesterday to an intraday low of 24 today, closing at 27.70.

However, some market analysts suggest we are unlikely to see a V-shaped recovery in the market after such a large spike in volatility. 😫

Andrew Thrasher, CMT, shared a great chart today showing previous instances that saw further downside before an ultimate recovery. It also reinforced the perspective of several charts we shared yesterday, which suggested that forward returns are strong after volatility spikes but that the path to getting there would be bumpy. 🫨

Some traders on Stocktwits are taking shots on the long side at current levels. For example, @Honeystocks shared his view of the Russell 3000 index (representing 98% of investible U.S. equities), which suggests that if prices are above their 2021 highs, then the bull case remains intact. 🐂

Still, other Stocktwits users are not so sure. Sentiment on the platform remains mixed, with the S&P 500 and Dow Jones Industrial Average sitting in ‘bearish’ territory, while the Nasdaq 100 is ‘bullish.’ The Russell 2000 remains the odd man out, with sentiment stuck in neutral for now.

Let us know what you’re doing, and we’ll share the data tomorrow. 👇

What moves are you making?

STOCKTWITS & 11thESTATE PARTNERSHIP

Get Your Piece Of The $200m Uber Settlement

In 2019, Uber went public and raised over $8.10 billion. Soon after, the company faced major financial losses and several accusations. Uber was criticized for bypassing local regulations in many areas and for ignoring serious safety issues, including sexual assaults, deaths from crashes, and fatal assaults before the IPO.

Uber agreed to pay $200M to investors to settle claims that its subsidies increased costs during the IPO and that planned cuts could have risked key growth opportunities.

EARNINGS

Super Micro Slumps Despite Stock Split

Artificial intelligence (AI) plays like Super Micro Computer are scrutinized heavily in the current environment, with investors questioning whether their business fundamentals can meet lofty outlooks and valuations.

Super Micro Computer’s shares have a volatile after-hours session, rising sharply before falling deeply into the red. 🙃

Adjusted earnings per share of $6.25 were well below the $8.07 anticipated by analysts, while revenues of $5.31 billion beat the $5.30 billion expected.

The company said its gross margin fell from 17% to 11.20% YoY, which analysts flagged as a major concern given its “record demand of new AI infrastructures.” The company blamed stock-based compensation and supply chain issues as the primary reasons for the earnings and margin compression. 🔻

Those headwinds are not expected to dissipate anytime soon. Management’s first-quarter revenue guidance easily topped estimates, but the midpoint of its earnings guidance was below the consensus view.

The earnings call did not help things, with prices accelerating to the downside following management’s answers to various questions. 😐

So, if earnings and margins are a concern, what caused the stock to pop? Initial excitement about the company’s announced 10:1 split and revenue beat caused traders and investors to rush in. However, as Wall Street digested the results, the stock gave back its gains (and then some). ⏪

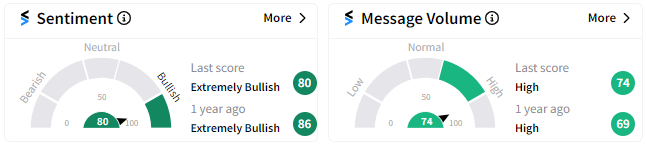

Still, retail investors are seemingly sticking by the company and focusing on its long-term potential. Stocktwits sentiment remained near its YTD highs in the ‘extremely bullish’ range after the results. 💪

EARNINGS

Other Noteworthy Pops & Drops

Uber: The ridesharing and food delivery giant’s earnings per share and revenue both topped expectations. It was an upbeat quarter by most metrics, and management’s third-quarter guidance quenched Wall Street’s appetite. Shares rose 11% as Stocktwits sentiment moved into ‘extremely bullish’ territory. 🚗

Jumia Technologies: The African e-commerce company fell sharply after the majority of its key metrics missed analyst estimates. Additionally, the company filed to sell more than 20 million American Depositary Shares (ADSs) at $10.59 to raise the funds needed to reignite user growth. Shares fell more than 53% as Stocktwits sentiment hit ‘extremely bearish’ territory, even as people debated the merits of another company acquiring it. 📦

Lumen Technologies: The fiber and telecommunications company secured $5 billion in new business related to AI connectivity and announced it’s in active discussions to secure another $7 billion in sales opportunities. After the close, shares extended gains to more than double on the day after its second-quarter earnings and revenue topped expectations. 🤖

Airbnb: The vacation rental company warned of moderating QoQ growth in its key “Nights and Experiences” category with it’s “seeing shorter booking lead times globally and some signs of a slowdown from U.S. guests.” Earnings per share missed expectations, with revenue beating marginally. Shares fell 16% after the bell, with Stocktwits sentiment in ‘neutral’ territory. 🛋️

SunPower: The residential rooftop solar installer has filed Chapter 11 bankruptcy protection and is planning to sell its assets. Shares fell 44%, while its largest stakeholder, TotalEnergies, also dipped 1% on the news. 🪫

Disney: The media giant is raising streaming prices for Hulu, Disney+, and ESPN+ to boost its revenue and margins. Beginning in mid-October, most plans will cost $1 to $2 more per month. Disney continues to push its customers toward bundles as part of its strategy, with shares popping 2% on the news. 📺

Kenvue Inc: The parent company of Band-Aid and Tylenol reported strong quarterly results and reiterated its financial guidance. It sees 2024 net sales growth of 1% to 3% and adjusted earnings per share of $1.10 to $1.20. Shares rose 3%, and Stocktwits sentiment pushed back into ‘bullish’ territory. 🩹

Links That Don’t Suck

🧑💻 Register for a free 2-hour trading workshop on 8/10 to learn the fundamentals of sound investing*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍