NEWS

Investors Swap Graphics Cards For Cardboard Boxes

Big tech’s breakouts continued, with money finding its way to laggards like Amazon and Tesla. Your regularly scheduled Daily Rip author, Mr. Tom Bruni, is traveling today. So you’re in the good hands of Stocktwits’ lead crypto analyst and Litepaper author, Jon Morgan. 👀

Today's issue covers a possible rotation out of leaders into laggards like Amazon, Nvidia’s shareholder meeting, and an earnings recap about Micron, Levi Strauss, and BlackBerry. 📰

Here's today's heat map:

2 of 11 sectors closed green. Consumer discretionary (+1.45%) led, & energy (-0.98%) lagged. 💚

U.S. crude oil inventories shot up by 3.591 million barrels vs. expectations for a drop of 2.85 million. Gasoline stocks also surged by 2.654 million barrels, and refinery utilization took a nosedive by 1.30%. 📉

Speaking of oil, over half of oil executives surveyed by the Dallas Fed think U.S. crude output will be headed south if the shale sector’s merger frenzy keeps up. With $250 billion in takeovers, don't expect the U.S. to surprise the oil market like it did with last year’s production spike. 🛢️

May new home sales fell 11.30% MoM and 16.50% YoY, as higher rates and record-high prices put a lid on housing market activity. That’s a six-month low, with the level of new home inventory on the market rising to its highest since October 2022. 🏠

Whirpool shares surged 17% on news that Bosch may be preparing a takeover bid for the company. Vista Outdoors jumped another 9% after MNC Capital Partners raised its bid to $3.20 billion. 💰

Southwest Airlines slumped after cutting its second-quarter revenue guidance, citing “changing consumer behavior.” 🛬

LGBTQ+ dating app Grindr rose to a 1.5-year high after the company’s investor days outlined a roadmap that leverages AI and should help it grow revenues 20-25% annually through 2027. 💗

FedEx shares jumped 15% to $294.50, marking the largest percentage increase since 1986, following the announcement of a review of its freight business. Analysts speculate this review could lead to a potential spinoff, which some market participants have been regularly pushing for. 🚚

General Mills forecasts a mixed fiscal 2025 with adjusted EPS expected to fluctuate between a 1% decrease and a 1% increase, and organic net sales potentially rising up to 1%. The company anticipates improved volume trends, driven by new products and strong brand campaigns, though category growth is projected to lag behind long-term goals. 🥞

Chipotle executed its massive 50-for-1 stock split, making its shares more accessible to employees and retail investors. Pre-split shares worth $3,283.04 are now trading as 50 shares at around $65 each, marking a historic move for the company. Analysts see potential benefits in attracting new investors, though some warn of increased volatility. 🌯

The crypto crowd is throwing a party after anti-crypto Rep. Jamaal Bowman got the boot, and pro-crypto Rep. John Curtis scored a win. These primary results could shake up U.S. digital asset policy, backed by a hefty dose of crypto community cash. 🏆

Other active symbols: $DJT (+7.72%), $ALT (-16.22%), $VLCN (+18.70%), $AVAV (+0.05%), $SOXX (-0.39%), and $QCOM (-2.39%). 🔥

Here are the closing prices:

S&P 500 | 5,478 | +0.16% |

Nasdaq | 17,805 | +0.49% |

Russell 2000 | 2,018 | -0.21% |

Dow Jones | 39,128 | +0.04% |

COMPANY NEWS

Nvidia CEO Jensen Huang’s Big Plans: AI Domination and No Looking Back 🦾

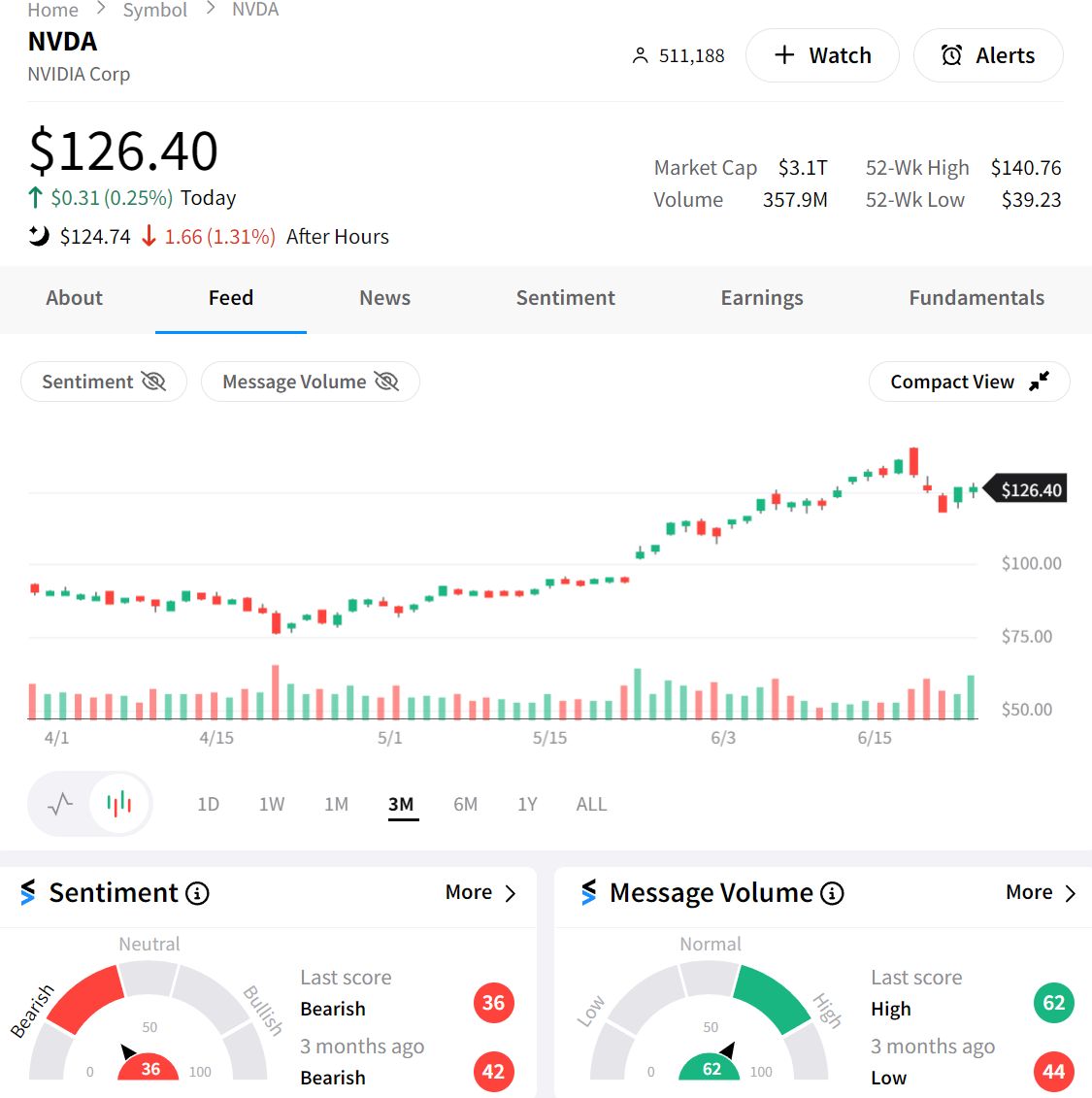

$NVDA CEO Jensen Huang took the stage at the company's first shareholder meeting since their stock went nuclear. 🤖

Since last year's meeting, Nvidia's stock has skyrocketed 193%, the company hit a $3 trillion valuation, and even briefly snagged the title of the most valuable company in the U.S.

Betting Big on AI

Huang noted Nvidia’s edge in the AI chip game, crediting a decade-old bet on AI that’s paid off massively. Billions of dollars in investments and thousands of engineers later, Nvidia’s got an 80% market share in AI chips. Not bad for a company that used to be all about gaming.

During the Q&A, Huang tackled questions about rising competition without naming names. He laid out Nvidia’s strategy: they’ve morphed into a data center powerhouse and are now eyeing new markets like industrial robotics. Their game plan? Partner up with every computer maker and cloud provider out there. 🫂

Huang made it clear that Nvidia’s AI chips are the “lowest total cost of ownership.” Sure, other chips might be cheaper, but when you factor in performance and running costs, Nvidia’s chips are the smarter buy. It’s all about creating a “virtuous circle” where more users lead to better improvements, which in turn attract even more users.

“The NVIDIA platform is broadly available through every major cloud provider and computer maker, creating a large and attractive install base for developers and customers, which makes our platform more valuable to our customers,” Huang said.

Shareholders Are Happy

Shareholders gave a big thumbs up, approving a nonbinding vote on executive compensation. Huang’s pay package for 2024? A cool $34 million, up 60% from last year. When your company becomes the most valuable in the world, a hefty raise seems just right. 🚀

STOCKS

Trading Chips For Cardboard Boxes 📦

Nvidia’s stint as the world’s most valuable company didn’t last long. Over the past five trading days, the stock has slid -11%. 👇

The Ripple Effect in Tech

$NVDA’s decline wasn’t an isolated event. The fall triggered a broader tech sector sell-off, especially among companies tied to the AI boom. Super Micro Computer ($SMCI), which relies heavily on Nvidia’s AI chips, has been down by 13% over the past five trading days. Similarly, $QCOM is also down a similar amount over that time period. 🔴

$AMD appears to have bucked the five-day trend - it’s up +1%.

Despite the recent dip, Nvidia's value has nearly tripled over the past year. Last week, it briefly surpassed Apple and Microsoft to become the most valuable U.S. company, boasting a market cap of over $3 trillion. But after such a meteoric rise, investors are taking a breather and locking in gains. 🔒

Investors Look Elsewhere

As Nvidia's stock cooled, investors shifted their focus to other tech giants, notably Amazon and Tesla. $AMZN stock rose 3.90%, pushing its market value past the $2 trillion mark.

Tesla, too, has seen renewed investor interest as funds flowed from Nvidia's profit-taking into other tech laggards. $TSLA is knocking on the critical $200 level, closing today at $196, a +4.82% gain. 🔼

STOCKTWITS “CHART ART”

The Crowd Is Catching Onto The Latest Cyber Breakout 🤩

With investors and traders spreading the love beyond a few names in tech, stocks like Crowdstrike are getting a second look as shares consolidate just below all-time highs.

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

EARNINGS

Micron, Levis, And Some Old Phone Company’s Earnings 💰

Micron Reports, Investors Sell

Micron ($MU) just flexed its tech muscles with a Q3 performance that beat Wall Street's modest expectations. The chipmaker posted an EPS of $0.62, outpacing the $0.51 consensus, and reported revenue of $6.81 billion, also beating forecasts. 👍

CEO Sanjay Mehrotra credited "robust AI demand and strong execution" for the company's 17% sequential revenue growth. High Bandwidth Memory (HBM) products are flying off the shelves, and data center SSD revenue hit a record.

Looking ahead, Micron sees Q4 EPS around $1.08, give or take 8 cents, with revenue projections at $7.60 billion, plus or minus $200 million. 💵

Micron's data center revenue grew by over 50% sequentially, driven by the AI boom. The mix of data center revenue is set to reach record levels in fiscal 2024 and keep growing in fiscal 2025. The company expects ongoing price increases through 2024.

Micron is currently down 5% after market hours and 9% over the past five trading days. 🌊

Levi Strauss Reports Mixed Q2 Results, Hikes Dividend

Levi Strauss & Co. ($LEVI) is keeping its denim game tight, with global direct-to-consumer (DTC) revenue climbing 8% in Q2 and 11% when adjusted for currency swings. 🪙

Wholesale net revenues rose 7%, or 8%, in constant-currency terms. In the Americas, net revenues soared by 17% on a reported basis and 16% in constant-currency terms. Adjusted for some shipment timing and the Denizen business exit, the Americas still managed a 3% increase, while the U.S. nudged up 2%.

Europe, however, seems to be having a bit of a wardrobe malfunction, with net revenues dipping 2% in both reported and constant-currency terms. On the bright side, that's an improvement from Q1. Asia was a mixed bag, with revenues flat year-over-year but up 6%, following a 27% surge last year. 📉

To sweeten the deal for investors, Levi announced an 8% hike in its quarterly dividend to $0.13 per share, totaling about $52 million. The payout will hit shareholders’ wallets on August 20, 2024, for those holding Class A and Class B shares as of August 2, 2024.

After market hours trading shows the pants are on fire - but not in a good way. LEVI is down -12% in the after-market session. 👖

BlackBerry’s Strategic Moves Pay Off in Q1

Out of the three earnings we’re looking at, this dumpster fire turned meme stock is the only one in the green after-market. For the quarter ending May 31, 2024, they blew past revenue expectations for both IoT and Cybersecurity. 💥

$BB CEO John J. Giamatteo couldn't help but pat himself on the back, boasting about the company's push towards operational independence for its two main businesses and its progress towards profitability.

BlackBerry reported a total revenue of $144 million for the first quarter of fiscal 2025. The IoT (Internet of Things) division shocked with an 18% year-over-year revenue growth, clocking in at $53 million, which surpassed the company’s guidance. IoT’s gross margin was an impressive 81%. 🤯

Meanwhile, the cybersecurity division didn't slack off either, exceeding guidance with $85 million in revenue and a 59% gross margin. The division also saw a 2% sequential increase in annual recurring revenue (ARR), hitting $285 million, with dollar-based net retention rate (DBNRR) improving for the third consecutive quarter to 87%.

Licensing and other revenue stood at $6 million. Despite a non-GAAP operating loss of $12 million and a GAAP operating loss of $39 million, BlackBerry beat its own guidance for a change. 😐

Adjusted EBITDA was negative $7 million. Total cash and investments totaled $283 million, with operating cash usage remaining flat at $15 million and free cash usage decreasing for the third consecutive quarter to $16 million.

BlackBerry is up nearly +7% in after-hours market trading. 📈

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍