NEWS

Investors Yearn For Earnings

Big tech rebounded as investors await a slew of earnings this week, with over 500 companies reporting results. Tesla, Google, Spotify, and more are on deck for tomorrow, so we can expect some big moves. Let’s see what you missed. 👀

Today's issue covers Ryanair losing altitude, AMC’s refinancing deal, Bank of America and Verizon dipping, and Ethereum ETF approvals. 📰

Here's today's heat map:

10 of 11 sectors closed green. Technology (+2.37%) led, & energy (-0.63%) lagged. 💚

China surprised the market with a rate cut after President Xi’s short-term stimulus plans disappointed investors. The move highlights the central bank’s urgency to support growth, with it emphasizing the need for fiscal stimulus. ✂️

Small-cap natural gas company Tellurian popped nearly 70% on news that Woodside will acquire it for roughly $900 million, widening its U.S. presence. 🤝

Tesla shares popped 5% ahead of tomorrow’s earnings report after Elon Musk said the company would begin using Humanoid robots next year. 🤖

CrowdStrike plummeted another 13% as the fallout from the global tech outage it caused weighed on investors’ perception of its long-term future. 😰

Shares of toymaker Mattel rallied 15% on a Reuters report that private equity firm L Catterton approached it with an acquisition offer. 🎱

And NXP Semiconductor dipped 8% in extended hours after its second-quarter adjusted earnings missed expectations despite revenue being in line. 🏭

Other active symbols: $S (+6.72%), $SAVA (+27.28%), $DIS (-1.68%), $SERV (+16.16%), $RR (-6.80%), and $MLGO (-10.49%). 🔥

Here are the closing prices:

S&P 500 | 5,564 | +1.08% |

Nasdaq | 18,008 | +1.58% |

Russell 2000 | 2,221 | +1.66% |

Dow Jones | 40,415 | +0.32% |

EARNINGS

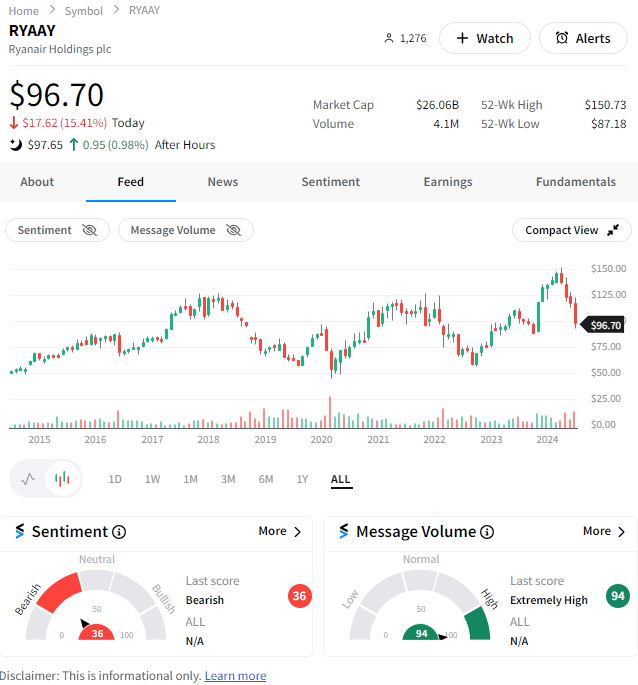

Ryanair Loses Altitude Amid Airline Turbulence

The budget airline saw profits tumble 46% YoY, dragging its European peers like EasyJet, Jet2, and Wizz Air down during today’s trading. 🙃

Although passenger traffic rose 10% YoY to 55.50 million during the quarter, increased competition and capacity have pushed prices down. The company now expects second-quarter fares to be materially lower than last summer vs. previous expectations of flat to modestly up.

Still, it’s trying to push forward and make hay while the sun shines, operating its “largest ever schedule” with over 200 new routes and five new bases. However, investors remain concerned about its inability to drive profits and lack of visibility into the coming quarters. 😬

As a result, Ryanair shares plunged 15%, and stocktwits sentiment turned bearish as investors expressed concern about management’s ability to navigate the broader industry headwinds. 🐻

Meanwhile, Delta struggles to recover from CrowdStrike’s impact on its systems over the weekend, even as its competitors are back to normal. Management says technical issues are weighing on its crew-tracking software, making it difficult to coordinate staff and causing 1,300+ delays and cancellations on Monday. ❌

SPONSORED

A.I. Trade Finder With Nearly Perfect Historic Win Rates

Stop trying to find the right stocks to trade on your own! Instead, use this revolutionary A.I. “Trade Finder” that analyzes the entire stock market in seconds and auto-generates stock & options trades with previous gains as high as 1,729%, every single morning.

Join pro trader Charlie Moon as he breaks down this brand-new A.I. software - LIVE on Tuesday at 8 PM ET. Click the button below to reserve your free seat before we reach capacity.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

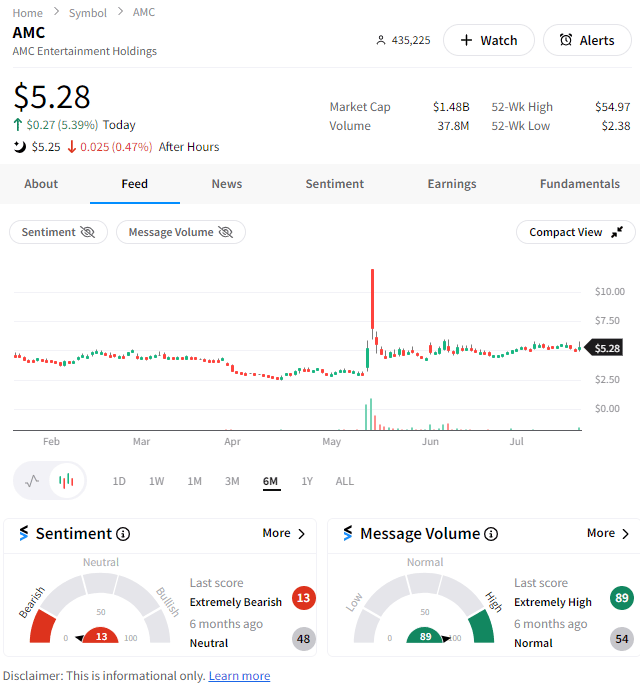

AMC Reaches Refinancing Deal

Beaten-down “meme stock” AMC Entertainment is back with another round of financial engineering to extend its runway.

The company agreed with creditors to extend up to $2.45 billion in debt maturities from 2026 to 2029 (or later). It’ll also reduce its total debt burden by $464 million by exchanging convertible notes for equity. 💸

As we’ve been saying for much of the last few years, management has unsuccessfully turned its core business profitable and will need debt or equity financing to buy more time to turn things around.

Investors are getting a fresh taste of that again, with shares down marginally and the Stocktwits sentiment meter hitting “extremely bearish” territory and roughly three-month lows. While management is optimistic that box office challenges are behind us, investors and analysts are unsure. 🤷

Meanwhile, the content wars continue to heat up as Warner Bros. Discovery tells the NBA it will match Amazon’s media rights offer. Live video and events (specifically sports) are on fire right now, and media giants are paying up to get their piece of the action. 💵

STOCKS

Berkshire Trims Its Bank Of America Stake

Two blue-chip stocks took a hit today for separate reasons but are worth mentioning. Let’s take a look at Bank of America and Verizon. 👀

With financials finally having their time in the sun, Warren Buffett’s Berkshire Hathaway is taking some chips off the table. A regulatory filing revealed the conglomerate sold 33.90 million shares at a $43.56 average selling price. 🏦

The $1.50 billion sale marks the first time since the fourth quarter of 2019 that it’s reduced its stake in the bank, though it remains its second-largest equity position after Apple. It still holds a whopping 999 million shares and maintained its spot as the bank’s second-largest shareholder (10.80% stake).

Still, some view this as a short-term top signal in a financial sector that’s seen a sizeable runup over the last year. Others view this as a common practice and his remaining position as a sign that he’s still confident in the company’s ability to continue higher over the long term. 💰

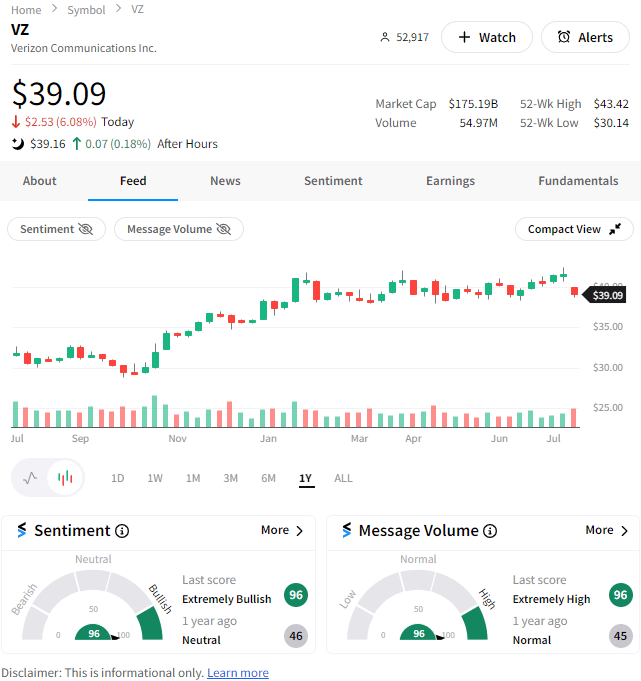

Meanwhile, retail investors are apparently “extremely bullish” on Verizon despite a six percent drop in today’s trading. 🙃

The company’s earnings met expectations, but its quarterly revenue missed estimates due to slow phone upgrades. Management says its myPlan program and promotional bundles with streaming services have given it a slight edge over AT&T and T-Mobile U.S. in a competitive telecom market.

While prices dropped today, sentiment among retail investors remains bullish for two core reasons.

First, many believe that Apple's integration of artificial intelligence (AI) into its upcoming phones will lead to a major upgrade cycle. Additionally, many view Verizon’s high dividend yield as an opportunity to get paid while they wait for its core business to rebound in the coming quarters and years. 💸

Time will tell if they’re right, but for now, they’re betting on a rebound in the telecom giant and further weakness in America’s second-largest bank. 🤔

CRYPTO

Spot Ethereum ETFs Finally Approved

Crypto prices have held up well over the last few weeks for several reasons, but one has been spot Ethereum ETFs gaining final regulatory approval.

And…we finally have news that five of these funds will begin trading tomorrow.

Our lead crypto analyst and writer, Jonathan Morgan, explains all the details in today’s Litepaper, which you should definitely read.

But for you equity-obsessed folks, check out our “Chart Of The Day” from Stocktwits user @Dr_Stoxx, showing Coinbase breaking out of its recent base to new highs. 📈

Many seem to think today was the start of the crypto-related-equity market’s next leg higher. Time will tell if they’re right, but regardless, many people have these stocks on their radars for the days and weeks ahead. 🤩

Bullets From The Day

🍪 Google backtracks plans to kill third-party cookies in Chrome. Advertisers collectively rejoiced after Google decided it would not kill third-party cookies but instead offer a new experience in the browser that allows users to make informed choices about their web browsing preferences. The company said its original plan would have adversely impacted online publishers and advertisers, so its updated approach focuses on elevating user choice. Engadget has more.

🍟 McDonald’s to extend its $5 meal deal after seeing an uptick in traffic. The promotion was initially supposed to run through the end of July but will be expanded through August after 93% of all McDonald’s restaurants voted yes to extend the deal. U.S. Chief Marketing Officer Tariq Hassan said the deal successfully drove foot traffic back from its competitors and boosted its image as an “affordable brand.” More from Yahoo Finance.

🧑⚖️ European Union (EU) threatens to fine Meta for its claim that Facebook is ‘free.’ The “pay or consent” model remains under scrutiny by European regulators, with the EU’s Consumer Protection Cooperation (CPC) Network saying the company has until September 1st, 2024, to propose changes to its “misleading” and “confusing” model. The Verge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍