NEWS

Japanese Yen Unwind Jolts Global Markets

It had been 474 trading days since the S&P 500’s last 3% selloff—until today—when we knocked that countdown back to zero. Last week’s global market selloff accelerated once futures markets reopened Sunday evening and have been in rough shape since. Let’s see what you missed. 👀

Today's issue covers why Japan sent the market into a tailspin, what experienced traders are doing in the current environment, and other noteworthy pops and drops from the day. 📰

Here’s the S&P 500 heatmap. 0 of 11 sectors closed green, with industrials (-1.74%) leading and technology (-3.33%) lagging.

And here are the closing prices:

S&P 500 | 5,186 | -3.00% |

Nasdaq | 16,200 | -3.43% |

Russell 2000 | 2,039 | -3.33% |

Dow Jones | 38,703 | -2.60% |

P.S. We’re experimenting with different formats to streamline your experience. Like something, don’t like something, hit me up. I want to hear from you. 👍

STOCKS

Your TLDR On The Yen, U.S. Economy, And Federal Reserve

If you woke up and thought that Japan was trending because of its Olympic performance, you were quickly disappointed once you opened your portfolio. ☹️

And in case your immediate response was to close your phone and not read three million explanations on the Yen carry trade, we’ll do our best to simplify the takeaways for you.

First, we’ll start with Stocktwits user letstradetogether’s excellent summary of the Japanese Yen’s recent volatility and why it triggered a global meltdown. 💴

As for the timing of the sell-off, essentially overleveraged institutions were forced to de-risk over the weekend. That led them to sell crypto because of its 24/7 nature. Then they moved to sell currencies, equities, and other assets once the futures markets opened on Sunday night and into Monday morning. 🔻

These fears essentially gave the market, which was already nervous about the labor market’s softening and the Fed’s potential misstep, a reason to sell off further. Additionally, the volatility caused some market participants, like Wharton’s Jeremy Siegel, to call for an emergency Fed rate cut.

However, the evidence (for now) suggests this selloff has more to do with positioning and less to do with true fears of a U.S. recession. If it were, there would be more signs, like credit spreads widening rapidly. ⚠️

Instead, what we saw was stocks levered to the U.S. housing market rallying along with treasury bonds today. Rocket Companies and Better Mortgage were among today's best performers, while others, like Redfin, Comerica, etc., fell less than the overall market. And check out the nice long-term reversal setting up in Rocket (h/t Stocktwits user Honeystocks).

If investors were truly worried about the U.S. economy falling sharply into a recession, they would not buy beaten-down fintech stocks whose underlying businesses are tied to mortgage and housing activity.

And remember, the stock market is not part of the Fed’s mandate. If the economy is not materially impacted by what’s happening, the Fed is not going to call an emergency meeting and cut rates. If anything, the market would likely view that as a “panicked” move and not respond kindly… 🙃

Michael Batnick, Director of Research at Ritholtz Wealth Management, offered a very measured take in his post about today’s selloff. 👇

Allow me to offer a positive outlook on what looks to be a very ugly day. This is an unwind: margin calls, leverage, selling everything, etc. I would much rather have this type of selloff than one that’s caused by earnings tanking and a re-rating in stock market multiples.

Over the weekend, I listened to the most recent calls from Amazon, Meta, and Apple. And let me tell you something: the backbone of our stock market is in the hands of really strong businesses.

So, if we assume the world as we know it is not ending, what are the experienced traders on Stocktwits doing in this environment? 🤔

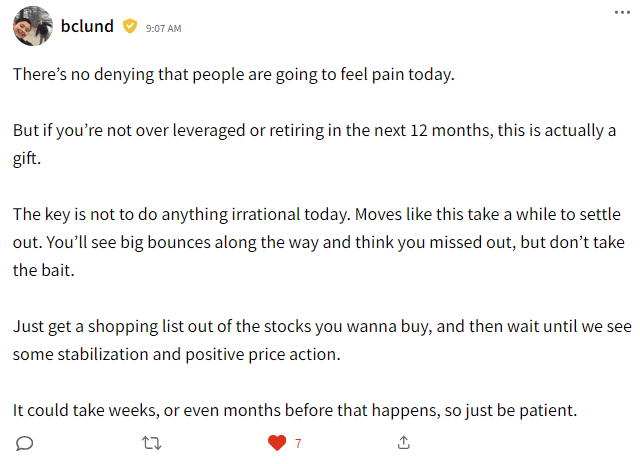

Stocktwits OG Brian Lund offered his decades of experience to the community, saying now is the time to prepare your shopping list for when the dust settles…whenever that turns out to be. 🤷

Meanwhile, Stocktwits user FlynancialAnalyst was our “Chart Of The Day” in today’s “Chart Art” newsletter for his bullish perspective on the small-cap Russell 2000 ETF ($IWM). 🐂

He’s betting that the classic technical analysis tenet that “former resistance turns into support” will hold true again, writing, “$IWM is sitting on VWAP from Oct '23 lows, trendline support, and 40 wk SMA. This is not where you sell $VOT $IWO $IWC”

If you’re worried about Japanese stocks specifically, well, the data suggests on-year forward returns following a 3-day crash are actually above average. However, the path to get there is often not an easy one. 🫨

As we discussed late last week, volatility is a feature, not a bug, of markets. Times like this are the reason equities pay a risk premium over cash, bonds, and other lower-risk assets. It’s the price we pay for a long-term payday.

Nobody knows exactly how this situation will play out. But what’s clear is that whether you’re an investor or a trader, having a clear plan to navigate this environment is key. Be safe out there, y’all; I'll catch you back here tomorrow with another recap of what’s likely to be a wild day. 🥴

STOCKS

Other Noteworthy Pops & Drops

Palantir Technologies: The AI software company popped 12% after its earnings and revenue topped estimates, while management raised its full-year guidance on ‘unrelenting’ AI demand. 🤖

Kellanova: The packaged food giant jumped 16% on a Reuters report that M&M-owner Mars is preparing an acquisition bid for the company. It posted better-than-expected results, too, though antitrust concerns remain. 💵

ZoomInfo Technologies: The software company fell 12% after announcing its longtime CFO is leaving the company. It also cut its full-year outlook. 📉

Chegg: The edtech platform fell 19% to new all-time lows despite its second-quarter earnings and revenue topping expectations. Soft guidance and continued worries about AI eating into its business weighed on shares. 📚

Tyson Foods: The chicken giant rose 2% after its earnings and revenue topped expectations, with its stronger outlook for chicken offsetting continued struggles in its beef segment. 🍗

Lucid Motors: The electric vehicle maker said its largest shareholder, Saudi Arabia’s Public Investment Fund, will inject up to $1.50 billion in cash to help support a production ramp of its new SUV. The news helped quell some fears that the fund was growing frustrated with the company and would no longer provide capital to support it. 🔋

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍