NEWS

Kashkari Crashes The Market

Stock market bears have been awaiting a catalyst to help them push prices lower, and Federal Reserve Bank of Minneapolis President Neel Kashkari delivered it. His hawkish comments around the path of inflation and rate cuts sent the market tumbling toward its worst loss in months. Let’s see what else you missed. 👀

Today's issue covers the doubts cast on rate cuts, Lamb Weston shares getting mashed, and a health insurance stock on life support. 📰

P.S. Want the best charts and trade ideas delivered straight to your inbox? Starting next Monday, we’re doing just that with our new “Chart Art” newsletter. See what to expect and subscribe for a free gift toward the end of today’s newsletter. 🎁

Here's today's heat map:

0 of 11 sectors closed green. Energy (-0.06%) led, & technology (-1.58%) lagged. 💔

Marketing giant HubSpot jumped 5% on news that Alphabet is reportedly weighing an offer for the $32 billion company. 💰

Software stock Zeta Global popped 14% after Morgan Stanley upgraded it from equal weight to overweight, saying it expects positive revisions to valuation and forward estimates. 👍

Paramount Global shares slumped 9% following reports that the media giant would likely need to raise new equity capital to move forward with Skydance Media’s merger proposal. 💸

Meta shares hit a new all-time high intraday after analysts at Jeffries and RBC raised their price targets, citing dominance in the digital ad market. Jeffries analysts wrote the company “has too many advantages to count.” 🤩

Amylyx Pharma remains near all-time lows on the news that it will pull its ALS drug from the market after a study showed patients didn’t benefit from it. As it attempts to survive, it will cut 70% of its staff. ✂️

Levi Strauss shares were up as much as 18% after its holiday earnings came in higher than expected. The company also raised fiscal 2024 guidance and said it’s seeing record sales through its higher-margin direct-to-consumer channels. 👖

Other active symbols: $AMD (-8.27%), $SQ (-6.18%), $TSLA (+1.62%), $TLRY (-5.96%), $CGC (-10.19%), $CDAL (+280.95%), & $UVXY (+6.37%). 🔥

Here are the closing prices:

S&P 500 | 5,147 | -1.23% |

Nasdaq | 16,049 | -1.40% |

Russell 2000 | 2,054 | -1.08% |

Dow Jones | 38,597 | -1.35% |

STOCKS

Fed Official Casts Doubt Over Rate Cuts

Minneapolis Fed President Neel Kashkari may not be a voting member of the Federal Open Market Committee (FOMC), but he sure likes sharing his opinions anyway…especially in the public eye. 🙄

Most Fed members have been seen in the media reiterating the consensus view that the central bank will cut at least three times in 2024, albeit warning that they would likely come in the back half of the year.

However, Kashkari, best known for his proprietary “frozen lasagna” inflation indicator, disagrees and was sure to let the market know. 🍝

During a virtual event today, he said, “In March, I had jotted down to rate cuts this year if inflation continues to fall back towards our 2% target. If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.”

He continued, calling the January and February inflation readings “a little bit concerning” and alluding to the economy and labor market’s persistent strength in the face of higher rates.

Earlier this week, we touched on several “technical” divergences building in the global stock market indexes, leaving them vulnerable to a potential pullback. We noted then that sellers lacked a clear catalyst to confirm those divergences and take short-term control of the trend. 📉

Well, Kashkari handed that catalyst over to the bears on a silver platter. That, combined with escalating tensions in the Middle East and Eastern Europe, sent stocks into a tailspin that they couldn’t recover from.

The chart below shows prices closing below their uptrend line and 20-day moving average, signaling to many traders and technical analysts that we’re in a risk-off environment in the short term. ⚠️

With tomorrow’s non-farm payroll data in focus, investors and traders are remaining cautious and protecting gains after a strong start to the year. 🛡️

And just in case this turns out to be the start of a larger market decline, I’ll be trademarking the term “Kashkari Crash” as soon as this newsletter goes out. 🤣

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

EARNINGS

Lamb Weston Shares Get Mashed

Lamb Weston is one of the world’s largest producers and processors of frozen potato products, but unfortunately, mashed potatoes were on the menu for investors as the stock experienced its largest one-day loss on record. 😱

Adjusted earnings per share of $1.20 fell short of the $1.45 expected, while sales rose just 16% YoY to $1.46 billion. Those sales were well below consensus estimates of $1.65 billion.

The company’s transition to a new enterprise resource planning (ERP) system in North America negatively impacted quarterly results more than anticipated. It reduced the visibility of finished goods inventories at distribution centers, impacting its ability to fulfill customers’ orders. 🥔

The result was lower sales volumes and margin performance, as well as a $25 million write-off of excess raw potatoes.

While it believes the impact of this change is largely behind it, its full-year fiscal outlook had to be reduced and disappointed Wall Street.

Despite investors’ gains getting fried in the process, Stocktwits community sentiment remains in “extremely bullish” territory as retail discusses the company’s long-term leadership position in the market. 🐂

We’ll have to wait and see if their optimism pays off or if they continue to get a raw deal on their potato bets. Time will tell! 🤷

STOCKTWITS “CHART ART”

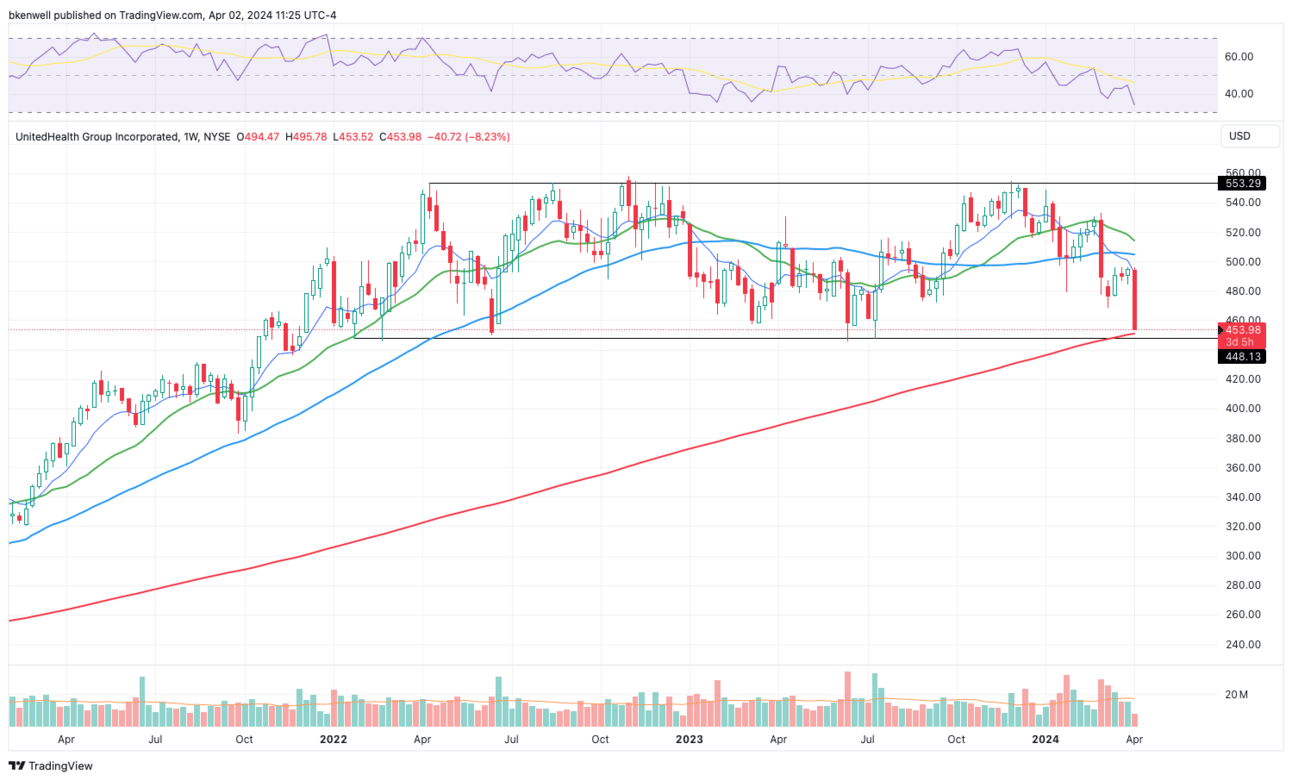

A Health Insurance Giant On Life Support 🧑⚕️

If you liked the chart and commentary above, you’ll love our new “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

We’re officially launching on Monday, April 8th. But to sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

🪫 Ford delays push into EVs, pivots to hybrids. The automaker is delaying production of an all-electric SUV and pickup truck, instead focusing on offering hybrid options across its entire North American lineup by 2030. The company says it will continue to invest in EVs, but it has to adjust with the market which has experienced a major slowdown in demand and increased competition in the U.S. and overseas. CNBC has more.

💵 Biden administration gives out $20 billion to “green banks.” The new funding is designed to support tens of thousands of clean energy and pollution-cutting projects across the U.S. It’s the largest single non-tax investment in 2022 climate law, the “Greenhouse Gas Reduction Fund.” Overall, the program is designed to mobilize private capital levels that far exceed taxpayer dollars by focusing on poor and disadvantaged communities most impacted by pollution. More from Axios.

🔐 The Disney+ password-sharing crackdown is upon us. Like other streaming giants, Disney is looking to juice its revenue and growth numbers by preventing users from sharing account access outside of their households. While anti-password sharing rules initially went into effect during the first quarter, the company is planning to roll out a “paid sharing” model beginning in a few countries this June before executing a broader rollout. The Verge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍