NEWS

Let’s Just Rename Monday GameStop Day

For those of us covering markets, our new version of the “Sunday Scaries” is Roaring Kitty rolling up to his keyboard to put out a post just before the weekend concludes. We’ve seen this two times, with his post yesterday revealing a massive position in GameStop and setting off another round of silliness. Let’s see what you missed. 👀

Today's issue covers an update to the GameStop saga, the NYSE’s latest trading hiccup, and why oil prices slid to a multi-month low. 📰

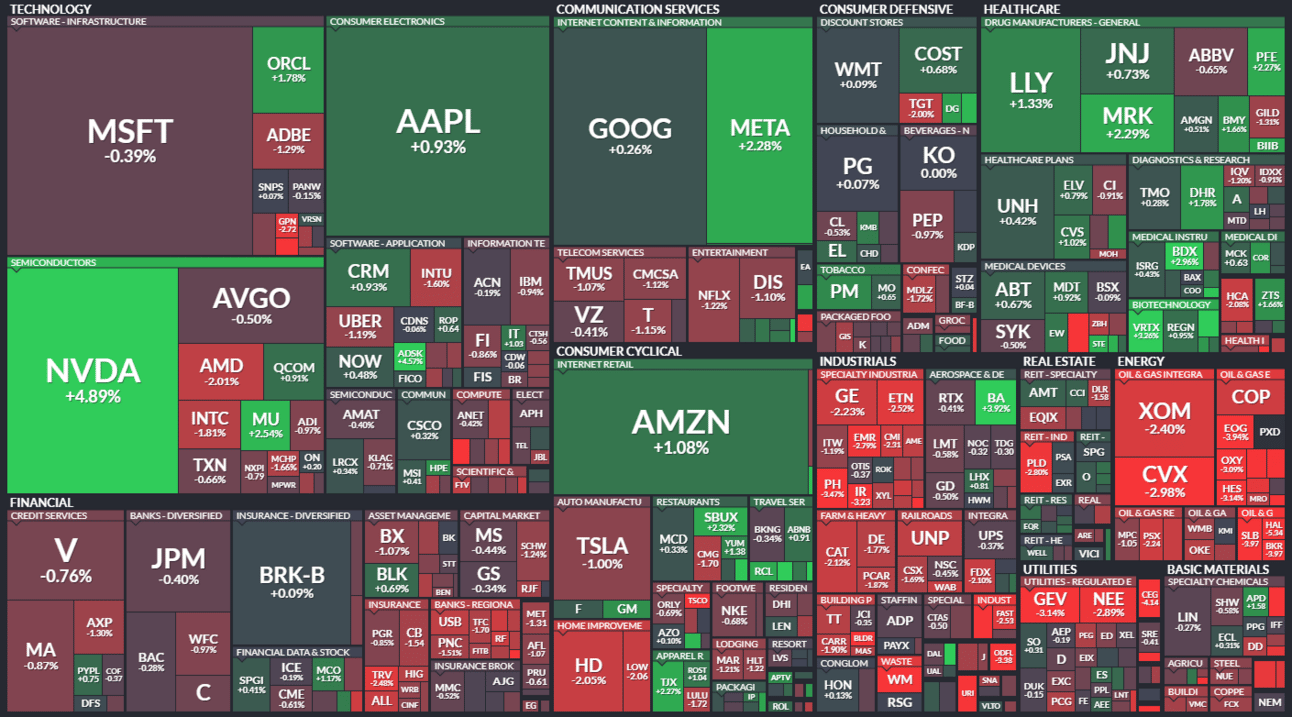

Here's today's heat map:

3 of 11 sectors closed green. Healthcare (+0.70%) led, & energy (-2.62%) lagged. 💚

Manufacturing data remained mixed in May, with ISM’s PMI missing analyst expectations, while S&P Global’s U.S. PMI saw another slight uptick in May. 🏭

Paramount Global shares popped 7% on reports that Paramount and David Ellison’s Skydance (backed by RedBird Capital and KKR) have agreed to deal terms. The deal, which has risen in value from $5 to $8 billion, now awaits signoff from controlling shareholder Shari Redstone. 📺

Waste Management shares fell 4% on news that it will acquire competitor Stericycle in a deal valued at roughly $7.20 billion ($5.80 billion in cash and $1.40 billion in the assumption of net debt). 🗑️

Merck and Moderna both jumped after their experimental vaccine improved survival in patients with deadly skin cancer. And Structure Therapeutics surged 55% after its experimental anti-obesity drug showed positive results in its midstage clinical trial. 💉

Betcon, Dickinson and Company rose 3% after acquiring Edward Lifesciences’ critical care products in a $4.20 billion all-cash deal. Meanwhile, pharma giant GSK fell 9% after a setback in the more than 75,000 cases related to claims that its Zantac drug contains carcinogens. 🧑⚖️

Software company Autodesk rose 5% on news that it will not restate its financial results after an investigation into its accounting practices. 📋

Recreational boat and yacht services company MarineMax jumped 27% on reports that OneWater Marine is looking to buy it for $40 per share. 🛥️

Other active symbols: $NVDA (+4.89%), $FFIE (+7.10%), $CRDL (+6.11%), $AFMD (+68.51%), $GWAV (-26.44%), & $CRKN (+17.90%). 🔥

Here are the closing prices:

S&P 500 | 5,283 | +0.11% |

Nasdaq | 16,829 | +0.56% |

Russell 2000 | 2,060 | -0.50% |

Dow Jones | 38,571 | -0.30% |

STOCKS

Don’t Hate The Player, Change The Game

If you’re just getting up to speed on the Roaring Kitty x GameStop collab of the summer, check out our newsletter from two weeks ago that explains the story in detail. But for the rest of you, let’s dive into the latest twist and turns… 🙃

It all began familiarly, with traders enjoying a quiet Sunday evening and preparing for the week…only to be uno-reversed-carded by the man himself.

That was accompanied by a Reddit post from his account, which outlined a massive position in GameStop…owning 5 million shares of common stock and thousands more $20 strike call options expiring in about three weeks. That’s a position worth over $210 million. 🤯

This news obviously sent GameStop shares soaring via the platforms that offer 24/7 trading, which continued in the pre-market hours. The stock rose about 75% at the open, though that turned out to be the high of the day. 🔺

Throughout the day traders and investors theorized what his next move would be. Did he sell into the strength? Is he buying more? Why did he amass so many short-dated call options? But answers they did not receive…

Instead, what we learned from an exclusive WSJ report was that Morgan Stanley’s E*Trade brokerage was considering removing Roaring Kitty from its platform due to “market manipulation” concerns. 🚫

That poured fuel on an already raging fire of online discourse, with everyone chiming in with their thoughts. Many see it as Wall Street changing the rules of the game on retail investors and traders once again.

Even Dave Portnoy came to Roaring Kitty’s defense, disclosing his own issues with E*Trade in his usual, colorful language. 😆

Despite all of the noise and mayhem around the stock today, shares still closed up around 21% on the day. And Roaring Kitty posted another update showing his massive $85 million gain as of today’s close.

In other words, he’s not leaving. At least not yet…it appears.

Whether there’s a greater purpose in his return remains up for debate. But what’s clear right now is that he’s here to secure the bag. And securing it he is…

Our social team did a great job of summarizing today’s sentiment in one tweet. We’ll leave it at that and be back tomorrow with more updates. 🫡

STOCKS

Maybe We’re Not Ready For 24/7 Trading…

Last week, the S&P 500 and Dow Jones Industrial Average prices did not update for over an hour…and this week, several stocks seem to have traded down nearly 100% for a short period. 🫨

An NYSE spokesperson confirmed a “technical issue” with industry-wide price bands that triggered trading halts on up to 40 symbols. But while those limits were hit, some stocks like Warren Buffett’s Berkshire Hathaway Class A shares had traded hands at a 99.97% discount to Friday’s closing price.

Talk about a case of the Mondays…right? ☹️

Nevertheless, the NYSE announced it was canceling all “erroneous” trades for Berkshire that occurred at or below $603,718.30 (or between 9:50 and 9:51 am ET). The ruling was final, though the exchange said it could bust other trades as its investigation progresses.

Some market participants weren’t happy with the exchange's explanation despite its immaterial impact on the broader market indexes. 😠

Trust is an essential element for markets to function normally, and between the GameStop saga and somewhat frequent technical issues, the “ultra curious” are spinning up some wild theories…

Nonetheless, maybe all these recent errors and concerns should give us pause before we push onward into this “24/7 trading” world that many want to dive into so quickly. Lord knows we writers aren’t ready to cover all the mayhem that would be unleashed on a daily basis…

With “meme stocks” and other factors driving increased activity during what’s typically a quieter part of the year, we’ll have to wait and see if there are any more technical issues that impact market participants’ experience in the coming months. I’ll have my popcorn ready. 🍿

IN PARTNERSHIP WITH MONEYSHOW

Join Me At The Virtual MoneyShow Next Week! 👀

My presentation, “Where Retail Investors & Traders Are Making Money in 2024,” will take place on June 11th, 2024, from 11:15 to 11:45 am ET. Register for free, and I’ll see you there! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

COMMODITIES

OPEC+ Can’t Stop The Energy Wreck

Just as everyone got on the energy trade bandwagon, the market flipped the script. WTI crude fell to a four-month low following the OPEC+ decision, while beaten-down natural gas prices jumped.

OPEC+ agreed to extend its supply cuts into 2025 but allowed the unwinding of voluntary cuts beginning in October. This could signal several members’ desire to increase their output levels despite lower prices. ⚠️

Additionally, demand concerns remain with growth slowing in the U.S. and globally. Also, the risk premium associated with the Middle East is subsiding as a potential deal to wind down the Israel-Gaza war begins to take shape.

All eyes will be on this week’s energy inventories estimates, but the short-term momentum is clearly lower. And from a bigger-picture perspective, most of the energy complex’s performance is flat over the last three years. 😮

Energy stocks continue to drift lower, jeopardizing many potential breakouts. Meanwhile, those levered to natural gas are continuing to catch a bid as traders bet that the market’s aggressive rebound has more to run. 🤷

Bullets From The Day

👗 Fast-fashion firm Shein eyes London IPO amid U.S. regulatory scrutiny. Reports are the company’s confidential filing, which could take place as soon as the coming week as it seeks approval for a potential London-based initial public offering that could value it at around $64 billion. It last raised funding at $66 billion in 2023 and could likely score a much higher valuation on the New York Stock Exchange (NYSE), but has failed to satisfy regulator, exchange, and investor concerns. Reuters has more.

🎞️ X rolls out the red carpet for adult content. The social media platform has formally created rules for otherwise active NSFW (not safe for work) communities that have been allowed to flourish on its platform due to a lack of oversight. The new rules will still allow this content but say it must now be properly labeled so that its systems can prevent users under 18 (or those who haven’t added their birthdays to their profile) from accessing it. More from TechCrunch.

🔺 Spotify is raising prices for the second time in a year. The Swedish streaming giant announced another round of price hikes for its U.S. subscription plans, rising between $1 and $3 in July. This did not come as a surprise for those following the stock, given management suggested this move was coming as it looks to drive further into profitability. However, they recognize the value of various subscription tiers to offer users flexibility around what content they want to pay for. Yahoo Finance has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍