NEWS

Macro Moves Make For A Messy Market

Source: Tenor.com

U.S. stocks remain subdued by broader macroeconomic headwinds, though the energy sector has caught a renewed interest from investors and traders. Below the surface, however, there remains notable speculation occurring in some of the market’s most volatile businesses. 👀

Today's issue covers why all eyes are on oil, speculative names continuing to trend, and which stock got a major boost from the U.S. Department of Energy (DoE). 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with energy (+1.76%) leading and consumer discretionary (-1.16%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,700 | -0.17% |

Nasdaq | 17,918 | -0.04% |

Russell 2000 | 2,180 | -0.68% |

Dow Jones | 42,012 | -0.44% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $PW, $EVGO, $NRGV, $AMTD, $STEM 📉 $STZ, $BFLY, $PLBY, $BAC, $RKT*

*If you’re a business and want to access this data via our API, email us.

COMMODITIES

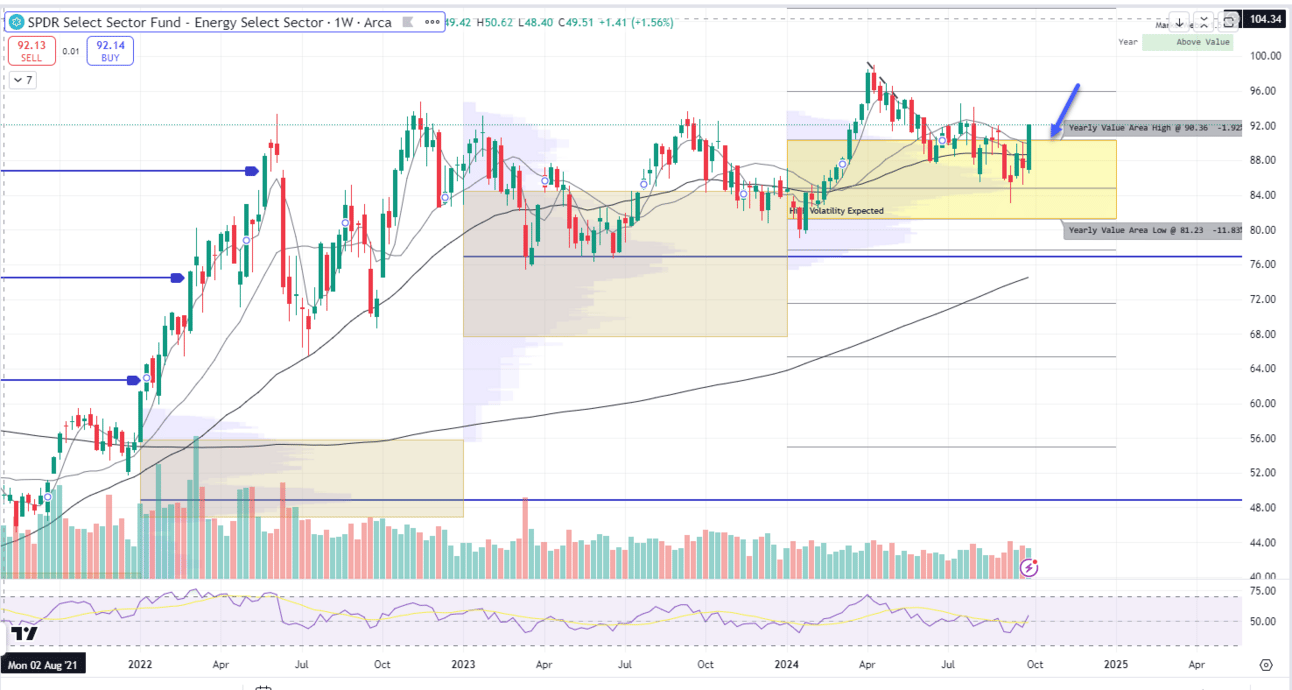

Another Day All About Oil 🛢️

U.S. and global crude oil prices continued their gains today on speculation that Israel could strike Iranian oil facilities as retaliation for yesterday’s missile barrage.

When reporters asked whether the U.S. would support that, President Joe Biden said, “We’re discussing that. I think that would be a little - anyway… there’s nothing going to happen today.” 😬

Still, the market quickly worked to price in that potential risk, pushing U.S. crude oil prices back into positive territory on a YTD basis. As a result, bulls and bears are heavily debating whether this is a temporary pop in prices or the start of a rebound in the broader energy sector.

Stocktwits user @cfromhertz shared a balanced perspective on why the sector could be ready for a sustained rally. 🤔

Bears argue that spare OPEC+ capacity would sufficiently cover any disruption to Iran’s exports if they’re impacted. However, analysts are primarily worried about supply disruptions in the Strait of Hormuz.

One analyst noted this would add a significant risk premium to oil and could push oil prices back to $200 per barrel if Iran’s infrastructure is materially impacted. ⚠️

Most see that as a worst-case risk, but the consensus view right now is that oil prices will likely have an upward bias until there is more clarity about the Middle East conflict’s impact on the market.

STOCKTWITS & 11thESTATE PARTNERSHIP

Effortlessly Find & Claim Shareholder Settlements 🕵️

In 2023, public companies settled a whopping $8.1 billion with investors. However, 75% of shareholders haven't claimed their payouts!

Even now, Apple, Alphabet, Zoom, and 50 other companies are distributing settlements to investors. Yet, most people either don’t know about these settlements or prefer not to spend time on the paperwork.

11thEstate identifies relevant settlements and recoveries, handles all the paperwork, and delivers the payouts to your account.

STOCKS

Speculative Plays Have Been Trending For Days 😵💫

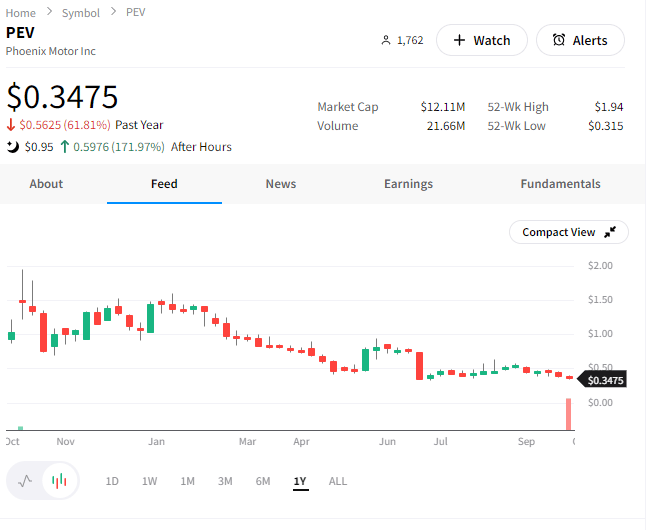

Phoenix Motors is the latest speculative name to experience a major surge. The nano-cap provider of light and medium electric vehicles surprised investors with a better-than-expected earnings result. 😮

Its first-quarter net revenues surged from $1.8 million last year to $9.4 million, with a net income of $14.8 million exceeding last year’s net loss.

During the quarter the company completed several major moves, including:

Acquired Proterra’s Transit business and battery lease portfolio

Received an order for six zero-emission electric buses

Formed a partnership with InductEV for wireless vehicle charging tech

Appointed a new COO and CFO,

Raised $11.1 million through private placements

Announced plans for an AI development center

The better-than-expected results were enough to help the stock rebound from all-time lows, soaring 167% after the bell. Given that many are betting against the stock, some traders speculate that this could be the catalyst for prices to make a sustained move to the upside. 💸

Source: Stocktwits.com

Regardless of how you feel about Phoenix Motors, a notable amount of activity is occurring in many of these “speculative” market bets.

Chinese micro/small-caps like AMTD Digital Ltd. ($AMTD), Magic Empire Global Ltd. ($MEGL), and UP Fintech Holding Ltd. ($TIGR) are among some of the most active and newly watched names on Stocktwits this week. 🫨

It just goes to show that attention and money are always flowing somewhere on the long side, even when seemingly important global events impact the “macro” picture.

How long this burst in speculative behavior will remain in these stocks remains to be seen. But for now, traders are taking advantage of the volatility while it’s here. Speculate safely, y’all. 🤷

COMPANY NEWS

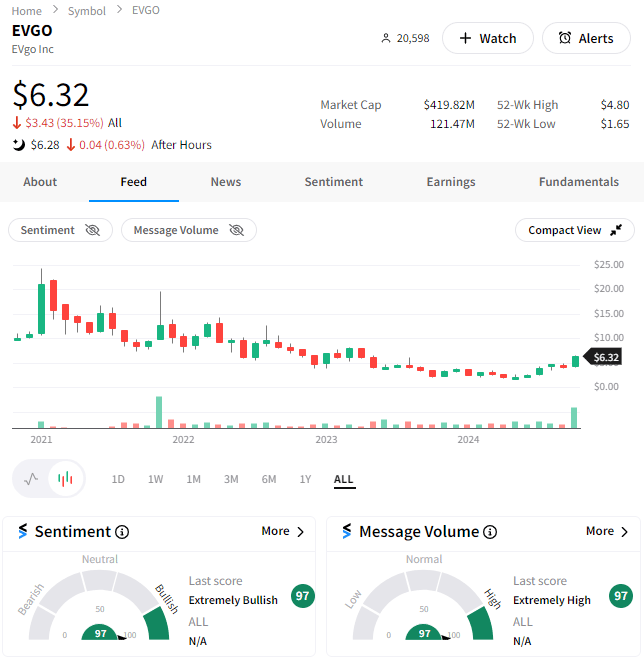

EVGo Gets A Boost From The U.S. DoE ⚡

While we’re on the topic of speculation, let’s talk about a beaten-down name that investors believe may have turned a corner earlier this year…and is getting an additional boost from the U.S. Department of Energy (DoE).

The small-cap owner and operator of a U.S. fast-charging network for electric vehicles (EVs) received a conditional loan guarantee of up to $1.05 billion to expand its network. 💵

The funding will help it build 7,500 additional fast-charging stalls across several states, as the Biden administration aims to bolster the nation’s charging network to 500,000 by 2030. 🔋

$EVGO shares surged 61%, their largest jump since January 2021 on the back of this news and an upgrade from JPMorgan to overweight.

The analyst expects firms that own and operate their own charging infrastructure to outperform over the long-term. And the Stocktwits community seems to agree, with sentiment hitting its highest level in a year. 📈

Source: Stocktwits.com

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls/Average Hourly Earnings (8:30 am ET), Unemployment/Labor Force Participation Rate (8:30 am ET), and Fed Williams Speech (9:30 am ET). 📊

Pre-Market Earnings: Apogee Enterprises ($APOG). 🛏️

After-Hour Earnings: None — enjoy your weekend! 🎧

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋