NEWS

Market Cap Kings Carry New Highs

The largest tech stocks in the world continue to rally, pushing the large-cap Nasdaq 100 and S&P 500 indexes to new heights. Meanwhile, the small-cap Russell 2000 and price-weighted Dow Jones Industrial Average have been left in the dust. Let’s see what else you missed. 👀

Today's issue covers investors eating up an AI IPO, Netflix joining the tech rally, and the market’s latest and greatest worry. 📰

Here's today's heat map:

4 of 11 sectors closed green. Technology (+0.37%) led, & industrials (-1.01%) lagged. 💚

Consumer sentiment unexpectedly fell to 7-month lows as worries over inflation and weaker incomes, especially among middle and lower-income Americans. 👎

Visa and Mastercard shares inched down on news a New York judge said she will “likely not approve” the $30 billion fee settlement, with opposers saying the temporary solution imposed a “virtually limitless” ban on future claims. 💳

Tesla shares fell today, even as Elon Musk claimed Optimus robots could make Tesla a $25 trillion company, which would be more than half the value of the S&P 500 today ($45.50 trillion) and a quarter of annual global GDP. 😂

Shopify continued its recent rally after Evercore ISI upgraded the stock from in line to outperform, citing its large addressable market. 🛒

Other active symbols: $GME (-1.44%), $ADBE (+14.51%), $SEDG (-7.88%), $SOFI (-5.00%), $AUPH (+5.61%), and $VXRT (-23.67%). 🔥

Here are the closing prices:

S&P 500 | 5,432 | -0.03% |

Nasdaq | 17,689 | +0.12% |

Russell 2000 | 2,006 | -1.61% |

Dow Jones | 38,589 | -0.15% |

IPOS

Investors Scoop Up Latest AI IPO

Demand for AI-related stocks and assets remains robust, with the latest U.S. initial public offering (IPO) reiterating that trend. 🤑

Google-backed Tempus AI went public on the Nasdaq today, with the healthcare diagnostics company pricing 11 million shares at the top end of its $35 to $37 price range. That allowed it to raise $410 million at a roughly $6 billion valuation.

Shares popped 10% at the open and traded as high as 15% above their initial pricing, closing roughly where they opened. 🔺

As for what the company actually does, it’s applying artificial intelligence and data analysis to help better inform the medical profession.

Its filing stated: “…we endeavor to unlock the true power of precision medicine by creating Intelligent Diagnostics through the practical application of artificial intelligence, or AI, in healthcare. Intelligent Diagnostics use AI, including generative AI, to make laboratory tests more accurate, tailored, and personal. We make tests intelligent by connecting laboratory results to a patient’s own clinical data, thereby personalizing the results.”

Interestingly enough, its founder and CEO Eric Lefkofsky was the co-founder and former CEO of Groupon…which has not been great to public market investors. We’ll see how his fourth public company experience turns out, as he remains the largest shareholder via his VC firm, Lightbank. 👨💼

Here’s a quick view of how shares traded, as investors and traders will likely have this one on their radar for the days and weeks ahead. 👀

STOCKS

The Latest Thing To Worry About

We all know that the largest tech stocks in the U.S. continue to defy gravity, with Apple getting its mojo back and Nvidia joining the $3 trillion club. 🤩

However, the lack of participation among other S&P 500 components has some investors and traders worried about the sustainability of this rally.

The chart being passed around this week was the S&P 500’s market-cap weighted index relative to the equal-weighted index. While it’s not expected that these two move with the same magnitude, technical analysts like to see them move directionally together.

Both indexes have been trending together for most of the last year but split in early April. While not a surefire signal by any means, technical analysts view this divergence as a potential warning sign of the market’s momentum being at risk. ⚠️

As for what will resolve this…the bears argue that once the market’s largest stocks stop going up, the index will come tumbling down because there are no stocks to offset that weakness.

However, bulls argue that money will rotate out of the biggest winners and into other market areas investors view as having more potential upside. So rather than a price correction, we’ll simply see other sectors start to drive the index’s performance.

As always, time will tell who is right. One point in favor of the bulls is the chart below from our “Chart Art” newsletter. 👇

STOCKTWITS “CHART ART”

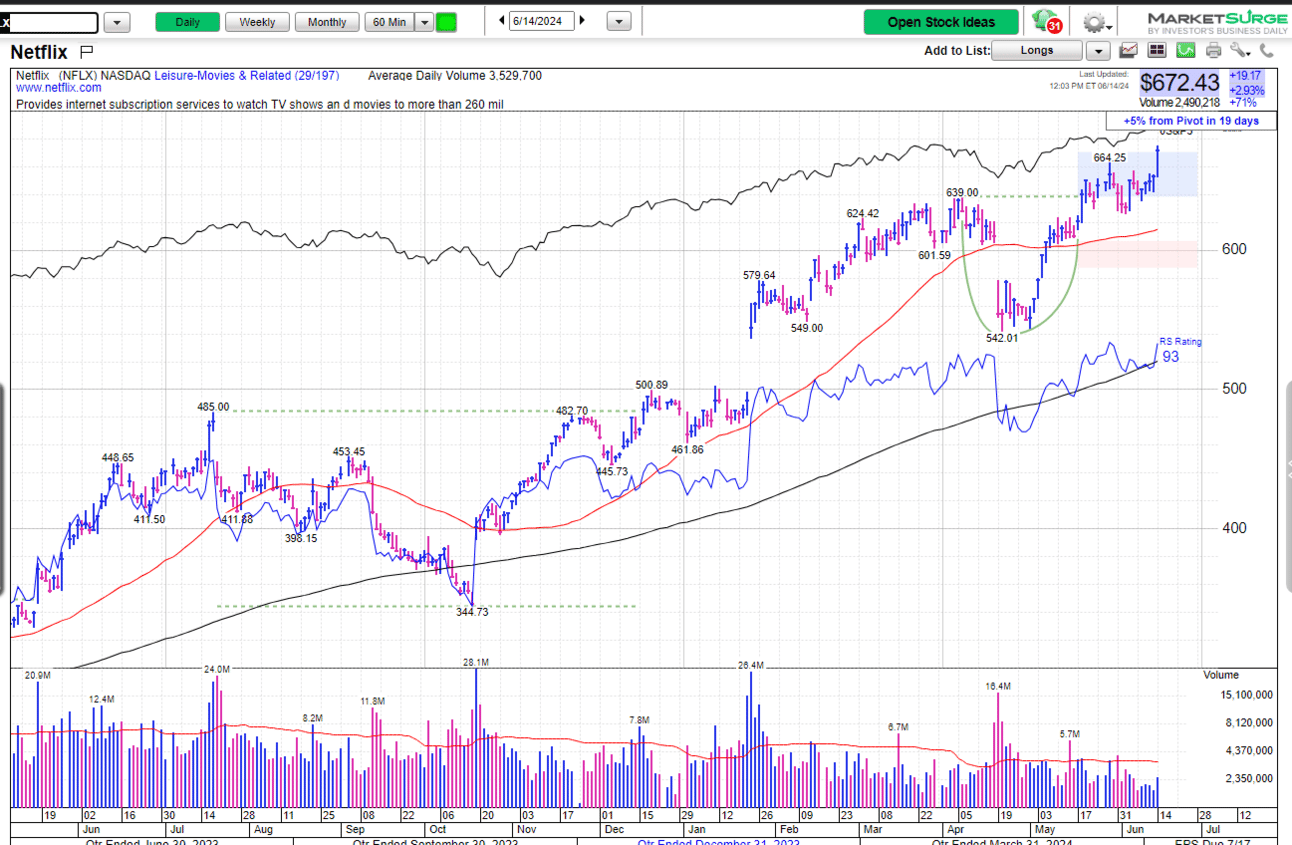

Netflix Joins Tech Peers In Breaking Out 🍿

The talk of the town this week was tech laggards like Netflix and Amazon, which were not participating in the recent rally. And it appears we quickly got a partial resolution to that conundrum…

Stocktwits user @MarkNewtonCMT shared a chart of Netflix breaking out to its highest level since late 2021. With the largest tech stocks’ valuations stretching during the recent rally, investors and traders are looking for the next group of stocks that are going to lead. 🕵️

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

🧑⚖️ Starbucks scores win against union in Supreme Court. The decision overturned a National Labor Relations Board (NLBR) order to reinstate the fired workers and will make it harder for the administrative body to stop companies from violating labor laws. The issue in the case was the NLRB’s power to stop an unfair labor practice while a case proceeds on the merits, a tool it will no longer be able to use. Axios has more.

⏸️ Ireland’s regulatory pressure causes Meta to pause some AI plans. The tech giant will pause its plans to start training its artificial intelligence (AI) systems using data from its users in the European Union and the U.K. The Irish Data Protection Commission (DPC), Meta’s lead regulator in the EU, raised concerns over the ability to implement this while still being compliant with GDPR regulations. More from TechCrunch.

🏘️ Redfin says U.S. home sales crumbled in May. Just 407,959 homes were sold in May, with only two months in history recording fewer sales. With housing affordability sitting at an all-time low due to record prices and high interest rates, there’s little incentive for people to move unless they have to. As a result, supply remains depressed, and buyers are stuck waiting on the sidelines for more inventory and/or lower prices and financing costs. Reuters has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍