NEWS

Market Goes Green For St. Patty’s Day

Source: Tenor

The market brushed off some negative comments from Treasury Secretary Bessent and Baidu’s cheap AI model rollout over the weekend and came into Monday ready to cement a two-day win streak. Big tech failed to catch a bid, but the rest of the market found its footing and rebounded as investors await Wednesday’s Fed meeting. 👀

Today's issue covers Pepsi’s bet on Poppi, the BNPL fintech battle heating up, Robinhood’s prediction markets rollout, and more from the day. 📰

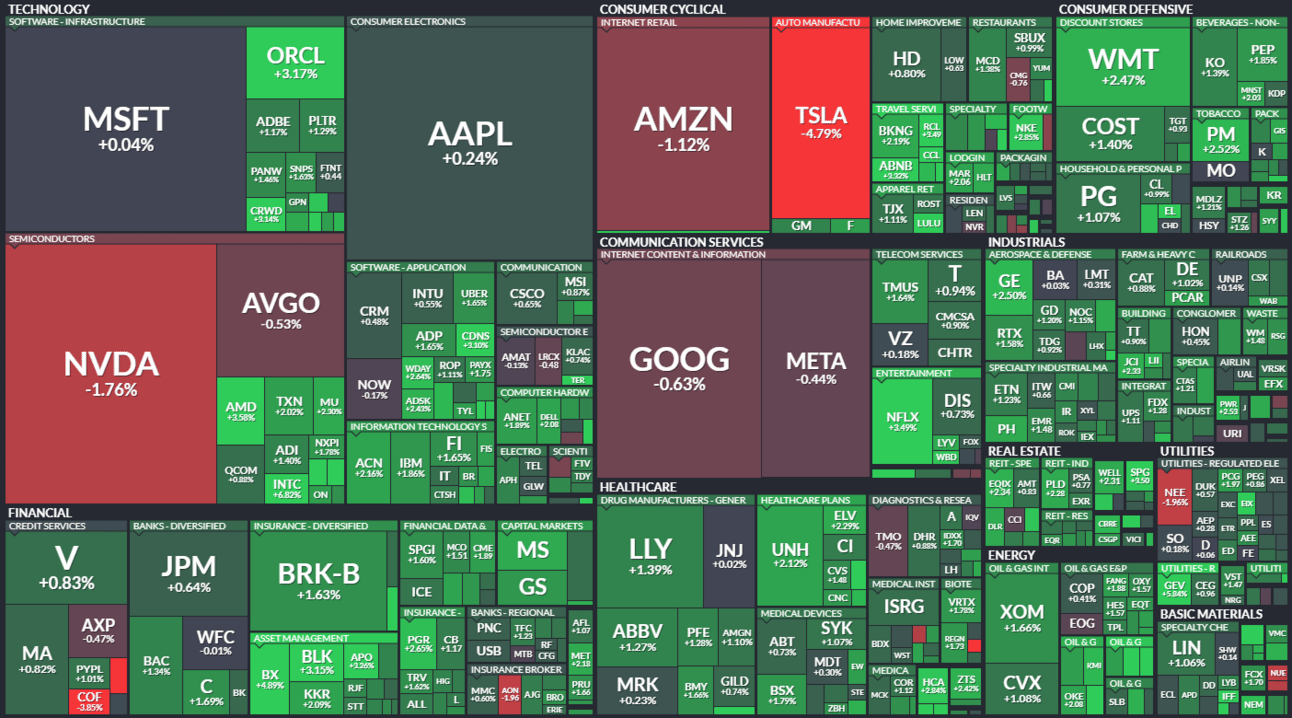

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with real estate (+1.76%) leading and consumer discretionary (+0.16%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,675 | +0.64% |

Nasdaq | 17,809 | +0.31% |

Russell 2000 | 2,068 | +1.19% |

Dow Jones | 41,842 | +0.85% |

COMPANY NEWS

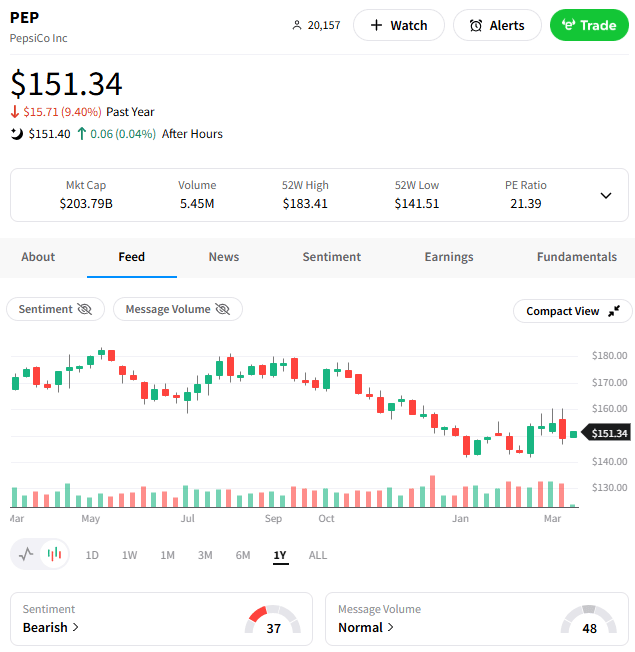

Pepsi Bets On A Post-Merger Pop(pi) 🫧

Multinational food and beverage companies aren’t typically the lead story in markets because, quite frankly, they’re usually boring. Slow growth, boring business. But every now and again, we have an opportunity to talk about them…and today’s one of’em.

The beverage market is a high-margin business but also one that goes through its phases. One of those phases has been the prebiotic soda boom, and Pepsi is betting that its popularity will continue as soda consumption continues its downward trend and beverage makers like itself look for new growth drivers. 📊

Pepsi will acquire upstart Poppi for $1.95 billion, with the net purchase price coming to $1.65 billion after $300 million in anticipated cash tax benefits. It will also make additional payments if certain performance milestones are met.

By 2023, Poppi’s annual sales had reportedly crossed $100 million, and with two straight years of Super Bowl ads, the company seemingly had deep pockets and a thirst to reach a wider audience for its products. 📺

However, it’s a competitive market, with rival Olipop recently valued at $1.85 billion in its latest fundraising round and Coca-Cola launching its brand, Simply Pop. As a result, Pepsi is hoping to use its size and economies of scale to supercharge the brand and establish a dominant market share in the space.

The Stocktwits community is seemingly skeptical of the move, with sentiment remaining in ‘bearish’ territory after the news. With Celsius and other high-growth beverage brands taking a hit over the last year, bulls are staying cautious. ⚠

Recession fears and concerns about the U.S. consumer could also be weighing on the stock. Retail sales rose just 0.2% MoM in February, with overall spending less than expected. A New York Fed survey found that more Americans expect credit requests to be rejected. And Forever 21 has filed for bankruptcy, the latest in a string of retailers.

It’s a rough environment to be a U.S. consumer-related company. Pepsi has the benefit of global diversification, but Poppi may not be the catalyst bulls have been looking for. Time will tell. 🤔

SPONSORED

The Best Bargain in Crypto – Here’s Why Institutions Are Buying

Markets are a roller coaster with Trump’s policies fueling uncertainty, but history proves volatility breeds opportunity.

While crypto has lost $1T in market cap, DeFi Technologies (OTC: DEFTF) still holds $750M in AUM—proving demand remains strong. Last month alone, they attracted $11.4M in net inflows, marking their 4th consecutive month of 8-figure investments.

📉 Crypto down $1T, yet inflows are accelerating

💰 $98.6M invested in DeFi Tech in just 4 months

🌎 Global expansion into Asia, Africa, and the Middle East

🔥 Institutional-grade crypto products with 8-figure monthly inflows

Major Holdings (Staked & Growing):

Bitcoin (BTC) – $223M AUM

Solana (SOL) – $227M AUM

Cardano (ADA) – $63M AUM

XRP, ETH, SUI, DOT, AVAX – $121M+ AUM combined

Even in turbulent markets, institutions continue to bet big on DeFi Technologies.

Are you positioned before the next breakout?

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

The Fintech BNPL Battle Heats Up 🔥

On Friday, Swedish fintech giant Klarna announced that it had filed to go public on the New York Stock Exchange (NYSE). Experts anticipate it coming to market at a roughly $15 billion valuation., which would match competitor Affirm’s current market cap. 🧐

Today, it announced that it partnered with consumer finance app OnePay to exclusively offer installment loans for purchases at U.S.-based Walmarts. The deal should boost its profile with investors and support its valuation as it comes to market.

U.S.-based competitor Affirm Holdings fell as much as 16% in pre-market trading before recovering to close down about 4%. Since 2019, the company has partnered with Walmart to offer payment options for purchases ranging from $150 to $2,000 at nearly 4,000 Supercenters nationwide. This Klarna deal pushes Affirm out. 💳

Still, the Stocktwits community remains ‘bullish’ on Affirm, with buyers suggesting that its partnership with Walmart represents only a small percentage of its revenue. However, bears say this is a broader sign that Klarna is gaining ground and taking meaningful market share from the company. 🐂

Reminder: Tomorrow at 10 am ET, we’ll premiere last week’s ‘Fireside Chat’ with Affirm’s CFO, where he answered the Stocktwits community’s questions. You can listen to it on the $AFRM symbol page or the Stocktwits YouTube. 📺

Meanwhile, Robinhood is pushing further into its future vision by announcing a prediction markets hub directly within its app, allowing traders to bet on the outcomes of the world’s biggest (or stupidest) events.

To deliver this service, Robinhood is partnering with Kalshi, a CFTC-regulated exchange (the only legal prediction market in the U.S.) Contracts began rolling out today and will be available to all eligible customers in the coming days. 🤝

$HOOD ( ▲ 5.9% ) shares rebounded today alongside the broader market, but sentiment remains neutral. It appears the nearly 50% drawdown in three weeks shook the faith of some bulls, who are waiting to see whether this tradeable low sticks or not.

Regardless, the “bet on anything and everything” trend continues to take hold. Nearly 60% of Stocktwits’ poll respondents plan to use the new Robinhood feature…and that’s exactly what the brokerage’s executives are betting on. 💸

Lastly, it’s worth noting that Berkshire Hathaway continues to bet on finance firms…but Japanese ones. Buffett has hiked his stakes in five Japanese trading houses, Itochu, Morubeni, Mitsubishi, Mitsui, and Sumitomo, to nearly 10% each.

While he’s trimmed U.S. equity positions for several years now, international equities continue to be an area Warren Buffett (and other investors) are looking to find value after 15 straight years of U.S. dominance. And so far in 2025, they’re right. 🌎

STOCKTWITS PRODUCT UPDATE

🚨 New Feature Launch: Why It’s Trending? 📈

“Why It’s Trending” delivers instant clarity on fast-moving market news and sentiment so you can confidently invest or trade.

Real-Time Insight – Get up-to-the-minute summaries powered by Stocktwits proprietary data, stream messages, and retail sentiment.

Simplicity & Context – No jargon, no fluff: concise explanations that save you time.

Enhanced Community Experience – Quickly jump into relevant discussions and make informed posts.

Empowerment for All Levels—Whether new or experienced, you can instantly understand the “why” behind trending stocks.

How can you access this? Visit any of the trending stocks shown in the trending bar. Once on the symbol page, hover or click the trending icon next to the symbol name to reveal why it's trending.

STOCKS

Other Noteworthy Pops & Drops 📋

Reddit ($RDDT -3%): Redburn Atlantic initiated coverage with a ‘Sell’ rating and a price target of $75, implying over 40% downside from current levels. The research firm noted that the company is trading at a significant premium to similar social companies.

Edison International ($EIX +4%): The Wall Street Journal reported that the company’s subsidiary, Southern California Edison, could be linked to the start of the Eaton fire in Los Angeles. An idle power line is at the center of an SCE investigation.

Micron Technologies ($MU +2%): Citi reiterated its ‘Buy’ rating and $150 price target ahead of earnings but cautioned about its coming quarter guidance.

Chevron ($CVX +1%): Chevron has taken a 4.9%% stake in Hess Corp., worth roughly $2.3 billion, as part of Chevron’s merger agreement from October 2023. Management says its stake purchase reflects its continuing confidence in the pending acquisition.

Alphabet ($GOOG -1%): The Google parent company is reportedly back in talks to buy the cybersecurity startup Wiz for $30 billion. Wiz had called off a $23-billion deal last year to focus on its IPO, with both sides likely concerned about regulatory scrutiny of a deal this size. However, if it can be pushed through, it could help Alphabet tap into the cyber industry and expand its cloud infrastructure segment.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Building Permits/Housing Starts (8:30 am), Import/Export Prices (8:30 am), Industrial Production (9:15 am), Japan Interest Rate Decision (11 pm). 📊

Pre-Market Earnings: Sundial Growers ($SNDL), Xpeng Inc. ($XPEV), Up Fintech Holdings ($TIGR), Tencent Music Entertainment ($TME), Huya Inc. ($HUYA). 🛏️

After-Hour Earnings: ZTO Express ($ZTO), Inovio Pharmaceuticals ($INO), Better Home & Finance ($BETR), StoneCo ($STNE). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋