NEWS

Market Mellows Out Ahead Of Tech Earnings

The major indexes bounced on the back of a tech rebound, but the volume and overall mood remained mellow. Eyes remain focused on earnings, with Tesla, Visa, UPS, and many more reporting tomorrow. Let’s see what you missed. 👀

Today's issue covers Verizon’s lackluster earnings, the NYSE channeling its inner degen, and more from the day. 📰

Here's today's heat map:

11 of 11 sectors closed green. Financials (+1.21%) led, & materials (+0.10%) lagged. 💚

AI-powered cloud data management platform Informatica plunged 11% today after saying it’s not for sale, causing Salesforce to abandon its pursuit. ⛔

Struggling mall retailer Express is on “meme stock” watch following an 18% pop. The company filed for bankruptcy and announced it will close more than 100 stores as it weights offers from bidders like WHP Global. 🏬

Spatial data company Matterport jumped 176% on news that CoStar Group is buying it for $1.60 billion. Unfortunately for long-term shareholders, the deal comes at less than half the company’s COVID-era IPO price and more than 85% below its all-time high. 🙃

London-based private equity firm CVC Capital Partners is going public in Amsterdam on Friday, making it the largest PE firm to go public since early 2022. General Atlantic is also planning to IPO later this year, with both firms snubbing the London Stock Exchange (LSE) in favor of other countries. 💸

Several after-hours earnings movers were noteworthy, including Nucor (-6.30%), Cadence Design Systems (-9.00%), Calix (-15.00%), Simpsons Manufacturing (-11.00%), and Medpace (-4.30%). 📊

Crypto miners mounted a rebound along with other names in the space as Bitcoin shook off its post-halving jitters and moved higher. ⚒️

Other active symbols: $TSLA (-3.40%), $AMC (+8.23%), $IBRX (-6.26%), $OCGN (-6.06%), $AGBA (+112.40%), $JAGX (+14.66%), & $IZM (-19.75%). 🔥

Here are the closing prices:

S&P 500 | 5,011 | +0.87% |

Nasdaq | 15,451 | +1.11% |

Russell 2000 | 1,967 | +1.02% |

Dow Jones | 38,240 | +0.67% |

EARNINGS

Verizon Shareholders Wait For A Profitable Call

Telecom giants AT&T and Verizon have had a rough run in the public markets lately as they compete for subscribers in an increasingly competitive market.

Unfortunately for investors, that narrative didn’t improve today when Verizon reported its quarterly results. 😞

The company lost a net 158,000 users in its consumer wireless postpaid phone business, which was actually a significant YoY improvement. Additionally, its Business Group’s net postpaid phone user additions of 90,000 were down about 33% YoY and represented about 20% of its annual revenues.

Overall, it lost 68,000 monthly bill-paying wireless phone subscribers, which was better than the 100,000 loss anticipated by analysts. 🔺

As a result, its operating revenue of $33 billion lagged expectations by $0.20 billion, while adjusted earnings per share of $1.15 beat the $1.12 consensus estimate. Free cash flow of $2.70 billion was also significantly lower than the $4 billion expected.

Like in 2023, management expects cash flow to improve in the second and third quarters, also maintaining its 2024 financial outlook.

The business continues to work off its post-pandemic boom results, leaving investors to wonder where these key metrics will normalize going forward. 🔮

Until there’s more clarity about what the future holds, investors continue to look elsewhere for opportunities. That’s particularly true if interest rates remain high and offer a risk-free alternative to rate-sensitive sectors like Telecom.

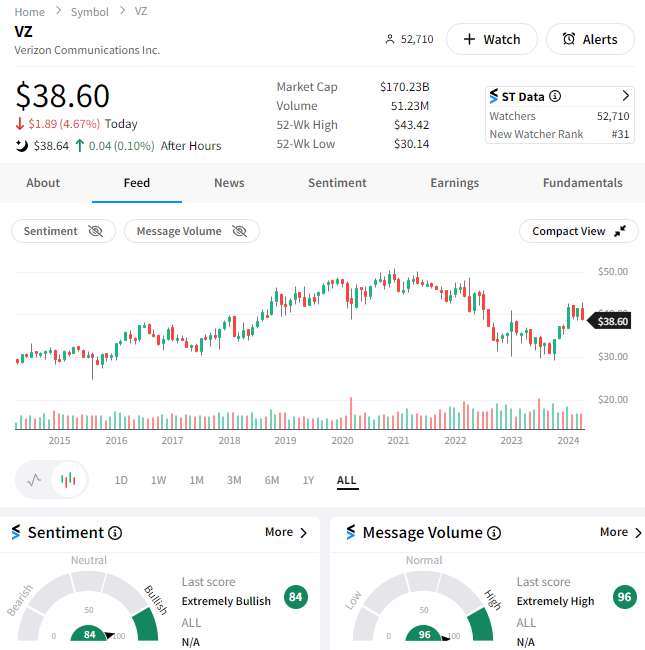

$VZ shares popped initially but closed down 5% on the day. Despite the lackluster price action, the Stocktwits community pushed sentiment into “extremely bullish” territory as they tried to find a bright side to today’s news. 🐂

STOCKS

NYSE Looks To Channel Its Inner Degen

With the spot Bitcoin ETF officially bringing the world of crypto to traditional finance, we’ve now got traditional finance looking to enter the world of crypto via 24/7 trading. 😵💫

The Financial Times reported that the New York Stock Exchange (NYSE) Is polling participants on the merits of trading stocks despite regulators scrutinizing an application for the first 24/7 stock exchange.

The NYSE’s data analytics team highlights the growing interest in trading overnight during the 8 pm to 4 am ET time period when equity markets are dark. With crypto markets never shutting off and other traditional financial markets like futures, currency markets, and others trading on a 24/5 schedule, the argument seems to be, “Why not add equity trading?” 🤔

While there’s certainly growing support for this change, many critics of the potential move say that maintaining the Securities & Exchange Commission’s (SEC) mission of “fair, orderly, and efficient markets” would be extremely difficult if it never closed. It would also raise the regulatory and staffing burden of firms operating in the space. 📝

Although these changes are still in the early stages, the fact that these conversations are occurring shows just how involved people and institutions have become in markets and how far and wide they’ll go to make a profit.

We’ll have to wait and see how this develops. But it is interesting to see the U.S. embracing the degeneracy of 24/7 trading, sports gambling, etc., while the EU and others take aim at TikTok over addiction fears.

Where the line is remains to be seen. But the world is certainly dealing with technology-enabled addictions at a scale it’s never seen before. The ramifications will be “interesting,” to say the least… 🤷

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

Bullets From The Day

🌞 Sam Altman makes a major solar investment to help power AI. The OpenAI CEO and VC firms Andreessen Horowitz and Atomic are investing $20 million in renewable energy company Exowatt. The startup is developing a modular energy platform to power data centers at a time when AI is expected to substantially drive up the power needs of global data centers. With AI advocates on the hunt for cheap and rapidly scalable energy systems, this space is ripe for the taking. And Exowatt thinks its offering will stand out because it can be deployed immediately. Inc. has more.

🎮 Gaming giant Embracer Group is splitting into three. The Lord of the Rings and Tomb Raider owner is forming three companies that specialize in AAA titles, indie and mobile gaming, and tabletop games. The Swedish gaming conglomerate’s split will form three publicly listed companies, allowing each entity to better focus on its respective core strategies and offer more distinct equity stories for shareholders. It comes as the company has been restructuring aggressively since losing out on a $2 billion partnership deal last year. More from The Verge.

🤑 Delta Air Lines raises wages as union attempts to organize flight attendants. The most profitable U.S. carrier is looking to stave off another attempt to unionize its flight attendants by raising pay for nonunion employees. It’s raising the minimum wage for U.S. workers to $19 per hour and boosting the pay for flight attendants and ground workers by 5%, impacting more than 80,000 employees. Flight attendants narrowly voted against unionizing in 2010, but given the current climate, the union may feel this is its best shot at a successful vote. Yahoo Finance has more.

Links That Don’t Suck

🧑💻 Join IBD's free 2-hour trading workshop on 4/27 to learn the smarter way to buy and sell stocks*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍