NEWS

Market Melts Amid “Meh” Earnings

Stocks tried to keep their upward momentum intact, but sellers came in throughout the day and pushed the indexes back into the red. With many of the “big name” earnings out of the way, lackluster results have failed to provide investors the courage to “buy the dip.” Let’s see what you missed. 👀

Today's issue covers Robinhood hopping and Shopify popping, a key risk-on/risk-off ratio flashing caution, and what the Ripple vs. SEC case conclusion means for crypto. 📰

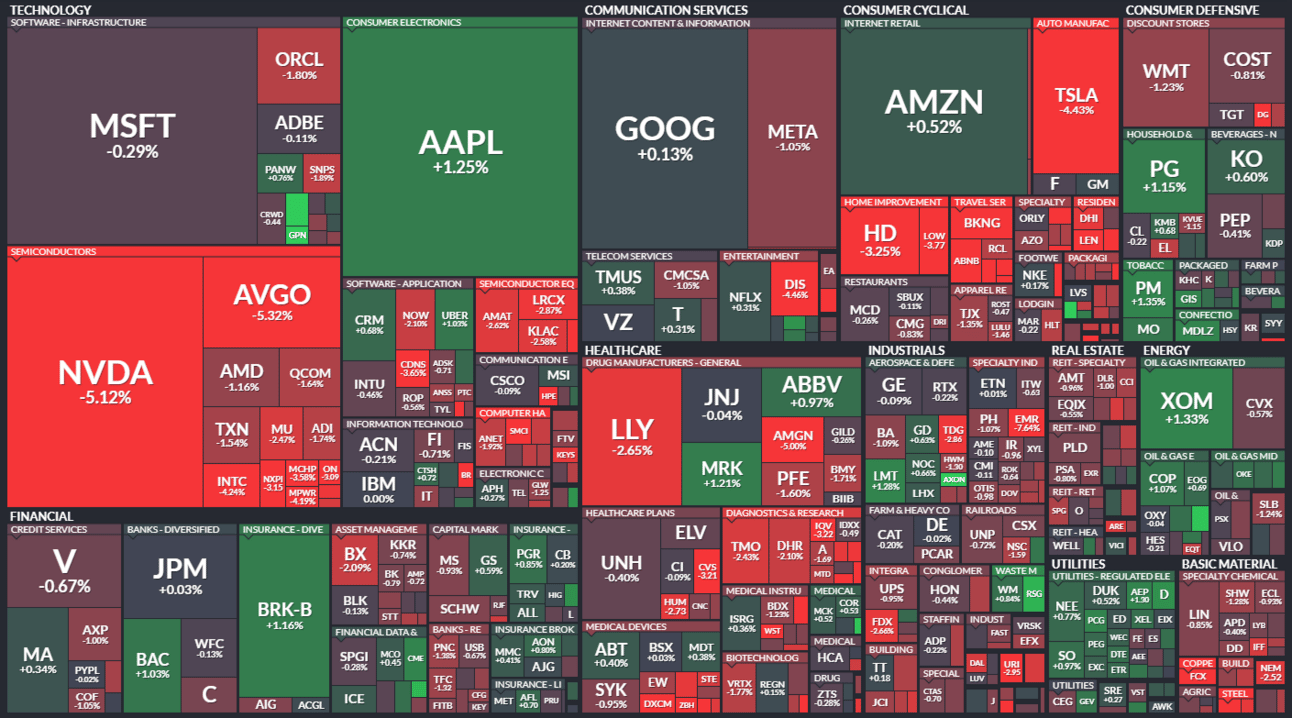

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with utilities (+0.56%) leading and consumer discretionary (-1.74%) lagging.

And here are the closing prices:

S&P 500 | 5,200 | -0.77% |

Nasdaq | 16,196 | -1.05% |

Russell 2000 | 2,035 | -1.41% |

Dow Jones | 38,763 | -0.60% |

P.S. We’re experimenting with different formats to streamline your experience. Like something, don’t like something, hit me up. I want to hear from you. 👍

EARNINGS

$HOOD Hops & $SHOP Pops

As we said in the intro, earnings have not inspired the bulls to step into a volatile market just yet. However, that doesn’t mean there aren’t some bright spots, as Shopify and Robinhood showed us today. 🙂

Canadian e-commerce giant Shopify’s adjusted earnings per share of $0.26 on revenues of $2.05 billion beat estimates of $0.20 and $2.01 billion. Gross merchandise volume (GMV) rose 22% YoY to $67.20 billion, easily topping the $65.80 consensus estimate. 🛒

For the third quarter, it expects revenue to grow at a low-to-mid-twenties percentage rate on a YoY basis, while gross margins are expected to rise by roughly 50 bps QoQ. It forecasted GAAP operating expenses of 41%-42% and a double-digit free cash flow margin for the rest of the year.

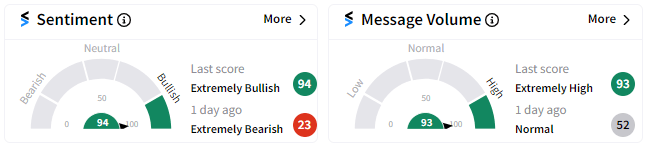

Retail investors are gaining confidence in management’s turnaround plan and ability to navigate the consumer slowdown. Stocktwits sentiment pushed to a one-year high in ‘extremely bullish’ territory as shares rose 18%. 👍

The retail brokerage and Neobank reported $0.21 in earnings per share on record revenues of $682 million. Analysts had anticipated $0.16 per share on revenues of $640 million. 💸

Driving the beat was transaction-based revenues rising 69% YoY, helped by options activity. The company said the number of customers trading options was up 25% YoY. Crypto revenue also rose 161% amid increasing activity and a 3 bp improvement in ‘take rate.’ 🔺

CEO Vlad Tenev reiterated the company’s growing subscription service, noting that Robinhood Gold reached 2 million subscribers and saying that’s evidence of “the flywheel accelerating.” The company remains focused on product improvements to drive to provide top value for customers, who Tenev says are “not just novices” (contrary to popular belief).

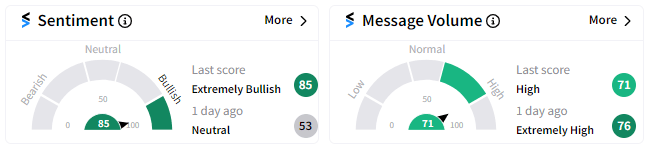

Shares of Robinhood are up just 2% after hours, but retail is fired up about what they heard. Stocktwits sentiment pushed into ‘extremely bullish’ territory from its ‘neutral’ zone yesterday. 🐂

STOCKTWITS “CHART ART”

A Key Risk-On/Risk-Off Ratio Flashes Caution ⚠️

There are a lot of ratio charts technical analysts reference when trying to assess risk appetite in the market. One of those is the ratio of the consumer discretionary sector relative to the consumer staples ratio. 👀

The reasoning for this is that long-only institutions cannot go to cash when they want to be more cautious in the market (like some are today). Instead, they’ll swap their long holdings in companies tied to cyclical economic activity for companies that can still do well in weaker economies.

That would mean selling restaurant chains or airlines whose products are considered ‘discretionary’ purchases and buying companies that sell consumer staples like household goods, foods/beverages, alcohol/tobacco, etc., that people will buy regardless of the economy’s health.

Stocktwits user @HostileCharts pointed out today that this ratio is hitting fresh lows for the first time in recent history, signaling some cautious positioning among market participants. 😬

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

CRYPTO

Ripple’s Battle With The SEC Is Officially Over

When we cover crypto in The Daily Rip, you know it’s because something big just happened. Today brought us the conclusion of a four-year battle between the Securities and Exchange Commission (SEC) and Ripple.

Below is an excerpt from today’s Litepaper newsletter, written by our crypto expert Jonathan Morgan. I’d encourage you to read the full history of the case there, but if you want the TLDR, this has got you covered. 👇

If you’re wondering why Ripple ($XRP) rallied as much as 30% today despite being required to pay a $125 million fine, there are two big reasons.

This cloud of FUD over the crypto market and whether XRP (and, by de facto status, the rest of the market) is a security is over.

$125 million is a tiny amount of the $2 billion the SEC originally wanted.

What Ripple Has To Do:

Ripple Labs, Inc. is permanently restrained from violating Section 5 of the Securities Act (basically, following current securities laws).

Ripple is ordered to pay a civil penalty of $125,035,150 within 30 days.

The SEC may propose a plan to distribute the collected funds, subject to Court approval.

Ripple must pay post-judgment interest on any overdue amounts.

Ripple cannot reduce compensatory damages in related lawsuits by offsetting them with this penalty.

For those who have been following this case, the fine and injunction are a big ol’ nothing burger. What’s most important is the case's conclusion: that XRP is not a security.

If you want to nerd out, you can read/find the ruling here. Otherwise, you can just subscribe to The Litepaper, which will keep you updated on how this case will impact the rest of the industry going forward. 👀

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Initial/continuing jobless claims (8:30 am ET) and Mexico’s interest rate decision (3:00 pm ET). 💼

Pre-Market Earnings: Cassava Sciences ($SAVA), Krispy Kreme ($DNUT), Under Armour ($UA), Penn Entertainment ($PENN) Plug Power ($PLUG), Cronos Group ($CRON), Ocugen ($OCGN), Novavax ($NVAX), Papa John’s ($PZZA), Eli Lilly ($LLY), Datadog ($DDOG), and Bitfarms ($BITF). 😪

After-Hour Earnings: Gilead Sciences ($GILD), Gevo ($GEVO), Cleanspark ($CLSK), Trade Desk (TTD), Unity Software ($U), SoundHound AI ($SOUN), Paramount Global ($PARA), Turtle Beach ($HEAR), Expedia Group ($EXPE), e.l.f. Beauty ($ELF), Bloom Energy ($BE), and Inovio Pharmaceuticals ($INO). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍