NEWS

Market Reverses Post-Payroll Rally

The U.S. stock market notched a rare down week, as mixed signals from the economy and Fed gave buyers pause after a historic run. Let's see what else you missed. 👀

Today's issue covers stocks breaking their win streak, palladium perking up, and a potential buying opportunity in Cassava Sciences. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's today's heat map:

4 of 11 sectors closed green. Real estate (+1.18%) led, & technology (-1.49%) lagged. 💚

Energy experienced some volatility after Exxon filed for arbitration to protect what it says is its right to pre-empt Chevron's bid for a stake in a prolific oil project off Guyana. The dispute could cause major problems for Chevron's $53 billion acquisition of Hess. 🛢️

Carvana and others like it continue to recover as more analysts jump on the upgrade bandwagon. Meanwhile, not everything is participating in this market rally, with Marvell Technology and MongoDB failing to reach their previous all-time highs before turning lower. 📊

Eli Lilly shares fell 2% after the U.S. Food and Drug Administration delayed its decision on its Alzheimer's drug, Donanemab. And Novo Nordisk CEO said the company's experimental weight loss pill could be best-in-class for the rapidly growing market. 💊

Lastly, Amylyx Pharmaceuticals plunged 83% after announcing that its ALS drug failed to meet its goal in a late-stage trial, meaning it may pull the drug from the market. 📉

Other symbols active on the streams: $SOXL (-11.52%), $M (+3.98%), $AMPY (-17.73%), $LTRN (+24.36%), $RIVN (+2.16%), $CERO (+28.25%), $CAPR (+16.86%), & $SHIB.X (+14.39%). 🔥

Here are the closing prices:

S&P 500 | 5,124 | +0.65% |

Nasdaq | 16,085 | -1.16% |

Russell 2000 | 2,083 | -0.10% |

Dow Jones | 38,723 | -0.18% |

ECONOMY

Stocks Break Their Win Streak

Nvidia's evil plan to take over the stock market was put on hold today despite labor market data helping build the case for a June rate cut. 🤔

The February jobs report showed that nonfarm payrolls rose by 275,000, topping the 198,000 expected. However, the previous two months' numbers were revised lower by 167,000 jobs, causing the unemployment rate to jump to 3.90% and signaling a further softening of the labor market. 🔻

On top of that, wage growth was just 0.1% MoM and 4.3% YoY, a positive sign for the Fed's fight against inflation.

Weakness in the labor market renewed investors' hopes for a June rate cut, causing stocks to surge after the open. However, after making a new high, sellers came in and pushed stocks lower throughout the day, as shown in Nvidia's chart below. An 11% swing in a $2 trillion stock is quite the single-day move on no company-specific news. 😳

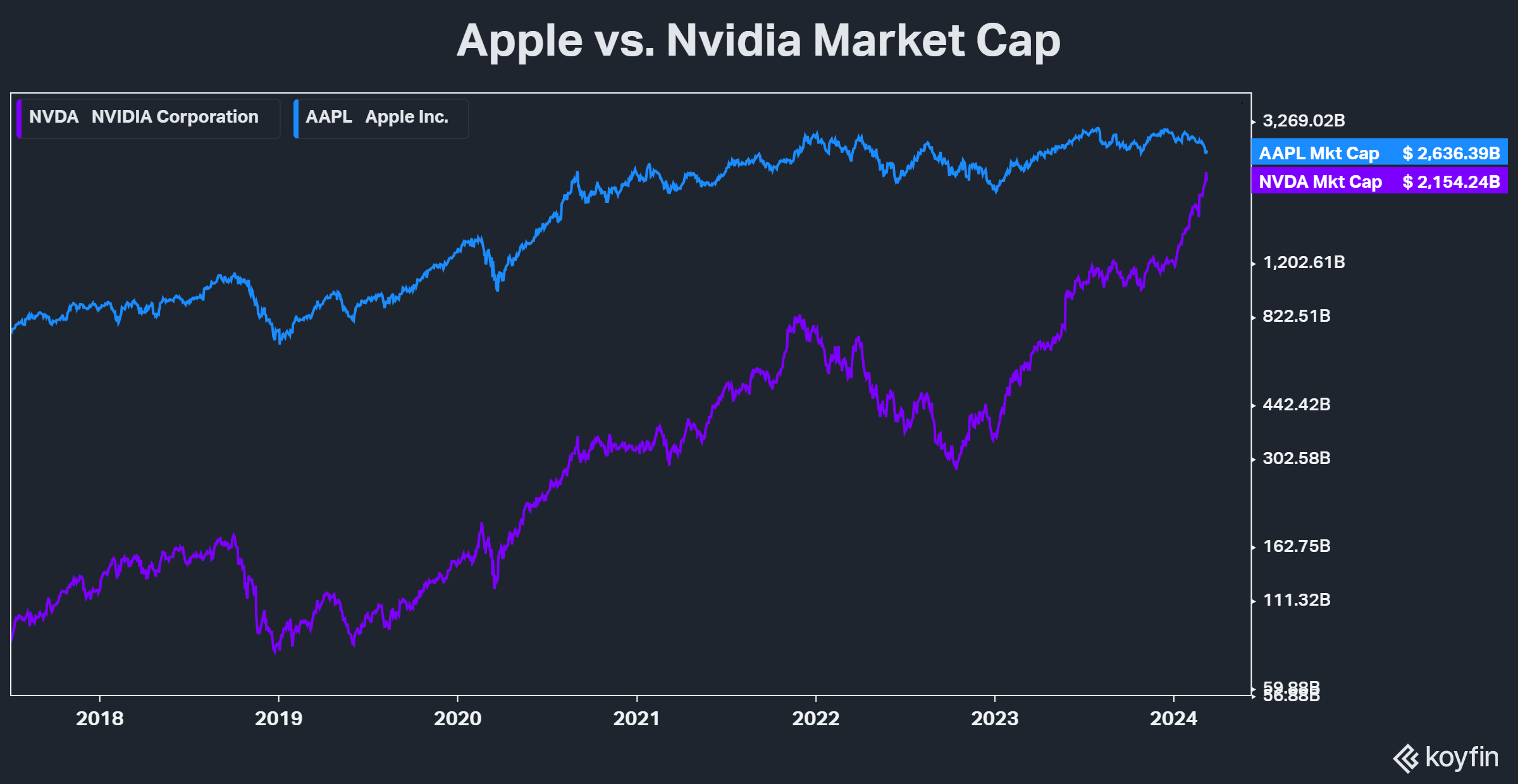

And speaking of Nvidia, one graph that's been going around lately to show just how wild the stock market's move has been is Nvidia vs. Apple's market cap. The gap between them has been closing at a record pace, with many pointing out it would only take a few good days from Nvidia and a few more bad days from Apple for it to become the second-largest company in the world. 🫨

Overall, the large-cap stock market indexes continue to grind higher while small and mid-cap stocks play catchup. Investors and traders will be watching to see if stocks posting their third down week of 2024 will change the momentum in the near term. ⚔️

STOCKTWITS CONTENT

Your Weekend Watch & Macbook Pro Giveaway

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

In this week's episode, the friends discuss:

Crypto: The growth drivers, risks, and behavior behind Bitcoin’s historic rally 🤩

Fiat Alternatives: Exploring the relationship between Bitcoin and precious metals 🪙

Markets: What the bond market and oil are saying about inflation 🌡️

Giveaway: One lucky subscriber will win a Macbook Pro on March 17 by entering here 💻

COMMODITIES

Palladium Perks Up

While we've already touched on gold moving to fresh all-time highs over the last two weeks, other precious metals are also catching a bid after a rough few years. 👀

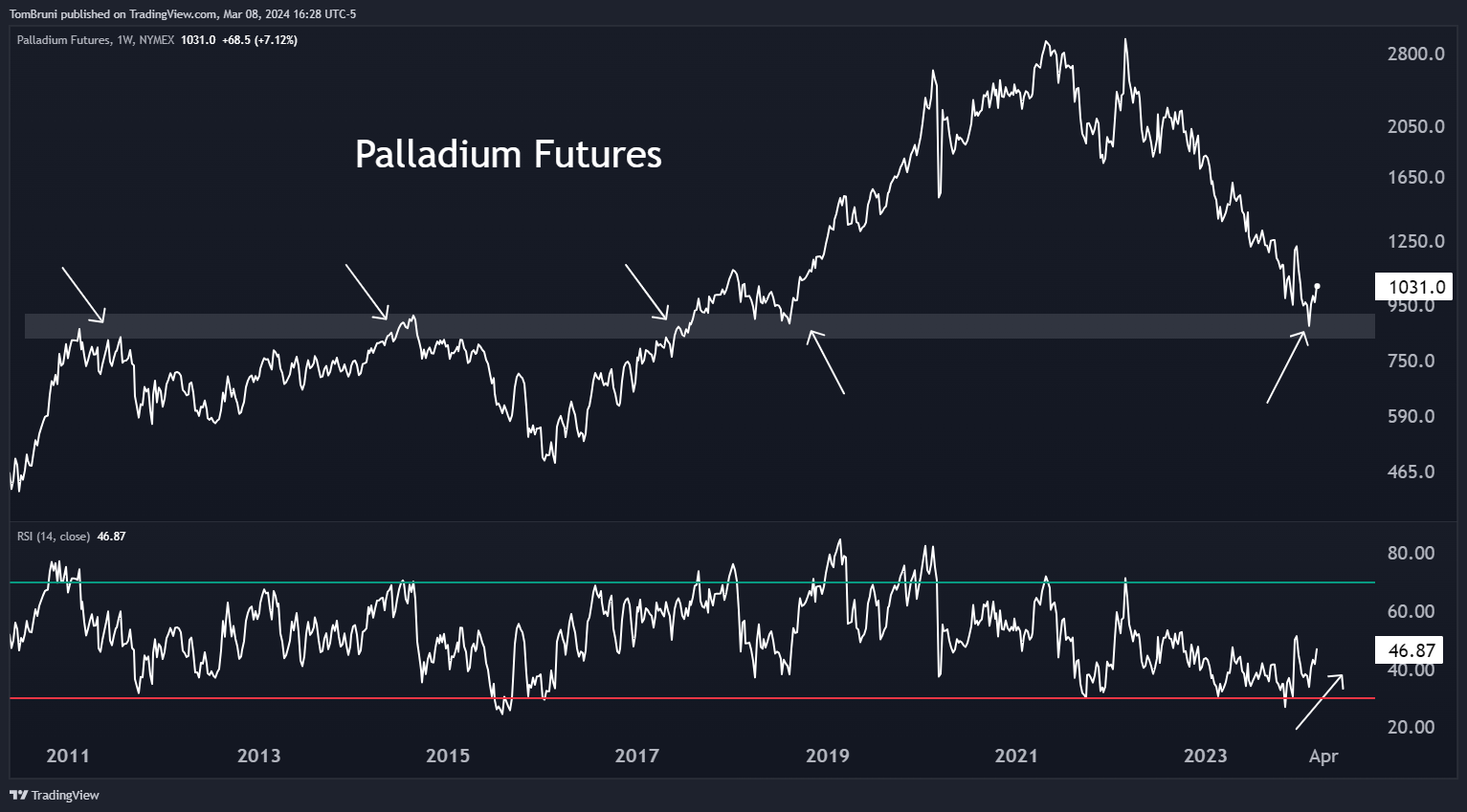

Below is a chart that technical analysts have been eying this week as palladium futures attempt to reverse their downward course. The weekly line chart goes back to 2010 and shows prices bouncing back from the $800 to $900 region, which has served as a transition area for buyers/sellers over the last 14 years. 📊

Additionally, technical analysts say the relative strength index (RSI) shows momentum improving even as prices made new lows earlier this year. This is what they refer to as a "bullish divergence" and is often looked at as a signal of a coming trend reversal. 🔺

In addition to the improving price action and momentum, some traders say speculators are positioned poorly for this market, holding record short positions. That means commercial hedgers, who are the actual companies dealing with physical palladium on a daily basis, are loading the boat long. And they wouldn't be doing that unless they had a hunch that prices were heading higher. 🤔

Now, commercial hedgers have very deep pockets and are often way early to trend reversals. But, analysts say the combined factors above paint a compelling case for prices to continue rising from here...especially if the rest of the precious metals space continues to perform well, too. 🤷

STOCKTWITS CONTENT

Follow Us On YouTube 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and our resident chart wizard Ivanhoff every week on our flagship show "Momentum Monday."

Stocktwits Spotlight

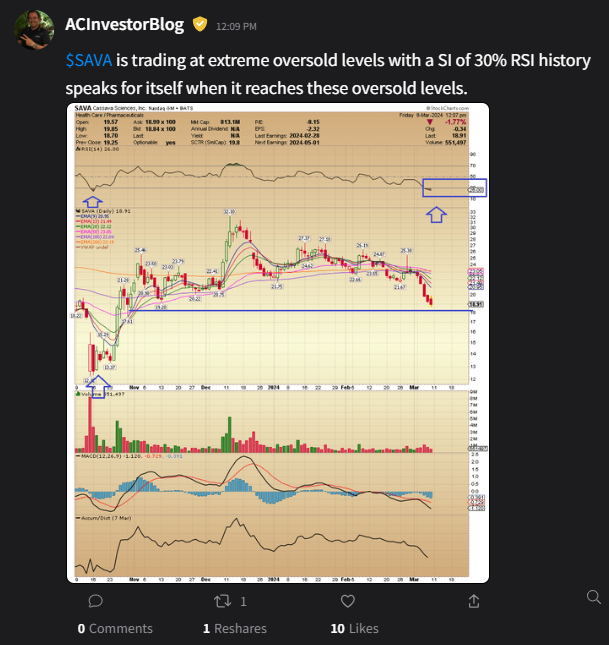

Cassava Sciences is a popular small-cap pharmaceutical stock that's back on people's radar after a rough three months of selling. While it was a pandemic-era darling that surged but came under pressure as short sellers targeted it and its business began experiencing issues. That caused many investors and traders to look elsewhere for opportunity. 🕵️

With that in mind, it's getting some attention today, with Stocktwits user Antonio Costa saying history suggests that the stock is deeply oversold as it approaches a potential support level. After several days of downside momentum, the stock could be worth a look again. 🤔

The Stocktwits community seems to agree, as sentiment flipped from extremely bearish territory yesterday to bullish territory today. Given the recent price action, it makes sense that sentiment would be a bit all over the place. But for now, bulls appear to be buying the dip.

If you want to see how his overall thesis develops and see more analysis like this, follow ACInvestorBlog on Stocktwits! 👀

Bullets From The Day

⚙️ Reddit launches free tools to help businesses grow their online presence. The social media giant is launching Reddit Pro, a suite of tools designed to help businesses grow an organic presence on the platform. It comes as the company tries to beef up its revenue and profitability ahead of its March 20th initial public offering (IPO), where it's seeking a roughly $6.5 billion valuation. TechCrunch has more.

🪫 Chevy cuts prices after lifting stop-sale order on Blazer EV. The company halted orders for its Blazer EV in December after numerous owners and reviewers reported significant issues with the vehicle's software, including blank infotainment screens and error messages while charging. After three months of work to fix the problem, the vehicle is back on the market but at a $5,900 lower price tag as the company looks to spur demand. When sales resume, it'll also qualify for the full $7,500 federal EV tax credit. More from The Verge.

🚚 Walmart opens a new front in the same-day delivery war. With Target unveiling its membership rewards program this week, Walmart is heating things up by launching an early morning on-demand delivery service. Under the new program, orders placed at 6 am will be delivered in an hour or less, charging a $10 express fee and base delivery fee for shoppers who are not Walmart+ members. Clearly, same-day delivery sales and subscription programs are a big business, and Walmart, Amazon, Target, and others are vying for their share. Axios has more.

Links That Don’t Suck

🤑 MarketSmith is now MarketSurge--check out the new features today and get 80% off the regular price*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.