NEWS

Market Turbulence Ticks Up

The bond rebound didn’t last long, with interest rates making new year-to-date highs and pressuring stocks and crypto. Meanwhile, commodities remain the standout as oil climbed into the mid 80s and gold topped 2,300. Let’s see what else you missed. 👀

Today's issue covers retail sentiment souring on Tesla, GE completing its three-way split, and a Chinese travel stock reaching new heights. 📰

P.S. Want the best charts and trade ideas delivered straight to your inbox? Starting next Monday, we’re doing just that with our new “Chart Art” newsletter. See what to expect and subscribe for a free gift toward the end of today’s newsletter. 🎁

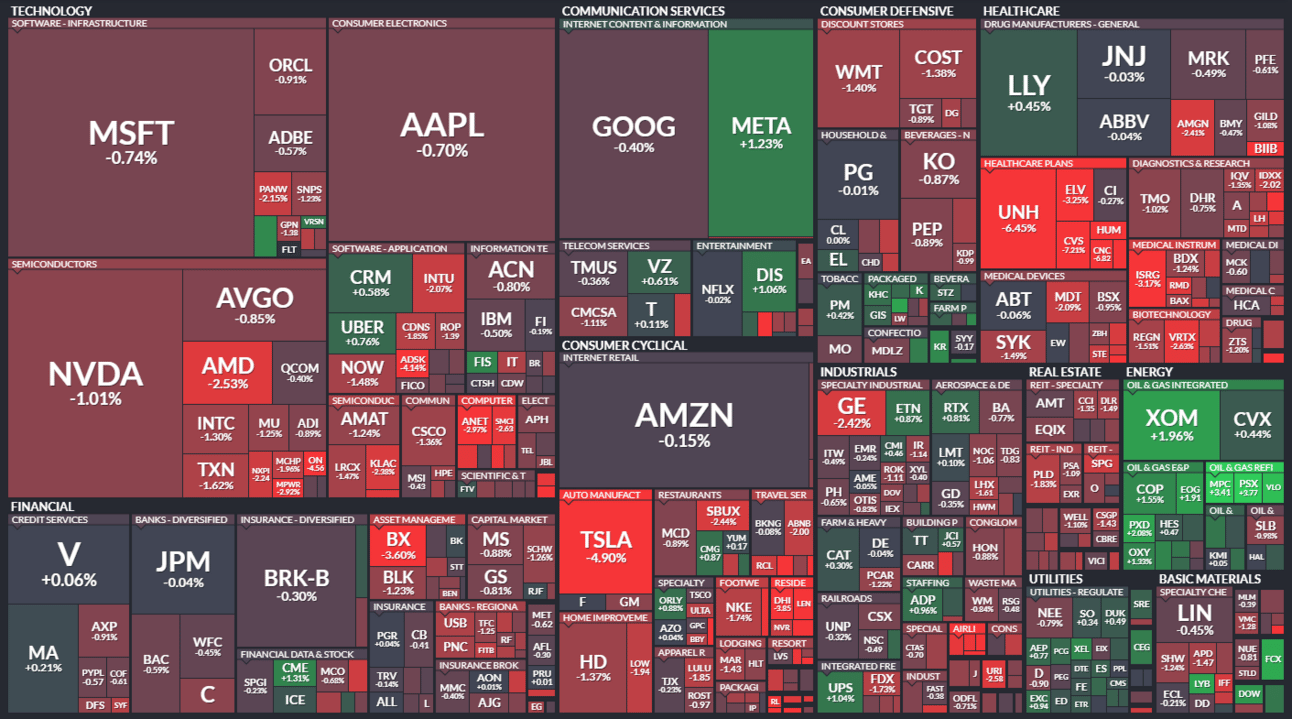

Here's today's heat map:

2 of 11 sectors closed green. Energy (+1.40%) led, & healthcare (-1.56%) lagged. 💚

The February JOLTs report remained little changed, with the ratio of job openings to available workers staying at 1.40 and total separations stagnant at 3.50%. Overall, the job market remains strong despite cooling from its 2022 peak. 💼

U.S. factory orders rebounded in February as manufacturing activity continued its volatile but steady rebound. Additionally, several Fed officials continue to support three rate cuts in 2024 but warn that they won’t be coming anytime soon, given inflation’s persistence and the labor market’s strength. 🏭

Healthcare insurance stocks tumbled today after the Biden Administration held its stance on Medicare Advantage payment rates that were well below what insurance companies demanded. Humana, United Healthcare, Centene Corp., and others all fell sharply on the news. 📉

ChampionX surged 10% on news that oilfield services giant Schlumberger will buy it in a $7.75 billion all-stock deal. Consolidation in the North American energy sector continues as oil prices rebound. 🛢️

Sports and entertainment giant Endeavor is being taken private by Silver Lake in a $13 billion deal, marking an end to its three-year “endeavor” as a public company that left shareholders with little to show for their time. 🙃

Crypto and related equities continued their weakness, as Bitcoin lost its hold on $70,000 and pulled back into the mid-$60,000s. ₿

Other active symbols: $DJT (+6.04%), $KULR (+71.71%), $CXAI (-27.15%), $MVST (-34.08%), $GOEV (-27.65%), $APAC (+43.03%), & $PVH (-22.22%). 🔥

Here are the closing prices:

S&P 500 | 5,206 | -0.72% |

Nasdaq | 16,240 | -0.95% |

Russell 2000 | 2,065 | -1.80% |

Dow Jones | 39,170 | -1.00% |

CRYPTO

Sentiment Sours As Tesla’s Deliveries Drop

It’s been a rough ride for electric vehicle makers over the last few years, with the recent environment not doing these companies any favors. 🪫

Electric vehicle demand has not been as robust as the industry expected. Consumers are turned away by a lack of affordable options, which high interest rates and financing costs have exacerbated.

Additionally, many consumers are opting for hybrids instead of fully electric vehicles, putting Toyota Motors and others in the driver’s seat for now.

And while demand remains soft, competition has been fiercer than ever. China’s BYD dethroned Tesla as the world’s top EV maker during the fourth quarter of 2023, and other competitors are all fighting for their piece of the pie by cutting prices. ✂️

Fewer sales, lower average selling prices, and rising costs are weighing on business results and causing investors to look elsewhere for opportunities.

Of the “Magnificent Seven” stocks, Tesla has had the weakest performance year-to-date and over the last one and three years. 🔻

Unfortunately for Tesla shareholders, that pain continued today after the company reported its first annual drop in vehicle deliveries since 2020.

Total first-quarter deliveries of 386,810, were about 8.50% below last year’s levels and well below analyst expectations for 457,000 vehicles. It also produced 433,371 vehicles, showing a meaningful gap between production and cars actually sold and confirming the demand slowdown.

$TSLA shares slipped back towards 52-week lows today, with Stocktwits sentiment falling to its lowest level of the year and settling in the “extremely bearish” range. 👎

While some still believe in the overall brand and Elon Musk’s leadership long-term, some argue it’s hard to ignore the opportunity cost of owning a struggling stock as much of the market rallies to new heights.

As always, we’ll have to wait and see how this develops in the coming weeks and months. But in the meantime, if you want to hear more about the bull and bear case for Tesla, join us for a Twitter Spaces on Thursday at 5 pm ET. 🚨

We’ll be joined by @WholeMarsBlog and @SawyerMerritt to discuss the burning question, “When Will Tesla Be A Buy?” Keep an eye on our Twitter account for the spaces link soon, and we’ll see you there on Thursday! 👀

STOCKS

132-Year-Old GE Completes Its Three-Way Split

General Electric has been around longer than anyone has been around for longer than anyone reading this, taking many forms over its 132-year history. 👴

Just two decades ago, it was the world’s most valuable public company. However, it has experienced a significant fall from grace and is hoping to restructure its way out of it.

Its first step came last year when it spun off GE HealthCare into a standalone company. And today, it split its energy unit, GE Vernova from GE Aerospace, creating three total companies that trade under the tickers:

Time will tell if these three companies will be as successful as executives and analysts expect them to be as separate entities. Despite the positivity on Wall Street, retail investors remain skeptical, with Stocktwits sentiment sitting in bearish territory for both GE Aerospace and GE HealthCare.

We’ll keep an eye on that interesting divergence as the stocks begin to trade more independently and develop their own identities. 👀

STOCKTWITS “CHART ART”

A Chinese Travel Stock On The Move 🧳

If you liked the chart and commentary above, you’ll love our new “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

We’re officially launching on Monday, April 8th. But to sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

🕵️ Senate investigates if worsening ER care is due to PE firm activity in healthcare. A Senate committee has asked three major private equity firms for information on how they staff hospital emergency departments to see if the industry’s large share of the nation’s ERs has harmed patients. With dozens of emergency department physicians expressing concerns, the investigation will look into alleged behavior, including improper billing, retaliation, and anti-competitive activities, among others. NBC News has more.

🛒 Amazon throws in the towel on its no-checkout shopping pursuit. The company’s dream to have customers scan while they shop has come to an end, with the retailer ending its “Just Walk Out” program at its brick-and-mortar grocery stores. Instead, it’s switching fully to “Dash Carts,” where customers can scan products as they put them in their cart to speed up the checkout process. Critics say self checkout, which has been around in some form since the 1980s, just isn’t that popular and isn’t worth trying to solve. Still, Amazon continues its attempt to successfully execute a seamless in-person retail experience. More from The Verge.

📰 Yahoo leans into news with an AI-powered app acquistiion. While most media businesses are pulling back from the news and cutting editorial jobs amid a slowdown in the advertising market, they’re looking to technology to pick up the slack. Yahoo is making a bet on AI-powered news by acquiring Artifact, created by Instagram’s co-founders Kevin Systrom and Mike Krieger. The financial terms were not disclosed, but we do know that Artifact will no longer operate as a stand-alone app. Instead, its technology will be integrated across Yahoo’s many products/properties in the coming months. TechCrunch has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍