NEWS

Markets Brace For “Nvidia Day”

Source: Tenor.com

U.S. stocks exhibited strength today alongside crypto as anticipation builds for Nvidia’s much-awaited earnings report tomorrow after the bell. With so much at stake, we’ve brought you the technical, fundamental, and social perspectives on Nvidia and the chip sector to help you prepare for the highly anticipated report. 👀

Today's issue covers the bull market behavior in crypto, everything you need to know for Nvidia earnings, and more from the day. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with technology (+0.83%) leading and financials (-0.68%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,917 | +0.40% |

Nasdaq | 18,987 | +1.04% |

Russell 2000 | 2,325 | +0.80% |

Dow Jones | 43,269 | -0.70% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SLN, $VRT, $SOAR, $SYRS, $ACRS 📉 $BATL, $XP, $INTU, $KYTX, $NOK*

*If you’re a business and want to access this data via our API, email us.

VIBES

The Bulls Are Back In Town 🤑

Before diving into Nvidia Day prep, let’s discuss some bullish behavior in today’s tape that has us feeling like we’re back in 2020/2021 all over again. 🤯

First, we’ll start with crypto, everyone’s favorite risk asset. Regulators finally approved the listing of options for spot Bitcoin ETFs, with BlackRock’s iShares Bitcoin Trust ($IBIT) listing on the Nasdaq being the first to begin trading today.

It traded roughly $1.9 billion in notional exposure, with the ratio of calls to puts at 4.4:1. For context, the popular gold ETF ($GLD) did $5 billion in trading volumes today (granted, it has been around for decades). Regardless, $1.9 billion is a massive amount (and likely a record) for day one of trading. Analysts say this likely played a role in Bitcoin making new all-time highs above $94,000 before pulling back. 💵

In the equity market, crypto-linked stocks are back on the move…but none more so than MicroStrategy. $MSTR shares are up over 75% just this month and have roughly quadrupled in price since their September 6th low. One ETF analyst noted that the presence of leveraged MicroStrategy ETFs, options, and overall leverage inherent in the company’s business structure plays a major role in its breakneck outperformance. 🚀

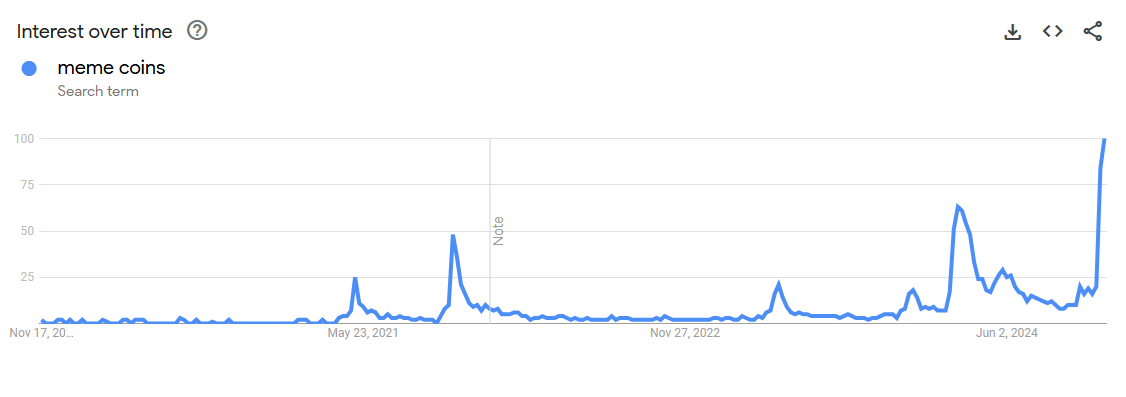

And if you need more evidence of the crypto bull market behavior, just look at Google searches for the term “meme coins” surging to new heights. Probably nothing, though. 😐

Source: Google Trends

As for the overall market vibes, a Financial Times report showed insiders are also selling aggressively in the current environment. The ratio of sellers to buyers recently surpassed its 2021 peak as corporate executives cash in on record-high stock prices.

Not to mention, Blackstone just struck a deal to take Jersey Mike’s Subs private for roughly $8 billion…as the race for returns expands further. What a load of bologna!

Markets can stay irrational longer than expected, but pockets of speculation continue to run rampant in the current environment. With elevated expectations comes the importance of businesses hitting their numbers to keep the bull run going. That’s why all eyes are turning to Nvidia tomorrow after the bell to make sure Jensen Huang and his team can keep the bull market vibes going. 😬

We’ve covered everything you need before Nvidia earnings in the story below. But if you want more coverage of the crypto side of things, definitely read today’s Litepaper, written by our resident crypto analyst, Jonathan Morgan!

SPONSORED

This Trading Bot Copies Congress, and has Outperformed the Market

Quiver Quantitative has built a trading bot that mimics stock trading by U.S. politicians, bringing a data-driven approach to copying the trading of Nancy Pelosi, Tommy Tuberville, and other members of Congress.

Quiver’s strategy, called the Congress Buys Strategy, tracks the performance of stocks that have been recently purchased by members of U.S. Congress (or their family). The holdings are weighted based on the reported size of the purchases, with weekly rebalancing.

This strategy has been doing well, and the methodology has had annualized returns of over 37% since 2020, outperforming the market on both an absolute and risk-adjusted basis.

To start copytrading the Congress Buys Strategy, along with dozens of other data-driven trading strategies published by Quiver Quantitative, you can visit www.quiverquant.com/strategies.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Your “Nvidia Day” Guide 📋

Why Nvidia is so important: 🤔

Simply put, it’s the largest company in the world ($3.65 trillion) and has an 80% market share in the GPU market, setting the standard for high-performance graphics and AI computing. Need we say more?

The technicals: 📊

From a technical perspective, there’s not a whole lot to dislike. Since bottoming in October 2022 and reclaiming its 200-day moving average in early 2023, the stock has been smoothly sailing…with mild corrections amid its 1,300% rally.

From a more tactical perspective, the stock recently retested its June highs to help reassure bulls that its recent breakout to new highs is legit. Its price action, trend, and momentum have been a technical analyst’s dream. 🤩

The market’s core concern is less about Nvidia and more about the broader semiconductor sector. ⚠

Below is a chart of the popular ETF $SOXX breaking below its trendline and 200-day moving average earlier this week, raising the caution flag for the first time in several years. Still, the bulls are hoping a blowout quarter from Nvidia can help resolve this small breakdown and get the whole sector back on track.

The fundamentals: 📝

Data center revenue and the company’s overall pipeline will remain the key focus areas for analysts. Based on recent news, here are a few more things to watch.

Does the company address concerns about its Blackwell chips overheating, which could require rack redesigns and create customer delays?

Does the company address Super Micro Computer’s recent troubles or note how they impact its business outlook? SMCI is Nvidia’s third-largest customer, and Nvidia is SMCI’s largest customer.

Does rising AI spending have its clients (and their stakeholders) concerned about the return on investment (ROI) they see from initial projects?

Sentiment: 🌡

With nearly 10,000 votes in, 59% of those polled on Stocktwits believe that Nvidia will beat earnings and jump (presumably to new highs). Our sentiment score also leans towards a positive outcome, jumping from ‘bullish’ yesterday to ‘extremely bullish’ today. As for Wall Street, zero analysts rate the stock as a ‘sell’ or ‘strong sell,’ and the average price target is roughly 10% higher at $161.

Source: Stocktwits.com

The Google search trend for “Nvidia stock” has cooled off slightly since its last earnings report but remains elevated relative to its longer-term history. While we may not see the same global focus on Nvidia tomorrow afternoon, plenty of people are still watching and expecting a major market move.

Source: Google Trends

To sum it up, both retail and institutional investors have a lot riding on tomorrow’s results. That’s why we’re inviting you to join tens of thousands of traders and investors live on Stocktwits to hear the earnings results and call live.

Pre-Chat Access: Jump in up to 2 hours early (3 PM ET) to see what everyone’s buzzing about and share your thoughts as the news rolls in. Follow this link, or just add $NVDA to your Stocktwits watchlist to be alerted when the call goes live. 🚨

And be sure to join our price prediction contest for a chance to win exclusive “Nvidia Day” merch. It’s super comfy, we promise. 😉

STOCKS

Other Noteworthy Pops & Drops 📋

Walmart: Shares popped 3% after revenue and earnings topped expectations, and management issued strong guidance. The company's focus on providing value to consumers drove same-store sales momentum and e-commerce sales strength. 🛒

Aclaris Therapeutics: Shares roared 47% higher after the biotech company entered into a licensing deal with Biosion for rights for two antibody products and announced an $80 million funding round. 💊

Robinhood: Shares rose 1% after it acquired custodial and portfolio management platform TradePMR for $300 million. The company is making an entry into the $7 trillion Registered Investment Advisor (RIA) market to help fuel future growth. 💵

C3.ai: Shares soared 25% following the news at the “Microsoft Ignite” event. Under the expanded partnership, all C3 AI applications, including C3 Generative AI, will be made available on the Microsoft Commercial Cloud Portal, streamlining access for enterprises. 💻

Amcor and Berry Global: The global packaging firms jumped after announcing an all-stock merger, maintaining a primarily NYSE and secondary ASX listings. 🤝

Vertiv: Shares soared 16% after the company’s investor day, which prompted at least five Wall Street analysts to raise their price target on the stock. 👍

AeroVironment: Shares rose 4% on news of an all-stock acquisition of defense tech startup BlueHalo. 💵

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: ECB President Lagarde Speech (8:00 am ET), EIA Energy Inventories (10:30 am ET). 📊

Pre-Market Earnings: Target ($TGT), Nio Energy ($NIO), Canaan ($CAN), ZIM Integrated Shipping ($ZIM). 🛏️

After-Hour Earnings: Nvidia ($NVDA), Snowflake ($SNOW), and Palo Alto Network ($PANW). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋