NEWS

The Market’s Eye Turns To CPI

Markets were mixed ahead of tomorrow’s consumer inflation data, one of the few data points left before next week’s Fed decision. As for today’s performance, banks and oil stocks came under pressure, while consumer discretionary and technology were firmly in the green. 👀

Today's issue covers why bank stocks sank, GameStop CEO Ryan Cohen’s latest games, and why consumer discretionary stocks could begin to outperform. 📰

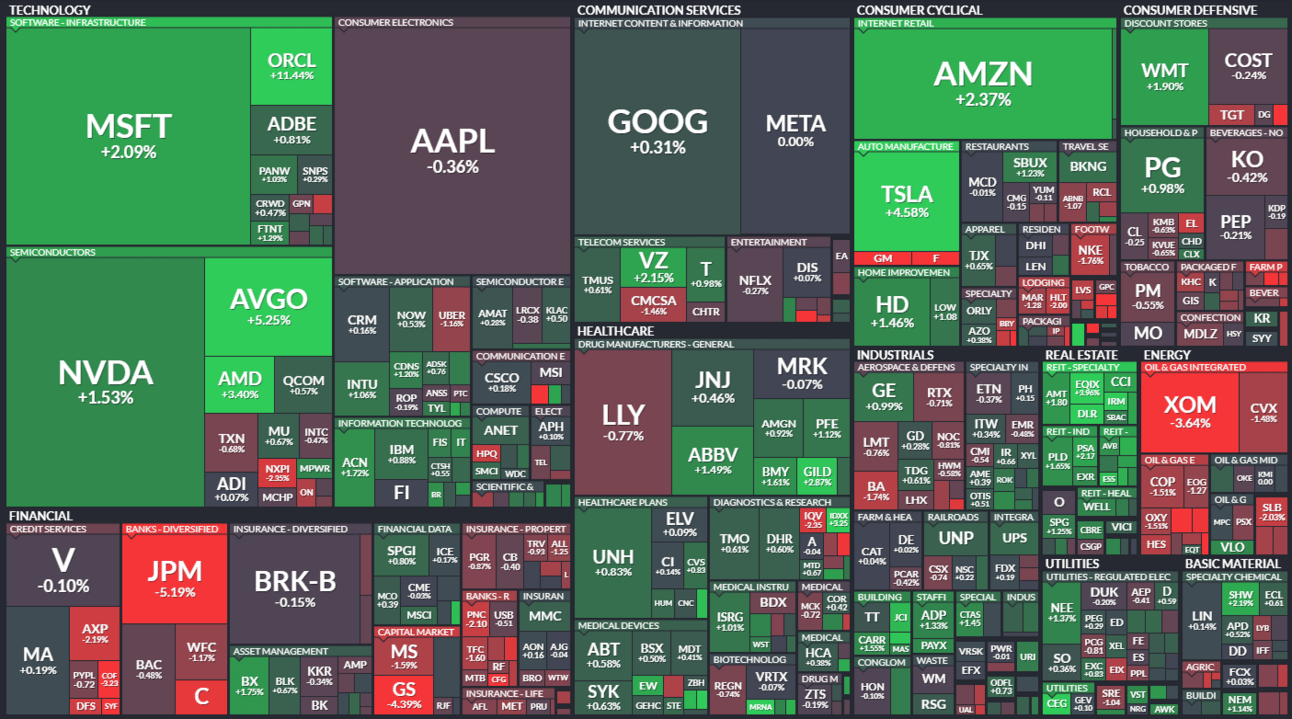

Here’s the S&P 500 heatmap. 7 of 11 sectors closed green, with real estate (+1.77%) leading and energy (-1.72%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,496 | +0.45% |

Nasdaq | 17,026 | +0.84% |

Russell 2000 | 2,097 | -0.02% |

Dow Jones | 40,737 | -0.23% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $QH, $IZEA, $VRDN, $FBLG, $NRBO 📉 $ALLY, $BOOT, $SMX, $IONS, $PLAY*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Bank Stocks Give Back Some Gains 💸

U.S. regulators unveiled plans to propose new capital requirements half as burdensome as their original plan, which should have been positive for the banking sector. However, the sector’s largest stocks tumbled after offering cautious outlooks at Barclay’s Global Financial Services Conference in New York. ⚠️

JPMorgan Chase said the bank is on pace to hit all its net interest income and expenses targets this year but warned analysts are a bit too optimistic about how much it will earn in 2025. The bank's COO echoed the CEO and CFO's commentary that the bank has been ‘overearning’ in recent quarters.

Bank of America told investors that investment banking fees will be ‘basically flattish’ YoY, with trading ‘up low single digits.’ Net interest income already troughed in the second quarter and should rebound. As for Berkshire Hathaway selling shares of the bank, CEO Brian Moynihan said he doesn’t know why the firm is doing this but appreciated it being an investor to help stabilize the company when it needed it most.

Goldman Sachs CEO David Solomon said trading revenue is expected to fall 10% YoY during the third quarter. It will also take a $400 million pre-tax earnings hit from its credit card partnership with GM as the bank continues to offload the rest of its failed consumer business. As for its bread and butter, the company did not share expectations about investment banking fees. Instead, Solomon said, “I feel very good about the way the firm’s positioned.”

Citigroup said credit costs are expected to rise by $200 million from the second quarter, with trading revenue down 4% YoY. Meanwhile, investment banking revenue should be up 20% YoY, as it completes four consecutive quarters of growth in that business.

Ally Financial fell sharply after warning that its consumers are under stress. CFO Russell Hutchinson said, “Over the course of the quarter, our credit challenges have intensified. Our borrower is struggling with high inflation and cost of living and now, more recently, a weakening employment picture.”

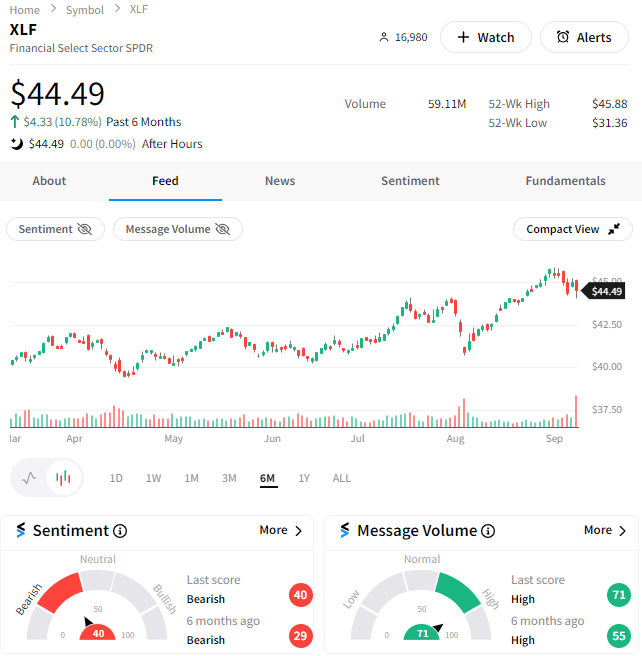

Popular financial sector ETF ($XLF) was down just over 1% on the day, with Stocktwits sentiment falling into ‘bearish’ territory on the news. 🐻

Source: Stocktwits.com

Financials have been a strong outperformer this year, but bank executives continue to warn that they may be unable to reproduce their recent stellar results. Investors seemed to think otherwise, at least until today. 😬

As always, time will tell. But for now, all eyes are on next week’s Fed interest decision and the next set of bank earnings beginning on Friday, October 11th.

STOCKTWITS “TRENDS WITH FRIENDS”

What’s In Store For A Seasonally-Weak September 🧐

EARNINGS

Ryan Cohen Keeps Playing Games 🙄

Although Roaring Kitty tried to reinvigorate the meme stock crowd last Friday with his first week in about two months, his influence seems to be waning as investors await a much-needed update from management on the business.

Unfortunately, investors did not receive any meaningful updates today. 🙃

The gaming retailer posted net sales of $798 million in revenue, down 31% YoY from last year’s $1.164 billion. Net income was $14.80 million, improving from last year’s net loss of $2.80 million.

Selling, general, and administrative expenses were 33.90% of net sales during the quarter. So despite falling about $52 million YoY, a larger revenue decline caused it to rise from 27.70% of sales in the second quarter of last year. 🔺

Still, the company’s cash, cash equivalents, and marketable securities were $4.204 billion as of the quarter's close, following share sales made earlier in the year to capitalize on Roaring Kitty’s ramp-up of the stock.

Classically, management did not hold an earnings conference call because that would have required answering difficult questions from investors (and analysts). Instead, it filed to sell 20 million more shares at the market, adding to the 120 million shares it sold earlier this year for $3.10 billion. 💸

It’s a prudent move, considering the stock price is still elevated. But what a slap in the face to existing shareholders...

Nevertheless, GameStop remains in the business of selling shares rather than games and other products to its customers. Until management can outline a clear plan to grow revenues either organically or through acquisitions, the stock will continue to trade solely off Roaring Kitty tweets, rumors, and vibes.

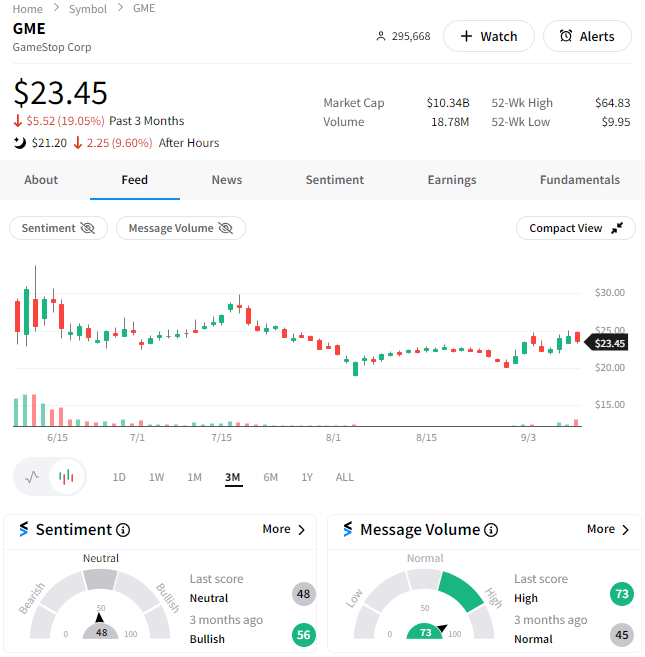

GameStop shares fell 10% after the bell, heading back toward 3-month lows as investors digested the news. The Stocktwits community’s sentiment remains neutral, as the extra cash is a long-term positive, but the lack of a plan to drive business growth and fear of additional dilution remains. 😕

Source: Stocktwits.com

On a related note, GameStop should take a page from Starbucks’ new CEO, Brian Niccol’s book. He wrote an open letter to all partners, customers, and stakeholders outlining his vision to return the company to its roots, outlining four key areas that will have the biggest impact. And shares reacted positively, rebounding from their lows to close up over 1%.

What's clearly missing is a clear vision and action plan for GameStop, but I don’t expect an open letter from management anytime soon. For now, Roaring Kitty’s cryptic tweets will have to do. 🤷

STOCKTWITS “CHART ART”

Consumer Discretionary Could Begin To Outperform 🛍️

Ratio charts are a major part of technical analysts’ toolbelt, with practitioners using them to measure the performance of one asset relative to another. The goal is to identify areas of relative strength to buy and areas of relative weakness to sell (or avoid). 🕵️

Stocktwits user @allstarcharts pointed to growing divergence in the Consumer Discretionary vs. S&P 500 ($XLY/$SPY) ratio, which recently made new price lows as momentum made a higher low.

This “bullish momentum divergence” is a potential signal that selling pressure is waning and that consumer discretionary stocks could be due for a change of trend relative to the broader market. 🤔

After major underperformance over the last three years, the improvement could signal market participants’ willingness to buy risker companies and stocks is increasing. That’s despite continued concerns about the economy and the overall stock market’s health.

As for what stocks could drive this trend? Amazon, Tesla, Home Depot, McDonald’s, and Lowe’s are the top weightings in this sector ETF to keep an eye on. 👀

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: MBA Mortgage Rates & Applications (7:00 am ET), Consumer Price Index - CPI (8:30 am ET), and EIA Energy Inventories (10:30 am ET). 📊

Pre-Market Earnings: Manchester United ($MANU), Designer Brands ($DBI), U.S. Global Investors ($GROW), and Vera Bradley ($VRA). 🛏️

After-Hour Earnings: Streamline Health Solutions ($STRM), MIND Technology ($MIND), and Lesaka Technologies ($LSAK). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋