NEWS

Markets Lack Direction Ahead Of U.S. Election

Source: Tenor.com

Those hoping for fireworks to start the week were left disappointed, as many investors and traders stick to the sidelines until they get more “certainty.” Ahead of what’s likely to be a close election, the Fed’s rate decision, and hundreds of earnings reports, we’ll say they may be waiting a while for uncertainty to dissipate... 👀

Today's issue covers a roundup of retail’s favorite earnings, what various polls say ahead of Election Day, and other noteworthy pops and drops. 📰

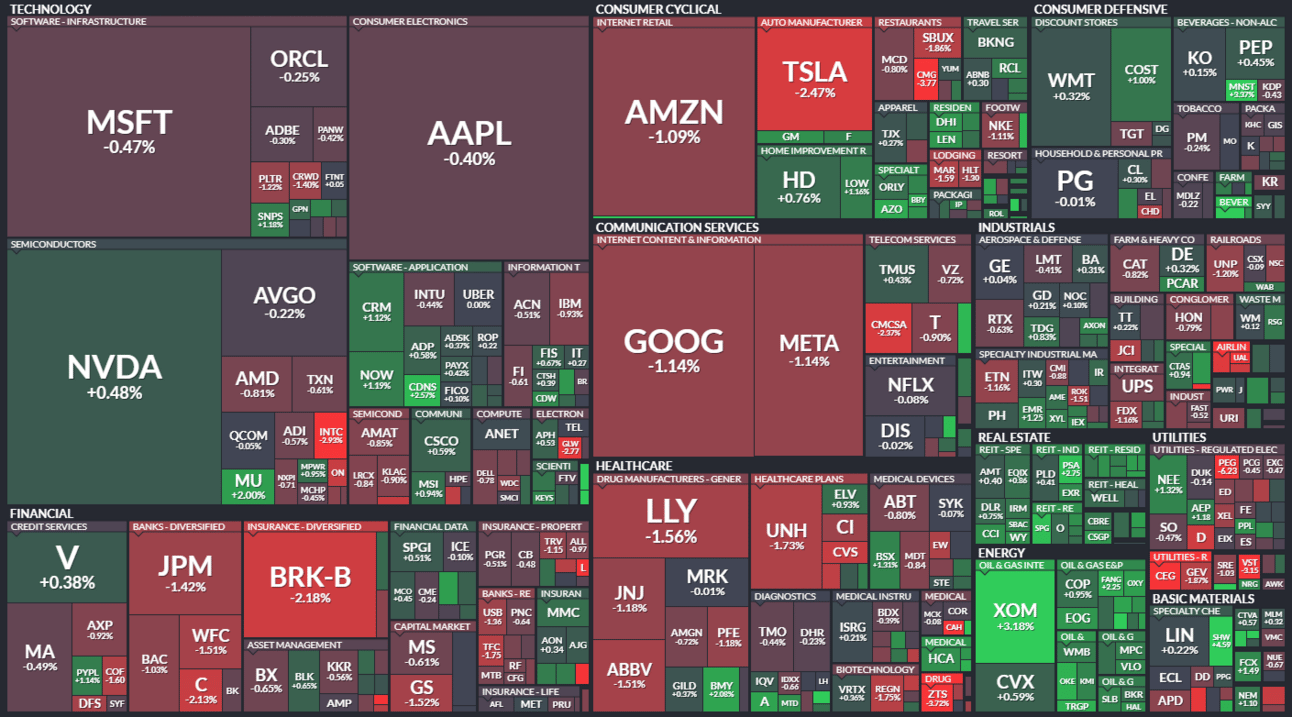

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with energy (+1.75%) leading and utilities (-1.19%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,713 | -0.28% |

Nasdaq | 18,180 | -0.33% |

Russell 2000 | 2,219 | +0.40% |

Dow Jones | 41,795 | -0.61% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $MQ, $TNYA, $ADN, $ALAB, $BOWL 📉 $PACS, $LSCC, $NGNE, $PLTR, $NXPI*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

A Roundup Of Retail’s Favorite Earnings 🤩

Three wildly popular stocks on Stocktwits reported results today, so let’s review.

Constellation Energy had a nuclear meltdown this morning, with shares falling 13%. It reported better-than-expected earnings after signing a 20-year power contract with Microsoft to reactivate the Three Mile Island Unit 1 nuclear power plant. ☢️

So why is the stock down? A negative decision by the Federal Energy Regulatory Commission (FERC) rejected Talen Energy’s proposal to increase power capacity at its Susquehanna nuclear power plant. The regulatory pushback was a harsh reminder for investors in this heavily regulated, capital-intensive industry that progress is nonlinear.

Palantir Technologies soared to fresh all-time highs in after-hours trading following an earnings and revenue beat. Co-founder and CEO Alex Karp said, “We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down.” 🧑💻

Revenue grew 30% YoY this quarter, with momentum that management expects to continue. It bumped up its revenue range for fiscal 2024, implying a 26% growth rate for the year and 24% growth in its U.S. commercial revenue.

Hims & Hers Health rose 8% after beating third-quarter earnings estimates and raising its guidance. The health and wellness platform cited strong subscriber growth and improving profitability. Looking ahead, its fourth-quarter revenue guidance was well above analyst estimates. 💊

Some investors are still seeking more clarity around the GLP-1 market, the FDA’s shortage list, and how it’ll impact the company’s future growth. But for now, management provided enough color to keep the fears at bay for another quarter.

POLICY

Here’s How The Polls Are Currently Polling… 📊

Polls and prediction markets are just a few ways investors are trying to get a handle on who will win tomorrow’s U.S. presidential election. Here’s how some of the widely-quoted metrics are currently moving.

Let’s start with Stocktwits’ new “Polls” feature that we just rolled out. In a few short days, nearly 44,000 users have voted in our poll, and 2/3 think Trump will win the election versus 1/3 for Harris. That’s a lot of votes! 🤯

Source: Stocktwits.com

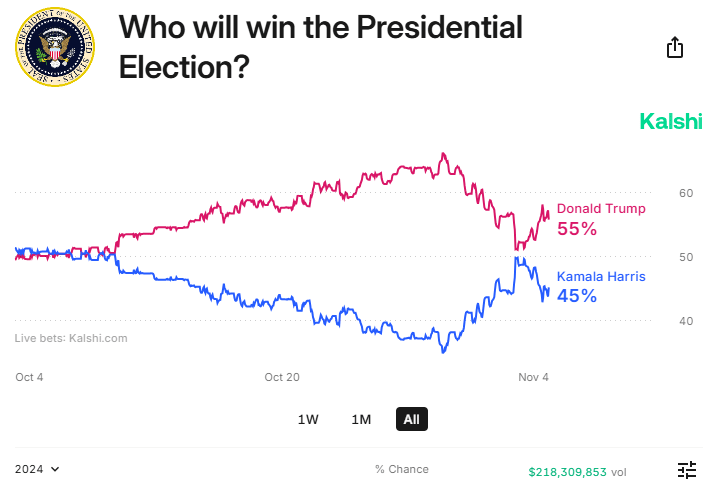

Next, we’ll look at Kalshi, the first U.S.-regulated exchange and prediction market. It is in the middle of its range, with 55% Donald Trump and 45% Kamala Harris. The move comes days after the two converged following weeks of trending. 🌎

Source: Kalshi.com

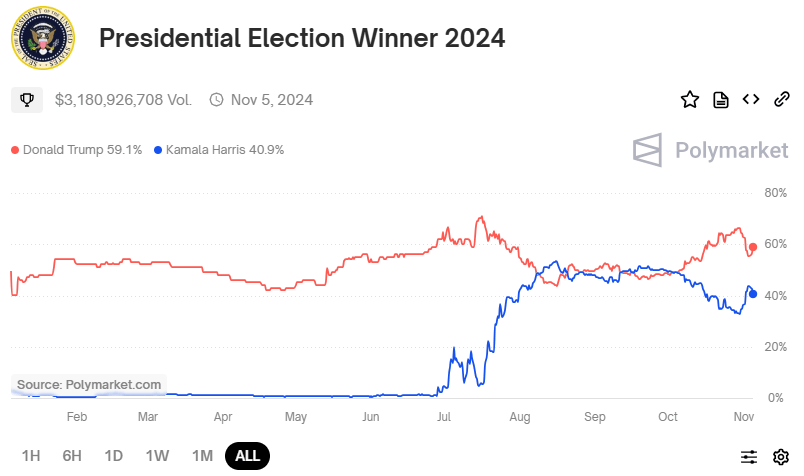

Lastly, we’ll check Polymarket, the world’s largest prediction market…with the caveat that U.S. residents cannot use the service. As such, it’s very much seen as international bettors’ views of the election. Right now, it’s sitting at roughly 59% Donald Trump and 41% Kamala Harris. 🌏

As for publicly traded stocks, there’s been significant volatility in Trump Media & Technology, Phunware, Rumble, Gevo, Aurora Cannabis, and other individual stocks linked to candidates or their specific policies/views. 🫨

Overall, it remains a close race by most measures…and we’re seeing that reflected in the S&P 500 Volatility Index ($VIX), which is sitting comfortably in the 20s and signaling heightened caution among investors and traders into tomorrow.

Time will tell how it plays out. But for all your market-related moves, keep Stocktwits open to stay updated on all the movers and shakers. 👍

STOCKS

Other Noteworthy Pops & Drops 📋

Chewy: Shares jumped 6% on news that it will replace Stercycle Inc. in the S&P MidCap 400 index, putting it into a prominent position within the consumer discretionary sector of the mid-cap market cap segment. 🐶

Dollar Tree: Shares rose 6% on news that its CEO and chairman, Rick Dreiling, stepped down on Sunday for “personal reasons.” This gave investors some hope that the struggling retailer could attract a leader suited to mount a turnaround. 💵

Yum China: Shares rallied 7% after reporting better-than-expected revenue growth, primarily attributable to net new unit contribution. Same-store transactions grew 1% YoY, its seventh consecutive quarter of growth. Restaurant margin held steady YoY, and management plans to continue adding stores to drive growth. 🌮

Air Transport Services: Shares soared 26% after the supplier of airfreight transport to Amazon agreed to be taken private in an all-cash $3.1 billion deal. ✈

B. Riley: Shares fell 13% after the investment-bank-backed Franchise Group filed for bankruptcy. The owner of Vitamin Shoppe, Buddy’s Home Furnishings, and Pet Supplies Plus filed for bankruptcy after months of losses and turmoil. B. Riley announced it would take an additional $120 million impairment on its equity investment in the parent unit of FRG and a loan to its founder and former CEO. 😵

Viking Therapeutics: Shares shed 13% after reporting the latest results from trials of its weight-loss drugs. Analysts are concerned about mounting competition in the space and the time and cost to bring both its oral and injectable versions of the drug to market in multiple dosage sizes. 💉

NXP Semiconductors: Shares slid 6% after the company’s fourth-quarter guidance missed expectations due to broader macro weakness in the automotive and Internet of Things markets in Europe and the Americas. Both its earnings and revenue outlook were lighter than expected. 📉

Lattice Semiconductor: Shares slumped 18% after its third-quarter results missed expectations, and the company outlined plans to cut costs. It will eliminate 14% of its workforce and operating expenses, helping push annual earnings growth into the low-double-digits range next year. ✂

Cirrus Logic: Shares fell 11% after the company provided weak third-quarter guidance that overshadowed its second-quarter beat. The audio chip maker is seeing strong demand for products shipping into smartphones and some progress in the laptop market, but analysts remain concerned about its core market. 😬

COMMUNITY VIBES

Nvidia Just Keeps On Winning… 👑

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: U.S. Presidential Election, Balance Of Trade (8:30 am ET), S&P Composite PMI (9:45 am ET), ISM Services PMI (10:00 am ET). 📊

Pre-Market Earnings: SNDL Inc. ($SNDL), Ballard Power Systems ($BLDP), Nintendo ($NTDOY), Marathon Petroleum ($MPC), Yum Brands ($YUM). 🛏️

After-Hour Earnings: Super Micro Computer ($SMCI), Ferrari ($RACE), Lumen Technologies ($LUMN), Coupang ($CPNG), Pan American Silver ($PAAS). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋