NEWS

Market Mixed As Investors Eye “Mag 7” Earnings

Source: Tenor.com

This market remains all about earnings, with investors and traders both looking for catalysts to move their favorite individual stocks and sectors. A significant portion of the “Magnificent 7” stocks will report in the next few weeks, so all eyes are temporarily shifting away from the Fed and toward fundamentals. 👀

Today's issue covers Netflix’s positive print, two stocks soaring to new highs on earnings, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with energy (+0.48%) leading and utilities (-0.89%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,841 | -0.02% |

Nasdaq | 18,374 | +0.04% |

Russell 2000 | 2,281 | -0.25% |

Dow Jones | 43,239 | +0.37% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SNA, $TRV, $MBLY, $PSTG, $AU, 📉 $DUO, $AFRM, $CSX, $CNC, $NRG*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Investors Give A “Thumbs Up” To Netflix Results 👍

Netflix tops the list of media companies investors pay attention to each earnings season as it provides a critical update on the global streaming environment, content costs, and the ability to monetize customers via paid and ad-supported methods. 📺

Netflix shares had pulled back from all-time highs ahead of its results, but with the company surpassing estimates for its key metrics, they’re regaining some ground in the after-hours session.

Source: CNBC.com

Its 5.1 million subscriber additions brought the total to 282.7 million, topping estimates slightly. Ad-tier membership rose 35% QoQ, and management said it will roll out to Canada this quarter and more broadly in 2025. However, given the small base and 200 billion hours of content to build ad inventory around, it does not expect advertising to become a primary growth driver until 2026. 🗓️

During the conference call (which thousands of people listened to live on Stocktwits), management harped on the company’s commitment to quality and strong balance sheet as Netflix’s key differentiator for its peers.

While legacy media companies turn to bundling and discounting to drive market share and engagement, Netflix expects its focus on offering the most value at the lowest possible cost to reign supreme.

Traders expect the momentum to continue tomorrow as shares rise 5% in after-hours trading. However, investors were unimpressed by the lack of material business updates and questioned the stock’s ability to continue higher, leaving Stocktwits community sentiment in ‘neutral’ territory as the debate rages on. ⚔️

SPONSORED

Go long on Netflix! $NFLU is the first 2X leveraged ETF for $NFLX, giving you the tools to trade with precision.

Bullish on Netflix? Ramp up with the T-REX 2X Long NFLX Daily Target ETF (NFLU). Seek to turbocharge your portfolio by tapping into Netflix's upward trajectory. NFLU is your ticket to leverage potential surges, enhancing your market position if Netflix climbs.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Buyers Turn Up The Heat In Travelers & Taiwan Semi 🔥

Travelers & Taiwan semi are very different companies, but both are hitting new all-time highs after earnings…and the Stocktwits community is all bulled up. 🐂

Taiwan Semiconductor, the largest manufacturer of semiconductors and artificial intelligence (AI) chips, shared a slightly more rosy view of the market today, helping offset some of the fears sparked by ASML Holding’s earnings debacle.

Third-quarter profits rose 54% YoY, net revenue rose 36% YoY to $23.5 billion, and gross margins improved by 3.5 percentage points YoY to 57.8%. Fourth-quarter revenue guidance implies 13% QoQ and 35% YoY growth, and management said full-year capital expenditures would be slightly higher than anticipated. 📊

Overall, management said its business and pipeline remain well supported by strong smartphone and AI-related demand for its 3nm and 5nm technologies.

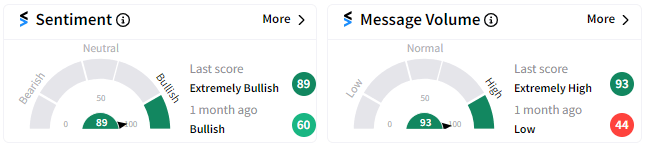

A 10% rally put TSM shares up nearly 100% on the year, and bulls expect them to run further. Stocktwits sentiment sits in ‘extremely bullish’ territory as traders await tomorrow’s open to see if the momentum continues. 🧐

Travelers saw earnings and revenue top estimates despite fears of higher insurance costs and sticker shock from consumers as individuals and businesses spend more on premiums. 😮

Core income jumped 3x to $1.22 billion, or $5.25 per share, smashing analyst estimates of $3.55. Meanwhile, net written premiums rose 8% as all its units experienced growth.

Underwriting gains climbed 400% from last year to $685 million, while net investment income rose 18% due to strong fixed-income returns and growth in fixed-maturity investments. Catastrophic losses (net of reinsurance) rose less than anticipated, jumping about 10% YoY from $850 to $939 million. 🔺

Overall, its combined ratio improved 5 percentage points YoY, falling to 85.6%. A ratio below 100% shows the insurer is earning more in premiums than claims it’s paid, so the lower the number, the better.

Shares soared 9% to new all-time highs and close near the day's highs, so many traders expect further upside in the days and week ahead. Who knew boring old insurance could be so bullish? 🤑

STOCKS

Other Noteworthy Pops & Drops 📋

📰 Uber Eyes Expedia Buyout

Uber reportedly mulled over acquiring Expedia, but analysts aren't thrilled. They question whether venturing into the travel-booking space is wise for Uber, fearing it could stretch the company too thin and divert focus from its main operations. Even with the CEO's ties to Expedia, the potential move makes Uber bulls uneasy. CNBC.

📶 Nokia’s Patchy Signal

Despite cost cuts boosting profits, Nokia's revenues fell short, sending shares down 3%. The company talked up its recovery signs, but with declining sales in key markets, some wonder if this optimism is more hope than reality. Reuters.

💼 Blackstone Tops Earnings

Blackstone delivered better-than-expected earnings and revenues, but with the stock underperforming the market this year, investors are left wondering if this uptick is sustainable. Mixed signals in the financial sector make it unclear whether Blackstone can keep outperforming expectations. Yahoo!Finance.

💉 Intuitive Surgical Surges After Earnings

The surgery-focused robotics company beat earnings and revenue expectations, with its da Vinci procedures growing 18% YoY. A key indicator of surgical activity, instruments and accessories revenue rose 18% YoY, while systems revenue grew 17%. Overall, the core measures of the company’s business remain healthy, and Stocktwits users are betting on further upside. Investing.com

📉 Jobless Claims Drop

Unemployment claims fell after a storm-induced spike, but don't celebrate just yet. Economists warn that the numbers might be shaky for an extended period thanks to recent hurricanes. It's unclear if this drop signals real improvement or weather-related noise, but the positive is that overall claims remain historically low. Reuters.

🏦 European Central Bank (ECB) Cuts To Spur Growth

After today’s cut, ECB insiders say the central bank expects another in December unless the economy picks up. Markets saw this coming and have already priced it in. Looks like the ECB is sticking to the script without any unexpected twists. ForexLive.

🛢️ Oil Inventories Drop

Crude oil stocks fell when a rise was expected, boosting oil prices slightly. If supply tightens unexpectedly for several straight weeks, consumers may have to brace themselves for potential price hikes at the pump. Nasdaq.

STOCKTWITS “TRENDS WITH FRIENDS”

How Meme Coins Are Impacting Markets & Culture 🐶

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Building Permits & Housing Starts (8:30 am ET), Fed Bostic Speech (9:30 am ET), Fed Kashkari Speech (10:00 am ET), Fed Waller Speech (12:10 pm ET), Fed Bostic Speech (12:30 pm ET). 📊

Pre-Market Earnings: American Express ($AXP), Procter & Gamble ($PG), Schlumberger ($SLB), Ally Financial ($ALLY), Regions Financial ($RF), Fifth Third Bancorp ($FITB), Comerica ($CMA), and Volvo ($VLVLY). 🛏️

After-Hour Earnings: None — enjoy your weekend. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

❌ Meta fires employees for spending food allowances on personal items like acne pads and wine glasses

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋