NEWS

Market Mixed As Meta Meets Its Maker

U.S. stocks had a mixed session but are melting lower in after-hours following big tech’s earnings miss. Now eyes turn to Microsoft, Google, Snap, and more major earnings tomorrow. Let’s see what else you missed. 👀

Today's issue covers Meta longs getting Zucked, TikTok’s ban at the center of consumer tech news, and Chinese stocks carving out a bottom. 📰

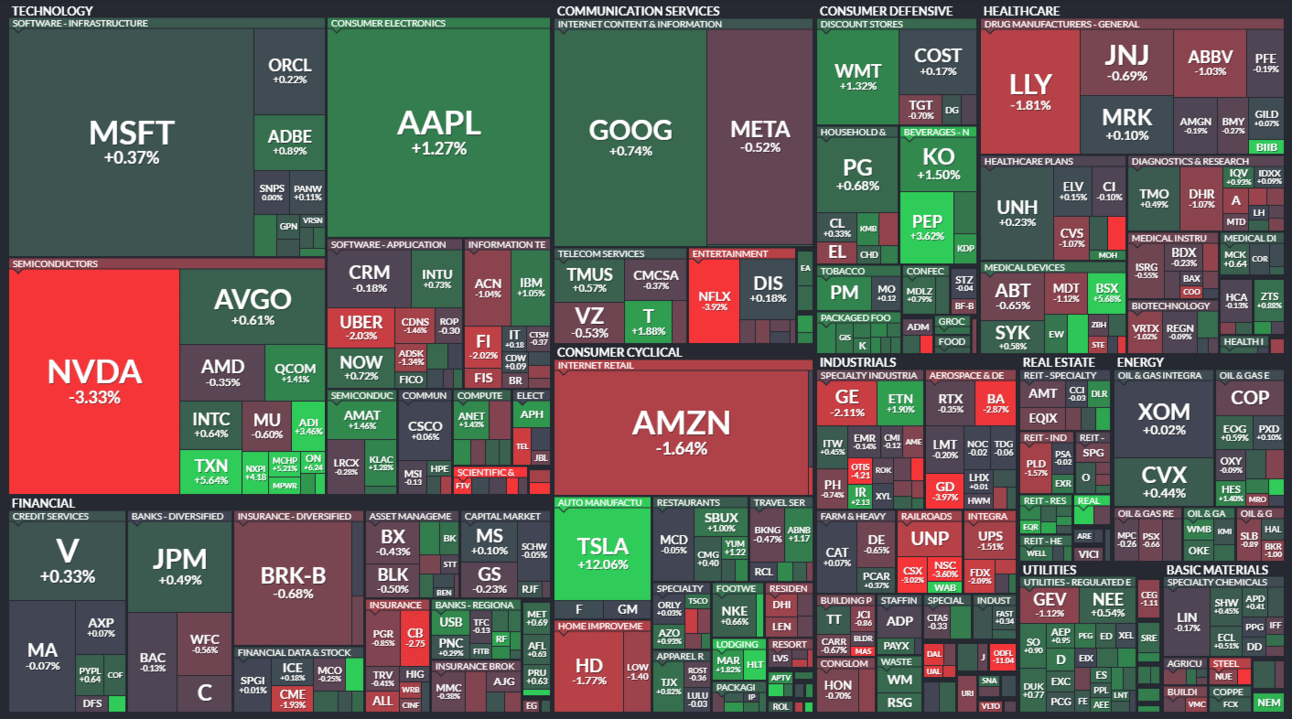

Here's today's heat map:

8 of 11 sectors closed green. Consumer discretionary (+0.96%) led, & technology (-0.80%) lagged. 💚

Mortgage rates pushed to new 2024 highs, stoking fears that the currently frozen housing market will not unthaw for the spring/summer busy season. Meanwhile, durable goods orders jumped in March thanks to a rebound in planes and autos but showed that most manufacturing remains mixed. 📊

The Bank of Canada’s summary of deliberations showed that monetary policy easing is expected to be “gradual,” with members looking for “further and sustained easing in core inflation.” ⏯️

Moderna’s shares popped on news that the COVID-19 vaccine maker has partnered with OpenAI, in a deal that aims to automate nearly every business process at the biotech company. 💉

Old Dominion Freight Line fell 11% after reporting mixed first-quarter results, with earnings meeting estimates but revenue missing marginally. 🚚

Tech dinosaur IBM fell 9% after its quarterly revenues missed expectations while the company also announced it will acquire HashiCorp for $6.40 billion. 💰

Toymaker Hasbro jumped 11% after its adjusted earnings and revenues both topped estimates after several quarters of disappointing results. Mattell also caught a bid after its quarterly loss narrowed, but revenues missed. 🪀

B. Riley Financial soared 37% after delivering its overdue annual report, which provided plenty to debate. Skeptics argue that the boutique investment bank’s accounting is deeply flawed, but that doesn’t seem to matter today. 🏦

Other active symbols: $TSLA (+12.06%), $NVDA (-3.33%), $VRT (+6.82%), $IBRX (-12.20%), $CSEE (+179.25%), & $HBAR.X (-4.59%). 🔥

Here are the closing prices:

S&P 500 | 5,072 | +0.02% |

Nasdaq | 15,713 | +0.10% |

Russell 2000 | 1,995 | -0.36% |

Dow Jones | 38,461 | -0.11% |

EARNINGS

Well, That Certainly Zucked

Is there anything more meta than the thing that’s supposed to drive a company’s future growth being the exact thing that trips it up? Because that’s exactly what we saw during today’s results from Meta. 🤦

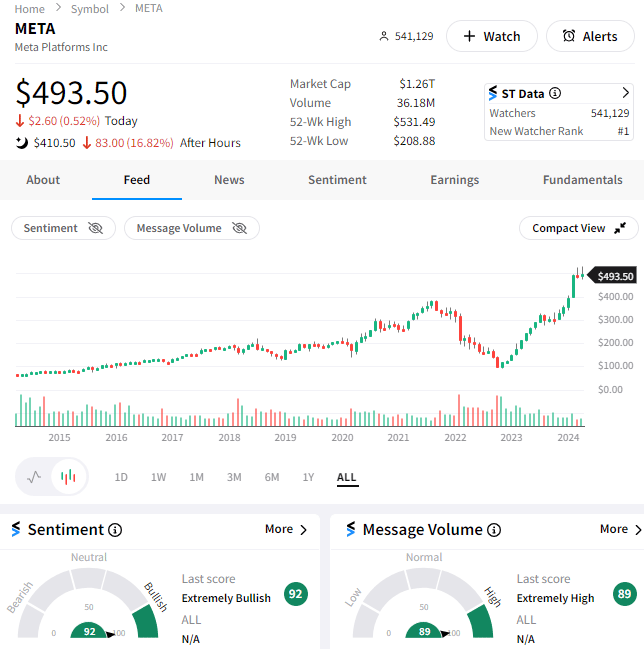

The stock is falling sharply after hours despite beating earnings and revenue for the current quarter. However, its guidance came in below expectations, and AI spending forecasts have investors concerned about near-term results.

Adjusted earnings per share of $4.71 topped the $4.32 expected, as did revenues of $36.46 billion vs. $36.16 billion. Notably, net income benefited from sales and marketing costs falling 16% YoY while revenue growth stayed solid. 🔻

Looking ahead, second-quarter revenue guidance had a midpoint of $37.75 billion. And while that represents 18% YoY growth, it was below the consensus analyst estimate of $38.30 billion.

The sell-off accelerated during the earnings call when CEO Mark Zuckerberg discussed investments in glasses, mixed reality, and other projects that aren’t anticipated to make money for years. 😨

He also said investments in artificial intelligence (AI) are ramping up, but hedged his statement by saying that once those services reach scale the company has a strong track record of monetizing them effectively.

Capital expenditure guidance for 2024 was raised from $30-$37 billion to $35-$40 billion, but headcount was down 10% YoY to just over 69,000 people.

Overall, Meta’s core businesses continue to fire on all cylinders. But expectations were very high coming into the print, and it’s often increasingly difficult to meet higher and higher expectations.

Also, it seems the market is still not fully comfortable with the trajectory of the company’s long-term investments, which remain loss leaders. 😬

Shares are down 17% after the bell, retreating from the all-time highs they’ve been at for much of the last three months. Notably, Stocktwits community sentiment remains in “extremely bullish” territory as investors and traders debate the stock’s future. 🧐

Today’s move is in stark contrast to yesterday’s Tesla results, highlighting the importance of expectations going into an earnings release. Even though Tesla’s numbers were bad across the board while Meta’s were good, one stock mooned, and the other got tuned (up).

Just another thing that makes this stock market thing we all love so difficult to navigate. 🙃

POLICY

TikTok Ban At Center Of Consumer News

While we’re on the subject of social media giants, we have to talk about the TikTok ban that was just signed into law as part of a larger $95 billion foreign aid package. With former attempts stalled in the Senate, House representatives attached a version to high-priority legislation to force a vote. 🗳️

The signed bill will force TikTok’s Chinese parent company, ByteDance, to divest from its U.S. operations within nine months (up to a year if progress is being made) or face a nationwide ban. 🚫

Critics have long argued the app could put U.S. customer data at risk given the Chinese government makes information sharing mandatory for Chinese companies. While TikTok has said it operates independently and protects U.S. data through an alliance with Oracle, broader concerns remained.

With the geopolitical tensions heating up globally and between the West and China, fears are that it’s ultimately being used to push agendas that are bad for U.S. citizens and the country. And with China banning U.S. apps and companies from its soil, concerns are that the U.S. allowing TikTok to operate here sets a bad precedent and power dynamic.

TikTok has long argued that its app is a vital part of Americans’ free speech and that losing access would harm small businesses, creators, and others who use its platform to reach their target audience. It also argued this would further consolidate power to a few U.S. tech giants that are already being pursued by regulators globally over anticompetitive practices. 🤖

TikTok CEO Shou Chew said the social media platform will challenge the new law on First Amendment grounds, showing that it has little intention of selling itself. Alternatively, some say that the company could dilute the product’s value before selling by messing with the algorithm, which is the essential sauce that’s helped it grow to its current size today.

Time will tell how this plays out, but many see this as a positive tailwind for competitors like Instagram Reels, YouTube Shorts, and other platforms that are leaning heavily into the short-form video content format. 🤳

Some pointed out that Joe Biden’s re-election campaign will continue to use a TikTok spokesman to reach its audience to illustrate just how messy this situation remains.

In other consumer news, Apple is reportedly cutting its Vision Pro production and rethinking plans for its next model due to low demand.

Final rules issued by the Department of Transportation (DOT) will require airlines to provide automatic cash refunds within a few days for canceled flights and “significant “ delays. The new rule defines a significant delay as three hours for domestic flights and six for international ones.

Lastly, the Biden 2025 budget proposal had some bad news for high-income investors. It proposes raising the top capital gains and dividends tax rate to 44.60%, the highest in more than a century.

STOCKTWITS “CHART ART”

Tesla’s Chart Structure Remains Troubling 🚨

If you liked this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

💳 Klarna’s new product hopes to make credit cards less evil. The buy now, pay later company is trying to build a credit card for the nearly two-thirds of Americans who don’t pay off their credit cards in full every month. Klarna says its new product features the four aspects that make it a good payment card for those who carry a balance, including no annual fee, simple-interest payment plan options, consumer protections, and more. Axios has more.

🤖 Nvidia acquires an AI workload management startup. The semiconductor giant purchasing Run:ai for a reported $700 million, with it continuing to offer the startup’s products under the same business model. It’ll also invest in Run:ai’s product roadmap as part of Nvidia’s DGX Cloud AI platform. The two companies have been close collaborators since 2020 and share a passion for helping customers make the most of their infrastructure. And given the trends in tech, that’s only going to become more and more important in the years ahead. More from TechCrunch.

🍪 Google delays cookie deprecation for the third time. The search engine giant first promised to phase out third-party cookies in 2020 but has delayed it several times, doing so again today. The delay comes as Google works closely with the U.K.-based Competition and Markets Authority (CMA) to ensure its tools that replace cookie’s tracking and measurement capabilities aren’t anticompetitive. Additionally, these proposals have received significant pushback from other adtech companies, publishers, and ad agencies who say the tools are difficult, don’t adequately replace the multiple functions of cookies, and give Google too much power. AdWeek has more.

Links That Don’t Suck

🧑💻 Join IBD's free 2-hour trading workshop on 4/27 to learn the smarter way to buy and sell stocks*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍