NEWS

The Market’s Moving Target

Stocks may have broken their consecutive-day win yesterday, but they notched a fourth week in a row of gains even as commodities picked up steam. Almost daily, money seems to flow into a new market area, leaving active traders to play “whack a mole” as the indexes melt up. Let’s see what else you missed. 👀

Today's issue covers meme stocks lacking meme-entum, uranium stocks riding the metals wave to new highs, and one market theory sending warning signals about this week’s Dow 40k milestone. 📰

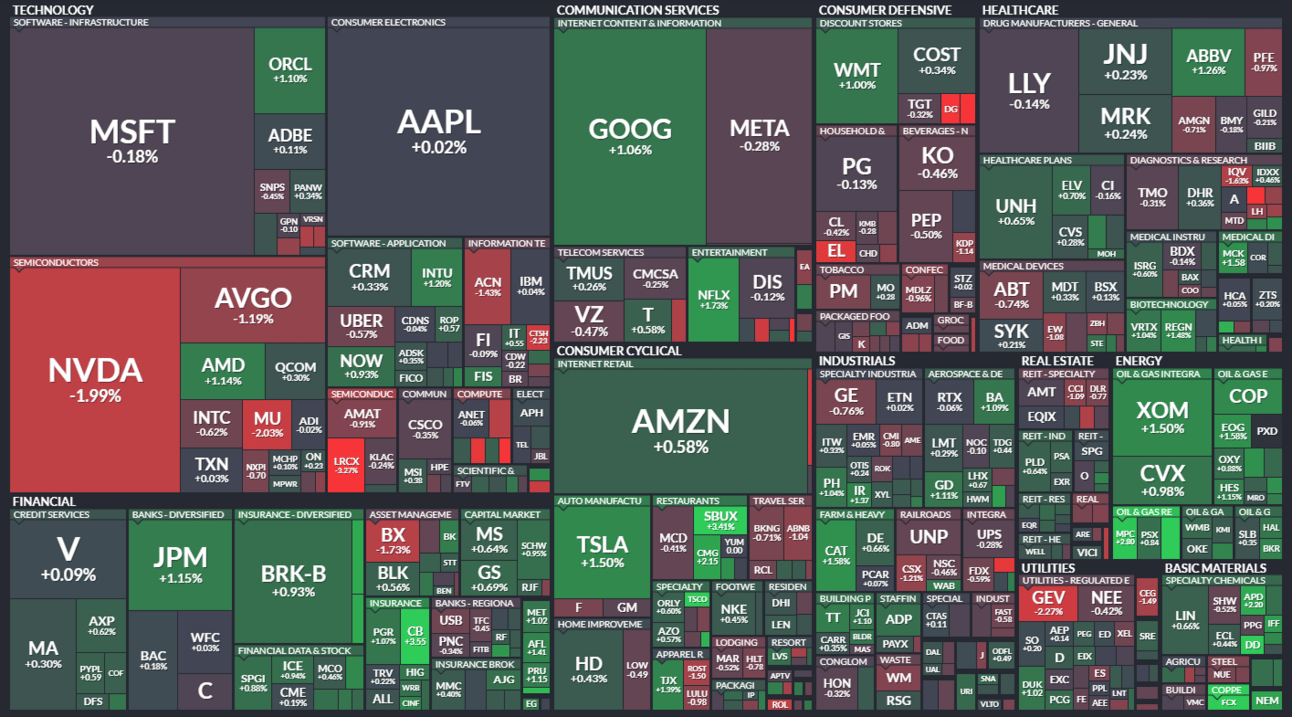

Here's today's heat map:

9 of 11 sectors closed green. Energy (+1.40%) led, & consumer staples (-0.24%) lagged. 💚

Chinese economic consumption remains slow as recent retail sales and investment data missed expectations. Meanwhile, its government is stepping up its efforts to support its sagging property market by purchasing properties at market prices and renting them at affordable rates. 📊

Reddit shares jumped 10% on news that it’s struck a deal with OpenAI, which will feed the social media giant’s posts into ChatGPT in real-time. The deal compliments its $60 million agreement with Google and reconfirms the lucrative potential of data sales in the large language model (LLM) world. 💾

Online networking company Doximity jumped 18% after beating fourth-quarter earnings and revenue estimates. Meanwhile, DXC Technology dropped nearly as much after earnings and revenue guidance missed expectations. 🤖

Cracker Barrel Old Country Store crumbled 15% after announcing an 80% cut to its quarterly dividend, preserving cash to support its strategic transformation. 🍯

Marijuana company Tilray is taking advantage of the recent reclassification pop by issuing new equity. It filed to sell up to $250 million worth of its common stock in an at-the-market program, reminding investors that this sector remains incredibly challenged despite U.S. legislative progress. 🥦

Other active symbols: $GME (-19.73%), $AMC (-5.17%), $FFIE (-37.58%), $JAGX (-55.34%), $DUO (+321.26%), & $GWAV (+4.05%). 🔥

Here are the closing prices:

S&P 500 | 5,303 | +0.12% |

Nasdaq | 16,686 | -0.07% |

Russell 2000 | 2,096 | -0.03% |

Dow Jones | 40,004 | +0.34% |

STOCKS

From Memes To Metals & Mining Stocks

On Tuesday, we wrote a refresher on “meme stocks” for those who needed to brush up on the current wave of meme-driven madness. And several aspects of that write-up proved relevant, given GameStop’s news.

As we noted then, prudent management teams will gladly take advantage of higher equity prices to raise capital, especially when disconnected from the business’s fundamentals.

And that’s exactly what GameStop did today, filing a shelf registration to offer up to 1 billion new common shares and 5 million preferred. It then entered an open market sales agreement to sell up to 45 million shares ASAP. 💰

While additional liquidity is a positive, it’s only helpful if it’s used to drive the core business toward profitability. And yet, management still has no plan to drive the sales growth it needs to get back on track.

Instead, it warned that first-quarter sales would fall from $1.237 billion a year ago to $872-$892 million, while analysts anticipated $1.045 billion. ⚠️

Although its net loss is expected to be narrower than expected, analysts know the company can only cut costs and sell assets for so long. Eventually, it has to make money selling video games…

It follows AMC Entertainment, who raised $250 million of “new equity capital” on Monday by selling 72.50 million shares. Like GameStop, it has a revenue problem but a much (much) worse balance sheet…

As a result, we saw GameStop, AMC, and other “meme stocks” give back much of the gains they garnered earlier in the week. Traders likely moved on to other market sectors that are working…like metals and mining.

So what is happening in that sector making the stocks go bonkers? Copper prices made new all-time highs, silver made 11-year highs, and gold is sitting firmly above $2,400. Even beaten-down platinum and palladium are turning a corner, making it a metals bonanza.

Improving sentiment around global economic growth and the artificial intelligence/technology boom boosting demand for metal components like copper has traders and investors bidding up the space. Additionally, while gold and silver have been crappy inflation hedges in the recent past, some still view it as a way to bet on an inflation resurgence. 🫠

The moves have traders taking notice in a big way, with several sector ETFs and big players breaking out to their highest levels in over a decade.

Our “Chart Art” newsletter teaser below shares one of several trade ideas the Stocktwits community is taking advantage of in the current environment. 👇

STOCKTWITS “CHART ART”

Uranium Stocks Make New Highs Amid Metals Meltup ⚒️

As discussed above, metals and mining stocks’ uptrends accelerated further this week. Add in the energy commodity complex perking up, and you’ve got a cocktail of catalysts for uranium stocks to continue their run.

And continue their run they are… 🏃

Stocktwits user @chessNwine highlighted the daily chart of uranium ETF $URA making new 10-year highs as the commodity crowd diversifies their bets across industries. Whether or not this trend will “go nuclear” in the coming weeks remains to be seen, but it’ll certainly be on traders’ radars. ☢️

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

STOCKS

Dow Theory Questions Legitimacy Of Dow 40k

Dow Theory is a commonly-referenced technical analysis concept, and it's popping up on people's radars again these days. 👀

There are six basic tenants to the theory, including:

The market discounts everything;

There are three primary kinds of market trends;

Primary trends have three phases;

Indices must confirm each other;

Volume must confirm the trend; and

Trends persist until a clear reversal occurs

While they're all somewhat connected, the main tenant we're focused on today is #4: Indices must confirm each other. 🤝

The idea is that the companies in the Dow Jones Industrial Average make the goods, while those in the Dow Jones Transportation Average ship them.

Well, while there are a lot of positives piling up for the market bulls, this theory is not one of them. As the chart below shows, the two indexes moved together through the end of 2023 but disconnected as the industrials pushed to new all-time highs and the transports lagged behind. 🤔

Now, there’s no specific timeframe in which one index needs to follow the other, but until it does, some market participants are questioning whether there are underlying issues in the economy being reflected here. ⚠️

This is a slower-moving indicator/theory, so it won’t matter overnight. But it’s certainly one to keep on your radar. Because if you’re a market bull, you’ll want to see transports make new all-time highs sometime this summer to confirm we’re in a healthy bull market. 🐂

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

Bullets From The Day

🛻 Honda expands its risky bet on hydrogen-powered trucks. The Japanese automaker revealed its new Class 8 truck powered by hydrogen fuel cells despite the recent rise in fuel prices and shaky outlook for its role in the transportation space. Despite selling just 223 new hydrogen fuel cell cars in the U.S. during the first quarter (a 70% YoY drop), the company continues to bet on the long-term potential of this technology. The Verge has more.

🗳️ United Auto Workers (UAW) union loses key vote in southern U.S. Autoworkers at a Mercedes Benz plant in Alabama voted against joining the union in a close 56% to 44% result of more than 5,000 eligible votes. The UAW was hoping its strong momentum would help it break into the tougher southern U.S. states but said losses are part of the process and that the result exhibits continued support for its longer-term goals. More from CNN Business.

📰 Newspaper conglomerate adding AI-generated summaries to articles. Gannett, which owns hundreds of newspapers in the U.S., is launching a new program using artificial intelligence (AI) to generate bullet points at the top of its journalists’ stories. The AI feature, labeled “key points,” uses automated technology to create summaries that appear below the headline, aiming to enhance the reporting process and improve the audience experience. The program is slowly rolling out, with some summaries already appearing in several online USA Today stories. The Verge has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍