NEWS

Markets Red As Semis Surge Ahead

The market's bullish undertone continues as Bank of America becomes the latest firm to boost its S&P 500 target, citing higher and more predictable earnings growth. Let's see what you missed. 👀

Today's issue covers semiconductor stocks continuing to soar, the battle of the clothing box services, and an interesting perspective on Tesla's slide. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

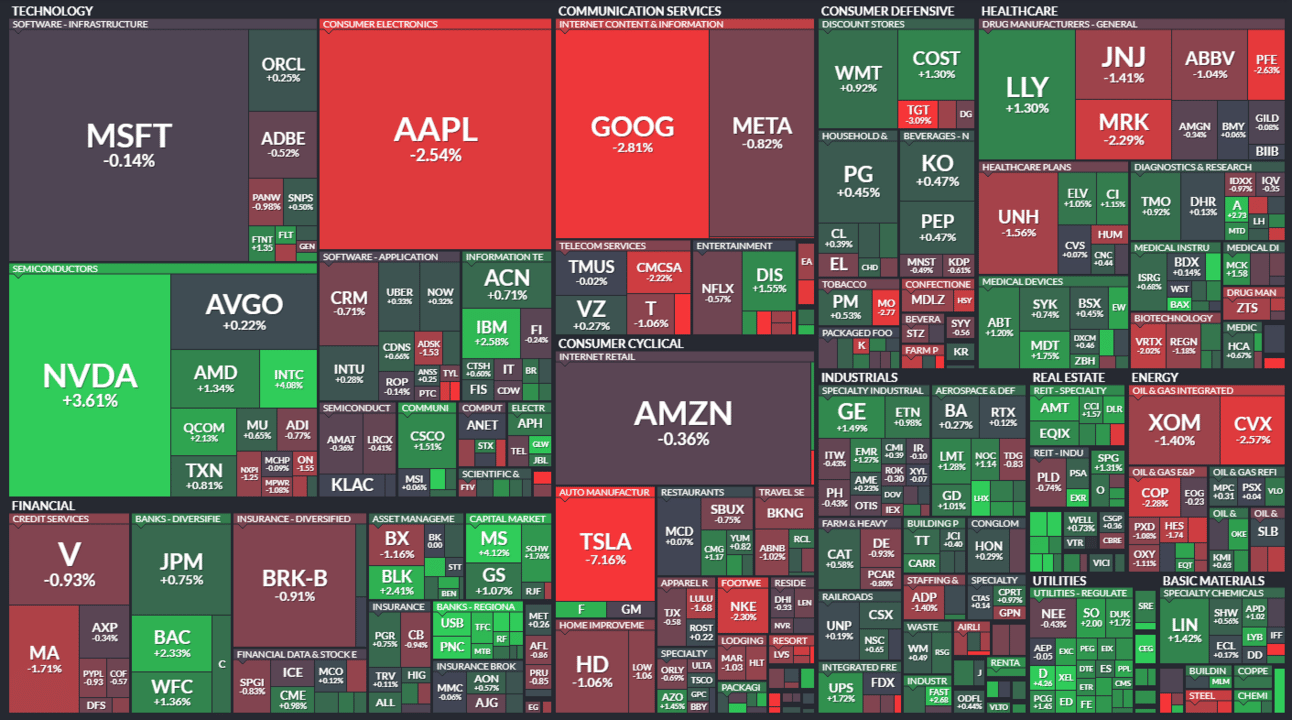

Here's today's heat map:

7 of 11 sectors closed green. Utilities (+1.64%) led, & communications (-1.39%) lagged. 💚

Boeing shares remain volatile as the FAA found 'multiple instances' of quality control issues and passengers sue Boeing and Alaska Airlines for $1 billion over the midair door panel blowout in January. Still, strong demand for airplanes continues to outweigh concerns, with American Airlines ordering 260 new planes and betting on a bigger first class to drive profits. ✈️

Meanwhile, Spirit Airlines shares plummeted on news that JetBlue is ending its $3.8 billion merger agreement after losing the antitrust lawsuit. ❌

Apple shares remain bruised, with the consumer tech giant losing $100 billion in market value after being hit with a $2 billion EU antitrust fine in its case against Spotify. Speaking of laggards, sentiment is souring on Google, with several analysts sharing why it may be time to sell the stock in favor of other tech winners. 👎

Macy's shares jumped 14% on news that Arkhouse Management said it and Brigade Capital Management have raised their buyout offer for the department store. The news kicks off a week of retailer earnings, with high-flyers like Abercombie & Fitch and Costco set reporting. 🏬

Trump-linked stocks like Phunware Inc. and Digital World Acquisition Corp. surged today after the Supreme Court rejected attempts to ban the former president from the 2024 ballot. 🗳️

Physical gold followed through after last week's upside breakout, with digital gold also pushing higher as Bitcoin approaches a new all-time high. Notably, not all crypto-related stocks participated in today's rally, with several Bitcoin miners falling sharply. 🪙

Other symbols active on the streams: $SMCI (+18.65%), $PHUN (+81.36%), $FSR (-8.50%), $BBAI (+25.14%), $FUFU (+105.80%), $MARA (-4.78%), $MSTR (+23.59%), & $SHIB.X (+58.54%). 🔥

Here are the closing prices:

S&P 500 | 5,131 | -0.12% |

Nasdaq | 16,208 | -0.41% |

Russell 2000 | 2,074 | -0.10% |

Dow Jones | 38,990 | -0.25% |

STOCKS

Semi Stocks Continue To Soar

Semiconductor stocks remain the focus of investors and traders, with Nvidia and Super Micro Computer pushing to all-time highs. The industry is starting the week with several analyst upgrades as Wall Street continues to chase these companies higher. 🌠

Despite the growing concern that the fundamentals may not fully support these short-term surges in price, the path of least resistance remains higher.

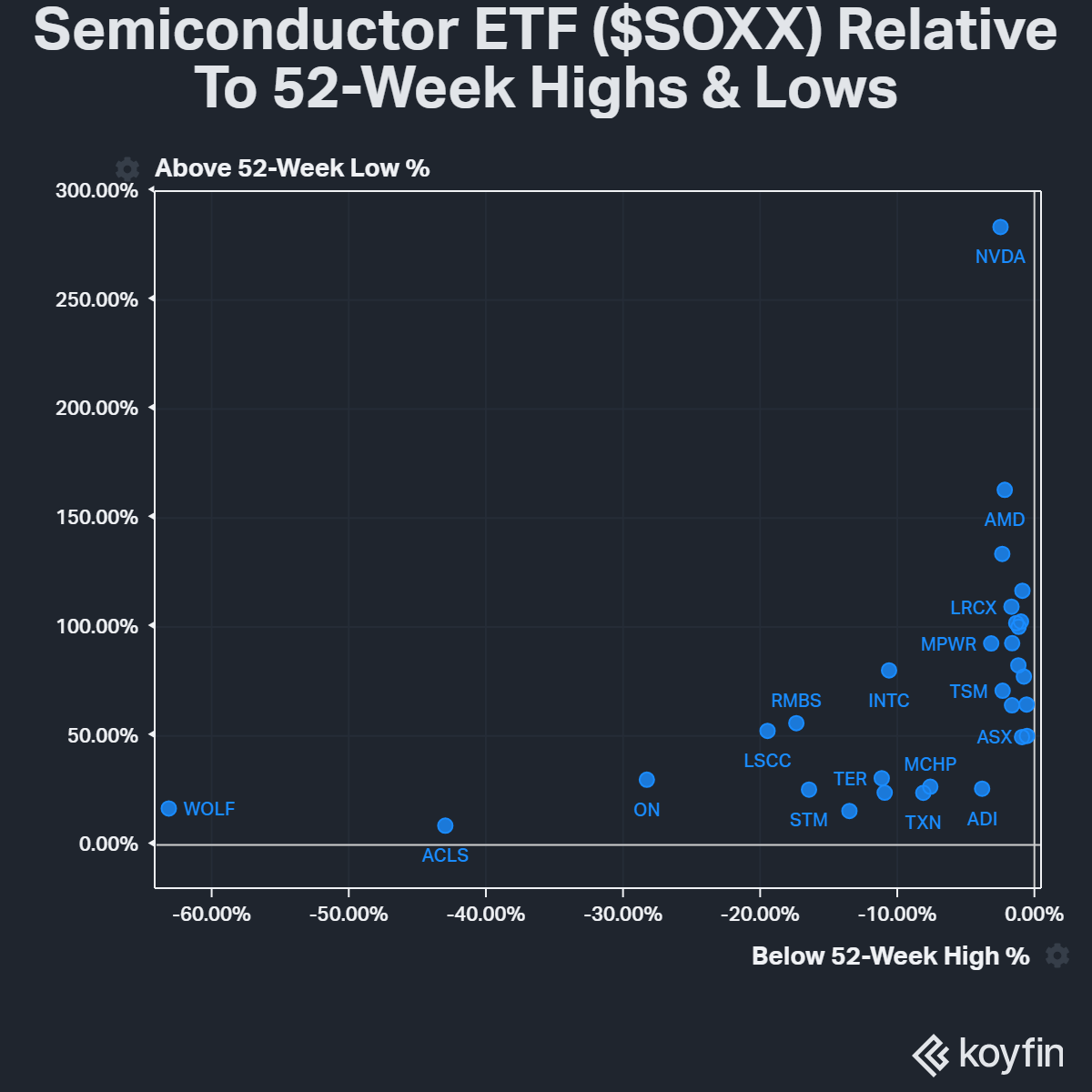

To provide some perspective on how crazy the move in this sector has been (as well as outliers in the group), below is a chart of $SOXX ETF components plotted vs. their 52-week highs and lows. 😮

On the upside, we obviously see major winners like Nvidia, AMD, Broadcom, etc., all up triple digits from their 52-week lows and sitting just below their 52-week highs. This is clearly where the momentum is, as investors begin to spread their money around to stocks that haven't rallied as much yet. A great example is Taiwan Semiconductor, which has already started to play catch up. 👍

On the downside, it's clear which stocks are not getting any love. Names like Wolfspeed, Axcelis Technologies, and even ON Semiconductor failing to gain traction with the overall market. 👎

The big question now is whether these laggards will eventually catch a bid or if money will continue to pile into the biggest winners in the sector. Those who have been betting on a catchup have been punished for that approach, so we'll have to see if that changes in the days and weeks ahead. 🤷

STOCKTWITS CONTENT

A Brand New Momentum Monday 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart wizard Ivanhoff every week on "Momentum Monday."

In this week's episode, the group discusses:

SMCI joins the S&P 500, and AMD breaks out again 🌠

Heavily shorted stocks continue to squeeze 🫨

Bitcoin nears a new all-time high as the crypto run coin-tinues ₿

2024’s no-brainer plays and top picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

EARNINGS

The Battle Of The Clothing Boxes

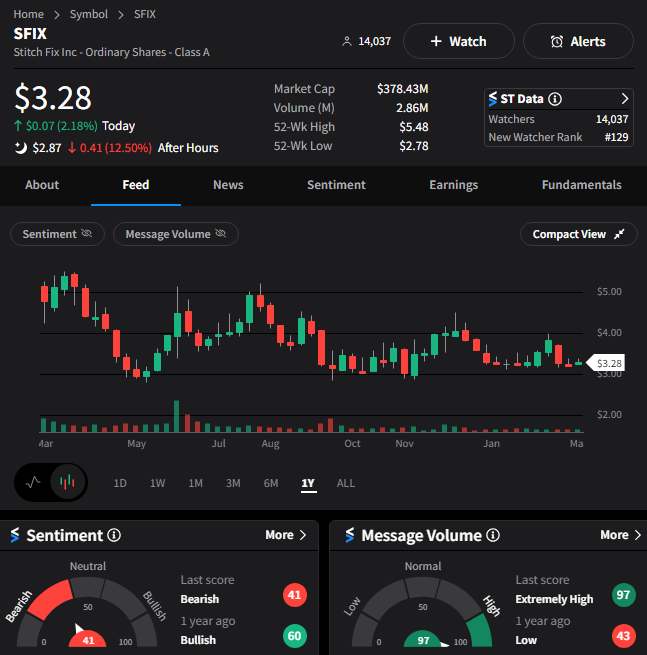

The online personal styling business might've been a solid bet during the ZIRP era, but it has really taken a beating in the post-pandemic world. Today, we heard from Stitch Fix and ThredUp, battling for survival in the public markets. 📦

First up, Stitch Fix reported a $0.29 per share loss on $330.40 million in revenues. Both numbers missed estimates of a $0.22 loss and $330.88 million. Looking ahead, the company's third-quarter revenue guidance of $300 to $310 million also missed expectations. 🔻

On the positive side, the company has no bank debt and about $230 million in cash, so it has some time to figure things out. But with cash flow from continuing operators at negative $26.10 million, investors aren't being as patient as the company might hope they'd be.

$SFIX shares are down about 12.50% after the bell, nearing all-time lows. 📉

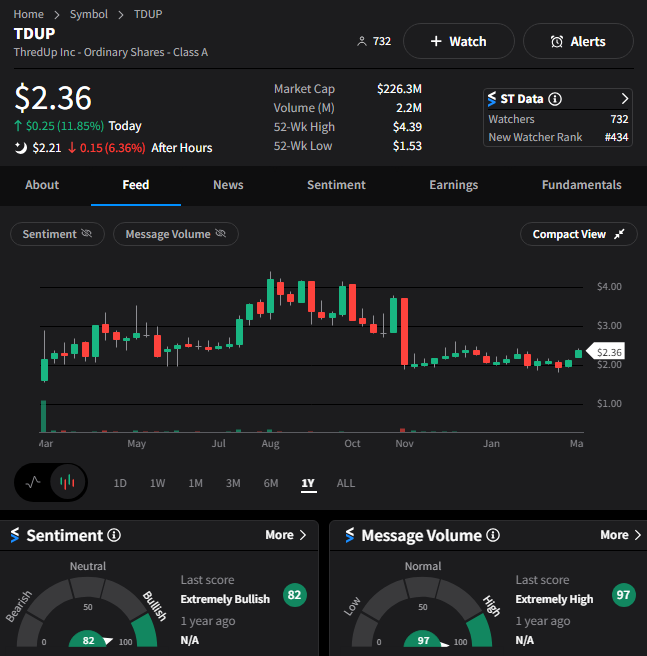

Competitor ThredUp had a mixed report, with a $0.14 per share loss and revenues of $81.40 million. Earnings were $0.01 shy of expectations, while revenue beat by about $1 million.

The company expects full-year 2024 revenue of $340 to $350 million, while Wall Street anticipated $343.10 million. Despite that, $TDUP shares are still down about 6.50% after the bell as investors assess the company's long-term viability. 🤔

With these companies experiencing weak or declining revenues and margins, investors are looking for some sort of turnaround plan from management. So far, there's not been much to grab onto, especially with many other stocks and industry groups performing so well. 👎

As always, we'll have to wait and see. But for right now, the boxed clothing companies are battling it out for survival.

Stocktwits Spotlight

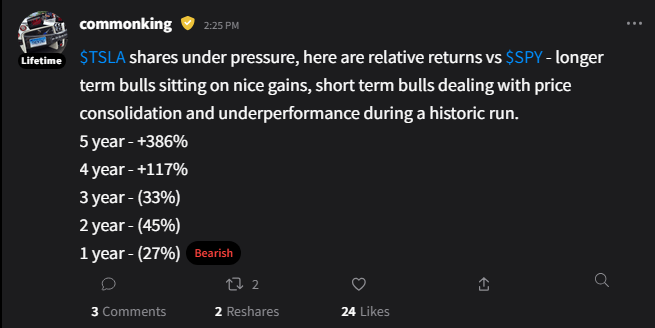

Tesla shares shed another 7% on news that some of its largest competitors are once again cutting prices to stoke demand. China's BYD is now pricing its best-selling SUV at $16,000 to compete with gas cars. Additionally, fear about Tesla's first-quarter delivery volumes is beginning to creep into the stock. 🪫

Despite the negativity building across the electric vehicle community, Stocktwits user commonking seems to be sticking with the stock. He shared the chart above comparing the stock's recent underperformance to its longer-term returns.

His argument seems to be that all great growth stocks go through periods of consolidation where the fundamentals catch up and exceed the stock price. But as long as the business continues to progress, then the stock is still a long-term buy. 📈

Time will tell if that thesis pans out again. In the meantime, if you like analysis of "best-in-class" companies within long-term growth trends, then follow commonking for more posts like this! 👀

Bullets From The Day

⚠️ NYCB deposits may be at risk following Moody's downgrade. Analysts remain concerned that the struggling regional bank will have to pay more to retain deposits from customers who are worried about the recent turmoil in its stock and downgrades from credit rating agencies. Specifically, the downgrade could trigger contractual obligations from business clients of NYCB who require the bank to maintain an investment-grade deposit rating to feel safe about their deposits exceeding the $250,000 covered by FDIC insurance. CNBC has more.

🎓 One chart may settle the "is college still worth it" debate. The wage gap between recent college and high school grads has been widening for decades, and grew even further throughout the pandemic. Despite those stats supporting college in the aggregate, Americans have been falling outof love with the idea of a four-year degree because of the sky-high cost and struggle to obtain gainful employment after graduating. Despite that narrative building, the broader numbers still suggest those who go to college are better off financially. More from Axios.

💸 Germany wants big tech to pay for the regulations set on them. Regulators from Europe's largest economy want big tech companies to contribute toward the compliance costs of new European Union rules aimed at curbing their power. Seven Giegold, state secretary in charge of competition policy at Germany's economy ministry, said the move would help EU antitrust regulators better enforce the Digital Markets Act (DMA), which goes into effect for six companies on March 7th. Reuters has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.

t