NEWS

Mega-Cap Rebound Masks Mixed Tape

Apple and Google’s new AI partnership buoyed the U.S. stock market indexes. Meanwhile, the Bank of Japan is set to shake things up tonight as traders anticipate a hawkish policy decision. Let’s see what else you missed. 👀

Today's issue covers AI recharging the “Magnificent Seven,” sellers cracking in the energy space, and the S&P 500 rebalance. 📰

Here's today's heat map:

4 of 11 sectors closed green. Communications (+1.78%) led, & real estate (-0.69%) lagged. 💚

The NAHB Housing Market Index rose for the fourth straight month and reached an eight-month high on the back of moderating mortgage rates, a lack of existing inventory, and persistent demand. 🏘️

As Boeing continues to find its footing, Brazilian planemaker Embraer said demand is high, but supply chain issues are weighing on its 2024 aircraft deliveries estimate. It expects to deliver 125 to 135 executive jets in 2024, compared to 115 in 2023. ✈️

Hertz shares fell 6% on news that the car rental company’s CEO is departing after just two years following a bad bet on the electric vehicle market. It’s yet another sign of waning consumer demand for fully electric vehicles. 🪫

Speaking of EVs, startup Fisker plunged 16% on news it will raise up to $150 million through a convertible note offering and pause production of its Ocean EVs for six weeks as it struggles with weak demand. ⚡

Cisco Systems managed to avoid scrutiny from antitrust regulators and complete its $28 billion acquisition of Splunk in just six months. The deal will further diversify Cisco’s hardware-focused business via Splunk’s software products. 🤝

As trading volumes continue to grow, Robinhood is following WeBull into the futures market by purchasing a U.S. futures executing broker from Marex. 💸

Other symbols active on the streams: $NVEI (+32.41%), $STNE (-8.36%), $GOEV (+49.48%), $STI (+56.32%), $SOUN (-10.73%), $MSTR (-15.69%), & $SOL.X (+4.30%). 🔥

Here are the closing prices:

S&P 500 | 5,149 | +0.63% |

Nasdaq | 16,103 | +0.82% |

Russell 2000 | 2,025 | -0.72% |

Dow Jones | 38,790 | +0.20% |

COMPANY NEWS

AI Recharges The “Malevolent Seven”

Several of the “Magnificent Seven” stocks, namely Tesla, Apple, and Google, have been trashed by investors for their recent lack of performance. And stock market bears have pointed to their underperformance as a clear sign that the market lacks solid footing and is setting up for a big decline.

However, two of those three names were in the news today with a new potential catalyst to help them catch up with the rest of the pack. 🤔

It was reported today that Apple is reportedly in talks to license Google’s suite of generative artificial intelligence tools, called Gemini, for future iPhones. With Apple’s next big iPhone update (iOS 18) expected during its Worldwide Developers Conference, investors and other stakeholders expect the company to outline a comprehensive plan for capitalizing on this new “gold rush.” ⚒️

The news boosted Alphabet shares back into positive territory, leaving just Apple and Tesla in the red. With AI providing a potential catalyst, traders are looking for further gains from these stocks in the days and weeks ahead. We’ll have to see if they get it…

Nvidia was also in the news today because of its AI event. The Transcript posted a great summary of Nvidia’s event below in case you missed it.

One thing that caught people’s attention was the robots CEO Jensen Huang brought on stage during the presentation. 🚨

Call me crazy, but anytime a company starts bringing out robots into their presentation, a part of me definitely feels like they’re trying too hard. Maybe Nvidia will be the company that overpromises and actually delivers, but it does feel like things have gotten a bit ahead of themselves lately… 😵💫

Honestly, it seems like the market might agree with that perspective for right now. Currently, $NVDA shares are down about 1% after the event, so we’ll have to see how things develop in the days ahead. 🤷

STOCKTWITS CONTENT

A Can’t-Miss Market Event 👀

We will be live with the one and only Tom Lee of Fundstrat & Bitwise CEO Hunter Horsley to discuss all things markets & crypto on Tuesday, March 19th at 3PM EST! 🗓️

Beluga Founder Sonny Singh will be joining as well to moderate this marketing-moving conversation. Save your spot by clicking here.

COMMODITIES

Sellers Continue To Crack In The Energy Space

Commodities and their related stock-market sectors remain a key theme in the newsletter, with oil continuing to rebound into the mid-80s and another fresh breakout in the energy sector grabbing our attention. 🛢️

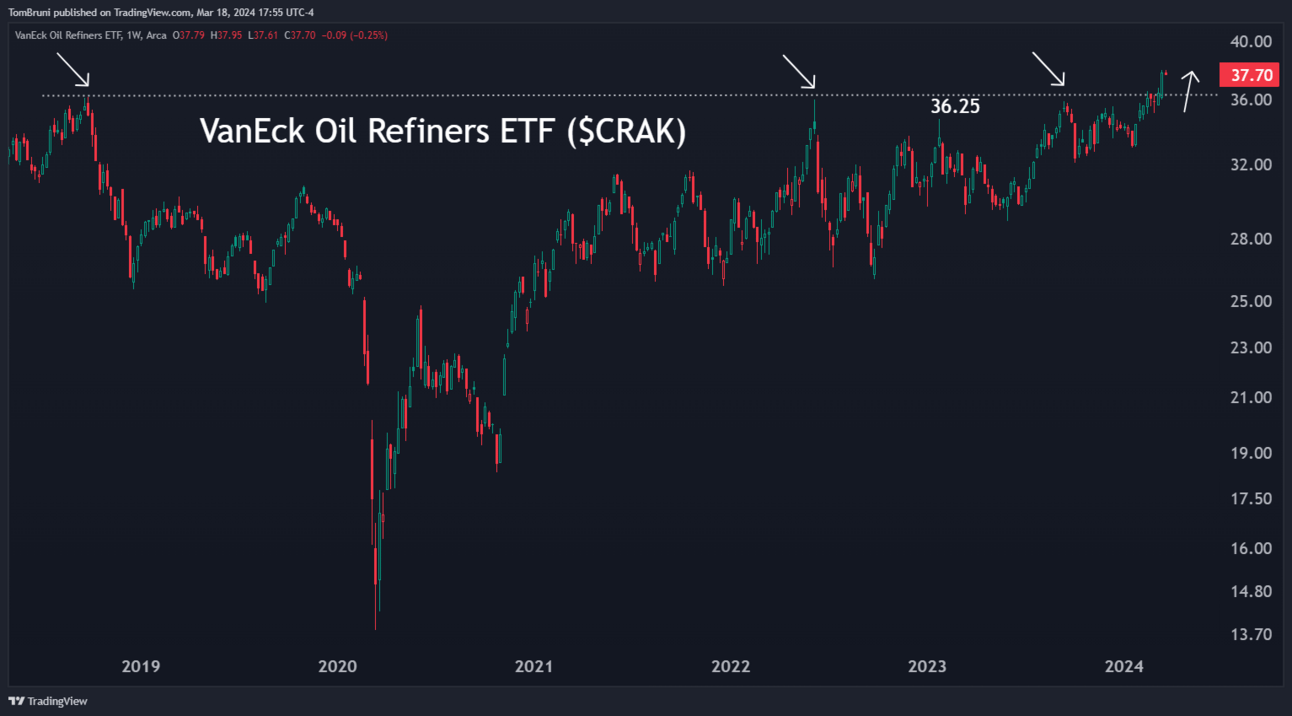

Below is a look at the VanEck Oil Refiners ETF ($CRAK) breaking out to fresh all-time highs after about five years of going nowhere. 📈

This ETF represents a basket of companies involved in refining crude oil into petroleum products used for transportation, heating, and other purposes. Given its various weightings in U.S. and international holdings, it offers a more diversified way to play this segment of the energy market. 🧺

Given the breakout here, traders will be eying some of the sector’s top holdings, including Phillips 66 ($PSX), Marathon Petroleum ($MPC), Valero Energy ($VLO), and HF Sinclair Corp. ($DINO).

I’m glad I filled up my gas tank this morning, given analysts are suggesting higher prices are ahead! ⛽

STOCKS

S&P 500 Composition Changes

The Standard & Poor’s Indexes announced their quarterly rebalance earlier in the month. Today, the indexes are trading for the first time with their new holdings. 🧺

Morningstar’s article has a great table that summarizes all of the changes, but there were a few we thought were worth mentioning. 👇

S&P 500 Large-Caps: Super Micro Computer Inc. ($SMCI) and Decker’s Outdoor Corp. ($DECK) will replace Whirpool Corp. ($WHR) and Zions Bancorp. ($ZION).

We’ll have to wait and see how these holdings getting shifted around affects their individual stock performance, especially as mega/large-caps (and even mid-caps) continue to outperform the small-cap sector by a wide margin. 📊

STOCKTWITS CONTENT

A Brand New Episode 🍿

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart wizard Ivanhoff every week on "Momentum Monday."

In this week's episode, the group discusses:

Cocoa’s loco action and strength in the commodity sector 🫘

Robinhood’s trading volumes and “degenerate” market behavior 🤑

Palantir CEO’s wild attack on short sellers and Fisker’s final move 😡

Community AMA and top picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

Bullets From The Day

🤳 MrBeast continues to crush the “creator economy.” YouTube’s largest creator is filming a game show for Amazon Prime Video, with over 1,000 contestants and a top prize of $5 million. The trend of media companies partnering with the largest creators in the world continues despite mixed results as the world of social media and traditional media merge. TechCrunch has more.

⚽ Women’s soccer team sales surge as sports appetite remains voracious. The National Women’s Soccer League season just kicked off this weekend, but the action has been going on behind the scenes for much longer. Two franchises were just sold, with Carlyle agreeing to buy Seattle Reign FC for $58 million and LLCP buying the San Diego Wave for about $113 million. And a third deal is currently in the works, with Angel City FC seeking a new control investor at a roughly $180 million valuation. More from Axios.

🤑 Sources say Reddit’s IPO is as much as five times oversubscribed. The strong demand means it will likely reach its targeted price range of $31 to $34 per share, with the potential to overshoot it and raise even more funds. Still, the ultimate valuation will still be well below the $10 billion private fundraising round it performed during the last cycle’s peak in 2021. Reuters has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍