NEWS

Meme Coins Overtake Meme Stocks

The U.S. stock market was more or less overlooked today, as crypto guys and gals took over the Stocktwits’ streams and Fintwit-sphere. Let’s see what you missed during today’s busy session. 👀

Today's issue covers crypto’s takeover of Stocktwits’ streams, Oracle’s all-time highs, and the breakout in a new semiconductor name. 📰

P.S. We’ve officially completed our newsletter platform transition to Beehiiv. To help ensure you receive our emails and receive the best content, please follow the steps in the first section below!

Here's today's heat map:

5 of 11 sectors closed green. Materials (+1.13%) led, & industrials (-0.52%) lagged. 💚

Consumers’ long-term inflation expectations ticked up in February as gas prices rose to a four-month high, reigniting concerns that the Fed’s target of 2% may be further away than Wall Street anticipates. 🌡️

Japanese stocks cooled off briefly despite the country’s fourth-quarter growth being revised upward and its economy avoiding a recession. A stronger economy likely means the Bank of Japan will adjust its ultra-loose policy at some point this year, pressuring stock and other asset prices. 🔻

Bally’s Corp. surged 28% after hedge fund Standard General made a buyout proposal valuing the casino operator at $15 per share, a 41% premium to last week’s closing price. 🎰

Other symbols active on the streams: $FSR (-9.12%), $STI (+125.75%), $DUO (+10.41%), $SMCI (-5.25%), $GRPH (+18.79%), $PIK (+80.37%), $MSTR (+9.53%), & $MARA (-12.10%). 🔥

Here are the closing prices:

S&P 500 | 5,118 | -0.11% |

Nasdaq | 16,019 | -0.41% |

Russell 2000 | 2,066 | -0.81% |

Dow Jones | 38,770 | +0.12% |

HELP US HELP YOU

Help Us Deliver Great Content 🙏

Please follow the steps below to ensure you receive all our emails. This will let your email provider know that our messages are welcome in your inbox.

Your inbox settings: 📬

Gmail users: Move us to your primary inbox.

On your phone? Hit the 3 dots at the top right corner, click “Move to” then “Primary”

On desktop? Back out of this email, then drag and drop this email into the “Primary” tab near the top left of your screen

Apple mail users: Tap on our email address at the top of this email (next to “From:” on mobile) and click “Add to VIPs.”

For everyone else: Follow these instructions.

Tell us about yourself: 🙋

The more we know about you, the better, more tailored content experience we can deliver. Please complete this brief survey to help us deliver you the best content possible.

Testimonials: 💌

Do you love these emails? We’d love to hear from you. Simply reply to this email with why you love our newsletter. (P.S. It also lets your inbox know to keep us front and center)

CRYPTO

Crypto’s Stocktwits Takeover

If you’re a Stocktwits user, you know that weekends are typically the time when 24/7 assets like crypto hit our trending tab. But what we don’t typically see is that behavior continuing into Monday once traditional markets reopen, and people begin discussing the thousands of companies and assets that exist in the TradFi world. 🫨

Well, today was the first time in a long time that crypto (specifically speculative altcoins) took control over the trending section, with Ripple, Stellar Lumens, Litecoin, and more leading the charge. Bitcoin soared above $72,000 and Ethereum cracked $4,000, pouring fuel on the crypto fire. 📈

It was also a slow, down day in the stock market, so the rest of the trending and most active list was tech/spec-focused. We saw big gainers like MicroStrategy soaring and losers like Fisker (sorry, not sorry) falling bigly.

One notable divergence that continues to build is the difference in performance between crypto miners and Bitcoin. The Bitcoin Miners ETF Crypto $WGMI has yet to make a new high in 2024 as Bitcoin soars. 🙃

One theory there is that these stocks used to be one of the few “pure plays” to gain exposure to Bitcoin through the equity market, but with the addition of ETFs and the resurgence of stocks like Coinbase and Robinhood, they’re just a lot less interesting. 🤔

The other is that the Bitcoin halving will make it harder to mine and reduce their profits, though bulls have pushed back and said the fundamental changes in their business wouldn’t result in this type of underperformance on their own. 📝

Regardless of the drivers, it now feels like everyone is trying to grab their piece of the current crypto (and overall asset) bull market. 🤑

For example, The London Stock Exchange just made the decision to accept applications for Bitcoin exchange-traded notes (ETNs).

And Bernstein analysts reiterated their “$150,000 by mid-2025” Bitcoin price target, citing the next halving event and spot ETF inflows.

Meanwhile, traders will be waiting to see if “meme stocks” experience the same level of animal spirits as altcoins and the sports-betting market seemingly have. The real test will be Reddit’s initial public offering (IPO) on March 20th, with the company rewarding its loyal users with shares but allowing them to sell them immediately.

As always, today’s action brought out the bears, who claimed that the markets are irrationally exuberant and that this will all end badly. We’ll have to wait and see what the future holds. 🤷

For now, we’ll leave you with a message from NFTNick.eth, who has emerged as a figurehead of the current crypto hype cycle. We are all so, so doomed (eventually). 🤦

P.S. If you like crypto and want more great content, make sure you’re subscribed to our Litepaper newsletter and follow @StocktwitsCrypto on Stocktwits and @StocktwitsCrypt on X (aka Twitter). 👍

STOCKTWITS CONTENT

A Brand New Momentum Monday 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and chart wizard Ivanhoff every week on "Momentum Monday."

In this week's episode, the group discusses:

Is Apple’s dip buyable or is there more weakness to come? 🍎

What to make of Nvidia’s reversal and Coinbase’s relentless rally 📊

Howard’s thoughts on SoFi Technologies as neobanks rebound 🏦

Community AMA and top picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

EARNINGS

Oracle Investors See Good Vibes Ahead

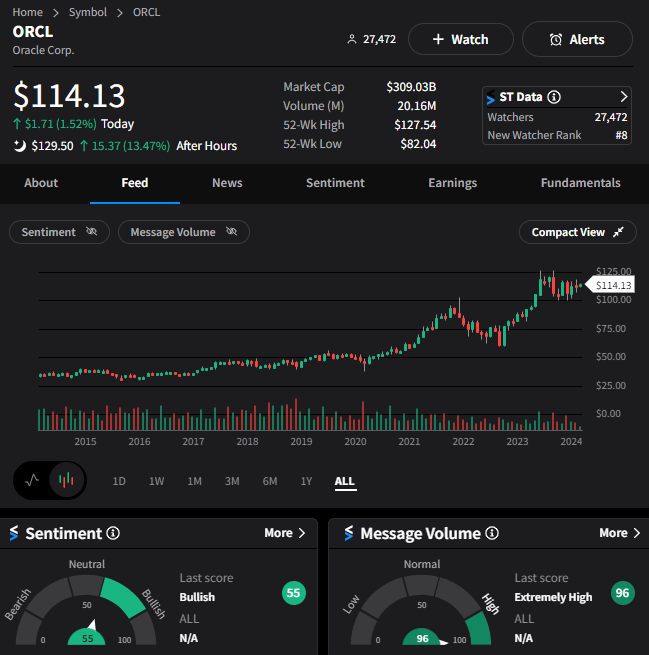

Cloud giant Oracle’s earnings report was apparently filled with good vibes since its stock is hitting new all-time highs, so let’s take a look. 👇

The company’s adjusted earnings per share of $1.41 topped the $1.38 expected, while revenues of $13.28 billion missed estimates by $0.02 billion.

CEO Safra Catz said the company's previously stated goals of $65 billion in sales by fiscal 2026 “might prove to be too conservative given our momentum.”

That’s because its cloud services and license support segment saw a 12% YoY rise, with the company attributing it to strong demand for its artificial intelligence servers. Catz said Oracle added several “large new cloud infrastructure” contracts during the quarter, with cloud revenue up 25% YoY. 📈

AI and cloud strength were all the market needed to hear for shares to jump in the after-hours session. That said, the Stocktwits community is still a bit skeptical, hanging out in slightly “bullish” territory. We’ll have to wait and see if that changes in the coming days. 🐂

Stocktwits Spotlight

While most people were distracted by the big tech selloff and a raging crypto rally, others continued to find new names to bet on in the stock market. 🧭

Stocktwits user AnchorsAweigh shared this weekly chart of NXP Semiconductor breaking out of a three-year base to fresh all-time highs. In the technical analysis world, these types of clean breakouts are typically higher-probability than messier ones, which is why they garner a lot of attention when they happen. 😍

And with earnings not happening until May 6th, there’s plenty of time for this setup to develop before there’s a known volatility event to navigate.

If you want to see follow-ups to this chart and more analysis like this, follow AnchorsAweigh on Stocktwits! 👀

Bullets From The Day

☠️ Liquid Death raises new funding at a $1.4 billion valuation. The beverage maker is raising $67 million in new financing at a valuation roughly double what it secured funds at nearly a year ago. The new financing comes from national distributors and several names in the entertainment and sports space, with it being used to grow distribution nationally and accelerate product innovation. The company had $263 million in retail sales during 2023, posting triple-digit growth for the third consecutive year. Retail Dive has more.

🗺️ Americans live further away from work than ever. The distance the average American lives from their workplace has soared from 10 miles in 2019 to 27 miles at the end of 2023. Pre-pandemic, just 1 in 100 workers lived more than 50 miles from their job. Today, that number is 1 in 20, with higher earners having the luxury of living furthest from their office (an average of 42 miles) compared to just 18 miles for lower earners. More from Axios.

❌ Choice Hotels abandons takeover bid of Wyndham. After nearly a year-long pursuit of its rival, Choice Hotels International is throwing in the towel. Repeated rejections and failing to garner enough support from Wyndham’s shareholders for a hostile takeover bid have left it with nothing to show for it. As for Wyndham, management and shareholders likely feel vindicated after rebuffing the advance as a low-premium bid that was fraught with antitrust risk. Reuters has more.

Links That Don’t Suck

🤑 MarketSmith is now MarketSurge--check out the new features today and get 80% off the regular price*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.