NEWS

Meta Adds To Tech’s Momentum

Strong results from AMD and Morgan Stanley’s bullish note on Nvidia helped buoy big tech, and the Fed setting up a September cut added fuel to the fire. Additionally, a cooling labor market and strong earnings from Meta after the bell have bulls ready to charge again tomorrow. Let’s see what you missed. 👀

Today's issue covers Meta’s ‘flawless’ quarter, the Fed setting up a Sept. cut, Nancy Pelosi’s latest buy, and something we need to taco bout. 📰

Here's today's heat map:

7 of 11 sectors closed green. Technology (+4.24%) led, & healthcare (-0.37%) lagged. 💚

Pending home sales rose 4.80% in June after a jump in available inventory helped draw buyers out of the woodwork, though transactions fell 2.60% YoY. 🏘️

Buyers finally hooked up with Match Group shares after the company announced plans to cut 6% of its staff and reported earnings that suggest its worst may be behind it. It rose 13% in its best day since November 2022. 💘

Carvana shares jumped another 11% after topping second-quarter earnings expectations and issuing guidance that points to a ‘record year.’ 🚗

Texas-based power company Vistra rebounded 15% after receiving a license extension to operate its Comanche Peak Nuclear Power Plant through 2053. ⚡

Constellation Energy also rose 13% after grid operator PJM’s auction results cleared 17.60 gigawatts of capacity from the company from 2025 to 2026. ☢️

Teladoc tumbled 14% after its revenues missed estimates and management withdrew its full-year and long-term outlook. 📉

And two chip stocks had opposite results. Qualcomm jumped 6% after topping estimates and issuing strong guidance. While Arm Holdings fell over 10% after issuing second-quarter earnings guidance below analyst estimates. 😮

Here are the closing prices:

S&P 500 | 5,522 | +1.58% |

Nasdaq | 17,599 | +2.64% |

Russell 2000 | 2,254 | +0.51% |

Dow Jones | 40,843 | +0.24% |

GUEST AUTHOR: STOCK MARKET NERD

Meta Earnings Review: “A Flawless Quarter”

Meta was the star of the earning show today, so we asked Stocktwits user Bradley Freeman (aka @StockMarketNerd) to help us break down the results. 🧠

Before we dive into the numbers, here’s Brad’s takeaway from the report:

This was a flawless quarter. Asia Pacific ad growth of nearly 30% is wildly impressive to me. Its young adult resurgence on Facebook is too. That’s especially considering this quarter lapped 40%+ Y/Y growth there and the initial surge in Shein and Temu demand. Meta AI is well on its way to ubiquity and avoiding another annual CapEx guidance raise was important for profit estimate trends. Reality Labs continues to incinerate cash, yet margins remain elite. Just imagine what this can look like if that segment starts to see peak losses. More compounding, more cash printing, more new product traction and more leverage. More of the same for this elite company. Great quarter.

And now, here are some of Brad’s key highlights from the report: 👇

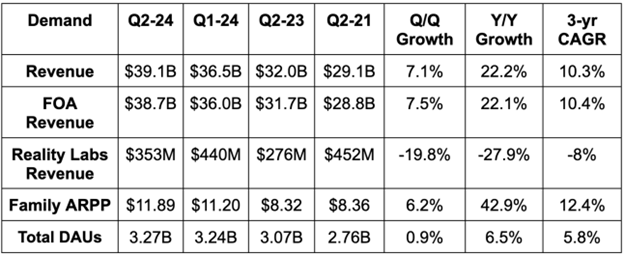

As the table below shows, Meta beat revenue and daily active user (DAU) estimates. Additionally, ad impressions rose 10% YoY, with price per impression rising 6% QoQ, its fastest growth in over 3 years. 📈

As for margins and profitability, Meta beat EBIT estimates by 3.10% and the consensus GAAP EPS estimate of $4.76 by $0.40. 🔺

Looking ahead, Meta’s Q3 revenue guidance beat by 1.40%, with management reiterating 2024 operating expense (OpEx) and capital expenditure (CapEx) guidance. This should lead to upward profit revisions for 2024. 📊

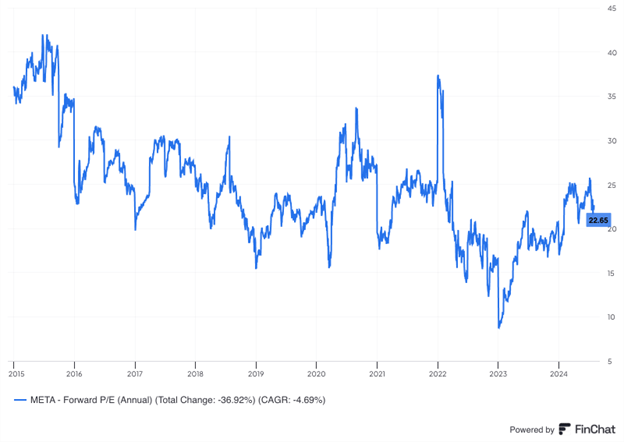

From a valuation perspective, Meta trades for 23x this year’s earnings. Analysts currently expect EPS to rise by 35% Y/Y this year and by 14% Y/Y next year. Here’s how that multiple compares to its historical norms:

Overall, as alluded to at the top of this post, it was a stellar quarter for the company and the stock is responding, with shares up 7% after the bell. 🤩

Big thanks to Brad for guest authoring this post and providing great coverage of today’s top earnings story.

If you want more of Bradley’s analysis, you can check out his “Stock Market Nerd” newsletter, which sends detailed coverage on dozens of public companies right to your inbox. And make sure to follow him on Stocktwits for more great info! 👍

POLICY

A Big Day For Central Banks

It was a big day all around for central banks, with Japan hiking its key rate to its highest level since December 2008 and halving the pace of its bond-buying program over a two-year period. 🔺

Its central bank has struggled to curtail a rapidly falling Yen as it opted to keep policy ultra-loose to stimulate growth. However, it now suggests the risks of a weak Yen putting upward pressure on inflation is now the more critical problem to focus on. 📝

As for the Fed, the U.S. central bank held rates steady as expected. However, it adjusted the language in its statement to reflect a new attentiveness towards risks “to both sides of its dual mandate.” 👀

The Fed has seen the risk of inflation staying above its 2% target as far more important than the risks to its “full employment” mandate. But now, with the labor market continuing to cool and inflation coming down slowly but steadily, it sees more reasons to loosen policy (even if only slightly).

The U.S. bond and stock markets responded positively to this change, as the consensus view on Wall Street had already shifted to a September 25 bp cut. And with the Fed looking like it will deliver, the market’s focus now turns to the timing of additional cuts and their impact on the economy. 🔮

INSIDER ACTIVITY

Pelosi “The Prophet” Strikes Again

While we were all wondering if we should buy the dip in Nvidia, Nancy Pelosi was out there putting her money to work. 🤑

The trader extraordinare’s latest “periodic transaction report” indicated that she sold 5,000 shares of Microsoft and purchased 10,000 Nvidia shares last Friday, July 26th.

The move suggests she’s “doubling down” on Nvidia after purchasing 10,000 shares initially on June 26th when prices were about 10% higher. 💰

Notably, she’s not the only one buying the dip in the chip giant. Morgan Stanley analyst Joseph Moore moved Nvidia to the bank’s ‘Top Pick’ list and views the recent 30% pullback from all-time highs as a buying opportunity.

He maintained his ‘overweight’ weighting and $144 price target, saying the earnings environment will likely remain strong for the entire AI complex.

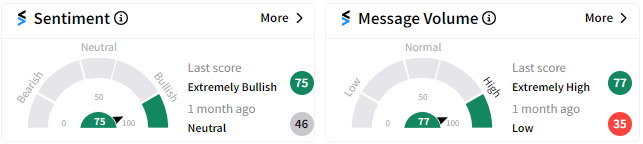

Stocktwits users are seemingly buying the dip, too, with the sentiment meter pushing back into ‘extremely bullish’ territory from its neutral rating a month ago (when prices were at all-time highs). 🐂

Time will tell if Pelosi has picked it right, but with her trade, Morgan Stanley’s note, and AMD’s strong results, bulls are fired up about Nvidia again. 🤩

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Space is going quickly so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

COMPANY NEWS

Something To Taco Bout 🌮

As restaurant chains look to curb costs and keep up with changing consumer demands, several are heavily embracing artificial intelligence (AI). 🤖

Yum Brands announced today it will use AI at hundreds of its Taco Bell drive-thru restaurants by the end of the year, expanding its rollout in the U.S. and eying a global implementation soon.

Early results at more than 100 of its stores have shown improved order accuracy, reduced wait times, and decreased employee task loads. Together, those pieces have helped drive profitable growth for the company and its franchisees. 👍

While Wendy’s and White Castle have made bets in the area, Yum Brands’ plans are the most ambitious to date. With the company pushing into the next frontier, analysts are waiting to see if any of its competitors advance their plans to roll out the tech at their restaurants.

I’m personally a late adopter of technology, so I still prefer talking to a human when ordering. But what do you think? I’ll share the results tomorrow! 🤔

Do you prefer ordering with an employee or AI chatbot?

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍