NEWS

A Mixed-Up Monday In Markets

Source: Tenor.com

Oil and defensive assets like gold ruled the day as geopolitical tensions escalated further over the weekend. Meanwhile, earnings continue to drive major moves in popular stocks and create opportunities across various sectors. Let’s see what you missed. 👀

Today's issue covers a positive case of the Mondays, B. Riley breaking buyers’ spirits, a breakout in gold, and why India is in the headlines. 📰

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with technology (+0.82%) leading and communications (-0.69%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,344 | +0.01% |

Nasdaq | 16,781 | +0.21% |

Russell 2000 | 2,062 | -0.91% |

Dow Jones | 39,357 | -0.36% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $WKEY, $GNLN, $CNTM, $CXAI, $ASND, 📉 $RILY, $YMAB, $HD, $FTRE, $EL*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

A Solid Monday For This Software Stock 💻

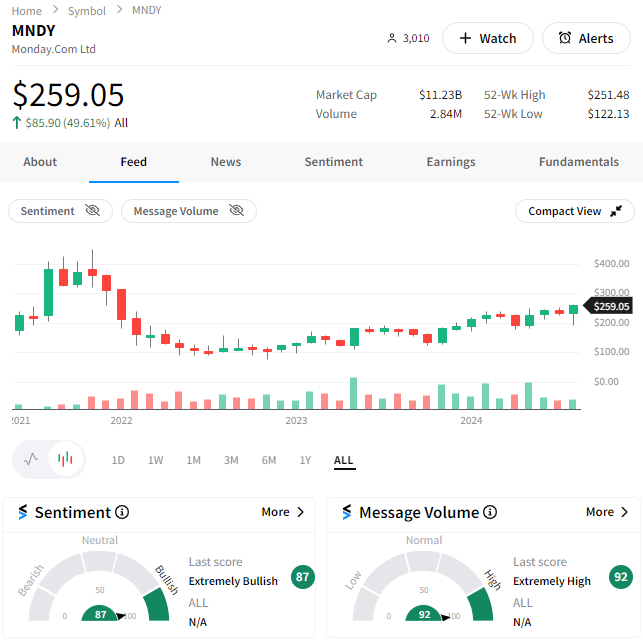

Cloud-based project management software provider Monday.com delivered a strong second-quarter profit and raised its sales outlook, breathing life back into the sector that’s been plagued by disappointment this earnings season. 🥳

The company reported adjusted earnings per share of $0.94 on $236.10 million in revenue, topping management’s prior guidance and analyst’s consensus view of $0.56 on $229 million in revenues.

Customers with contractors for more than $100,000 in annual recurring revenue (ARR) were up 49% YoY, with $50,000+ ARR customers also rising 43% YoY. That signaled to Wall Street that more higher-paying businesses have come on as clients. 🤑

Management said introducing more generative artificial intelligence (AI) features into its product helped drive sales, while automating customer service helped improve margins. Looking ahead, it expects the momentum to continue, with its new full-year revenue forecast of $956 to $961 million topping a prior forecast and analyst estimates.

Shares rose 15% to more than 2.5-year highs as Stocktwits sentiment returned to its highest level over the last year. 🐂

COMPANY NEWS

B. Riley Breaks Buyers’ Spirits 😭

Investment bank B. Riley Financial lost more than half of its value after telling Wall Street it expects a second-quarter loss of $14 to $15 per share, driven by a large noncash loss. 🫨

It’s also delaying its quarterly filings with the Securities and Exchange Commission (SEC) to buy itself more time to finalize the valuations of some of its loans and investments.

The losses are related to the performance of its investment in Franchise Group (FRG) and its Vintage Capital loan receivable, which is primarily collateralized by its equity interests in Franchise Group. In other words, it’s got a lot of exposure to Franchise Group, whos retail brands include Vitamin Shoppe, Pet Supplies Plus, and furniture seller American Freight.

And if you think those don’t sound like particularly strong companies, you’re right. Consumer spending at these brands has weakened further alongside the economy, jeopardizing Franchise Group’s turnaround strategy. 🛍️

Additionally, there are significant regulatory concerns at play, given B. Riley and founder Bryant Riley are investigated for their ties to Briah Kahn, a businessman who helped the firm take FRG private last year.

Too much leverage and an uncertain future are a bad mix of variables for investors to deal with. Not to mention the company also suspended its dividend while it sorts itself out. As a result, shares fell another 52% today, and Stocktwits sentiment plunged into ‘extremely bearish’ territory. 📉

While we’re talking banks, it’s worth mentioning regional bank KeyCorp. rose 9% after the Bank of Nova Scotia paid $2.80 billion for just under a 15% stake in the company. 🏦

The purchase gives the Canadian bank an angle into the key U.S. market it’s been angling to take share in for years.

STOCKTWITS “CHART ART”

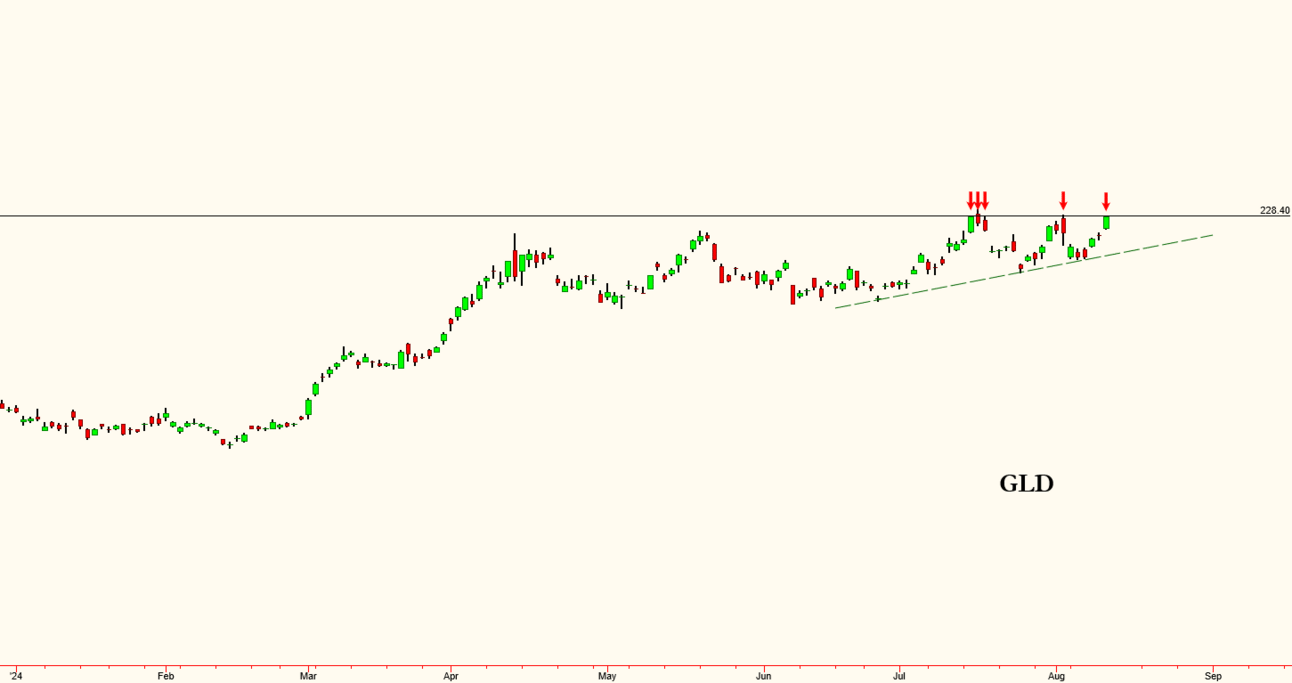

Gold Grabs Top Spot Amid Rising Global Tensions 🛡️

Rising Middle East tensions caused investors to reach for defensive assets, with gold and silver closing near the highs, trailing only crude oil on today’s market scoreboard. 💪

While this weekend’s geopolitical activity gave the precious metal a short-term boost, Stocktwits user @crosshairtrader’s chart highlights that this move is part of the broader strength gold has shown throughout 2024.

He and other traders are awaiting confirmation that this breakout is the real deal before jumping in, but what’s clear is that this asset and its peers are on investors' radars ahead of this week’s U.S. inflation data. 🧐

Gold stocks also caught traders’ eyes. Barrick Gold reported earnings results that were buoyed by higher metals’ prices, helping the stock rally 9%.

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

STOCKS

Trump’s Return To Twitter Tumbles $DJT Shares 🐦

Donald Trump rejoined X today in classic unannounced fashion and plans to make a splash by being interviewed by Elon Musk on X at 8 pm ET.

Unfortunately for Trump Media & Technology shareholders, the former President's return to Truth Social’s main competitor is not good for business. 👎

Just last week, the company reported sales of $837,000 and a net loss of $16.40 for the quarter as management struggles to transform the company from a Trump trading proxy into an actual business.

And that problem just became more difficult to solve, given that Truth Social is no longer the exclusive platform for following the former President’s every thought. 🤦

As a result, we saw $DJT shares continue their march toward 6-month lows, falling another 5%. Stocktwits sentiment also pushed further into ‘bearish’ territory as investors debated the company’s potential. 🐻

INTERNATIONAL MARKETS

Indian Stocks In The Headlines 🌏

While Indian stocks remain near their all-time highs and among the best-performing emerging markets, several of its biggest companies were back in the headlines today for some not-great reasons. 🙃

First, we’ll start with the good one. Telecom giant Bharti Airtel is purchasing a 24.50% stake in British Telecom (BT) from troubled U.S. provider Altice, which has begun to pare down its operational assets. The deal will help Bharti take on two of the telecom industry’s existential milestones, 5G and AI. 📡

Moving onto the bad, we’ll start with Adani Group’s shares losing billions in value after U.S. short seller Hindenburg published a new report alleging self-dealing within the Securities and Exchange Board of India (SEBI).

The short seller claims chair Madhabi Puri Buch and her husband previously held investments in offshore funds also used by Adani Group. Hindenburg suggests this is evidence that the regulator cannot be trusted as an objective arbiter of Adani in their year-long feud. ⚔️

Lastly, what was once the country’s second-most valuable startup valued at $10 billion, experienced a 76% decline in its most recent round of funding. Oyo, which operates a chain of budget hotels, raised $173.50 million in series G funding at a $2.40 billion valuation, now below the total $3.30 billion it’s raised in equity and debt financing. ❌

And speaking of international markets, it's worth mentioning that crude oil popped for the fifth straight day after the U.S. sent more forces to the Middle East over the weekend. That rally comes even as OPEC cut its demand growth forecast, citing weaker expectations for China. 🛢️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: NFIB business optimism index (6:00 am ET), producer price index (8:30 am ET), and Fed Bostic speech (1:15 pm ET).

Pre-Market Earnings: Home Depot ($HD), Sea Ltd. ($SE), Paysafe Ltd. ($PSFE), Tencent Music Entertainment ($TME), Cipher Mining ($CIFR), On Holdings ($ON), Organigram ($OGI), Intuitive Machines ($LUNR), and Hut 8 Mining ($HUT). 😪

After-Hour Earnings: Asensus Surgical (ASXC), LogicMark ($LGMK), Hive Digital Technologies ($HIVE), Zeva Therapeutics ($ZVRA), Serve Robotics ($SERV), Nauticus Robotics ($KITT), and Franco-Nevada ($FNV). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋