NEWS

Narrative Shift Leads To A Nosedive

Source: Tenor

It was the worst day for the Nasdaq since 2022, with tech megacaps losing close to $1 trillion in market capitalization. Recessions fears continue to rise, sending global risk takers to the sidelines and long-term bulls waiting for a catalyst to break the market’s fall before jumping back into their favorite names. 👀

Today's issue covers signs that Main Street is sliding alongside Wall Street, Redfin being rescued, another space stock slipping, and more from the day. 📰

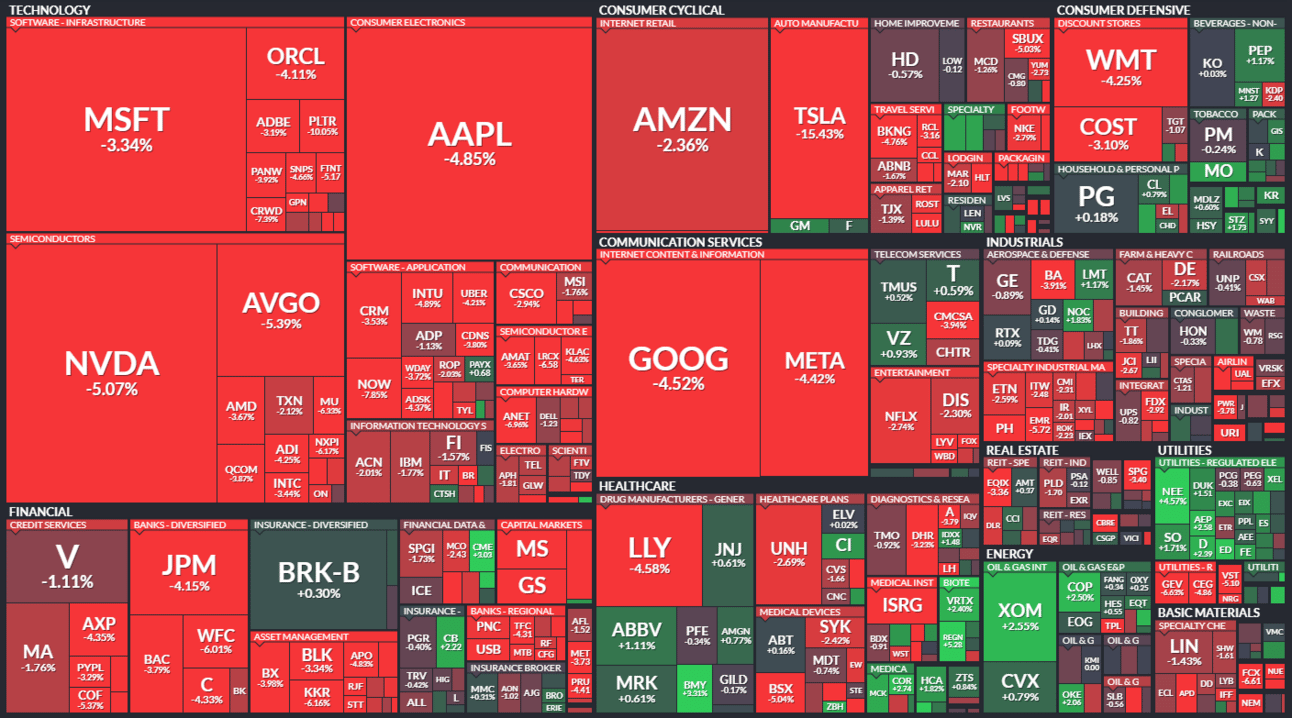

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (+1.10%) leading and technology (-4.25%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,615 | -2.70% |

Nasdaq | 17,468 | -4.00% |

Russell 2000 | 2,019 | -2.72% |

Dow Jones | 41,912 | -2.08% |

STOCKS

Main Street Slides Alongside Wall Street 😱

Wall Street’s recent decline from its highs and Trump’s policies introducing economic uncertainty has combined to hit consumers and businesses alike. There’s no better sign of that than Delta Air Lines plunging 15% after slashing its outlook.

The airline cut its first-quarter profit and sales forecast due to weaker domestic travel demand and citing declines in both corporate and leisure bookings. 📊

“The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand.” On CNBC, CEO Ed Bastian said he does not expect a recession but that consumers and businesses are pulling back due to the uncertain macro environment.

This real-world impact is what Wall Street is finally pricing into risk assets. The same risks that exist today existed several weeks and months ago, but now the market has decided it cares enough to act on it. As we’ve discussed, the bulls are losing the narrative game and lack a clear catalyst to turn the tide. 🐻

Risk assets, in general, continue to trend lower, with traders and investors looking for signs of capitulation. Bitcoin broke back below $80,000, while Robinhood, Reddit, Coinbase, MicroStrategy, and SoFi all sank double digits today. 📉

Source: Koyfin

Oarcle earnings after the bell offered little to no help for the bulls. Although the company touted its data center growth from AI, with revenue from its cloud infrastructure unit rising 49% YoY, its earnings and revenues still missed estimates.

Revenue rose just 6% YoY, with its cloud services business rising 10% YoY and accounting for 78% of its total sales. Oracle Chair Larry Ellison said “customer demand is at record levels” for its cloud infrastructure unit, and that the company is scheduled to double its data center capacity this calendar year. 🤖

With Stocktwits community sentiment still in ‘extremely bearish’ territory for all the major indexes, investors and traders are looking for clear signs of a bottom. Some are looking for a spike in put buying or overall trading volumes. Regardless of what measure they’re using, almost everyone is looking for a “washout” type move where prices quickly reverse and provide a low to trade against.

Time will tell if tomorrow is “Turnaround Tuesday” or “Terrible Tuesday,” but either way, overnight volatility and fear is expected. 😬

STOCKTWITS COMMUNITY

Have Your Voice Heard 📣

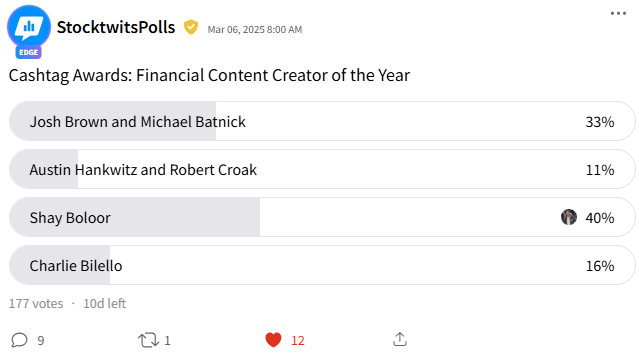

The Stocktwits Cashtag Awards are live, and voting has started! There are over a dozen categories, and we’ll highlight one in each newsletter until voting closes.

The “Financial Content Creator Of The Year” award goes to the individual, podcast, or live show that set the gold standard for financial content, and celebrates exceptional storytelling, insightful market analysis, and actionable advice delivered through engaging and accessible formats.

The winner demonstrates an unparalleled ability to educate, entertain, and inspire investors while elevating the conversation around the financial world. Vote now!

COMAPNY NEWS

Redfin Rescued From Its Foxhole 😰

Digital real estate brokerage Redfin Corp. ($RDFN +64%) soared after fintech platform Rocket Companies announced it would acquire the company in a $1.75 billion all-stock transaction that values Redfin at $12.50 per share. Each Redfin share will be exchanged for a fixed ratio of 0.7926 shares of Rocket Companies. 💰

The companies have a “unifieid vision of a better way to buy and sell homes,” and expect to achieve more than $200 million in run-rate synergies by 2027 ($140 million in cost synergies and $60 million in revenue benefits). ✂

It highlights the difficult environment residential real estate companies have been navigating since the end of their pandemic-era boom. After falling over 96% from their 2021 highs, shares of Redfin have been stuck in a wide trading range, lacking direction.

As BuccoCapital pointed out on Twitter, the company really never had a plan for surviving a long period of high interest rates, high housing prices, and housing market inactivity. When asked by analysts how the company would adapt to rates staying higher for longer, CEO Glenn Kelman had said “Great question. Plan B is drink our own urine or our competitors’ blood, stay in the foxhole.” 😵💫

If only there were signs… Nevertheless, even with the meager return (or loss) generated by holding Redfin shares, we’d imagine most investors are happy to finally be done with it and happy to move their capital to a more productive use. 😥

Given the environment for growth stocks, this analog is a good reminder of what generally happens when future expectations and business fundamentals get too far out of line. What will be this cycle’s Redfin remains to be seen. But it’s not the first, and it certainly won’t be the last… Know what you own, and stay safe out there. 🫡

STOCKS

Other Noteworthy Pops & Drops 📋

Veren Inc. ($VRN +16%): Canadian oil companies Veren Inc. and Whitecap Resources have agreed to merge in an all-stock transaction valued at C$15 billion.

Cohen & Company ($COHN -3%): The financial services firm announced fourth-quarter losses, with revenues declining 46% YoY.

Blade Air Mobility ($BLDE -5%): Announced a partnership with Skyports Infrastructure to offer flights between downtown Manhattan and JFK Airport.

International Business Machines ($IBM -2%): The company secured a legal victory in the U.K. against U.S. tech entrepreneur John Moores and his firm, LzLabs, over allegations of trade secret theft.

COMPANY NEWS

Another Space Stock Slips 🚀

Aerospace manufacturer and space infrastructure technology company Redwire Corporation is losing additional altitude after hours. 🔻

The company reported a 24.7% YoY increase in revenue for full-year 2024, but its net loss also widened sharply from $27.3 million in 2023 to $114.3 million. Free cash flow also fell to $28.3 million. In a capital-intense business that’s not too surprising, but the earnings call being delayed until tomorrow left investors without answers.

Despite the uncertainty and current environment pumelling growth stocks, Stocktwits sentiment remained in ‘extremely bullish’ territory. Shares are set to open up below their 200-day at roughly 5-month lows, so we’ll see if bulls buy the dip or if bears continue to feast on the stock’s broken momentum. 🫢

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: NFIB Business Optimism (6:00 am), JOLTs Jobs Data (10:00 am), WASDE Report (12:00 pm). 📊

Pre-Market Earnings: FuelCell Energy ($FCEL), Kohl’s ($KSS), Dick’s Sporting Goods ($DKS), United Natural Foods ($UNFI), Ciena ($CIEN), Nuwellis ($NUWE). 🛏️

After-Hour Earnings: SIGA Technologies ($SIGA), Stitch Fix ($SFIX), Groupon ($GRPN), Allbirds ($BIRD), Zevra Therapeutics ($ZVRA), loanDepot ($LDI). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋