NEWS

News Flash: September (Usually) Sucks

Source: Tenor.com

September is off to a rough start, which is not necessarily surprising given it’s the worst month of the year on average. The volatility has traders and investors asking the same question: is this dip buyable? Most analysts expect earnings and labor market data throughout the rest of the week to set the market’s tone. 👀

Today's issue covers how we know that “somebody always knows something,” tech stocks getting a shellacking after earnings, and crude oil crashing back into negative territory YTD. 📰

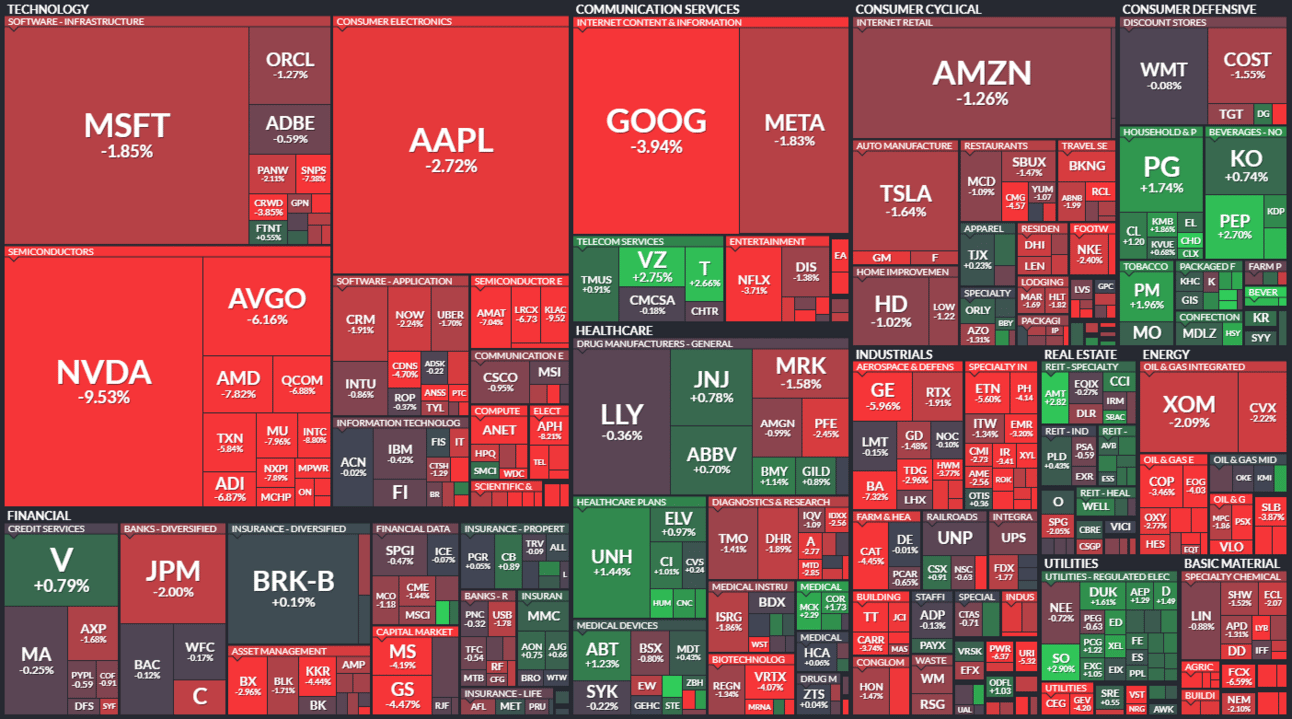

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with consumer staples (+0.70%) leading and technology (-4.59%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,529 | -2.12% |

Nasdaq | 17,136 | -3.26% |

Russell 2000 | 2,149 | -3.09% |

Dow Jones | 40,937 | -1.51% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $GTLB, $SIFY, $DYN, $HYFM, $PCVX 📉 $PD, $RMCO, $CDE, $NVCR, $AZUL*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Somebody Always Knows Something 🤔

September is off to a rocky start, but seasonality buffs know this is the norm and not the exception. Before we get into today’s stats about the rest of the month, we need to talk about Nvidia. 😑

Despite raising guidance after beating earnings and revenue expectations, the stock has been selling off to the tune of $280 billion just today. That’s the largest single-day market cap decline in history.

After the bell rang, some news broke that reminded us of the old adage, “Somebody always knows something.”

Bloomberg reported that the Nvidia AI antitrust investigation is ‘escalating,’ with the Department of Justice (DOJ) reportedly sending subpoenas to the tech giant. Probably just a coincidence that the stock has been selling off over the last few days…right? 🕵️

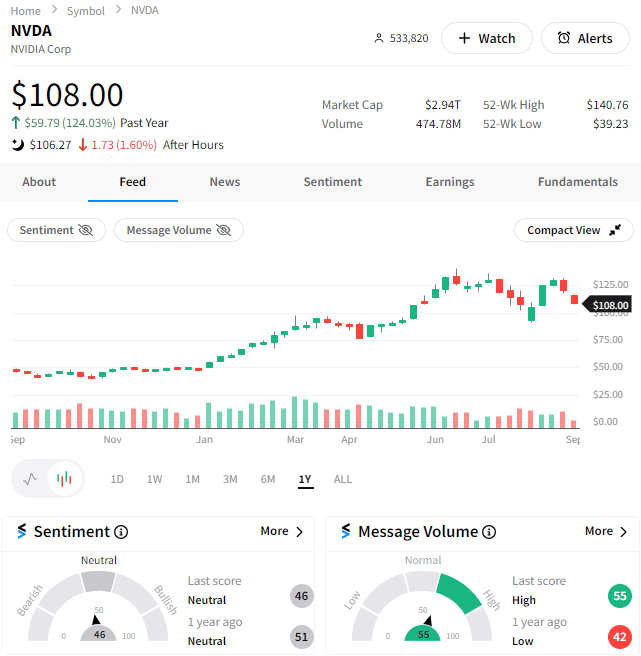

Anyway, the news sent Nvidia shares down 10% on the day, yet Stocktwits sentiment is still only in ‘neutral’ territory. The question many are asking about Nvidia and several other ‘Magnificent Seven” stocks that are correcting is, “Do we buy the dip?” And this sentiment suggests an unclear consensus view among Main Street investors. 🤷

Source: Stocktwits.com

One factor impacting investors’ approach to that question is their view of the overall market through the rest of the year. So far, with a volatile August and a swift decline to start September, investors are feeling uneasy. 😬

And today’s action isn’t likely to improve quickly, as Jay Woods, CMT reminds us. His chart below shows that September is the worst month of the year and the only one with a negative average return. ⛈️

And although the magnitude of the average decline improves during an election year, it’s still not positive, and October is often even worse! 😫

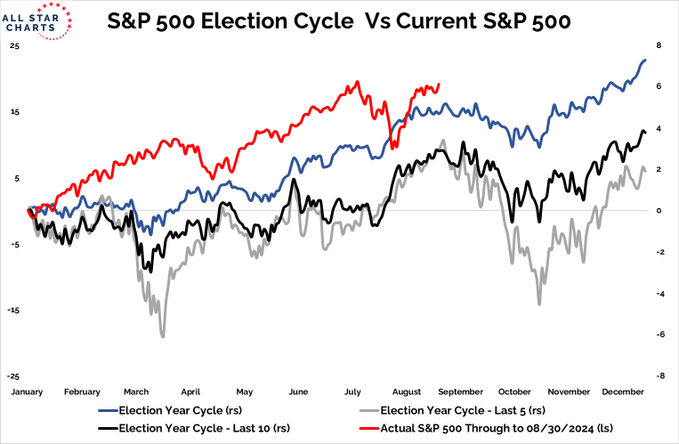

Grant Hawkridge’s election cycle seasonality chart gives us a good idea of where we are (in red) compared to the past. If history repeats (or at least rhymes), Grant’s analysis suggests the next two months could be rough for stock market bulls. 🗓️

Even one of Wall Street’s biggest bulls, Tom Lee of Fundstrat Global Advisors, is calling for a 7-10% correction over the next eight weeks. With that said, he says it should be a buying opportunity and still expects his ‘40% rally in small-cap stocks by year-end’ thesis to play out. 😮

But nonetheless, history and many of Wall Street’s most-followed analysts are painting a cautious picture for stocks through September and October. Time will tell if they’re right, but it seems nervous investors are selling first and asking questions later. ⚠️

STOCKTWITS “TRENDS WITH FRIENDS”

China’s Plan To Win The AI Robotics Race 🤖

EARNINGS

Software Gets A Shellacking 🤕

Several popular software stocks reported today and did not deliver. Let’s quickly review how the stocks and our community reacted. 👇

PagerDuty: The digital operations management platform cut revenue guidance and reported weaker-than-expected sales growth. That came after missing revenue projections for the current quarter. Interestingly, Stocktwits sentiment remains in ‘extremely bullish’ territory, so retail is apparently betting on a turnaround.

Asana: The work management software maker beat earnings and revenue expectations, posting nearly $13 million in free cash flow. However, its full-year revenue guidance missed estimates, while net revenue retention fell below 100%. Notably, the Stocktwits community is still ‘extremely bullish’ on the stock despite it falling another 13% after hours.

Zscaler: The cybersecurity company’s profit outlook fell short of expectations. Management anticipated $2.81 to $2.87 for the full fiscal year, well below Wall Street’s consensus estimate of $3.33. Its revenue outlook marginally beat expectations, but not enough to offset the massive earnings miss. Like the other stocks above, Stocktwits sentiment remains in ‘extremely bullish’ territory.

With Stocktwits sentiment staying positive for these stocks, we’ll have to wait and see if they rebound in the coming days and weeks. But for now, they’re getting crunched after hours. 🙃

CHART OF THE DAY

Crude Oil Crashes Into Negative Territory 🛢️

We started the year with oil prices breaking back above $80 and Wall Street analysts calling for triple-digit prices again. But less than six months after prices peaked, we’re probing nine-month lows and are back in negative territory on a YTD basis. 📉

Today’s nearly 5% decline was due to signs that the dispute halting Libyan crude production and exports is close to being resolved.

The country’s legislative bodies agreed to appoint a new central bank governor within 30 days after U.N.-sponsored talks, potentially ending the standoff between rival political factions over control of the central bank and oil revenue. 😠

As for U.S. oil prices, bears are pouncing on this decline and looking to do more damage. Stocktwits sentiment has shifted into ‘extremely bearish’ territory for popular oil ETF $USO, with uncertainty about the U.S. election, Fed policy, and overall economy also weighing on prices. 🐻

Source: TradingView.com

Still, the bulls say prices are still in a wide trading range, and that demand should start to enter the market in the mid-$60s. 🐂

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: U.S. Imports/Exports (8:30 am ET), Bank of Canada Rate Decision (9:45 am ET), JOLTs Jobs Data (10:00 am ET), and Fed Beige Book (2:00 pm ET). 📊

Pre-Market Earnings: Dollar Tree ($DLTR), Dick’s Sporting Goods ($DKS), Hormel Foods ($HRL), and Ciena ($CIEN). 🛏️

After-Hour Earnings: C3.ai ($AI), Hewlett Packard ($HPE), ChargePoint Holdings ($CHPT), AeroVironment ($AVAV), Casey’s General Stores ($CASY), and Lakeland Industries ($LAKE). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

HAPPENING ON STOCKTWITS

Ask A Stocktwits OG Your Trading Questions 🧑🏫

“Ask Me Anythings” (AMAs) are back on Stocktwits, and we’re asking some of our most active community members to share their investing and trading knowledge. 🧠

This week, Dr. Stoxx will answer questions live on the platform on Thursday at 1 pm ET. Ask your question here and follow that thread to see all the great questions and answers!

P.S. If you’re interested in doing an AMA or know someone who would be, hit up the @Stocktwits handle with your suggestions! 👍

Links That Don’t Suck 🌐

🤑 Is your portfolio ready for a boost? Let IBD Digital help––save over 70% on a 4-month subscription*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋