NEWS

No Rate Cuts? No Problem.

Disinflation’s downward progress helped renew hopes of at least one rate cut in 2024, with big tech stocks leading the major indexes to fresh all-time highs. The Fed’s latest update reversed most of the market’s early moves, so traders remain on watch for a reversal. Let’s see what else you missed. 👀

Today's issue covers the Fed’s latest economic projections, Broadcom breaking up its share price, and a stock that’s literally off to the races. 📰

Here's today's heat map:

5 of 11 sectors closed green. Technology (+2.21%) led, & consumer staples (-1.10%) lagged. 💚

Apple’s AI-driven rally pushed its market cap to a new all-time high, briefly overtaking Microsoft and Nvidia as the world’s most valuable stock. 🍏

More air came out of GameStop shares after the trading volumes in “Roaring Kitty’s” options chain exploded, sparking speculation around the meme stock leader’s next move. Meanwhile, the company has reportedly raised more than $2.10 billion dollars from selling 75 million shares, leaving it well capitalized. 😵💫

Paramount shares remain volatile after controlling shareholder National Amusements halted talks with Skydance about their proposed merger. ❌

Casey’s General Stores soared 17% to new all-time highs after reporting earnings and revenue that topped expectations. ⛽

Marketing automation company Klaviyo jumped from all-time lows after Barclay’s issued an upgrade and called it an industry bright spot. 🔺

Homebuilder shares popped on rate cut hopes, and UBS reiterated its buy ratings on both Lennar and KB Home despite recent underperformance. The supply vs. demand imbalance in the U.S. housing market is expected to remain a secular tailwind for the industry despite high prices and rates. 🏘️

Taiwan Semiconductor jumped 4% to new all-time highs after Bank of America raised its price target on news of Apple’s push into artificial intelligence (AI). 🦾

Chinese electric vehicle makers like XPeng and Li Auto moved lower on news of new European tariffs on EVs coming from the country. Meanwhile, at Stellantis’ investor day, cost-cutting and China were the talk of the town as the company set ambitious 2030 financial targets. 🪫

Women’s clothing and accessories maker Vera Bradley fell 17% after posting a surprise loss and sales miss. The company is seeing pressure across all income levels and channels, especially households under $75,000. 👚

Other active symbols: $AMC (-5.94%), $FFIE (-6.83%), $NVAX (-5.17%), $AFRM (+5.77%), $KITT (-28.11%), and $BMR (+18.86%). 🔥

Here are the closing prices:

S&P 500 | 5,421 | +0.85% |

Nasdaq | 17,608 | +1.53% |

Russell 2000 | 2,057 | +1.62% |

Dow Jones | 38,712 | -0.09% |

NEWS

Dot Plots Reiterate Fed’s “Data-Dependent” Stance

The day started off with a weaker-than-expected consumer price index (CPI) reading, renewing downward progress in core inflation and reigniting hopes of several rate cuts coming during 2024. 🥳

Stocks and bonds both rallied sharply ahead of the Fed meeting, which included only a couple of key updates.

As expected, the Federal Reserve kept interest rates unchanged again, noting the “modest” progress in inflation toward its 2% target. That improved from its previous statement, which stated a lack of further progress. 👍

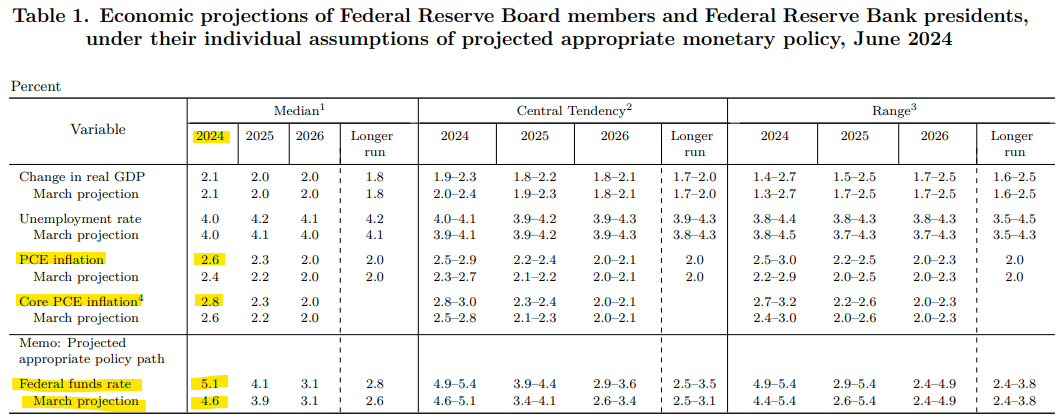

In terms of economic projections, only short-term expectations were impacted. Inflation’s downward progress has been slower than anticipated and the Fed has consistently stated it would keep rates higher for longer if needed to drive further progress toward its goal.

And further progress, we’re slowly but surely getting. Just look at the labor market softening and economic growth slowing its expansion rate. 🔻

With that in mind, we saw 2024 median inflation expectations tick up slightly, as did the median federal funds rate.

A move from 4.60 in March to 5.10 in June signifies that we may only see one cut this year but that the Fed expects its longer-term projections to remain unchanged over 2025 and 2026. 🔺

So the core messaging has stayed the same: rate cuts are likely in 2024, but now we’ve gone from six down to three and now down to one being the base case. And then the Fed will play catchup (or down) in 2025 as the data allows. ◀️

While stocks and bonds closed higher on the day, they trended lower following the release of this information. So we’ll have to wait and see how things play out.

And if you’re interested in a great press conference summary, you can check out my good friend Callie Cox’s thread on X for more. 🧵

COMPANY NEWS

Broadcom Breaks Out On Breakup News

The hottest trend among tech stocks besides artificial intelligence (AI) these days is stock splits…and semiconductor giant Broadcom is hopping on the trend.

The announcement of its 10-for-1 stock split came alongside stronger-than-expected second-quarter results. ✂️

Adjusted earnings per share of $10.96 on revenues of $12.49 billion topped the $10.84 and $12.03 billion anticipated. The chipmaker also raised full-year revenue guidance to $51 billion, up about 1% from previous estimates. 🔺

While the company is a smaller player in the artificial intelligence (AI) space, with $3.10 billion in sales this quarter coming from AI products, expectations are for it to be a much larger part of the business going forward.

CEO Hock Tan noted, “Infrastructure software revenue accelerated as more enterprise adopted the VMware software stack to build their own private clouds.” He also said the company expects full-year networking segment revenues to grow 40% YoY this fiscal year, compared to its previous forecast of 35%. Strong demand for AI chips is the primary driver there. 🤖

Other segments of its business, like wireless chips, broadband, and industrial chips, remain challenged. But for now, the market is focusing on AI’s potential impact on the business (and financial engineering) when valuing the stock.

Shares soared to new all-time highs on the news, with many speculating that the reduced share price would help broaden the shareholder base and increase demand. The Stocktwits community was already bullish on the name headed into its results but pushed further into “extremely bullish” territory. 🐂

STOCKTWITS “CHART ART”

Ferrari Shares Are Off To The $RACE(s) Again 🏎️

With the broader market indexes breaking out to new all-time highs, it’s no surprise that former market leaders are getting back on the road.

Stocktwits user @JFDI shared a chart of luxury automaker Ferrari breaking out of its recent consolidation, with traders expecting it to make new all-time highs ahead of its next earnings report on August 1st. 📈

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

🍿 Sony buys Alamo Drafthouse movie theater chain. Sony Pictures Entertainment is acquiring the Texas-based movie theater chain known for its dine-in service. This is the first time in 75 years that a major Hollywood studio will own a movie theater company, with it being managed by Sony’s newly-created Sony Pictures Experiences division. Alamo’s Chapter 11 bankruptcy during the pandemic helped Sony to gain an attractive entry price into the highly uncertain space. Axios has more.

🍌 Chiquita Brands found liable for funding Clombia’s right-wing paramilitary group. A Florida jury ordered the company to pay $38.30 million to the families of eight people killed by a group in Colombia that the banana grower had funded for years during the country’s civil war. It had previously acknowledged the funding by pleading guilty in 2007, but it still faces thousands of claims from victims of the group it funded. This legal win is expected to empower those other cases and bring more cases to trial (or force a global settlement). More from CBS News.

⛔ Europe risks a trade war with China after its latest move. The European Union (EU) hiked tariffs on electric cars imported from China, thwarting access to a critical market for its auto industry. Additional tariffs bring the highest overall rate close to 50%, likely making it uneconomical for Chinese electric vehicle (EV) makers to compete in the region. It escalates an already tense situation between the EU and China, as it says the country’s large subsidies are creating artificially low car prices and hurting competition. CNN Business has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍