NEWS

No Kiss From A Prince Will Save This Toad 🐸

The Dow is officially on its longest winning streak since December 2022. All the indices except the NASDAQ were in the green today. How many companies had earnings before and after the bell today? Almost 400! 👀

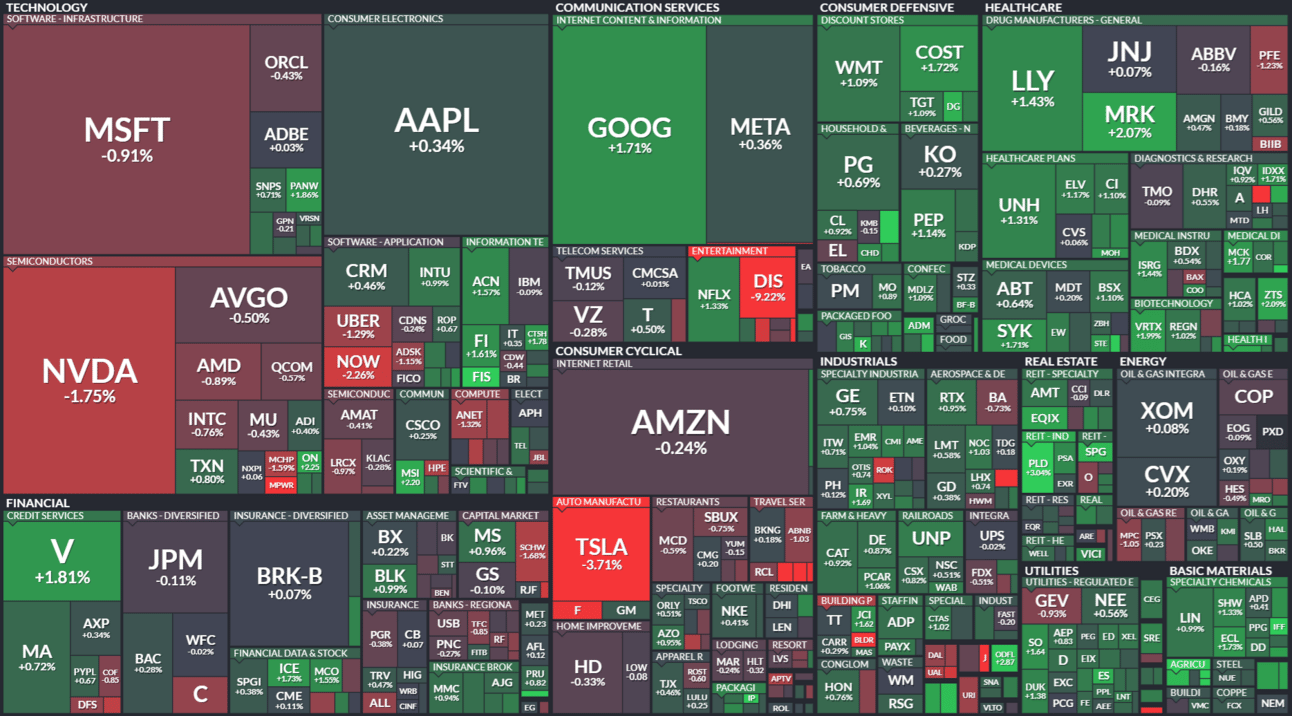

Here's today's heat map:

8 of 11 sectors closed green. Materials (+1.17%) led, & consumer discretionary (-0.56%) lagged. 💚

After stellar earnings and guidance yesterday, Palantir ($PLTR) is getting hammered. It’s down nearly -15% today. 🔻

Apple unveiled its latest iPad lineup, but judging from the price action, $APPL’s investors are not that interested. It’s up +0.46% today, and Stocktwits’ sentiment score shows traders mostly ‘meh’ on the announcement. 🫤

Celsius Holdings, Inc ($CELH) has kicked off 2024 with a bang, posting record first-quarter revenues of $355.7 million, a 37% increase year over year, and a gross profit of $182.2 million, up 60% from the previous year. The company's diluted earnings per share also soared to $0.27, marking a 108% rise. 🍺

$BP sustained its share buyback program with a $3.5 billion pledge for the first half of the year. Operating cash flow is the lowest since Q4 2020 and rising net debt is over $3 billion. 🛢️

Other active symbols: $UBER (-1.36%), $GME (+1.47%), $LYFT (-4.91%), $UPST (-17.11%), $TWLO (-6.41%), $BTC (-1.00%), and $MULN (-5.16%). 🔥

Here are the closing prices:

S&P 500 | 5,187 | +0.13% |

Nasdaq | 16,332 | -0.10% |

Russell 2000 | 2,067 | +0.35% |

Dow Jones | 38,884 | +0.08% |

EARNINGS

Disney’s Earnings: Not Exactly a Fairy Tale Ending

Disney’s ($DIS) latest earnings conjured less "happily ever after" and more "Mirror, Mirror on the wall, why did the stock just slip a fall?" 🪞

Despite a surprise profit from Disney’s streaming, the broader picture reveals a kingdom besieged by declining traditional TV numbers and underwhelming box office performance. 👎

Streaming: A New Hope or Just Fantasy?

The streaming realm at Disney seemed like a shining castle on the hill, with a reported operating income of $47 million. Yet, this fairy tale had its villains—overall, streaming lost $18 million.

Disney’s traditional TV business wasn’t breathing much fire, with revenues plummeting 8% to $2.77 billion and profits dropping 22%. The curse of the cord-cutters continues, and no amount of fairy dust seems to bring back the cable subscribers. Disney’s deal with Charter Communications ($CHTR) only added to the sorrows, with a significant drop in channel carriage adding insult to injury.

A Whole New World or Same Old Story?

Disney's attempts to turn the tide include a massive $60 billion investment in theme parks and a new standalone ESPN streaming app. However, the immediate future looks more "Fantasia" than fantastic, with streaming expected to report losses next quarter.

Yet, Disney’s hopes remain high, with forecasts of a profitable fourth quarter and a robust fiscal 2025. The theme parks and new Disney+ subscribers did provide some sparkle, but whether this sparkle can light up the path to sustained profitability remains a question mark. ❓

Streaming Income: Disney+ and Hulu together made an operating profit of $47 million, up from a loss of $587 million last year.

Overall Streaming Losses: Despite some successes, total streaming services, including ESPN+, reported a loss of $18 million.

Traditional TV Business: Revenue from traditional TV declined by 8% to $2.77 billion; operating profit fell 22%.

Theme Parks: Operating income from Disney's theme parks rose to $2.3 billion, a 12% increase from last year.

Total Revenue: Quarterly revenue was $22.1 billion, in line with expectations.

Diluted EPS: Excluding certain items, diluted earnings per share were $1.21, surpassing analysts' estimate of $1.10.

EARNINGS

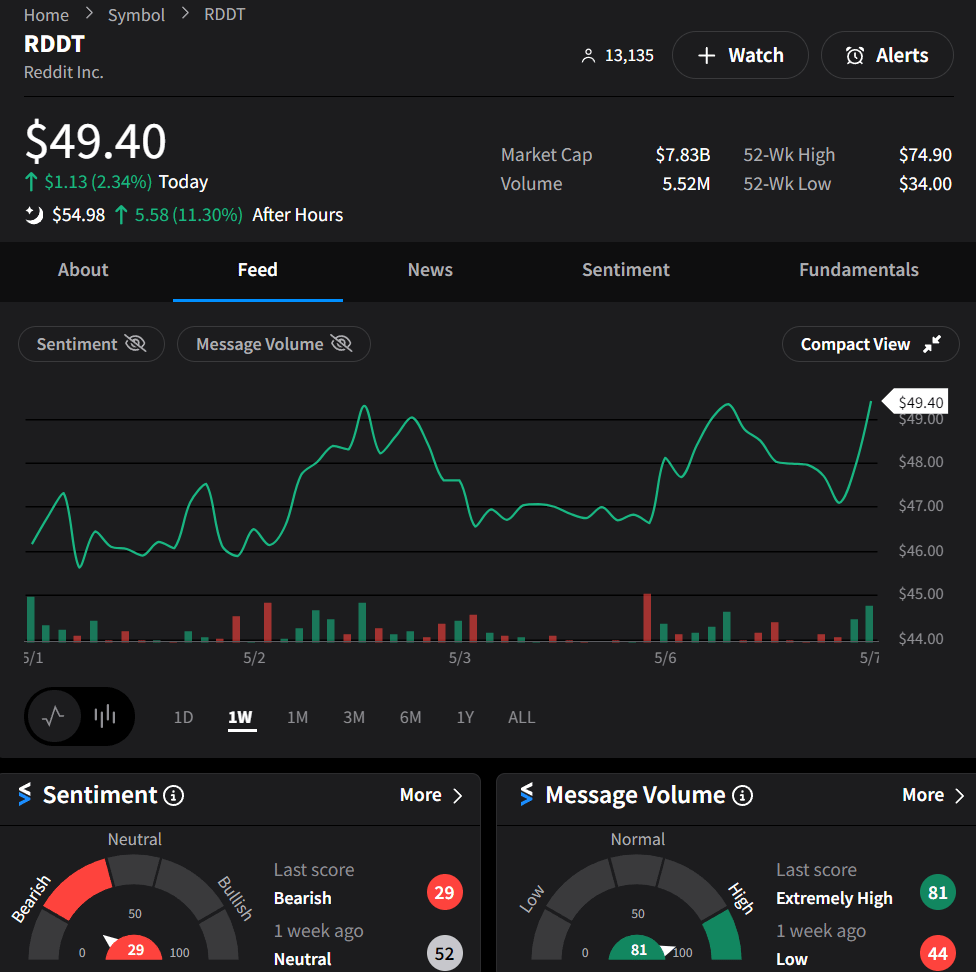

Reddit Razzle-dazzled Its Earnings 💎

Stocktwits users were frothing at the mouth for these earnings today, tons of activity on the stream! 🤯

Despite a staggering $575 million loss primarily due to IPO-related expenses, the company has shown impressive growth in both user base and revenue.

Revenue: Reached $243 million in Q1 2024, a 48% increase from $163.7 million the previous year, surpassing Wall Street estimates of $214 million.

Net Loss: Stood at $575.1 million, primarily due to $595.5 million in stock-based compensation, compared to a loss of $60.9 million a year earlier.

Daily Active Users: Jumped to 82.7 million, up 37% year-over-year.

Reddit shot up +17% to $58 before returning to the $54 value area (+10%), where it's currently trading in the after market hours.

Revenue Forecast for Q2 2024: Projected to be between $240 million and $255 million, well above analysts' average estimate of $223.8 million.

Adjusted EBITDA: Expected to range from break-even to $15 million, compared to analysts' anticipated loss of $18.2 million.

Reddit's CEO, Steve Huffman, emphasized the platform's commitment to enhancing user experience through AI-driven content, a venture that has already secured a lucrative deal with Google ($GOOG) worth about $60 million per year. 💸

EARNINGS

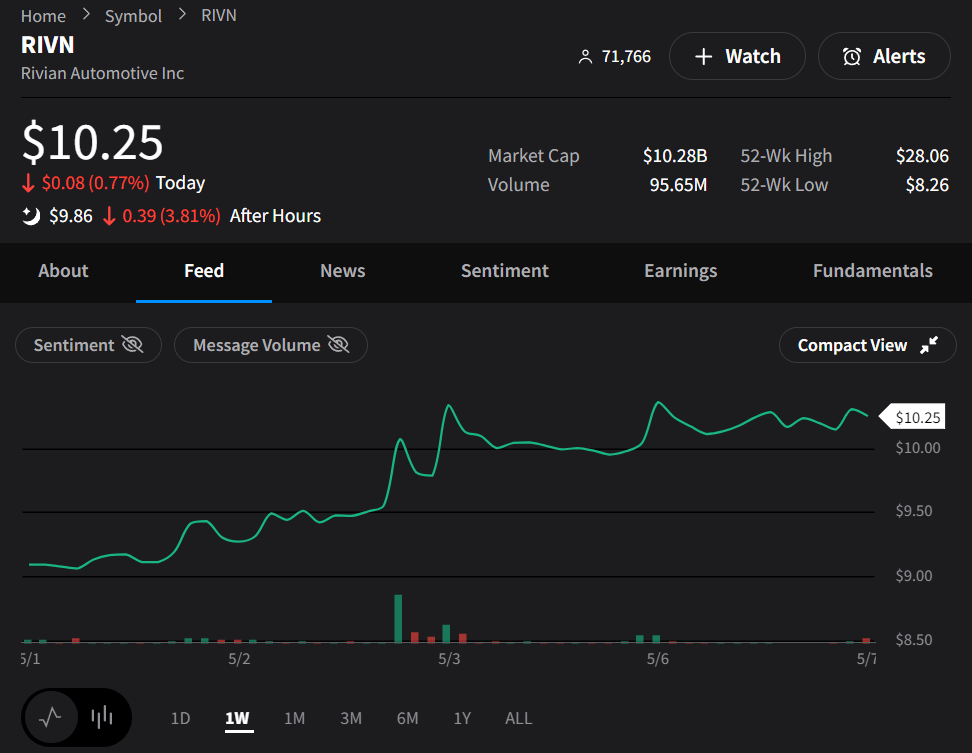

Rivian Revenue Runs Higher But Net Losses Popped A Tire 🛞

Rivian Automotive Inc ($RIVN) hit a few potholes but still managed to steer through some rough financial terrain in Q1 2024. Despite a net loss that's enough to make any investor grab the 'OH SHIT' handles, not everything is bad.

Revenue: Rolled in at $1,204 million, cruising past estimates of $1,163.40 million.

Net Loss: Accelerated to a painful $(1,446) million from $(1,349) million in the previous year, overshooting the dreaded estimates of $(1,079.37) million.

EPS: Stalled at $(1.48) per share, missing the $(1.17) target by a mile.

Gross Profit: Showed slight improvement, albeit still in the red at $(527) million, bettering last year's $(535) million.

Operating Expenses: Swelled to $957 million, up from $898 million last year, fueled by pricier stock-based compensation and depreciation.

Adjusted EBITDA: It received a tune-up, improving to $(798) million from $(1,020) million last year.

Liquidity: Rivian ended the quarter with $9,053 million in the tank, including cash and credit facilities.

The company celebrated the roll-out of its 100,000th vehicle this quarter and introduced a new midsize platform that promises to cut production costs by over $2.25 billion. Additionally, the makeover of Rivian’s Normal, Illinois plant is expected to shift manufacturing efficiency into high gear. 🚗

EARNINGS

Allegiant & Nikloa Earnings. 📊

Allegiant Travel Co ($ALGT) navigated a turbulent first quarter, leaving investors checking their emergency exits. Here's a streamlined look at the crucial financials and forecasts. 🧑✈️

Revenue: Increased slightly by 1.0% to $656.4 million, surpassing forecasts of $644.27 million.

Net Income: Swung to a loss of $0.9 million from last year’s $56.1 million profit, missing estimates of $11.65 million.

EPS: Reported a GAAP loss of $(0.07) per share, with adjusted EPS at $0.57, beating the expected $0.50.

Operating Income: Dropped by 83.8% to $15.4 million.

Airline-only Income: Plunged 75.2% to $24.2 million, reflecting operational strains.

Special Charges: Totaled $16.7 million, including aircraft depreciation and property damage.

Q2 Guidance: EPS is projected between $1.25 and $1.75.

Annual Forecast: Anticipates a slight decrease in system ASMs by about 1.0%.

Despite surpassing revenue expectations, Allegiant's performance was marred by significant income losses and operational challenges, steering the company into a phase of cautious optimization and strategic adjustments. 🛫

Nikola Corporation ($NKLA) had a bumpy Q1, underperforming Wall Street forecasts. 🪂

Revenue: Tumbled to $7.5 million, falling well short of the anticipated $15.8 million.

Net Loss: Improved slightly to $147.7 million, down from last year's $169.1 million, thanks to a 15% cut in operating expenses.

Earnings Per Share (EPS): Posted a loss of $0.09 per share, aligning with expectations but marking an improvement from the previous year’s $0.26 loss per share.

Truck Deliveries: Managed to deliver 75 hydrogen fuel cell trucks but delayed further deliveries of its battery trucks to the end of 2024, originally scheduled for mid-year.

Revenue Breakdown: Truck revenues fell by 26% to $7.4 million despite increased production activities.

Next Quarter Projections: Expects to deliver between 50 and 60 hydrogen trucks.

The tough economic environment and a shift toward more affordable hybrid vehicles have slowed sales of Nikola's higher-priced electric trucks. The company's response to these challenges and its strategic decisions will be crucial for its future direction. 🚦

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

Bullets From The Day

📱 TikTok Challenges U.S. Divestiture Law in Court

TikTok and its parent company ByteDance are suing to block a new U.S. law that mandates the divestiture of the app by January 19, 2025, or face a nationwide ban, arguing it infringes on First Amendment rights. The law targets TikTok uniquely, prompting the company to assert that such legislative action is unprecedented against a single platform, and the forced sale is deemed commercially, technologically, and legally impossible. The Washington Post has more.

🏦 Toxic Culture at FDIC Exposed

A Wall Street Journal investigation has uncovered a long-standing environment of sexual harassment and misconduct within the Federal Deposit Insurance Corp (FDIC), revealing incidents where employees were propositioned and harassed with little to no repercussions for the perpetrators. The toxic culture, which includes the sending of lewd photos and inappropriate behavior during official travel, has persisted despite numerous complaints and legal actions. More from the Wall Street Journal.

💼 JPMorgan’s Strategic Financial Maneuver

JPMorgan Chase ($JPM) has reported an unexpected $8 billion gain from an equity transaction involving Visa ($V) stock, providing a significant pre-tax boost to its second-quarter earnings. This financial windfall stems from exchanging certain classes of Visa stock held since the company's days as a cooperative. Despite this boost, the overall banking environment remains challenging with tepid lending and competitive deposit rates. From Yahoo!Finance.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍