NEWS

No One Shocked: Musk, Tesla Investigated. Again.

Wow, to the Dow on its sixth day of green on the screen! But out of the major indices, the Dow stood alone. The Russell, not surprisingly, was the big loser today, down nearly as much as the Dow was up. Let’s see what you missed. 👀

Today's issue covers a new investigation into Tesla, and a boatload of earnings: Robinhood, ARM, Shopify, Uber, and more. 📰

Here's today's heat map:

4 of 11 sectors closed green. Utilities (+1.05%) led, & real estate (-0.9%) lagged. 🟥

U.S. wholesale inventories for March 2024 remained unchanged at a 0.4% decline from the preliminary estimate, following a 0.4% increase in the previous month. Despite stable inventory levels, wholesale sales saw a significant drop of -1.3%, marking the weakest performance since January. Year-over-year, wholesale sales increased by 1.4%. 📉

U.S. mortgage applications saw a rebound, increasing by 2.6% in the week ending May 3, 2024, after a previous drop of 2.3%. The uptick was supported by both the purchase index, which rose to 144.2 from 141.7, and the refinance index, which climbed to 477.5 from 456.9. This recovery coincides with a decrease in the 30-year mortgage rate to 7.18% from 7.29%. 🏠

The Atlanta Fed's GDPNow model has revised its growth estimate for Q2 2024 sharply upwards to 4.2%, a significant increase from the previous 3.3%. This adjustment reflects stronger predictions for personal consumption expenditures and private domestic investment, which have risen to 3.9% and 6.8%, respectively. 😱

Beyond Meat ($BYND) reported a significant downturn in the first quarter of 2024, with net revenues dropping 18% year-over-year to $75.6 million. The company recorded a net loss of $54.4 million, improving slightly from last year, amidst efforts to reduce operating costs and optimize production processes. 🥩

$ARM’s shares fell despite topping expectations with $928 million in revenue. For fiscal 2025, Arm projects revenue to be between $3.8 billion and $4.1 billion, with profits ranging from $1.45 to $1.65 per share, slightly below the analysts' expectations of around $4.01 billion in revenue and a $1.53 profit per share. 🦾

The first quarter of 2024 showed $AMC with total revenues of $951.4 million, slightly down from the previous year’s $954.4 million. The net loss showed improvement, dropping to $163.5 million from a more severe $235.5 million the year before. On a per-share basis, the net loss decreased to $0.62 from $1.71. Not exactly a blockbuster success. But, considering the 6% decline in the North American box office due to last year’s strikes, AMC's ability to nearly maintain its revenue levels could be seen as a director’s cut above the rest. 🎟️

$MULN (+18.99%), $IONQ (+2.96%), $PYPL (-0.31%), $RIVN (-0.05%), $BTC (-2.32%), $DJT (+4.23%), $GME (-1.89%), and $TTD (-2.55%). 🔥

Here are the closing prices:

S&P 500 | 5,187 | +0.00% |

Nasdaq | 16,302 | -0.18% |

Russell 2000 | 2,054 | -0.48% |

Dow Jones | 39,056 | +0.44% |

STOCKS

Scrutiny On Autopilot 👨✈️

Tesla ($TSLA) is navigating a maze of legal challenges as U.S. prosecutors dig into allegations of securities and wire fraud linked to claims about its Autopilot and Full Self-Driving (FSD) capabilities. 🏎️

According to Reuters, authorities are probing whether Tesla misled investors and consumers by overstating the autonomous capabilities of their electric vehicles.

The investigation by the Department of Justice, initially reported in October 2022, focuses on various communications by Tesla and its CEO, Elon Musk, which suggest the cars can operate without human intervention. 🤖

The Legal and Safety Quagmire

Despite Musk's claims of near-total autonomy, Tesla's technology remains at Level 2 autonomy, requiring active driver supervision. A 2016 promotional video famously depicted a Tesla driving itself, a portrayal at odds with the actual capabilities of the technology at the time.

The National Highway Traffic Safety Administration (NHTSA) has linked Autopilot to over 200 crashes, prompting a comprehensive review and recalls. Further, Tesla faces a slew of lawsuits alleging that its marketing misleads on the true nature of its driver assistance features, potentially encouraging driver negligence.

The ongoing investigation could lead to criminal charges or civil penalties for Tesla, depending on the findings regarding the discrepancies between public assertions and the actual performance of its technology. 🕹️

EARNINGS

HOOD Makes A Bull’s Eye 🎯

Robinhood's ($HOOD) Q1 earnings report is a clear win for the company, showcasing a significant leap in revenue to $618 million and earnings per share at an impressive $0.18, far surpassing expectations. 🏹

This surge was driven largely by a notable 232% increase in cryptocurrency revenue, contributing $126 million, alongside solid gains in options and equities trading.

HOOD’s customer base expanded, with funded accounts growing to 23.9 million, up by 810,000 from the previous year, while assets under custody ballooned by 65% to reach $129.6 billion.

However, the recent SEC Wells Notice suggests some potential challenges ahead. Overall, Robinhood’s first-quarter performance paints a picture of a company ready to keep rolling in green and with plenty of it to fend off the SEC. 💵

EARNINGS

SHOP & UBER: 'We Deliver Disappointment!' - Sponsored by BUD's Consolation Lager 🍻

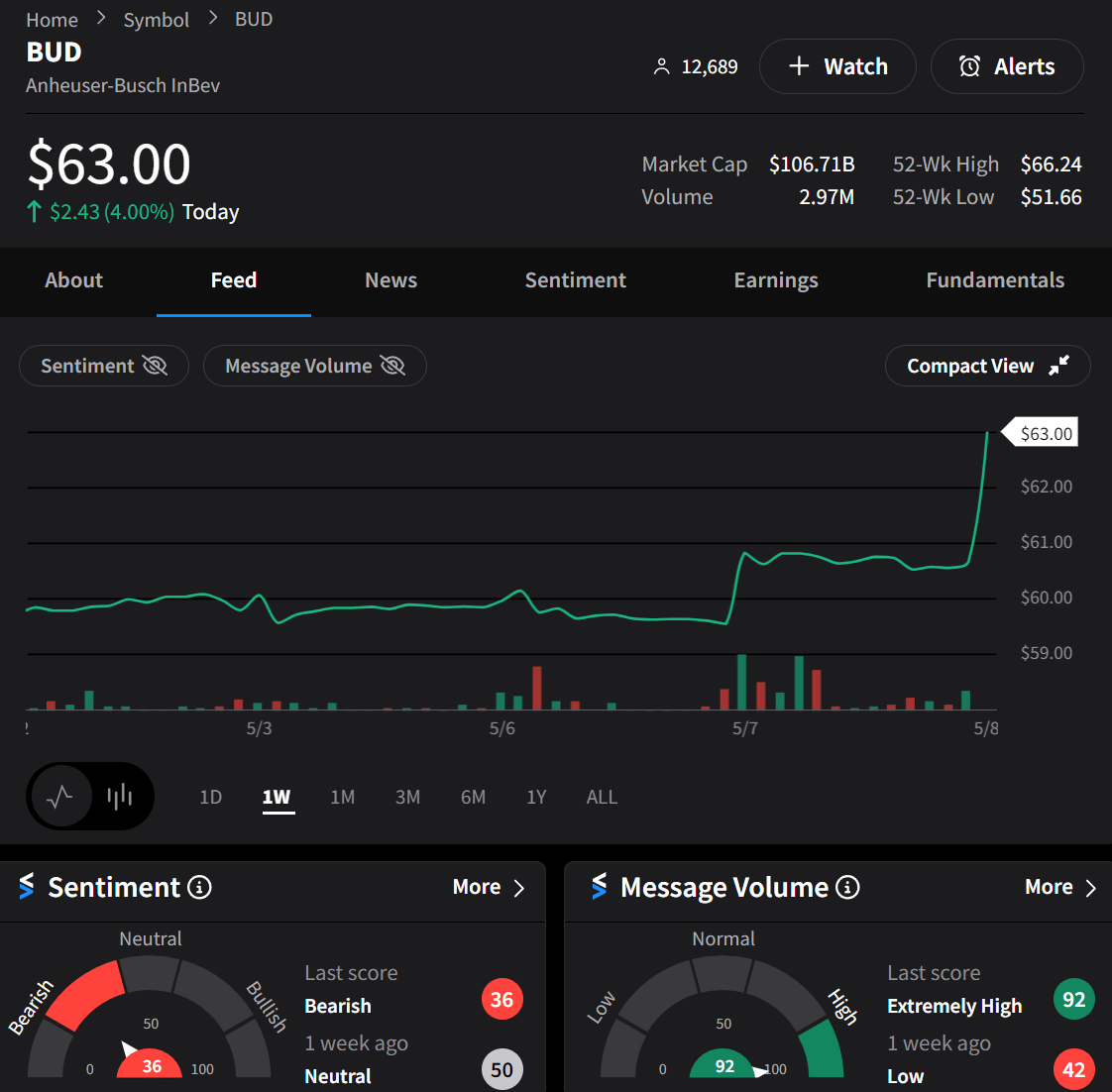

BUD: Afloat in a Sea of Mediocrity 🍺

$BUD is not doing too badly compared to its peers.

Total Revenue: A modest increase of 2.6%.

Megabrand Revenues: The megabrands, led by Corona, swelled by 6.7%, with Corona alone up 15.5% outside its homeland—apparently, beer does sell better under the sun.

Digital Sales: About 70% of their revenue is now digital, with BEES buzzing with 3.6 million active users.

Total Volume: A slight dip of 0.6%, with beer volumes specifically down by 1.3%.

Normalized EBITDA: Up by 5.4% to $4.987 billion. They must be brewing something right, or maybe it's just the price hikes.

Underlying Profit: Up from $1.31 billion to $1.509 billion. A round of applause for squeezing out more from each hectoliter!

Outlook: The company remains cautiously optimistic, projecting steady growth aligned with modest market expectations.

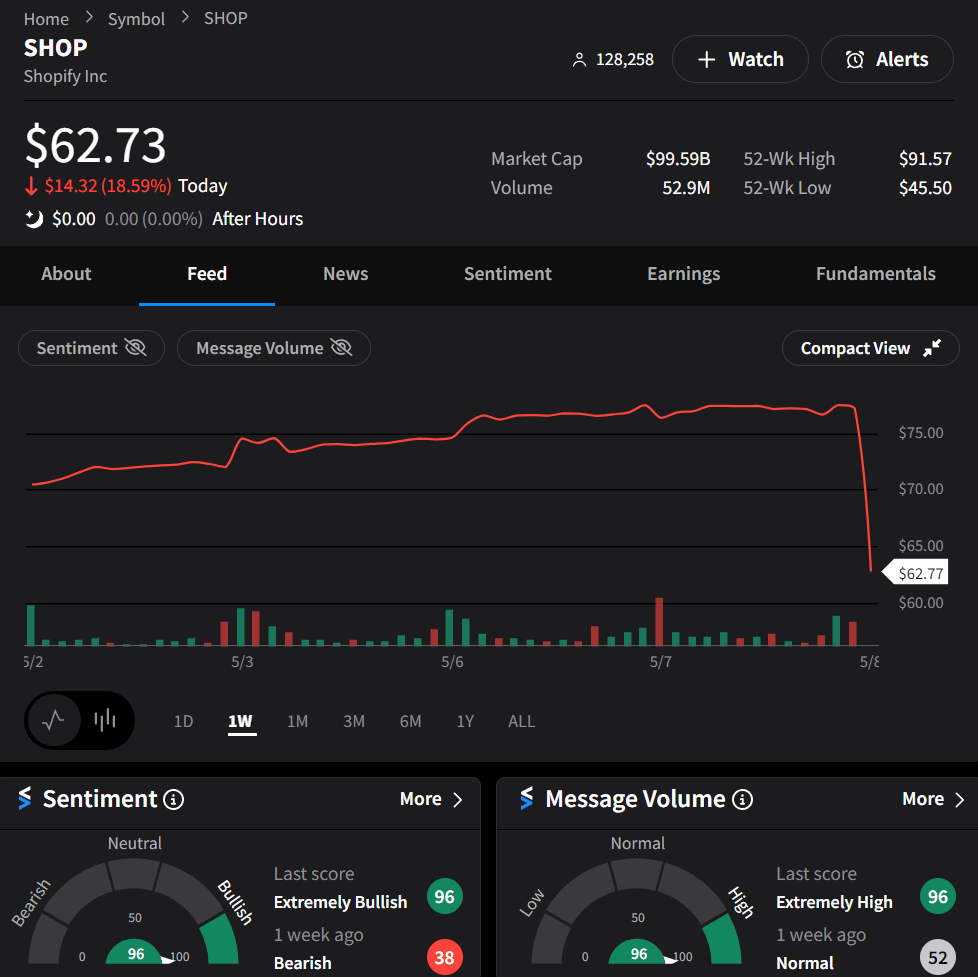

Shopify: The E-Commerce Eeyore 🫏

Shopify ($SHOP) reported first-quarter revenue of $1.86 billion, slightly surpassing analysts' expectations of $1.85 billion. Despite this beat, the company projected its slowest quarterly revenue growth in two years. 🤦♀️

They anticipate growth in the high-teens percentage range for the next quarter, significantly below the previous average of around 26%. This sluggish forecast, combined with broader economic uncertainties, led to a sharp 20% decline in Shopify's shares. ⤵️

Uber: At Least The Ride Got You Home 🚘

Uber ($UBER) reported earnings for the first quarter of 2024, with significant growth indicators. The company's revenue rose to $10.1 billion, a 15% increase year-over-year, driven by a 20% growth in gross bookings, which reached $37.7 billion. Additionally there was a substantial rise in both mobility and delivery services.

Despite these positive results, Uber reported a net loss of $654 million, largely due to a $721 million hit from unrealized losses related to the revaluation of equity investments. The adjusted EBITDA was notably strong at $1.4 billion, an 82% increase from the previous year, reflecting improved profitability.

Looking ahead, Uber's emphasis on expanding its services and improving profitability is promising. However, it remains to be seen how the company will manage its investment-related risks and continue its growth trajectory in a competitive and uncertain market environment. 🤷♀️

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

Bullets From The Day

🚗 GM Transitions from Chevy Malibu to EVs

General Motors ($GM) has announced the end of the Chevrolet Malibu's production to make way for new electric vehicles, marking the end of its historic run since 1964. This shift is part of GM's broader strategy to prioritize electric vehicles (EVs) and SUVs, highlighted by a $390 million investment in its Kansas assembly plant for future Chevrolet Bolt EVs. From Yahoo!Finance.

🔒 U.S. Plans Restrictions on AI Exports to China

The U.S. government is considering tightening controls on the export of advanced artificial intelligence (AI) models to China and Russia, aiming to safeguard critical technologies. This regulatory effort includes restricting the sale of proprietary AI software, building on previous measures that limited the export of sophisticated AI chips used for military advancements. This move faces challenges in enforcement but reinforces the growing focus on national security in the tech industry. More from Reuters.

💳 Mastercard and U.S. Banks Test Tokenized Asset Settlements

Mastercard ($MA), in collaboration with major U.S. banks, is testing a new shared-ledger technology to streamline the settlement of tokenized assets like securities and commercial bank money. This initiative, part of the Regulated Settlement Network proof-of-concept, aims to enhance transaction efficiency and security across borders. The project involves key financial players like Citigroup ($C) and JPMorgan Chase ($JPM) and seeks to transform how financial transactions are conducted in the digital age. Coin Edition has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍