NEWS

Nonfarm Numbers Cause Fear-Filled Friday

The saying “Be careful what you wish for, as you might just get it” seems fitting today, given investors’ reaction to the softening economy they’ve eagerly awaited. Fears of a recession and Fed misstep sparked a major selloff and one of the largest one-day volatility spikes we’ve seen since the pandemic. Let’s see what you missed. 👀

Today's issue covers the odds of a “not-so-soft” landing, conflicting seasonality signals, and $AMC CEO’s wild post-earnings commentary. 📰

Here’s the S&P 500 heatmap. Notably, 3 of 11 sectors closed green, with consumer staples (+0.88%) leading and discretionary (-3.68%) lagging.

And here are the closing prices:

S&P 500 | 5,347 | -1.84% |

Nasdaq | 16,776 | -2.43% |

Russell 2000 | 2,109 | -3.52% |

Dow Jones | 39,737 | -1.21% |

P.S. We’re experimenting with different formats to streamline your experience. Like something, don’t like something, hit me up. I want to hear from you.

ECONOMY

Market Braces For A “Not-So-Soft” Landing

The market and Fed wanted the labor market and overall economy to cool enough to bring down inflation but not enough to cause a recession. So far, monetary policy has helped tow that line pretty well, but today’s labor market data made investors feel the Fed made a misstep at Wednesday’s meeting.

Nonfarm payrolls grew by just 114,000 during July, well below estimates of 185,000 and June’s downwardly revised 179,000 figure. 📊

More importantly, the unemployment rate ticked higher from 4.10% to 4.30%, bringing into play something called the “Sahm" Rule,” which states that the economy is in recession when the three-month average of the jobless level is half a percentage point higher than the 12-month low.

In other words, when the 3-month unemployment rate is above its lowest level from the last 12 months, we may be in a recession. And now it is. 😳

The problem there is that other areas of the economy are still humming along, and the Atlanta Fed’s current-quarter growth estimate still sits above 2%. And it’s technically impossible to have a recession with the economy growing… 🙃

With corporate and household balance sheets in good shape, no systemic asset price bubble in place, and a Fed that has tools available to help buoy growth, economists say a “hard landing” is not likely.

However, a broader slowdown is occurring, and the pace of that slowdown has accelerated. As a result, some analysts felt today’s data reinforced the narrative that the Fed is behind the curve and should’ve cut by 25 bps on Wednesday. 😬

That caused a knee-jerk reaction in the bond market, where Fed Fund Futures now indicate the market has priced in a 50 bp cut in September, another 25 bp in November, and another 25 or 50 bp cut in December.

As we know, the market’s predictions are fickle and change on a dime, so these new estimates are unlikely to come true. That said, the possibility of a 50 bp cut in September is widely viewed as possible if data continues to suggest the Fed needs to make up for this week’s ‘misstep.’ ✂️

U.S. stock market volatility obviously soared amid the selloff. Here’s the roadmap technical analysts are using for the Nasdaq 100, once again indicating a few potential levels of support at current levels or slightly below.

Our next story covers the jump in volatility and what seasonality says could be ahead for the rest of August, so give it a read. 👇

STOCKS

Volatility Soars Amid Conflicting Seasonality Signals

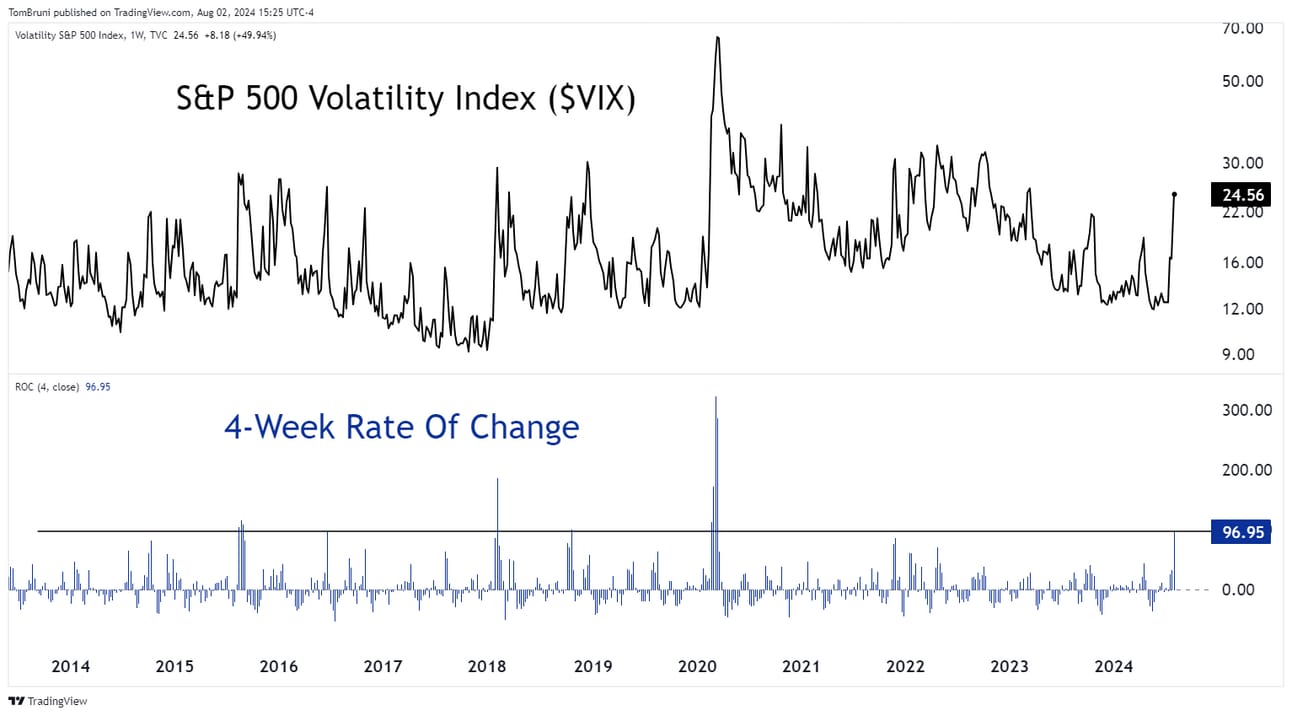

With the market now worried about the economy more than inflation, volatility is picking up at rates not seen since the pandemic (at least by some measures). 😰

For example, the S&P 500 Volatility Index ($VIX) popped to over 25 today and rose over 85% over the last four weeks. That’s its largest one-month percentage change since the pandemic, and there have been few other moves of this magnitude over the last decade.

With that said, we’ve been in a falling volatility regime since late 2022 and spent much of 2024 in what has been a historically low volatility environment.

Stat master Ryan Detrick, CMT, kindly reminded us that volatility is a feature of markets, not a bug. His stats also suggested that the quiet first half of the year was the ‘abnormality,’ not this market correction we’re currently seeing. 🤔

Ryan’s chart below shows just how often the S&P 500 has seen different correction levels each year. So far this year, we’ve had two 5% corrections, so nothing out of the ordinary. And it would be perfectly normal to see further downside.

As for what we can expect for the rest of August, Ryan points to one definitive stat. His chart below indicates that while August is typically a more volatile, lower-performing month of the year, during election years, it has never been lower and sports a strongly positive average return. 😮

Time will tell if that historical tendency holds true this year. But for now, a normal level of volatility is back and is expected to stick around given the new uncertainty around the Fed and economy, the upcoming election, and other “macro” risks taking place around the globe. 🫨

Longer-term investors on Stocktwits, however, remain focused on the positives by creating a shopping list of stocks they want to buy on the dip. 📝

STOCKTWITS & 11thESTATE PARTNERSHIP

Effortlessly Find & Claim Shareholder Settlements 🕵️

In 2023, public companies settled a whopping $8.1 billion with investors. However, 75% of shareholders haven't claimed their payouts!

Even now, Apple, Alphabet, Zoom, and 50 other companies are distributing settlements to investors. Yet, most people either don’t know about these settlements or prefer not to spend time on the paperwork.

11thEstate identifies relevant settlements and recoveries, handles all the paperwork, and delivers the payouts to your account.

EARNINGS

AMC Apes Left Without Answers

AMC investors have had another rough year, with many global markets and sectors deeply in the green for 2024 while its shares crater. And to add insult to injury, its peers Imax and Cinemark Holdings have begun to take off recently…leaving investors wondering when (or if) AMC will catch up. 😐

Today’s earnings report didn’t give investors any answers, even as revenue of $1.03 billion met estimates and its adjusted loss per share of $0.10 was much narrower than the $0.43 expected. 🔺

The company had softened today’s blow in July by sharing preliminary results and warning that the 2023 actor and writer strikes reduced the number of new releases in the first half of 2024. Otherwise with such a large YoY revenue decline, traders would expect the stock to be down quite a bit on the news.

During the earnings call, CEO Adam Aaron touted the company’s recent move to extend $2.45 billion in debt maturities from 2026 to 2029 and beyond, making a comment along the lines of that debt ‘no longer being a problem.’ 🤔

For those of us living in reality, the company’s massive debt burden remains a material problem.

In addition, Aaron reiterated multiple times during the call that “cash is king” and enthusiastically pointed to the company’s more than $700 million in cash on its balance sheet. What he failed to mention is that cash came from secondary share offerings and not its business operations…which remains the core issue for shareholders. 🤦

As the graph below shows, the company’s top-line results remain extremely volatile and vulnerable to many external factors.

Even when revenues are high, the company struggles to generate cash from operations, as indicated by its “adjusted EBITDA” metric hovering above/below zero for much of the last several years. Its net cash used in operating activities rose to $34.60 million from $13.40 million last year. 💵

AMC shares are flat after the bell, and Stocktwits sentiment remains in ‘bearish’ territory. The earnings report and call did not provide any concrete answers on how management will turn its operations profitable, leaving investors wondering why they continue to own AMC instead of the other theater chains the market is treating more favorably. 🙃

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍