NEWS

Not Quite A Turnaround Thursday

Source: Tenor.com

The Dow narrowly snapped its longest losing streak in decades, providing some relief amid concerns over the Fed's hawkish stance. Bitcoin traded down to $97,000, while oil prices fell due to anticipated oversupply in 2025. Traders just want to get through tomorrow’s inflation data unscathed so they can head off for the holidays. 👀

Today's issue covers earnings from two forgotten favorites, an economic data recap, your new holiday “must watch,” and other notable pops and drops. 📰

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with utilities (+0.45%) leading and real estate (-1.72%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,867 | -0.09% |

Nasdaq | 19,373 | -0.10% |

Russell 2000 | 2,222 | -0.45% |

Dow Jones | 42,342 | +0.04% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $NVNI, $CNTM, $CARA, $ANGI, $ZCAR 📉 $SCHL, $NKE, $XBP, $EQT, $RIG*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Two Forgotten Stocks Propose A Fix 🤔

Nike and FedEx are typically the talk of the town, but in a rip-roaring bull market that’s left them behind, they haven’t been on the right side of the conversation for a while. Let’s see if their earnings reports today changed that at all. 👀

Starting with Nike, new CEO Elliott Hill outlined his strategy to return the company to growth, blaming deep discounting for earnings and revenue declines. Despite recent headwinds, the sneaker giant managed to top fiscal second-quarter expectations, prompting an initial spike in the shares after hours.

However, forward guidance and the turnaround strategy’s timeline left many feeling less enthused. Management expects gross margins to be down 3 to 3.5 percentage points during the holiday quarter and sales down low double digits. ◀

Hill stated that the company has become far too promotional, with digital platforms delivering a roughly 50/50 split of full-price to promotional sales. Additionally, too many resources were focused on driving online sales, paying for performance marketing, and isolating wholesale partners. The company will reverse that trend and win back their trust, but first, it needs to sell through elevated inventory levels.

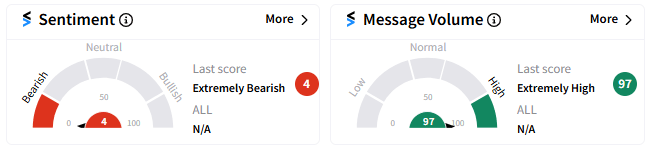

The stock is about flat following a volatile after-hours session, where shares were up as much as 12% and down as much as 5%. However, Stocktwits sentiment has flipped into ‘extremely bearish’ territory as investors debate the company’s potential. 😐

Source: Stocktwits.com

Meanwhile, shipping giant FedEx is back in the news after delivering its latest earnings report. The company’s second-quarter earnings topped estimates while revenues missed, a trend investors are used to at this point. Freight market weakness is not new, and cost-cutting measures have helped management buoy earnings. 🚚

However, the big story of the night was that it plans to separate its freight business, leaving two publicly traded companies. Activist investors and other shareholders have consistently pushed for this model, claiming it would unlock significant value. And it appears the Board of Directors finally agrees.

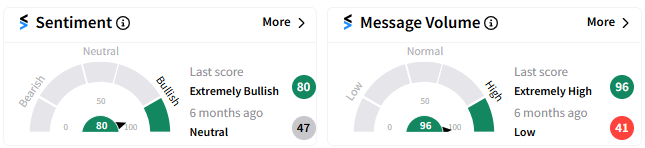

FedEx shares rose more than 8% after the bell, and Stocktwits sentiment pushed into ‘extremely bullish’ territory as the market digested this news. 🐂

Source: Stocktwits.com

SPONSORED

This Trading Bot Copies Congress, and has Outperformed the Market

Quiver Quantitative has built a trading bot that mimics stock trading by U.S. politicians, bringing a data-driven approach to copying the trading of Nancy Pelosi, Tommy Tuberville, and other members of Congress.

Quiver’s strategy, called the Congress Buys Strategy, tracks the performance of stocks that have been recently purchased by members of U.S. Congress (or their family). The holdings are weighted based on the reported size of the purchases, with weekly rebalancing.

This strategy has been doing well, and the methodology has had annualized returns of over 37% since 2020, outperforming the market on both an absolute and risk-adjusted basis.

To start copytrading the Congress Buys Strategy, along with dozens of other data-driven trading strategies published by Quiver Quantitative, you can visit www.quiverquant.com/strategies.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

Accenture (+7%): The IT services giant reported an earnings beat and upbeat guidance, with demand for AI-powered tools helping reignite revenue growth.

Canoo (-22%): The electric cargo vehicle manufacturer announced a series of difficult steps to keep its operations moving forward.

Boeing (+3%): The embattled aerospace giant was buoyed by Türkiye's low-cost carrier Pegasus Airlines, which ordered up to 200 Boeing 737-10 airplanes.

Oklo Inc. (+14%): Wedbush initiated an ‘Outperfom’ rating on the nuclear power provider citing elevated demand from the surge in AI applications.

Bio-Path Holdings (+120%): The biotech announced promising preclinical data for its drug candidate BP1001-A, targeting obesity and related metabolic disorders in Type 2 diabetes patients.

Mesoblast (+36%): The biotech received Food and Drug Administration (FDA) approval for the first-ever treatment for children with a form of graft vs. host disease.

Vertex Pharmaceuticals (-12%): The biotech fell to its lowest levels since May on mixed data from a Phase 2 study on its investigational oral pain signal inhibitor.

Bill Holdings (+5%): Bill Holdings will replace Lennox International, Inc. ($LII) in the S&P MidCap 400 Index, effective before the market opens on Monday, Dec. 23.

Nukkleus Inc (-3%): The company announced the pricing of its $10 million private placement with a single New York-based family office investor. The proceeds will finance its proposed acquisition of Star 26 Capital Inc.

Worthington Steel (-14%): The metal manufacturer extended its losing streak to eight days following disappointing second-quarter earnings and industry headwinds.

uCloudlink Group (-28%): The mobile data-sharing marketplace saw a surge in retail interest and trading activity despite lacking a clear catalyst.

PRESENTED BY STOCKTWITS

The Perfect Holiday Watch Party Movie 👀

Remember Glauber “Pro” Contessoto, aka “The Dogecoin Millionaire?” With crypto roaring back like it’s 2021 again, his name is making a comeback alongside Dogecoin’s price as retail looks for a repeat of the ‘meme coin’ mania. 🤑

His story was captured in a film nominated for ‘Best Documentary’ in the 2024 Astra Awards, and we’re rolling it out in four digestible parts over the coming four days, right on the Stocktwits YouTube channel.

See how THIS IS NOT FINANCIAL ADVICE exposes the risks and rewards of today’s market through expert commentary and the anxiety-inducing stories of real people trying to make millions. If you love markets, it’s the perfect holiday watch. 🍿

ECONOMY

Today In Economic Data 🌎

Third-quarter GDP was revised upward to 3.1%, as consumer spending and exports rose more than initial estimates. Consumer spending jumped 3.7%, the most since the first quarter of 2023. GDP growth has topped 2% in eight of the last nine quarters.

U.S. existing home sales topped a rate of 4 million in November for the first time in six months, as buyers give up on waiting for lower interest rates. Strength in the labor market and the overall economy is supporting a sluggish housing market.

Initial jobless claims look to end the year on a positive note, falling more than expected to 220,000 last week. While hiring has slowed materially, firings and other separations have not ticked up yet, so this leading indicator remains historically low.

Overseas, the Bank of England left interest rates unchanged after U.K. inflation rose to an eight-month high. It also downgraded its forecast for GDP growth as the country struggles with sticky inflation and tepid economic growth.

Lastly, the Bank of Mexico lowered rates by 25 bps and signaled that larger cuts would be considered in the future if inflation’s downward progress continues.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Core PCE Price Index & Personal Income/Spending (8:30 am ET), Michigan Consumer Sentiment (10:00 am ET). 📊

Pre-Market Earnings: Carnival Cruises ($CCL), Winnebago Industries ($WGO). 🛏️

After-Hour Earnings: None — enjoy your weekend! 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Privacy: Your responses are confidential and will only ever be shown in aggregate after being combined with those of other survey respondents. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋