NEWS

Nvidia Claims The World’s #1 Spot

Semiconductor giant Nvidia continues to dance upon the graves of its haters/doubters, topping a $3.30 trillion market cap and becoming the world’s largest publicly traded entity. Meanwhile, things remain mixed under the surface as the major indexes trudge higher. Let’s see what you missed. 👀

Today's issue covers the stock market’s new head honcho, the tale of two troubled stocks, and silver regaining its shine. 📰

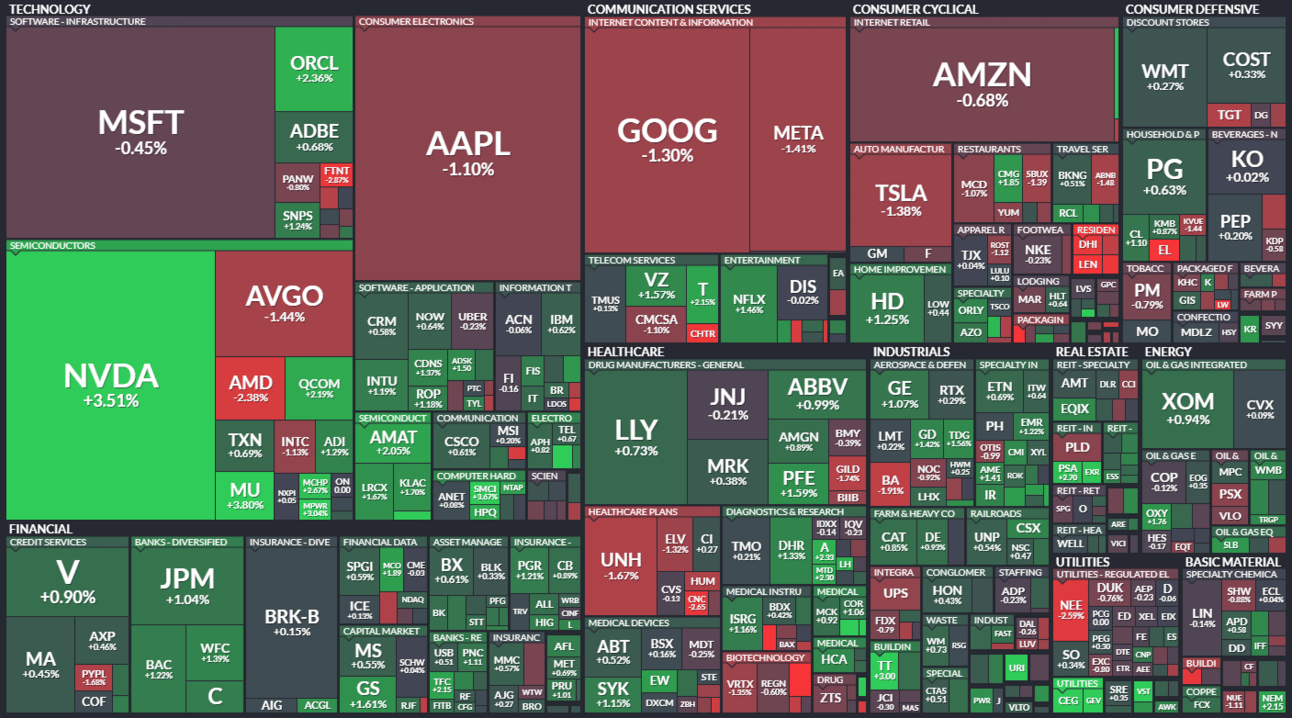

Here's today's heat map:

8 of 11 sectors closed green. Financials (+0.63%) led, & communication services (-0.59%) lagged. 💚

The Reserve Bank of Australia kept rates unchanged at 4.35%, with risks to its November rate cut forecast given inflation remains above its 2%-3% target range. Meanwhile, several U.S. Fed speakers reiterated the need for patience to ensure inflation is sufficiently on its way toward 2%. ⏯️

U.S. retail sales rose 0.10% MoM in May, below the 0.20% estimate. Excluding auto sales, they were down 0.10% as the consumer continued to soften alongside the labor market. Business inventories were up 0.30% MoM in May, rebounding from an unexpected decline in April. 🛍️

U.S. industrial production rose its most in 10 months during May, up 0.90% vs. expectations of 0.40%. Capacity utilization rose more than expected to 78.70%, with motor vehicle output and utilities driving the gains. 🏭

Lennar shares fell 5% despite reporting stronger-than-expected second-quarter results. Analysts say quarterly guidance was an issue, with new orders projected to decline QoQ as housing affordability remains challenged. 🏘️

Utility giant NextEra Energy fell as much as 5% intraday on the news it will sell $2 billion worth of equity units at $50 each (along with other preferences). Rocket Lab USA rose 13% after signing a 10-launch deal with Japanese Earth observation company Synspective. 💸

E.l.f. Beauty jumped 9% after Canaccord Genuity raised its price target to $250, citing the cosmetics retailer being positioned for strong growth. 💄

Six Flags and Cedar Fair both rose mid-single-digits on news that their merger is expected to be completed on July 1st. Six Flags will pay a special dividend of $1.53 per share following the deal’s closure. 🎢

Energy drink maker Celsius Holdings finally caught a bid after Piper Sandler reiterated its overweight rating, with its price target implying a 50% upside. 🫨

Other active symbols: $HOLO (-19.96%), $PLTR (+3.20%), $CRKN (-13.46%), $MU (+3.80%), $AVTE (-14.54%), and $DELL (+5.01%). 🔥

Here are the closing prices:

S&P 500 | 5,487 | +0.25% |

Nasdaq | 17,862 | +0.03% |

Russell 2000 | 2,025 | +0.16% |

Dow Jones | 38,835 | +0.15% |

STOCKS

Nvidia Goes Full-On Meme Stonk

The market has been focused on meme stocks like GameStop, AMC, and others…but maybe Nvidia’s social (and business) momentum should’ve been what we were all paying attention to instead. 😵💫

Nonetheless, the semiconductor giant soared to fresh all-time highs, passing Apple on its way to claiming the #1 stock spot by market cap. 🫅

The trend in this stock has only gotten steeper, and more and more folks are raising concerns about its fundamentals meeting sky-high expectations in the future. Still, like meme stocks, momentum and FOMO drive the short-term price action while the business takes a back seat.

There’s not much more to say here than congratulations to all the shareholders who were along for any bit of this historic run. 🥳

Also, nothing changes sentiment like price…just ask Jim Cramer, who people were dunking on a bit today for his “entertaining” takes and timing. 😂

STOCKS

The Tale Of Two Troubled Stocks

While we’re on the subject of crazy stock moves, it's worth mentioning two widely followed stocks whose businesses are questionable at best. 😬

The first is electric vehicle startup Fisker, which filed for bankruptcy protection on Monday. It plans to obtain financing and sell itself, making it CEO Henrik Fisker's second failed auto venture.

A company statement blamed various “market and macroeconomic headwinds” that impacted its ability to operate efficiently. For the rest of us following the space regularly, it’s simply the latest in a series of EV startups to go bankrupt because it could not execute the grandiose plans it pitched investors. 🪫

Next up is Trump Media and Technology, which plummeted more than 20% between regular and after-hours trading on news that additional shares will be coming on the market. 💸

The prospectus filed on Tuesday said that up to 14,375,000 additional shares would be issuable if early investors in the company exercise their public warrants. That could create more *potential* selling pressure for the stock, which has lacked a fundamental reason to rise…well, since inception.

As always, financial engineering is a normal part of a company’s operations, but it can’t be the only part…🤷

IN PARTNERSHIP WITH MONEYSHOW

Join Me At MoneyShow Toronto This September!

My presentation, “How To Use Social Sentiment To Profit In Markets,” will explain how investors and traders use Stocktwits’ unique social data to stay ahead of the market’s top trends. Register here, and I’ll see you then! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

COMMODITIES

Silver Regains Its Shine 🤩

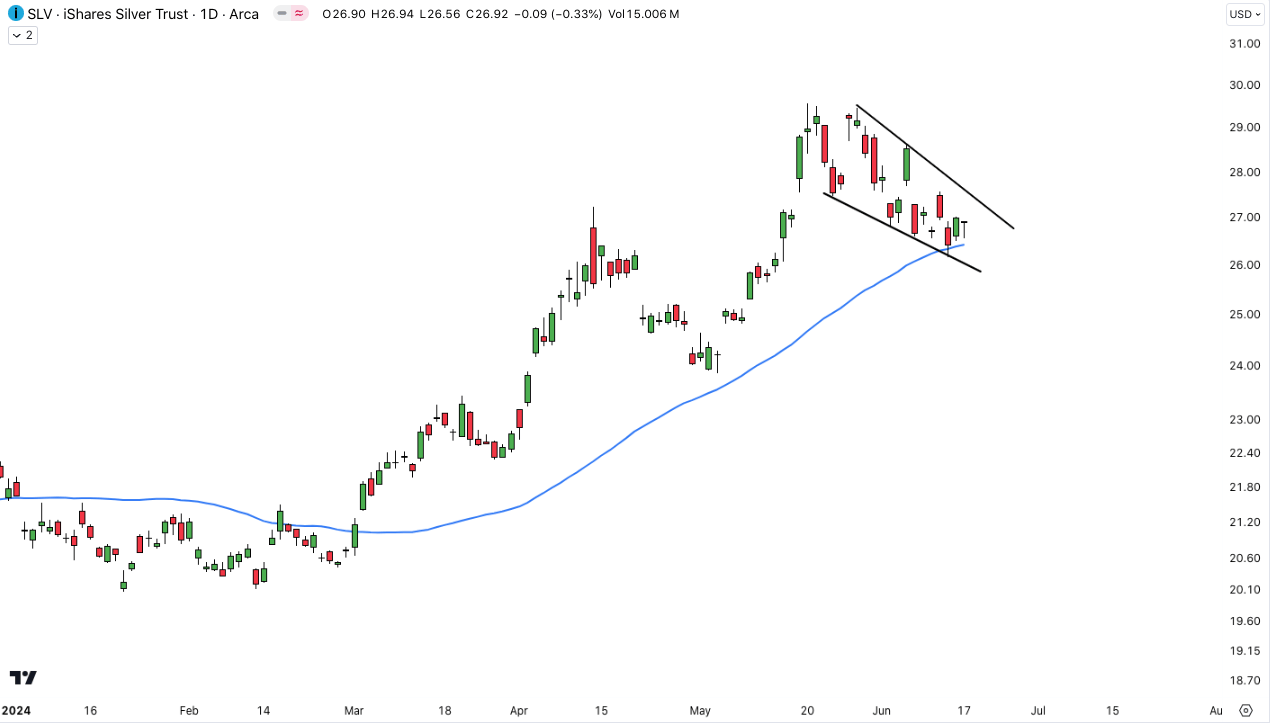

While the rest of the market was doing backflips about Nvidia’s new highs, some Stocktwits users noticed Silver prices stabilizing near support. 🧐

As the chart below from @Thelonius_Stonk shows, the silver ETF $SLV has found buyers at its 50-day moving average and could begin its next leg higher in the coming days.

The point is that traders will be keeping an eye on the metals space in general, as copper and gold also exhibited similar conditions. 👀

Bullets From The Day

😂 A new app wants to record your reaction to TikToks and other content. Seen is looking to solve a problem we apparently all have: sending a friend a funny TikTok video or other content only to receive a laughing emoji in return (if anything). The video messaging app allows users to send videos in private one-on-one iMessage or group chats of up to 11 people. But when you receive the content, they must record a video of themselves, which is sent back to the original person with their reaction. They’re essentially trying to connect people in a more real way. TechCrunch has more.

🤝 Amazon union inks deal with Teamsters. The consumer tech giant’s Amazon Labor Union (ALU) members are joining forces with one of the biggest unions in the U.S. as they attempt to bring Amazon back to the bargaining table. However, with the labor market still tight enough in certain industries to give workers leverage, they’re looking to strike while the iron is hot…even if that means calling in the big guns. More from The Verge.

🤖 McDonald’s AI-powered drive-thru test with IBM ends. The fast-food giant has been testing artificial intelligence (AI) technology at select drive-thrus since 2021 but is winding down the program to explore other options. The test gave McDonald’s confidence that the solution is something they want to pursue but raised concerns about its partner's ability to tackle this challenge. As a result, executives say they’ll reach a decision on the future of voice ordering by the end of the year. AP News has more.

Links That Don’t Suck

💪 Free access is over, but you can still power your portfolio with Leaderboard––6 weeks is just $59*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍