NEWS

Nvidia Day Results: Nobody Wins

Source: Tenor.com

Only Nvidia options sellers are celebrating tonight, with those hoping for fireworks following its earnings were disappointed. Instead, the action was in other major stocks like Target, Snowflake, and MicroStrategy. While there may be a delayed reaction to the results, chip stocks are stuck in limbo without leadership. 👀

Today's issue covers Nvidia’s failure to impress, Target’s continued turbulence, and more noteworthy pops and drops. 📰

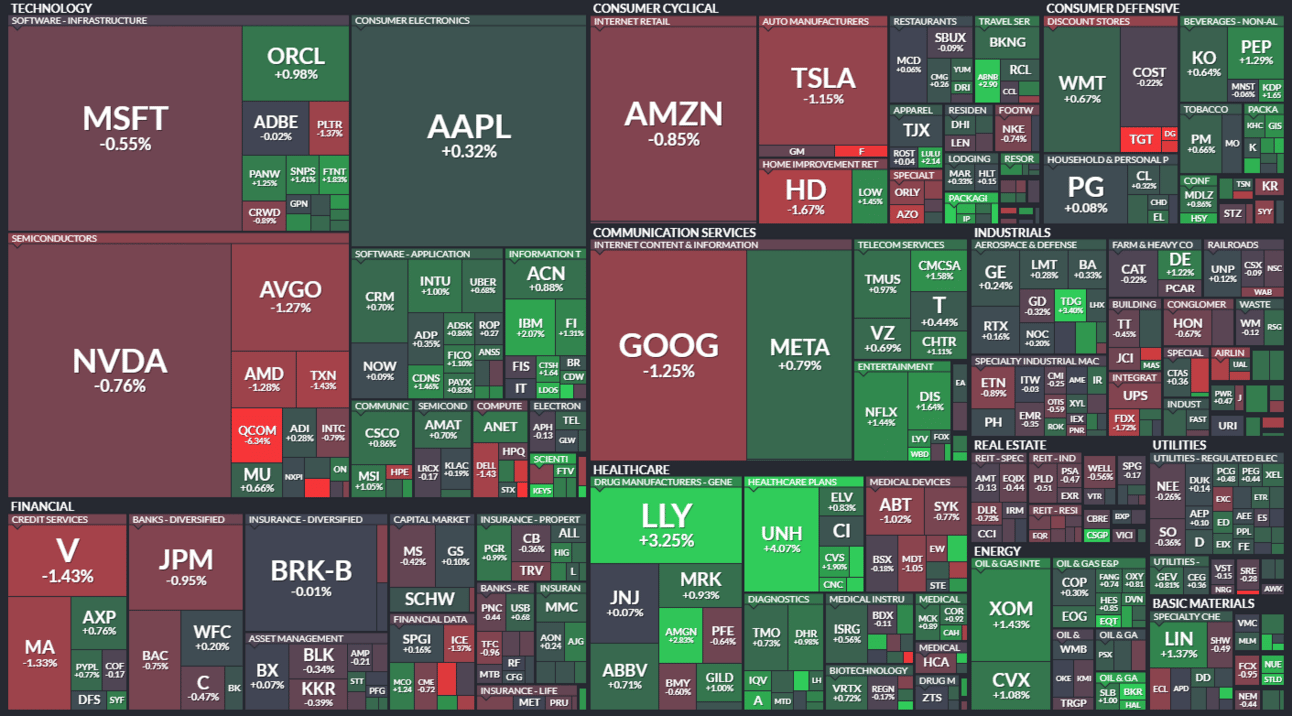

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with healthcare (+1.18%) leading and consumer staples (-0.51%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,917 | +0.00% |

Nasdaq | 18,966 | -0.11% |

Russell 2000 | 2,326 | +0.03% |

Dow Jones | 43,408 | +0.32% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $FBRX, $QSI, $SLXN, $DUOT, $PANW 📉 $JACK, $WSM, $LCTX, $ELF, $SBLK*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Your “Nvidia Day” Recap 👀

We kicked off the day with our “Daily Rip Live” broadcast, as hosts Shay Boloor and Jordan Lee welcomed a special guest to discuss all things Nvidia, crypto’s run, Target’s lackluster results, and Snowflake and Palo Alto Network earnings previews.

Semiconductor stocks traded down marginally throughout the day alongside the broader market, with Stocktwits sentiment staying in ‘extremely bullish’ territory ahead of Nvidia’s results, with poll participants expecting a beat and new highs.🐂

Source: Stocktwits.com

Revenues of $35.08 billion topped the $33.16 billion and represented 94% YoY growth (down from 122%, 262%, and 265% in previous quarters). Data center revenue surged 112% YoY to $28.82 billion, with about $3.1 billion related to networking parts sales rather than AI chips. 📈

For the current quarter, adjusted earnings of $0.81 also beat the $0.75 expected, and gross margins of 73.5% were slightly above estimates. Its other segments, like gaming, automotive, and professional visualization, are also faring well. 👍

Every major customer is racing to be first to market, and Nvidia has already shipped about 13,000 samples of its next-gen Blackwell chips.

Management expects the volume of shipments to ramp up significantly next year but warned that demand will exceed supply for several quarters in fiscal 2026. Additionally, gross margins will be in the low 70% range during the initial ramp-up and return to the mid-70% range as it reaches full production. 🏭

During the conference call, Jensen Huang shared this on AI market potential: "The way to think through that is I believe that will be no digestion until we modernize a trillion dollars worth of data centers.” On the inference market, he said, "Our hopes and dreams is that someday the world does a ton of inference. And that's when AI has really succeeded. It's when every single company is doing inference inside their companies."

For the coming quarter, Nvidia expects $37.5 billion in revenues, ±2%, implying a YoY growth of about 70%. Despite the overall deceleration, Nvidia said its AI enterprise revenue is set to grow at over 200% this year. 📊

Overall, the results were good but not good enough to surpass sky-high expectations. Shares are down roughly 1% after the bell, though Stocktwits community sentiment remains in ‘extremely bullish’ territory. We’ll see how the stock digests today’s news and will update you on any major changes. 🚨

Source: Stocktwits.com

SPONSORED

Trade 2X/-2X NVDA with T-REX Leveraged ETFs

Whether you're bullish 🐂 or bearish 🐻 on Nvidia, T-REX ETFs provide a gateway to dynamic market strategies. Gain access to leveraged exposure with 2X NVDA (NVDX) and -2X NVDA (NVDQ) ETFs, designed specifically for trading Nvidia.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Tough Times Continue For Target 😬

While Walmart and Costco are crushing it, Target has had a tough time adjusting to consumer trends since the pandemic… with that continuing today. 😭

Shares plunged 21% after the big-box retailer’s adjusted earnings per share of $1.85 came in well below the $2.30 expected. Revenues also missed estimates by about 1%, citing “lingering softness in discretionary categories.”

Despite reducing prices on more than 10,000 items this year due to customers stressing “the importance of value and affordability,” shopping demand for higher-margin discretionary items has remained tepid. 🛍

Same-store sales rose just 0.3% YoY in the quarter, with customer traffic across stores and websites rising 2.4% YoY. A bright spot was digital sales, which grew 10.8% YoY due to double-digit gains in curbside pickup and same-day home deliveries. However, comparable sales fell 1.9% YoY as consumers opted for lower-priced, lower-margin food and everyday essentials.

While the company has made efforts to keep pace in these categories, it continues to lag significantly behind competitors. For example, groceries account for 60% of Walmart’s U.S. business but only about 23% at Target. 🫘

Chief Commercial Officer Rick Gomez said, “Consumers have become increasingly resourceful and strategic on how they shop. They know deals are out there. They’re willing to search for them, and they’ll wait for the exact right moment to head into our stores or log on to our app.”

In other words, Target has known that consumers have grown increasingly strict with their budgets for much of the last two years but has failed to adjust its strategy to meet that demand adequately. On the costs side, it’s failed to make the necessary changes to offset the margin pressure coming from its sales mix and promotional activity.

That’s the core reason its shares are down over 55% from their all-time highs, while Walmart and Costco are hitting new highs almost daily. 📉

The company reduced its guidance after raising it last quarter, giving investors whiplash and raising further concerns about management’s handling of the business. COO Michael Fiddelke said, “…it’s disappointing that a deceleration in discretionary demand combined with some cost pressures has caused us to take our guidance back down after raising it last quarter.”

Dollar General and other lower-end retailers fell in sympathy over worries about the health of U.S. consumers. However, most investors believe this is a management issue at Target rather than a broader macro trend, especially since other retailers have been able to execute (e.g., Williams-Sonoma’s new all-time highs after reporting results).

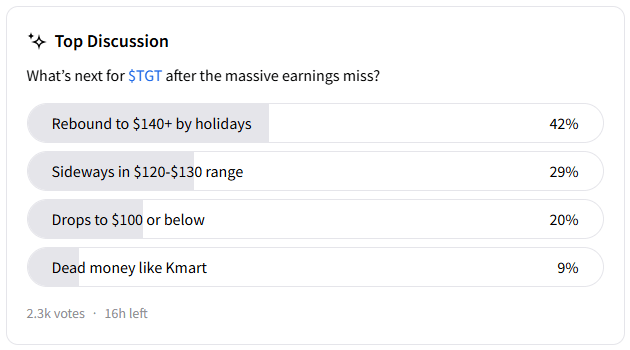

For now, two-thirds of the Stocktwits community is looking elsewhere for opportunities…at least until management can prove itself. 😐

Source: Stocktwits.com

STOCKS

Other Noteworthy Pops & Drops 📋

Lemonade (+16%): Morgan Stanley upgraded the fintech insurance company from ‘underweight’ to ‘equal weight.’ It also raised its price target from $23 to $42, citing optimism about the long-term growth potential following its investor day. 🍋

Snowflake (+18%): The software giant broke a streak of three straight post-earnings declines, with its outlook impressing for a change. It’s also planning to acquire the data-integration platform Datavolo to help simplify customer workloads. ❄

Palo Alto Networks (-5%): The cybersecurity giant topped earnings estimates but missed on revenues. It will undergo a 2-for-1 stock split on December 12th. ✂

Netflix (+1%): Pivotal Research raised its price target on the streaming giant to $1,100, a new record for Wall Street analysts. It cited the “(mostly) successful” Mike Tyson vs. Jake Paul fight. 🥊

e.l.f. Beauty (-2%): Short-seller Carson Block (who founded Muddy Waters Research) revealed a short position in the stock at the Sohn Conference in London. It alleges the beauty giant has overstated revenue in recent quarters. 👎

Forte Biosciences (+129%): The nano-cap biotech’s $53 million equity financing was oversubscribed, supporting the clinical development of its core drug, FB102. 💵

MicroStrategy (+10%): Hit new all-time highs on news it will quicken its Bitcoin buying after boosting its convertible notes sale by almost 50%. 🤑

Red Cat Holdings (+34%) & Palladyne AI Corp. (+8%): Announced an expansion of their partnership to include joint go-to-market initiatives for self-flying drones. 🤝

Keysight Technologies (+15%): Topped fourth-quarter earnings and revenue estimates. It also raised guidance, prompting several positive comments from Wall Street on the maker of electronics test and measurement equipment/software. 👍

Dolby Labs (+16%): The audio technology company reported mixed fourth-quarter results but issued upbeat forward guidance. Management focused on strong momentum in Dolby Atmos and Dolby Vision into 2025. 🔈

Semler Scientific (+28%): The medical tech and software company raised $21.5 million more to purchase more Bitcoin, embracing a MicroStrategy-like strategy. 🤑

ZIM Integrated Shipping (+1%): The shipping giant reported upbeat third-quarter results and raised full-year guidance, declaring a regular and special dividend. Increased exposure to spot volumes in the Transpacific trade drove results. 🚢

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Initial/Continuing Jobless Claims (8:30 am ET), Philadelphia Fed Manufacturing (8:30 am ET), Existing Home Sales (10:00 am ET), CB Leading Index (10:00 am ET), Kansas Fed Composite (11:00 am ET), Fed Goolsbee Speech (12:25 pm ET), Fed Hammack Speech (12:30 pm ET). 📊

Pre-Market Earnings: PDD Holdings ($PDD), Baidu ($BIDU), Baozun ($BZUN), iQYI ($IQ), BJ’s Wholesale Club ($BJ). 🛏️

After-Hour Earnings: Gap ($GAP), Ross Stores ($ROST), Intuit ($INTU), Netapp ($NTAP). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋