NEWS

Nvidia Faces A Reversal Of Fortune

Source: Tenor.com

The major U.S. indexes closed red today as stronger-than-expected economic data crushed hopes for a first-quarter rate cut. Treasury yields surged, with the 10-year hitting its highest level since 2007, weighing on stocks as investors grappled with higher-for-longer rate expectations. 👀

Today's issue covers Nvidia’s 9% reversal, JOLTs data dampening rate cut odds, JPMorgan’s back-to-office mandate, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with energy (+1.00%) leading and technology (-2.01%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,909 | -1.11% |

Nasdaq | 19,490 | -1.89% |

Russell 2000 | 2,250 | -0.74% |

Dow Jones | 42,528 | -0.42% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SANA, $CALM, $AZZ, $UNF, $MAIA 📉 $RMCO, $DG, $MBLY, $MDIA, $POWW*

*If you’re a business and want to access this data via our API, email us.

COMPANY NEWS

How About That Candle? 🫠

Directly after the Consumer Electronics Show (CES) 2025 keynote from Nvidia CEO Jensen Huang, over 70% of Stocktwits investors polled said the developments made them “more bullish” on the stock. However, today’s price action threw a wrench in the stock's short-term trajectory, so it’s worth revisiting. 😐

Stat master Jason Goepfert shared a crazy stat: Nvidia hit a 52-week high on the same day it closed lower than 50 days ago. This was the most material decline in the stock’s history, raising eyebrows among both bulls and bears. With that said, the latest date that came close was November 10, 2005, when the stock bottomed and then doubled over the next six months. So it’s interesting, but unlikely, a death knell.

Below, the stock’s nearly 9% intraday reversal prints quite the candle. In technical analysis, this is called a “bearish engulfing” candle, but it relies on follow-through the next day to validate a reversal and signal more downside. ⚠

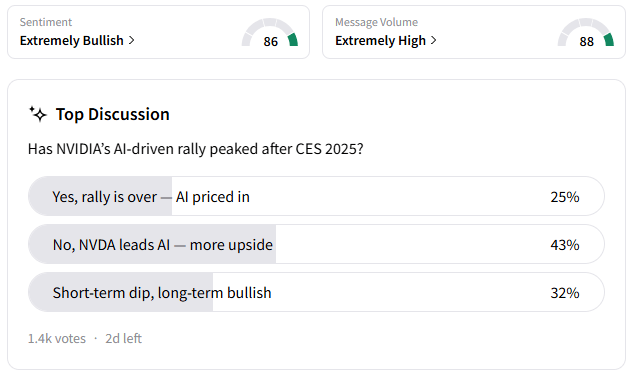

For now, prices are simply revisiting their June highs and settling into the middle of a multi-month range. What does the Stocktwits community think? Retail sentiment is still ‘extremely bullish,’ with nearly 75% of the 1.4k people polled seeing further upside for Nvidia as a leader in the artificial intelligence (AI) space. 🤖

We’ll see how the stock acts in the coming days and weeks. For now, head over to the Nvidia symbol page to cast your vote and discuss how the latest price action in the stock changes your view of Nvidia and the overall semiconductor space. 🗳

SPONSORED

Fueled for Fortune

Wired's "rocket fuel of AI" label has Wall Street buzzing. Projections skyrocketing to $80 trillion, akin to 41 Amazons, signal a seismic shift. But here's the kicker: astute investors have a shot at riding the wave with a company primed for supremacy. Dive into The Motley Fool's exclusive report for your front-row seat.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMY

JOLTs Data Dampens Rate Cut Hopes 😓

Besides the pressure from Nvidia hurting the stock market’s chance of a green day, better-than-expected economic data caused sellers to reemerge. 😬

The November JOLTs data showed that job openings rose to 8.1 million, well above economists’ expectations for 7.7 million. Separations remain relatively unchanged while demand for labor is picking up. On top of that, the December ISM reading topped expectations, showcasing the resilience of the U.S. economy.

Unfortunately for investors hoping for a Fed rate cut in the first quarter, the odds of that occurring are dwindling with each piece of upside economic surprise. The CME Fedwatch Tool now suggests there’s only a 50%-ish chance of a rate cut occurring in May, with the highest probability in June. 🔮

Source: CME Fedwatch Tool

Higher rates for longer mean some pressure on the equity markets and other risk assets, with investors now turning their focus to earnings season. If earnings growth remains positive, that could offset some of the negative impact that higher rates. But for now, sellers are pouncing on the chance to get a few more shots in.

And since we’re talking about jobs, we should note JPMorgan’s latest move. 👀

The largest U.S. bank, which employs more than 300,000 people globally, is expected to replace its existing three-day mandate for many workers with a full return-to-office (RTO) policy. 🏢

The decision would expand existing rules from April 2023 that required the bank’s managing directors to be present five days per week. This rule already impacts roughly 60% of the bank’s staff, but it’s the latest sign that CEO Jamie Dimon is following through on his belief that staff work better together in person.

And so far, shareholders are taking the announcement in stride. After all, the stock has had a stellar year, rising 41%, and currently sits near all-time highs. So if Jamie Dimon believes that in-person work will help continue to drive value, then the Stocktwits community isn’t going to argue with him. 🤷

PRESENTED BY STOCKTWITS

The First “Trends With Friends” Of 2025 🤑

Howard, Phil, JC, and Michael are joined by special guest Packy McCormick of “Not Boring” to discuss the overlap of technology and meme culture. From Fart Coin to Nvidia's groundbreaking AI advancements, this episode sits at the intersection of innovation, humor, and strategy to explore the opportunities and chaos shaping 2025.

STOCKS

Other Noteworthy Pops & Drops 📋

Instil Bio (+16%): Jefferies upgraded the shares to ‘Buy’ from ‘Hold,’ with a new price target of $52—more than double their current level.

XTI Aerospace (-18%): The VTOL aircraft company’s 1-for-250 stock consolidation, effective Jan. 10, will allow it to raise capital and pursue strategic acquisitions.

Southwest Airlines (-3%): The airline announced the sale and leaseback of 36 Boeing 737-800 aircraft, which will be owned and leased to the firm by Incline Aviation III, the third in BBAM's flagship aviation investment fund series.

Hoth Therapeutics (+173%): Trading volume skyrocketed, driven by positive interim data from its Phase 2a trial of HT-001, a therapy targeting skin toxicities caused by epidermal growth factor receptor (EGFR) inhibitors in cancer patients.

Moderna (+12%): On Monday, the United States reported its first human death from H5N1 bird flu in Louisiana. While most of the other 65 known U.S. cases have been mild, a severe case in Canada has further heightened alarm. This put Moderna, Novavax, and other vaccine makers back on traders’ radars.

Annovis Bio (-7%): The FDA approved the final protocol for its pivotal Phase 3 Alzheimer’s disease (AD) study, garnering significant retail investor attention.

AppLovin (-7%): BofA Securities analyst Omar Dessouky said the firm’s 3P estimates suggest a 4% quarter-over-quarter (QoQ) decline in the Palo Alto-based company’s fourth-quarter app revenues. This compares to the 2% growth the Street currently models.

Getty Images (+20%): It entered into a definitive merger agreement to combine with rival Shutterstock in a union of equals. Shutterstock also rose 16% on the news.

Meta (-2%): The social media giant appointed Trump ally Dana White as a director and ended its 3rd party fact-checking as it looks to embrace the era of “free speech.”

Robinhood (-6%): JPMorgan upgraded the shares to ‘Neutral’ from ‘Underweight’ while raising the price target to $43 from $20, saying alternative asset managers “continue to see compelling secular tailwinds.”

Aurora Innovation (+29%): The company announced a long-term partnership with Nvidia and Continental to deploy driverless trucks at scale.

Suncor Energy (+5%): The Canadian integrated energy firm announced record quarterly and full-year operational results.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋