NEWS

Nvidia Floats While Stock Market Sinks

Thursday’s market environment was the equivalent of a group project where only one person did any work, and Nvidia was that person. But in case that analogy went over your head, the market experienced its first broad-based decline in weeks while Nvidia’s earnings helped it to new all-time highs. Let’s see what else you missed. 👀

Today's issue covers DuPont’s disassembly plan, the SEC’s approval of the spot Ethereum ETFs, and a Netflix stat sure to make you feel old. 📰

Here's today's heat map:

0 of 11 sectors closed green. Technology (-0.81%) led, & real estate (-2.12%) lagged. 💔

The S&P Global flash PMI showed U.S. business activity picking up the most in two years. Interestingly, the measure of input prices rose to the second-highest since September, with the group’s gauge of prices charged rising, too. 🔺

Other measures remain mixed. Kansas City Fed manufacturing activity was flat in May, while the Chicago Fed’s national activity index dipped in April. 🏭

U.S. new home sales fell 4.70% MoM and 7.70% YoY, with March sales also revised significantly lower. The median price of a new home sold rose 4% YoY to $433,500, with builders continuing to lean toward the luxury market. 🏘️

Live Nation shares tumbled 8% on news that the Justice Department (DOJ) filed a lawsuit seeking to break up the Ticketmaster parent company. It claims the company has hurt consumers and violated antitrust laws through its outsized control over the live events industry. 🎫

Boeing shed another 8% after CFO Brian West said aircraft deliveries won’t recover in the second quarter, causing negative free cash flow. 🛬

Farm and equipment machinery maker Titan Machinery fell 15% after its first-quarter earnings and revenue fell short of estimates. Aerospace stock Triumph Group also fell 12% after posting weak full-year earnings guidance. 🚜

Biopharmaceutical company Cytokinetics fell 17% after announcing a $500 million common stock offering. 💸

And Deckers’ Outdoor shares made new all-time highs after reporting solid results. Total revenues were up 21% YoY, driven by strength in Hoka and Uggs, which offset declines in its Teva brand. The retailer also raised its full-year earnings and revenue expectations. 👟

Other active symbols: $SWIN (-84.28%), $GME (-13.26%), $FFIE (+6.25%), $AMC (-10.08%), $BNED (-30.07%), and $JAGX (-33.26%). 🔥

Here are the closing prices:

S&P 500 | 5,267 | -0.74% |

Nasdaq | 16,736 | -0.39% |

Russell 2000 | 2,048 | -1.60% |

Dow Jones | 39,065 | -1.53% |

COMPANY NEWS

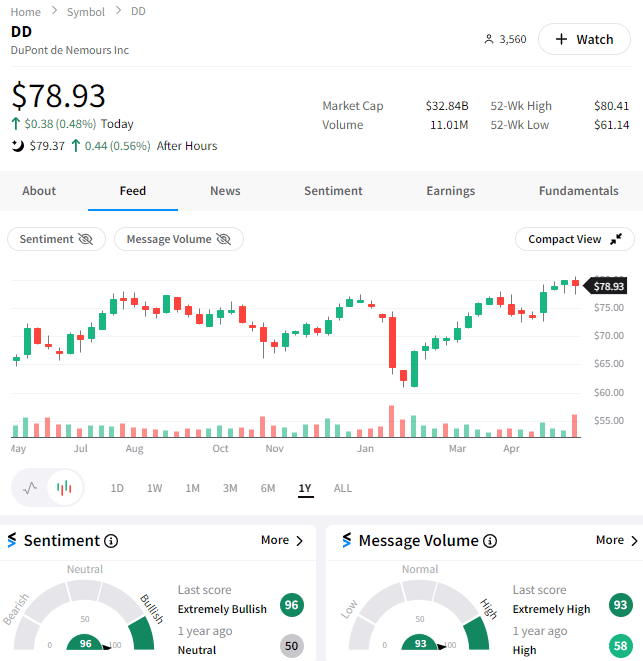

DuPont Decides To Disassemble

With its shares trading at the same level as two decades ago, chemical giant DuPont is looking to get off the sidelines and start courting investors again.

The 220-year-old company plans to follow GE and others by splitting itself up, hoping that three separate entities will be worth more than together. 💰

Executives outlined a plan to separate its electronics and water units through tax-free transactions, forming a trio of publicly traded businesses in a process expected to be completed over the next two years. The remaining company will focus narrowly on industries such as biopharma and medical devices.

Many traditional industrial conglomerates are finding fewer benefits from synergies and have more often just become a bunch of parts that loosely fit together.

DuPont shares were up marginally on the news, but the Stocktwits community liked what they heard. Message volume surged, and sentiment pushed into “extremely bullish” territory as investors debated the company’s prospects. 👍

CRYPTO

SEC Approves Spot Ethereum ETFs

The Securities and Exchange Commission (SEC) waited until the last second to approve spot Ethereum ETFs today, with the announcement coming shortly after 5 pm ET. 🥳

Today’s edition of the Litepaper outlined several reasons why the SEC had to approve the ETH ETFs:

FIT21 was successfully passed in the House with overwhelming bipartisan support last night (279-136), and President Biden said he would not veto it.

A string of SEC losses in court across multiple Federal judiciaries, often criticizing the SEC for their behavior and conduct - in the case of DebtBox ($DEBT), the SEC was censured for abuse of power.

Politicians just realized that there are 64 million dog owners in the U.S. but 85 million crypto owners. There’s no putting the genie back in the bottle.

Earlier, a bipartisan group of Congress members sent a letter to SEC Chair Gary Gensler, urging him to approve spot ETH ETFs. They argued that exchange-traded products (ETPs) bring transparency and regulated access to crypto for investors, similar to spot Bitcoin ETFs.

Gensler dodged giving a straight answer on the SEC’s decision. "I don't have anything on this particular filing," he said. At an event, he reiterated that most crypto assets are securities, parroting his prior comments. 🦜

Ethereum prices are trading erratically on the news, with much of its gains coming earlier this week when several prominent Bloomberg analysts raised their approval odds to 75%.

Stocktwits community sentiment is pushing into “extremely bullish” territory for the first time since early March. We’ll have to wait and see if this is a “sell the news” type event or if the upward momentum continues. 🐂

SPONSORED BY OUR FRIENDS AT PUBLIC.COM

A Brand New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

STOCKS

Netflix Went Public 22 Years Ago

We can always count on our social team to break out the stats that remind us how fast time passes. Today’s is all about the Blockbuster killer, Netflix. 👇

Now, excuse me while I go watch some Netflix and try to forget how silly I was for not buying Netflix shares when I was eight years old. 😭

Bullets From The Day

😨 Americans’ disconnect with the economy continues, as more than half believe we’re in a recession. A new poll conducted by Harris for The Guardian suggests that 56% of Americans believe the U.S. economy is in a recession and that the Biden administration is responsible. However, the data shows that’s not the case, as U.S. GDP growth is still growing (albeit more slowly). With that said, inflation and higher cost of living likely shape American’s views, making their experience feel worse than the data shows in the aggregate. Axios has more.

💻 Canva has mastered digital design and is now looking to tackle the office suite. The company is launching a new editing experience and Canva Enterprise package targeting businesses using a mixed bag of workspace tools. The specialized tier will provide more control over collaboration, brand management, and security for larger organizations. The updated experience will become widely available in August, though the first million users who find the “secret portal” hidden on its homepage can access it today. More from The Verge.

🤖 Robocaller using an AI version of Biden’s voice received a $6 million fine. The Federal Communication Commission (FCC) is coming down hard on the scammer who used voice-cloning technology to impersonate President Biden in a series of illegal robocalls during a New Hampshire primary election. With artificial intelligence (AI) making these scams easier than ever to pull off, law enforcement and regulators are hoping large punishments like this one will discourage the behavior. TechCrunch has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍