NEWS

Nvidia Remains The Port In The Storm

The global stock market selloff accelerated as oil, bonds, and other major assets all came under pressure. Nvidia remained green as its eyes stayed set on the $3 trillion market cap milestone. Let’s see what else you missed. 👀

Today's issue covers the after-hours tech wreck, two specialty retailers that can’t be stopped, and Chewy’s meme stock potential. 📰

Here's today's heat map:

0 of 11 sectors closed green. Communications (-0.52%) led, & energy (-1.73%) lagged. 💔

The Richmond Fed manufacturing index showed an unexpected improvement in May, breaking its streak of six consecutive negative readings. Meanwhile, the Dallas Fed services sector outlook fell in May, with growth mixed and wages rising MoM. 🏭

Cleveland Fed President Loretta Mester will step down on June 30th, and Goldman Sachs partner Beth Hammack will succeed her. Hammack will vote on the Federal Open Market Committee's rate-setting decisions. 🗳️

Oil and gas industry consolidation continues, with ConocoPhillips acquiring Marathon Oil in a $17.10 billion all-stock deal. The deal beefs up its assets in Texas’ Eagle Ford, North Dakota’s Bakken, the Permian Basin, and international presence with offshore assets in Equatorial Guinea. Also, Hess shareholders finally approved its $53 billion merger with Chevron. 🛢️

In the metals and mining space, BHP walked away from its $49 billion pursuit of rival Anglo American, who has resisted its previous takeover attempts, saying they’re “difficult to execute and would erode shareholder value.” ⚒️

Goldman Sachs is betting big on private lending, raising $20 billion for a new fund that’s looking to target private-equity-backed global businesses. 💰

Merck shares were down marginally after announcing a $3 billion deal for eye drug company EyeBio as it looks for new avenues to drive growth. 👁️

AST SpaceMobile stock surged 69% after the satellite-to-phones service provider announced a partnership with Verizon that effectively includes a $100 million raise via prepayments and a debt investment. It adds to the company’s latest deal with AT&T, as it looks to eliminate all U.S. dead zones. 🛰️

Cava initially fell after topping earnings and revenue expectations after the bell yesterday but recovered all its losses and closed at a new all-time high. 🥗

Health insurance stocks fell after UnitedHealth’s management commentary raised further concerns about its Medicaid business and pricing/margins. 🔻

The New York Stock Exchange is getting in on the crypto boom, reportedly collaborating with CoinDesk Indices to launch financial products tracking spot Bitcoin prices. With CoinDesk’s XBX index acting as the benchmark for $20 billion in ETF AUM, these parties are looking to provide options contracts that allow investors access to a “liquid and transparent” risk-management tool." ₿

Other active symbols: $AAL (-13.54%), $GME (-10.68%), $AMC (-7.79%), $JAGX (+8.19%), $BNED (+15.56%), and $CDZI (-3.13%). 🔥

Here are the closing prices:

S&P 500 | 5,267 | -0.74% |

Nasdaq | 16,921 | -0.58% |

Russell 2000 | 2,036 | -1.48% |

Dow Jones | 38,442 | -1.06% |

EARNINGS

Tech Wreck Takes Place After Hours

Several popular tech stocks are tumbling after hours; let’s find out why. 👇

First up is software giant Salesforce, which posted its first revenue miss since 2006 despite growing 11% YoY. Adjusted earnings per share of $2.44 topped the $2.38 expected, while total revenues of $9.13 billion missed by $0.04 billion.

Executives said budget scrutiny and longer deal cycles than usual, with management implementing go-to-market changes that cut into bookings. Notably, revenue from its '“Professional Services and Other” category was down 9% YoY. 🐌

Salesforce shares were down 16% after failing to live up to its AI-heightened expectations. Despite that, Stocktwits sentiment remains “extremely bullish.”

Software company UiPath's revenues rose 16% YoY to $335 million, topping expectations, while its loss narrowed to $0.05 per share.

However, the big news was that CEO Rob Enslin will resign on June 1, with co-founder Daniel Dines, who stepped down as co-CEO just four months ago. Dines co-founded UiPath in 2005 and will look to “right the ship” as the stock remains well below its post-IPO highs from 2021. 📉

Like Salesforce, executives said sales cycles for larger, multi-year deals were elongating, and customers are scrutinizing deals further. That, along with the leadership shakeup, caused it to reduce its full-year revenue guidance by 10%.

UiPath shares fell 30% on the news, though Stocktwits sentiment remains in “extremely bullish” territory.

Lastly, lab supplies and services company Agilent cut its full-year outlook for revenue and adjusted earnings. Executives said the company's core markets are improving but at a slower pace than anticipated. 🔻

Its third-quarter earnings forecast was also lower than Wall Street expected.

Agilent’s shares fell 13% after the bell, with the Stocktwits community seemingly staying away as sentiment sits in “extremely bearish” territory. 🐻

SPONSORED

Earn rebates on every options contract traded at Public.com

Are you an options trader? At Public.com , you'll earn a rebate on every contract traded with no commissions or per-contract fees. That's because Public offers a rebate on every contract you buy or sell. Joining Public is easy, and your rebates can add up fast. If you trade 1,000 option contracts on Public, you'll earn $60 to $180 in rebates and avoid up to $1,000 in fees that other platforms charge.

So, don’t change your strategy; change your platform—and start earning rebates one every options contract traded. Plus, get up to $10,000 when you transfer your existing portfolio to Public.

Discover why NerdWallet recently awarded Public five stars for options trading (and 4.6/5 stars overall), and earn rebates on options trades with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Two Specialty Retailers Continue Their Run

While many retailers are struggling in the current environment, several have found the secret sauce…and they reported results today. 🤩

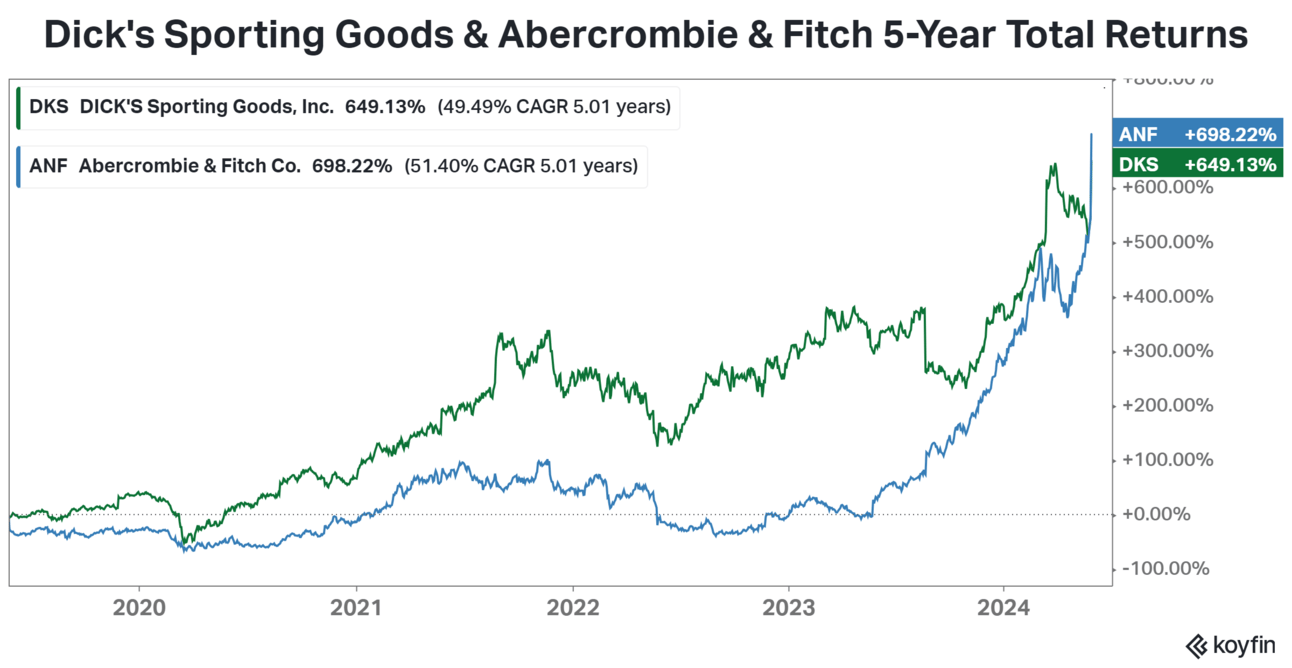

Mall retailer Abercrombie and Fitch soared to new all-time highs after its adjusted earnings per share of $2.14 on revenues of $1.02 billion easily topped expectations.

The company has been one of the biggest winners in retail, with Abercrombie brands seeing 31% growth and Hollister brands seeing 12% growth. Comparable sales grew 21% YoY, and executives expect revenues to grow 10% YoY, up from a previous estimate of 4%-6% and analyst estimates of 7%. 📊

Executives say successfully navigating seasonal transitions with product mix, compelling marketing, and inventory discipline helped drive the results. They’re hoping to build on the recent success by developing the Hollister brand, which accounts for over half of the company’s overall sales.

International markets could also be a growth driver, with revenues in Europe, the Middle East, and Africa up 19%. Asia Pacific also grew 10%, led by China. 🌏

Shares were up 24% to a new all-time high, though Stocktwits community sentiment is in neutral territory as some investors worry about the company’s ability to sustain growth against difficult comps.

Next up, Dick’s Sporting Goods made new highs after saying that shoppers are spending more on sneakers, apparel, and athletic gear. 🏅

The retailer’s earnings per share of $3.30 on revenues of $3.02 billion topped Wall Street estimates, with growth coming from all areas of its business.

Executives say consumers are prioritizing healthy, active lifestyles and are enjoying Dick’s product mix and shopping experience in-store and online. 🏃

The company raised its full-year guidance, but is still cautious on the second half of the year given the uncertain macro environment.

Dick’s shares rose 16% to new all-time highs, with Stocktwits community sentiment sitting in “extremely bullish” territory. 🐂

American Eagle Outfitters did not have the same good fortune, falling 9% after beating profit expectations but warning of slower sales growth ahead. ⚠️

EARNINGS

Can Chewy Achieve Meme Stock Status?

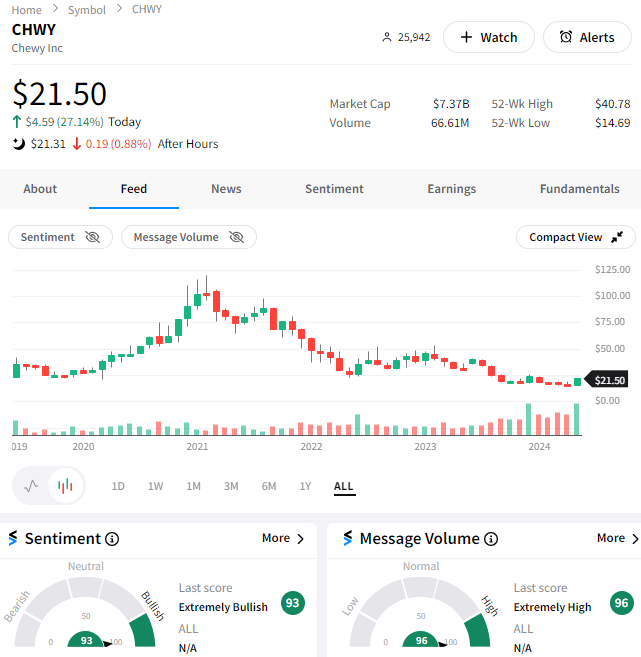

Beaten-down online pet retailer Chewy is rising from the dead, causing many to ask whether the heavily bet against stock could be the next to squeeze. 🕵️

The company’s adjusted earnings per share of $0.31 on revenues of $2.88 billion surpassed expectations of $0.20 and $2.85 billion. Executives said Autoship customer sales rose 6.40% YoY to $2.23 billion, a meaningful jump for its core customer base. 📦

The company also announced a share-repurchase program of up to $500 million, which it could use to buy back shares at depressed prices.

With about 5% of the stock’s float sold short and momentum turning higher, the Stocktwits community is looking at this to potentially squeeze. Sentiment is in “extremely bullish” territory as traders look to ride the turnaround. 📈

Meanwhile, the latest “meme stock, Faraday Future Intelligent Electric, plummeted 62% after its earnings pulled the rug on its squeeze story.

The electric vehicle maker withdrew its production outlook, citing current market conditions and funding levels. The news caused Stocktwits community sentiment to fall into “bearish territory” as the stock’s upward momentum shifted down. 📉

We’ll discuss this stock more on Friday, so be sure to read The Daily Rip then for more information on this “meme stock’s” wild story. 😵💫

Bullets From The Day

🤖 PwC becomes OpenAI’s first resale partner. The professional services firm will become OpenAI’s biggest enterprise customer, covering 100,000 users. The consulting firm will also become its partner for selling the AI company’s enterprise offerings to other businesses. For PwC, the deal shows how it believes its own industry will evolve in the long-term while giving it a new angle to win consulting business TechCrunch has more.

✂️ Walgreens is the latest retailer to cut prices on thousands of items. The pharmacy retailer is joining Target, Walmart, and Amazon, which have cut prices on thousands of household goods to lure inflation-weary consumers back into stores. This move comes at a time when consumers remain worried about inflation and the economy, keeping discretionary spending low. More from CNN.

📰 The Atlantic and Vox Media are the latest publishers to partner with OpenAI. One of the oldest magazines in the U.S. and one of the nation’s largest digital media holding companies have both secured licensing and product deals with ChatGPT parent OpenAI. The deals provide OpenAI with much-needed credible content to train its algorithms and inform its chatbots while giving the media companies a much-needed revenue stream. They’ll also leverage OpenAI’s technology to help develop new internal tools and products. Axios has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.