NEWS

Overheated Market Simmers Over

Source: Tenor.com

All four major U.S. indices ended the day in the red for the first time in weeks. Asian markets gained on China’s pledge for more stimulus, but Nvidia shares dropped as China opened an anti-monopoly probe. Extremes in speculative behavior mixed with a cocktail of bad news and geopolitical escalation may make for a shaky year-end. 👀

Today's issue covers China jumping with tech stocks dumping, a recap of Monday’s M&A activity, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with healthcare (+0.29%) leading and communications (-2.13%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,053 | -0.61% |

Nasdaq | 19,737 | -0.62% |

Russell 2000 | 2,393 | -0.67% |

Dow Jones | 44,402 | -0.54% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $HUIZ, $OLLI, $CMRX, $DUO, $SONN 📉 $HSY, $RTX, $TMUS, $CRSP, $PARA*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Chinese Stocks Pop While U.S. Tech Flops 📊

We spoke about this months ago after the initial efforts, but if China’s government has shown anything over the years, it’s that it won’t let its economy be left behind (or at least will fight against the appearance of it being left behind). 😡

Overnight markets surged after China vowed “more proactive” fiscal measures and “moderately” looser monetary policy next year to boost domestic consumption. While policymakers had used policy to prop up a vulnerable property market and manufacturing sector, the consumer side of the coin remained weak.

Now, it’s stepping up efforts to help its consumers play catchup with its first monetary policy easing in 14 years. 💸

Chinese stocks soared, causing U.S. stocks and other risk assets to jump too. Popular ETFs like $MCHI and individual stocks like Alibaba, JD.com, PDD Holdings, Baidu, and more all caught a major bid, reversing their recent decline.

Source: Stocktwits.com

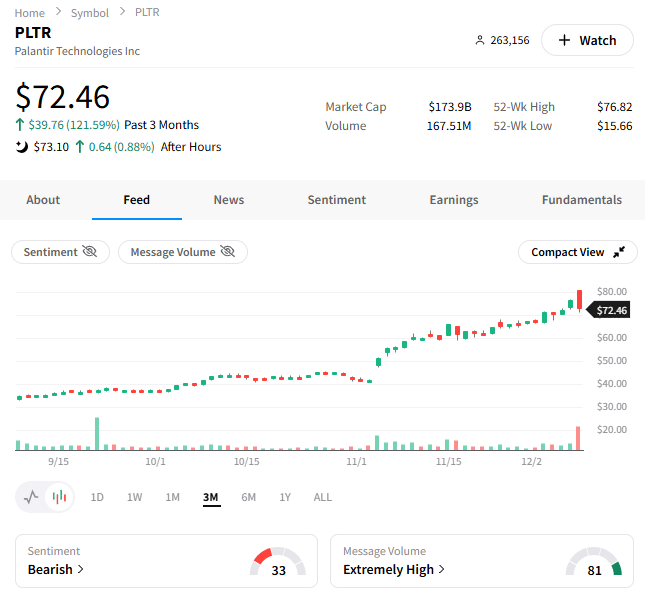

Strength overseas helped drive gaps higher in several popular U.S. stocks and indexes, but those quickly reversed. There’s no better example of this than Palantir Technologies, which has risen over 400% in one year and 120% in the last 3 months.

The stock gapped to new highs above $80 at the open but quickly faded as investors took profits or attempted to short the extended stock. That set the tone for the day, with many winners experiencing similar action, dragging the major indexes lower. 🙃

Source: Stocktwits.com

In addition, semiconductor stocks came under pressure after China opened an antitrust investigation into Nvidia. China’s State Administration for Market Regulation (SAMR) reportedly focuses on Nvidia’s compliance with the terms of its $6.9 billion acquisition of Mellanox Technologies in 2019. Also, Bank of America downgraded AMD to "‘Neutral,’ citing increased competition and delayed AI offerings. 👎

Overall, the market is taking a breather after weeks and weeks of ramping to the upside. Tops are generally processes, not points, so we’ll see how things develop in the coming days and weeks as investors prepare their portfolios for 2025.

SPONSORED

Invest with the art investment platform with 23 profitable exits.

How has the art investing platform Masterworks been able to realize an individual profit for investors with each of its 23 exits to date?

Here’s an example: an exited Banksy was offered to investors at $1.039 million and internally appraised at the same value after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector, resulting in 32% net annualized return for investors in the offering.

Every artwork performs differently — but with 3 illustrative sales (that were held for 1+ year), Masterworks investors realized net annualized returns of 17.6%, 17.8%, and 21.5%.

Masterworks takes care of the heavy lifting: from buying the paintings, to storing them, to selling them for you (no art experience required).

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

The content is not intended to provide legal, tax, or investment advice. Past performance is not indicative of future performance. Investing involves risk. “Net Annualized Return” refers to the annualized internal rate of return, or IRR, net of all fees and costs, to holders of Class A shares from the primary offering, calculated from the final closing date of such offering to the date the sale is consummated. A more detailed breakdown of the Net Annualized Return calculation for each issuer can be found in the respective Form 1-U for each exit. The 3 median returns above represent the ones closest in percentage to the median of the 12 exits with holding periods over 1 year. Masterworks internally appraises artworks that are held by entities administered by Masterworks Administrative Services on an ongoing basis, and obtains an independent review of appraisals by a third-party appraiser on an annual basis.Appraisals are prepared in accordance with the 2024-2025 Uniform Standards of Professional Appraisal Practice (“USPAP”) developed by the Appraisal Standards Board of the Appraisal Foundation, although it is noted that there are potential conflicts of interest given that some or all individual members of the appraisal committee are employees of Masterworks and Masterworks retains an ownership interest in the subject artworks as well as ownership of the Masterworks Platform. Masterworks compiles historical data from public auctions to produce metrics that we believe can be helpful in measuring and analyzing historical trends in artist markets and the historical price appreciation of specific artworks. See important Reg A disclosures at masterworks.com/cd.

STOCKS

Other Noteworthy Pops & Drops 📰

M&A activity: A Monday mashup of deals. 🤝

Omnicon Group (-10): The advertising company announced the acquisition of Interpublic Group of Companies ($IPG) via a stock-for-stock deal.

BP (+5%): The oil and gas giant announced a joint venture with Japan’s biggest power producer to invest 4.5 billion pounds in offshore wind farms, allowing it to gain some access to zero-carbon wind energy as it focuses on fossil fuels.

Hershey (+11%): Confectionary company Mondelez International is reportedly exploring an acquisition of the company in a deal that would create a combined company with nearly $50 billion in annual sales.

Arthur J Gallagher (-2%): The insurance brokerage, risk management, and consulting services firm will purchase insurance broker AssuredPartners in a $13.45 billion deal. It will expand its retail middle-market property and casualty focus.

Boliden (+3%): The Swedish miner will pay up to $1.45 billion for two mines from Lundin Mining in a deal to boost its copper and zinc production.

Macy’s (+2%): Barington Capital has partnered with private equity firm Thor Equities to mount an activist push. The group wants Macy’s to cut capital expenditures, raise its buybacks, and “take a hard look at options” for its luxury brands and real estate.

Pactiv Evergreen (+18%): Apollo Global Management’s Novolex will buy publicly traded packaging giant Pactiv Evergreen for around $3.22 billion.

Earnings: A mixed bag of results. 😐

Oracle (-6%): The computer technology company’s earnings and revenues slightly missed expectations. Like its peers, the stock is struggling to keep up with its own success, rising 80% YTD amid growing competition in its cloud infrastructure unit.

C3.ai (+15%): The small-cap artificial intelligence (AI) company posted its seventh consecutive quarter of accelerating revenue growth, and its loss narrowed. Its fiscal 2025 revenue forecast also topped estimates.

Rent The Runway (-24%): Shares popped then dropped after revenue rose 4.7% YoY and cash flow moved closer to breakeven. Weak average and total active subscribers, paired with modest revenue growth guidance offset the positives.

Telecom stocks tank: “Competition remains competitively intense.” 😬

Comcast Cable CEO Dave Watson said the company expects to lose more than 100,000 broadband customers during the fourth quarter, calling the broadband environment “competitively intense,” especially for price-conscious customers. Comcast fell 10%, dragging AT&T, Verizon, and others lower.

Crypto-linked stocks crack: Last week’s big winners become losers. 🙃

MicroStrategy made another large Bitcoin purchase for $2.1 billion. Apparently, issuing debt to buy Bitcoin at higher and higher prices makes the downside moves in crypto a lot harder to handle. Stocktwits sentiment is ‘bullish’ despite an 8% drop.

SPONSORED

Share your views on Investing & Trading! 🧠

Answer a short survey by 12/20/24 for a chance to win a $100 Amazon gift card.

Privacy: Your responses are confidential and will only ever be shown in aggregate after being combined with those of other survey respondents. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Productivity (8:30 am ET), WASDE Report (12:00 pm ET). 📊

Pre-Market Earnings: MoneyHero ($MNY), AutoZone ($AZO), United Foods ($UNFI), Ollie’s Bargain Outlet ($OLLI). 🛏️

After-Hour Earnings: GameStop Earnings ($GME), Dave & Buster’s ($PLAY), StitchFix ($SFIX), MIND Technology ($MIND). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in $PARA. 📋