NEWS

PLTR Earnings: They Saw The Future

The DOW just capped off its fourth straight day of green as inflation fears may have dipped a little. In fact, it seemed like everything was in the green today: stocks, oil, gas, natural gas, silver, gold, and platinum were all in the green. Let’s see what you missed. 👀

Today's issue covers Palantir’s blowout earnings, Tyson Foods’ not-so-great earnings, and insights from Berkshire Hathaway’s meeting over the weekend. 📰

Here's today's heat map:

10 of 11 sectors closed green. Technology (+1.48%) led, & real estate (-0.02%) lagged. 💚

After GameStop’s ($GME) insane-o moves last week, it’s been all over the place to start off this week. From +31.61% last Friday, GME opened today lower by -8.99% and lost as much as -16.49%. As of 1600 EST, it’s recovered nearly all of the losses and is only down -0.97% from Friday’s close. 🎮

Spirit Airlines ($SAVE) stock plummeted nearly 10% following the air carrier's disappointing quarterly loss and weak guidance. SAVE identified challenges, including bad weather and air traffic control delays. Revenue was slightly up to $1.47 billion, but the adjusted operating loss forecasted was significantly below expectations. 🛩️

Richmond Fed president Tom Barkin expressed optimism that current interest rates will eventually curb inflation. Barkin cited a strong job market and the Fed's deliberate approach to recent economic fluctuations. He reiterated the need for greater confidence in inflation returning to its target before considering rate cuts. 🤷♀️

Also, your normal Daily Rip author extraordinaire is on vacation. That means you get me (Jon Morgan), the author of Stocktwits’ crypto newsletter, The Litepaper, for this week.

Other active symbols: $MULN (+49.44%), $CELH (+2.79%), $BTC (-1.60%), $HIMS (+3.46%), $DIS (+2.66%), & $BA (-1.22%). 🔥

Here are the closing prices:

S&P 500 | 5,180 | +1.03% |

Nasdaq | 16,349 | +1.19% |

Russell 2000 | 2,060 | +1.23% |

Dow Jones | 38,852 | +0.46% |

EARNINGS

Crystal Ball Says: Money, Money, Money, Money 🔮

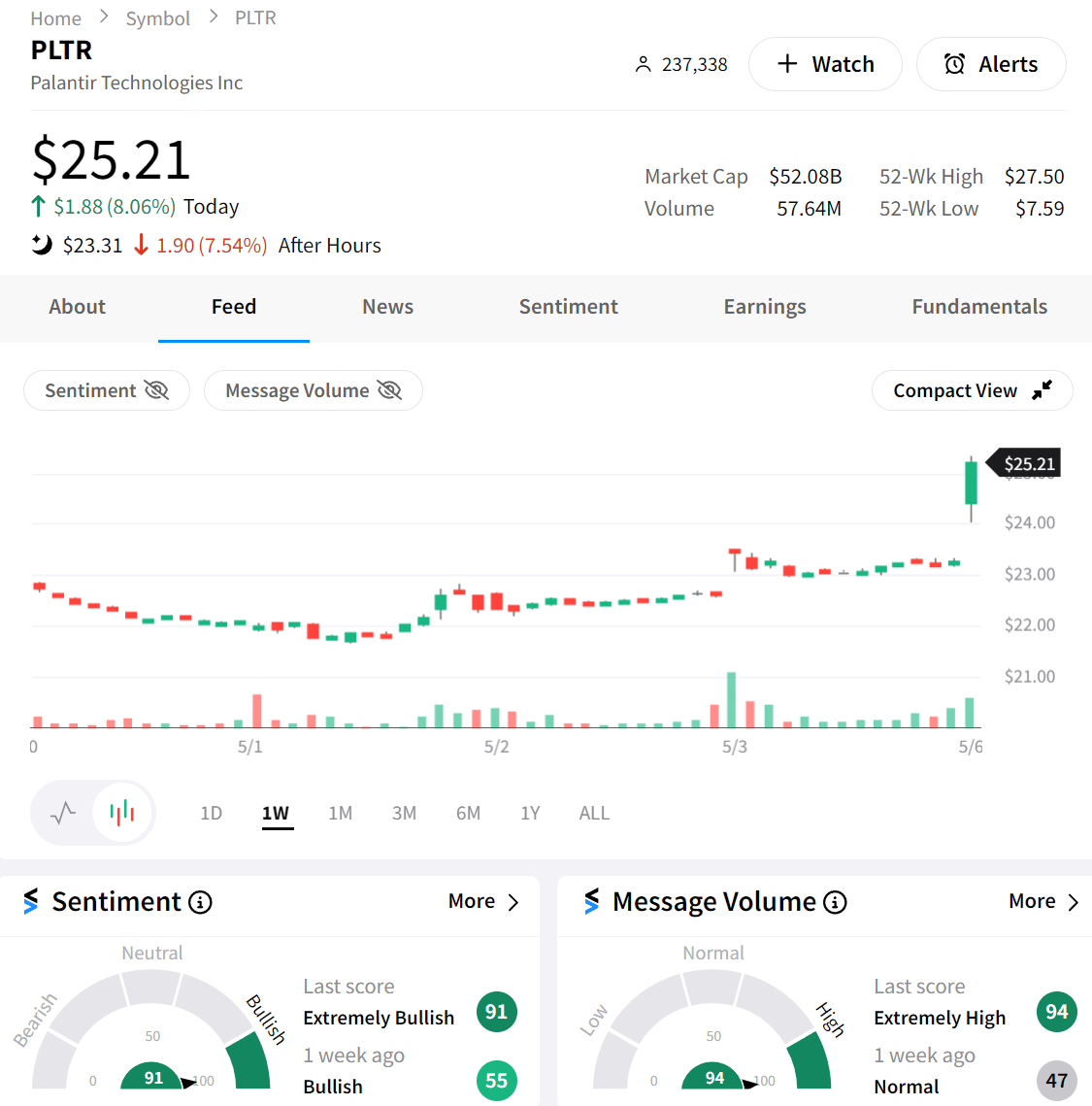

Palantir Technologies ($PLTR) kicked off 2024 with a bang, surpassing estimates with a 21% year-over-year revenue increase to $634 million, exceeding the anticipated $615.8 million. 💰

Sector-Wide Strength, Increased Projections, Raised Forecasts

The U.S. commercial sector saw significant growth, up 40% to $150 million. Overall, commercial revenues grew 27% to $299 million, while government revenues rose by 16% to $335 million. Notably, adjusted operating profit soared by 81% to $226.5 million, crushing the $198.2 million forecast.

Boosted by Q1's strong performance, Palantir has raised its full-year revenue outlook to between $2.68 billion and $2.69 billion, with adjusted operating profits expected to hit between $868 million and $880 million. The pivot from government reliance to expanded commercial engagement is paying off, highlighted by a 69% increase in U.S. commercial customers.

Commentary and Future Outlook

Chief Revenue Officer Ryan Taylor emphasized the pivotal role of Artificial Intelligence Programs (AIP) in driving growth. Palantir's aggressive commercial strategy has 660 boot camps and 87 deals worth over $1 million each.

For Q2, Palantir projects revenues of $649 million to $653 million, with continued strong adjusted operating profits. 🚀

EARNINGS

Tyson Foods Earnings: A Bitter Taste of Inflation 🦃

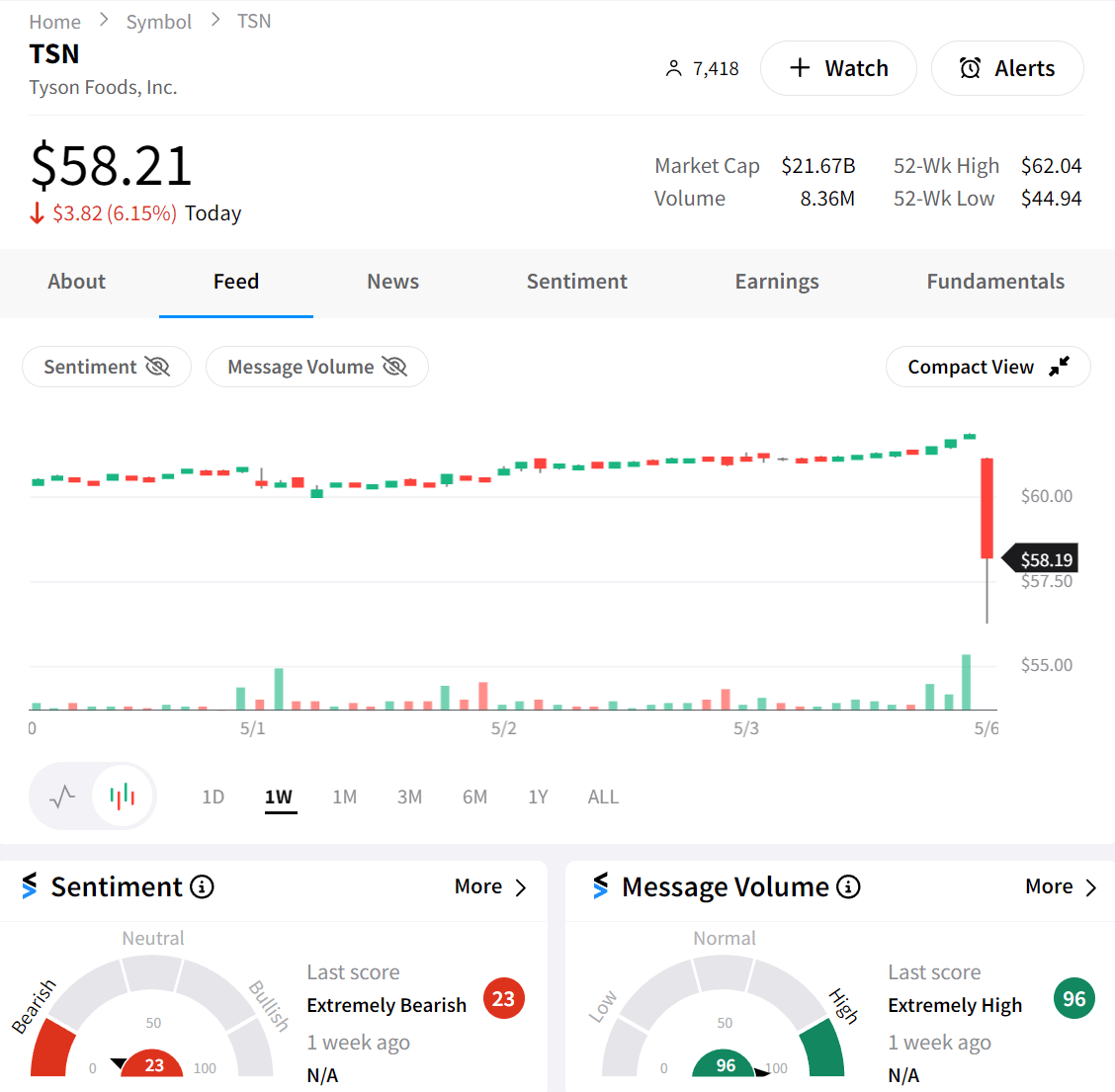

As inflation continues to nibble away at consumer wallets, Tyson Foods Inc. ($TSN) is feeling the squeeze. Here's the lowdown:

Earnings Snapshot: Despite a somewhat rosy picture painted by a second-quarter adjusted net income of 62 cents per share—a nice flip from a 4-cent loss per year earlier—the broader financial health seems a bit undercooked.

Revenue Miss: With sales pecking at $13.07 billion, Tyson fell short of the street's expectations by a nibble, expected to rake in about $13.16 billion.

Sector-Specific Struggles

Tyson's not just battling one troubled front; it's a multi-flank skirmish:

Prepared Foods Pressure: This segment, home to popular sausages and snacks under brands like Wright and Jimmy Dean, is on track to churn out slimmer profits in the latter half of the fiscal year. Talk about going from frying pan to fire.

Beef Business Blues: The largest chunk of Tyson's operations is currently wrestling with a cattle shortage—no cows, no cash. Udderly disappointing. And despite some positive movement in chicken and pork, thanks to lower costs, those margins are still tighter than a drum.

Grain Pain: Rising grain prices, crucial for feeding our feathered and porcine friends, are set to gobble up future margins. This is not ideal when you're trying to fatten the bottom line.

Looking Ahead

Tyson's path forward is littered with potential pitfalls. Here's what's keeping their execs’ feathers ruffled:

Consumer Caution: High inflation over the past three years has bred a more cautious, price-sensitive shopper, particularly among lower-income brackets.

Operational Adjustments: On a brighter note, Tyson's chicken biz has fluffed its feathers, turning a profit of $158 million from a deep loss last year, thanks to operational efficiencies like shutting down six poultry facilities.

Murky Outlook: for the fiscal third quarter—typically Tyson's strongest—combined with looming uncertainties around consumer behavior and commodity costs, it's clear that smooth sailing isn't on the menu. ⛵

IN PARTNERSHIP WITH MONEYSHOW

Join Us At MoneyShow’s Virtual Expo This June 👀

Stocktwits “Daily Rip” author Tom Bruni will present alongside other market experts, sharing unique insights on retail investor and trader trends. 📊

His presentation “Where Retail Investors & Traders Are Making Money in 2024” will take place on June 11th, 2024, from 11:15 to 11:45 am EDT. Register for free, and we’ll see you there! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

NEWS

Berkshire Hathaway's 2024 Shareholders' Meeting 🔑

As Berkshire Hathaway convened its annual shareholders' meeting this past weekend, an unmistakable absence was felt—Charlie Munger, the conglomerate's sage and wit, was no longer in attendance. 🥺

This marked the first gathering without his unmistakable presence, leaving a void that echoed through the CHI Health Center in Omaha, Nebraska.

The meeting, led by Warren Buffett and flanked by Greg Abel and Ajit Jain, became a reminder of Munger's mark on Berkshire's journey. As Warren Buffett took the stage, his demeanor was reflective, and his words were laden with reminiscence; the meeting transformed into a pilgrimage of sorts—a journey through Berkshire's storied past, its present realities, and its aspirations for the future.

Apple, Paramount, Succession, Continuity, and Tech

Despite a 13% reduction in its stake, Berkshire's unwavering confidence in Apple ($APPL) stood out. Operating profits rose 39% after taxes in the first quarter to a record $11.2 billion.

Buffet on Apple: "American Express and Coca-Cola are wonderful businesses. Apple is an even better business."

Berkshire's complete divestment from Paramount Global ($PARA) had substantial losses.

Buffet on Paramount: "It was 100% my decision, and we've sold it all, and we lost quite a bit of money." 🙁

Munger's absence emphasized discussions on succession planning, with Abel emerging as the likely successor. Buffett's endorsement of Abel's expertise in business fundamentals and capital allocation reportedly reassured investors.

Buffet on who will take over: "I would leave the capital allocation to Greg, and he understands businesses extremely well. If you understand businesses, you'll understand common stocks."

Buffett cautioned about AI. While recognizing AI's transformative potential, he emphasized the need for prudent risk management and foresight.

Buffett on AI, "Scamming has always been part of the American scene, but this would make those interested in investing in scamming—it's going to be the growth industry of all time." 🤖

Challenges, Reflections, And Future

Buffett was candid about acknowledging the difficulties of finding attractive opportunities while sitting on a pile of cash, which resonated with investors.

Regarding Berkshire's cash and Treasury holdings exceeding $200 billion, Buffett said, "It isn't like I've got a hunger strike or something like that going on; it's just that things aren't attractive."

Munger's legacy was a recurring theme throughout the meeting, with Buffett paying tribute to his invaluable contributions to Berkshire's journey.

Buffet on Munger, "When you get that in your life, you cherish those people, and you sort of forget about the rest." ❤️

Buffett's closing remarks encouraged continued shareholder engagement and participation. Buffett, in his noteably dry humor, concluded, "I not only hope you come next year. I hope I come next year."

Also, if you lack tears or laughs, make sure to watch The Berkshire Hathaway Movie at timestamp 30:55 from CNBC's Berkshire Hathaway annual meeting coverage. 📹

Bullets From The Day

📉 Truth Social Cuts Ties with Auditor Amid Fraud Claims

Trump’s Truth Social has axed its accounting firm, BF Borgers, after the SEC accused the auditor of "massive fraud" and fined the firm a hefty $14 million. The social media venture distanced itself swiftly, ending its association the very day the SEC announced Borgers' lifetime ban from public company accounting. MarketWatch has more.

💸 Hedge Fund Outflows Continue Amidst Market Wariness

March saw a significant $9.9 billion exodus from hedge funds, marking the 22nd month of net outflows. Investors show continued hesitance to park new capital in these vehicles, according to Nasdaq eVestment. Despite positive returns across various strategies, only a few, including certain bond trading strategies, attracted fresh inflows. Multi-strategy hedge funds felt the brunt of this retreat, with $2.7 billion leaving, even as their managed assets hit a record $700 billion. More from Reuters.

🔒 Robinhood Crypto Faces SEC Heat Over Token Trades

Robinhood Crypto has received a Wells notice from the SEC, signaling potential enforcement action over the crypto tokens traded on its platform. Robinhood’s legal chief remains defiant, asserting that the listed assets are not securities and expressing confidence in the weakness of any potential SEC case. This development highlights the ongoing tension between crypto platforms and regulatory authorities, with the SEC maintaining a firm stance on most cryptocurrencies as securities. From Robinhood.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍