NEWS

Precious Metals Pump As Stocks Stay Positive

Source; Tenor.com

U.S. stocks closed another week in positive territory as Netflix made new all-time highs. However, the day's main story was precious metals, as silver jumped to a 12-year high, and the entire space shined bright on an otherwise muted day in the markets. 👀

Today's issue covers regional bank earnings, Procter & Gamble’s overseas slump, silver’s breakout, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with communications (+0.75%) leading and energy (-0.33%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,865 | +0.40% |

Nasdaq | 18,490 | +0.63% |

Russell 2000 | 2,276 | -0.21% |

Dow Jones | 43,276 | +0.09% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $BAER, $MGPI, $GNPX, $LGHL, $LTBR 📉 $ARQQ, $BIOR, $ACHC, $ORGS, $TRV*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Regions and Fifth Third: Banking on Thin Margins, Thick Challenges 😰

Regions Financial and Fifth Third Bank reported earnings today - here’s how things panned out in the regional banking space. 🏦

Regions Financial is playing a steady game, but it’s not without its challenges. Its third-quarter earnings came in at $446 million, and while it touts stable net interest income and a 3% revenue increase, it’s clear it’s grappling with a tough lending environment.

Strategic repositioning of securities and the redemption of preferred stock shaved $0.08 off their earnings per share, signaling that they’re still working to adjust their balance sheet for the current environment. 📊

On the plus side, Regions saw a solid performance from wealth management and capital markets income—although it’s unclear whether those improvements are a one-off or a new longer-term trend.

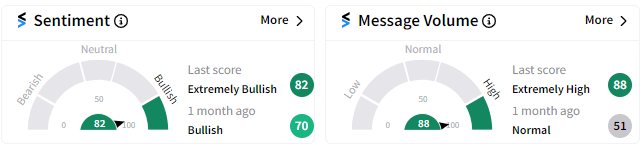

Shares were down marginally, but Stocktwits sentiment pushed back into ‘extremely bullish’ territory following the report. 🐂

The bank’s deposit base was essentially flat, ticking up just 0.7%, and it seems overly reliant on customer loyalty and adjusted income figures to keep things afloat. In a higher-rate environment, the key thing investors are watching is a bank’s ability to maintain or grow its deposit base…and so far, it’s doing a decent enough job to keep investors happy.

Fifth Third, meanwhile, is in a slightly different position. They posted net income of $2.1 billion, with $0.95 adjusted earnings per share, propped up by a massive $124 million tax benefit—thank you, EV lease credits! It’s a nice short-term boost but not a sustainable trend that can help with future quarters. ⚡

Net financing revenue dipped to $1.5 billion, reflecting tighter margins, and the 3.25% net interest margin ex-OID shows that funding costs are creeping higher.

Fifth Third was hit hard in auto financing— where losses surged, and the pre-tax income for that division dropped by $202 million. Still, management claims the portfolio is aging well, and tried to downplay the potential for further deterioration. 🚗

The real story for Fifth Third might be their liquidity, with $67.9 billion in the tank, covering uninsured deposits by a factor of 6.1. While they saw a $600 million dip in total deposits, that liquidity cushion gives them breathing room to weather whatever comes next. But just like Regions, they’re walking a tightrope to maintain deposit stability and avoid future revenue erosion.

Shares were down nearly 2% on the day, but Stocktwits sentiment actually ticked up into ‘extremely bullish’ territory as investors digested the news. 🔺

Gold is Reaching All-Time Highs — Are You Capitalizing on this Trend?

ESGold Corp (CSE: ESAU) (OTC: SEKZF) offers a prime opportunity to capitalize on the surging gold market with a project forecasted to generate CAD $112M in revenue. With just $8M needed to finish its Montauban plant, production is expected to kick off in just six months.

What sets ESGold apart? They're not only tapping into gold and silver, but also cleaning up the environment by processing toxic mine tailings and restoring natural ecosystems. It’s a win for both investors and the planet.

Already up over 50% in the last month, ESGold Corp is a public company gaining momentum.

Disclaimer: This ad is paid for and disseminated on behalf of ESGold Corp (it is sponsored content). We do not own any securities of ESGold Corp. This ad contains forward-looking statements, which are not historical facts. These statements are based on the current beliefs and expectations of ESGold Corp’s management and involve known and unknown risks, uncertainties, and other factors that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Words such as “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” and similar expressions often identify forward-looking statements. This is not financial advice, please do your own DD. See SEDAR+ for more information.

CHART OF THE DAY

Silver Surges To 12-Year Highs 🤩

Precious metals have been a major topic of discussion this year, with many playing the uptrend in gold via miners, leveraged ETFs, and other vehicles. However, many have been waiting for silver to join the rally to confirm this is a secular move in the metals space…and we may have gotten that signal today.

Stocktwits user @2kaykim shared a chart showing silver breaking out to 12-year highs as platinum and palladium also caught a bid. With gold’s beta-filled little brother silver finally making its move, traders and investors are betting on the bull market continuing in this space. 📈

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

STOCKS

Argentina's Impact on P&G’s Earnings 🔻

Procter & Gamble kicked off fiscal year 2025 by showing that even in a challenging market, they still have a knack for keeping things squeaky clean. 🪞

While net sales fell 1% to $21.7 billion, the company managed to maintain a 2% bump in organic sales. Core EPS came in at $1.93, a 5% increase over the prior year, thanks to cost-cutting and favorable product mix adjustments. It’s clear that P&G has figured out how to iron out the wrinkles in its strategy. 🧴

Argentina had a significant financial impact in the first quarter, with restructuring charges of about $0.8 billion after tax, primarily from non-cash charges related to foreign currency translation losses. These costs were a key reason for the 12% decline in diluted earnings per share, dragging it down to $1.61.

In true P&G fashion, they returned nearly $4.4 billion to shareholders this quarter through dividends and share buybacks. Despite restructuring charges from Argentina, their $4.3 billion operating cash flow shows they're still spinning a healthy profit.

Their core segments tell the real story: Fabric and Home Care scrubbed up a 3% organic sales increase, while Beauty saw a 2% drop—probably because even SK-II can’t work miracles in every market. 💄

STOCKS

Other Noteworthy Pops & Drops 📋

American Express reported its 10th consecutive quarter of record revenue, as its bet on the higher-end consumer continues to pay off. That said, revenue did miss expectations, but earnings per share of $3.49 topped estimates. Management raised its full-year earnings guidance, though revenue expectations are now at the low end of a previously stated 9%-11% range. Overall, cost-cutting continues to drive earnings strength even as revenue growth slows. 💳

SLB's Q3 earnings jumped 10% year-on-year, as their cost-cutting strategy paid off with a slick $9.16 billion in revenue. Their digital solutions continue to rake in cash, but international producers are tightening their belts because they’re concerned about oil prices’ long-term trajectory. Even with cautious spending from the big players, SLB managed to maintain a sweet, sweet profit margin of 25.6% due to operational efficiencies. 🛢️

Housing starts fell by 0.5% in September, putting a slight damper on the recent recovery. Elevated 30-year mortgage rates are sucking the life out of the market faster than you can say "refinance." With building permits also dropping, it shows a cautious approach by homebuilders trying to balance the need for more housing supply and what consumers can afford in the current environment.

Stellantis is closing its Arizona testing facility and offloading the 4,000-acre site in another cost-cutting move, much to the joy of Toyota, which is ready to pick up the slack. Overall, the struggling automaker continues to refocus on its core business and free up capital and attention to tackle its business's main challenges. 🏭

Intel's looking to offload a minority stake in its Altera business, trying to raise billions to save its foundry chip-making efforts. A deal valuing Altera at $17 billion could keep shareholders happy in the short term, but with Intel still down 50%,, investors are looking for a clearer turnaround story. Rumor has it Qualcomm is sniffing around for a takeover—though they may face some regulatory pushback if they pursue the deal. 💰

CVS Health shares fell 5% after the company announced a new CEO, longtime executive David Joyner replacing Karen Lynch. America’s largest drug store chain also withdrew its 2024 profit forecast and advised investors against relying on the full-year guidance it provided in August, citing higher medical cost pressures. 💼

COMMUNITY VIBES

One Tweet To Sum Up The Week 🤪

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋