Presented by

CLOSING BELL

Quantum Of Uncle Sam

The market climbed Thursday, more than recovering mid-week losses. Equities sold off after a report that software-enabled tech exports were on the table for tariffs with China, but Thursday's news that talks were still planned helped boost prices. CPI data is finally arriving tomorrow.

President Trump and Chinese leader Xi will meet one week from now in South Korea, in a meeting at the Asia-Pacific Economic Cooperation summit finalized today. Officials like Treasury Secretary Bessent are laying the groundwork for talks already, in a “frank and detailed” conversation about rare earths, Russian oil, and soybeans.

Speaking of oil, crude futures climbed after the White House finally sanctioned major Russian oil producers in a bid to push Putin toward a ceasefire deal in Ukraine. The goal is to freeze out buyers like India and China from Russian companies Rosneft and Lukoil. In January, the Biden White House sanctioned Gazprom Neft and Surgutneftegas, runners of Russia’s “shadow fleet,” but it had little effect on the Russian war effort. Let’s hope Russian exporters don’t find ways to circumvent sanctions again.

Aaand speaking of sanctions, Trump pardoned crypto billionaire Changpeng Zhao, founder of Binance, who in 2023 pled guilty to charges relating to money laundering and evading sanctions, as militants used his firm’s infrastructure to funnel funds to Hamas.

Today’s RIP: Intel beats, Tesla reclaims lost price, Quantum flies on U.S. stake rumor, and more. 📰

7 of 11 sectors closed green. Energy $XLE ( ▼ 0.09% ) lead and staples $XLP ( ▲ 0.87% ) lagged.

AFTER THE BELL

Intel, Ford, Deckers Round Out Thursday’s Reports

Tesla was gaining on Thursday, after hitting -4% following its earnings miss. Eyese turned toward after the bell reports.

Intel $INTC ( ▲ 5.71% ) was up 7% after its post-market Q3 report, its first performance filing since handing out a 10% stake to the Fed, and a 4% stake buy from Nvidia. It pulled in $13.7B in revenue, up year over year and above estimates, and 2C/share, DOUBLE the 1C analysts predicted. (An earnings report double can be major news, but it amounts to one more penny.)

Intel’s Foundry Services reported a loss of $2.3B in the quarter, as the company still struggles to pull buyers away from Taiwan Semi and toward a U.S. alternative large-scale semiconductor manufacturing.

Deckers $DECK ( ▲ 2.34% ) shares dived after a lackluster report from the Hoka and UGG shoe maker. The stock was down 8%, after domestic net sales fell 2.8%.

"Though uncertainty remains elevated in the global trade environment, our confidence in our brands has not changed, and the long-term opportunities ahead are significant," Deckers CEO Stefano Caroti said.

Ford $F ( ▲ 4.11% ) shares climbed, the car-making giant set a record with $50B quarterly revenue with its post-market report, but said the Novelis aluminum plant fire was going to hit the F-150 line to a tune of $1.5-$2B.

IN PARTNERSHIP WITH POLYMARKET

Trade the Outcome, Not Just the Stock Price.

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will GOOGL beat EPS?

Will NVDA mention China?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include GOOGL, AMZN, MSFT, and more. Built for how traders actually trade.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Later Loosers, Uncle Sam Is Going Quantum 🧬

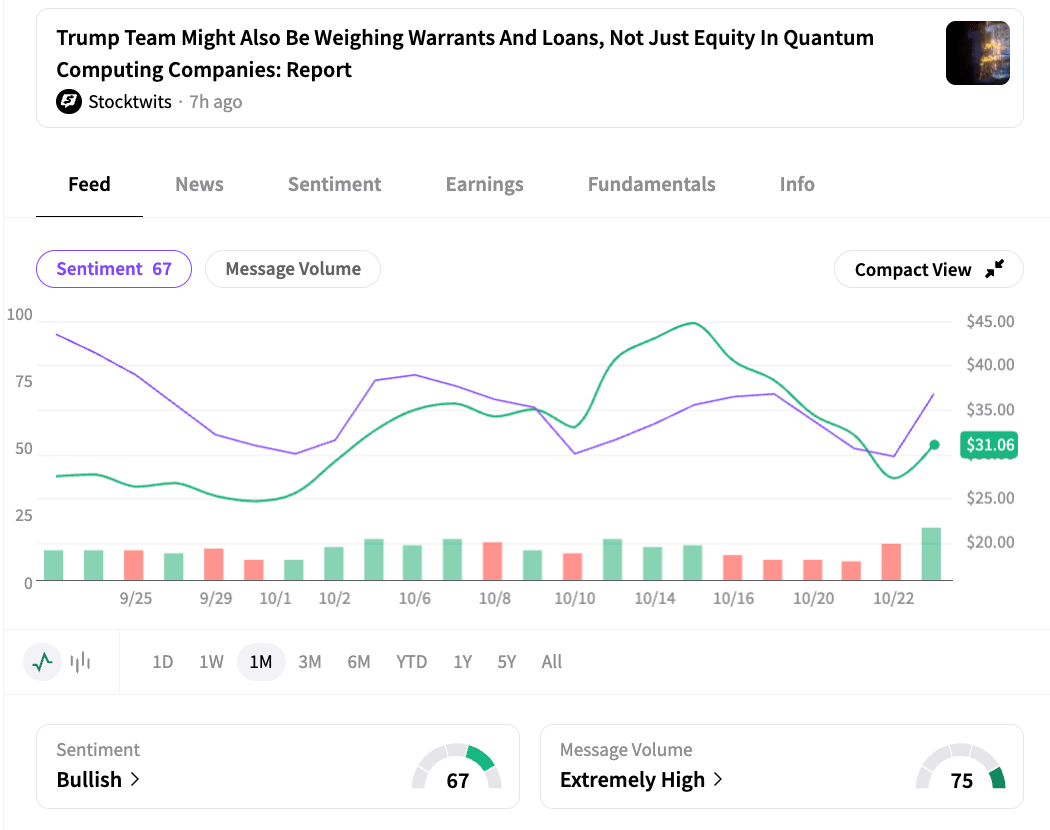

The quantum industry spiked Thursday, after a Wall Street Journal report that Uncle Sam was not stopping at rare earths and semiconductors: Captain America needs to lead with quantum-enabled chips.

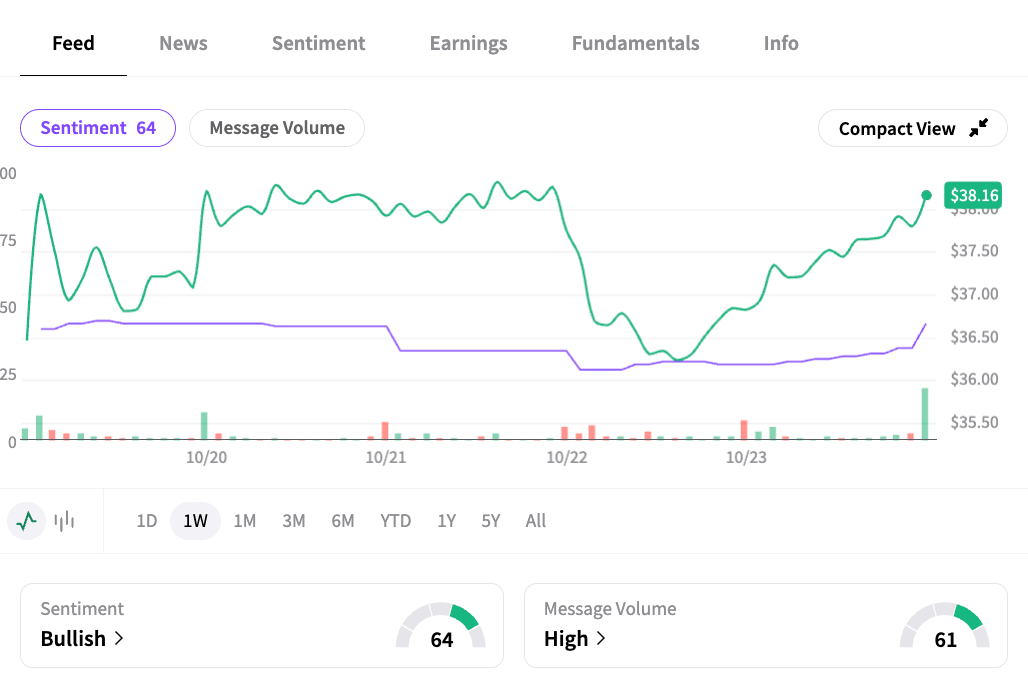

Companies like IonQ $IONQ ( ▲ 2.73% ) Rigetti Computing $RGTI ( ▲ 2.87% ) and D-Wave $QBTS ( ▲ 3.38% ) were climbing, specifically mentioned in the article discussing deals with the government for stake purchases, in exchange for federal funding:

“Deputy Commerce Secretary Paul Dabbar, a former quantum-computing executive and Energy Department official, is leading the funding discussions with companies in the industry,” per WSJ.

The report said companies are looking at funding awards for a minimum of $10M, which sounds small: a minimum investment like that would be a hundredth of the size of State Street Global Advisors’ ~$1B stake in D-Wave.

The news follows an insane rash of retail attention on quantum stocks. Google said Wednesday its Willow chip, the science fiction-like device that started the quantum craze a year ago, can run 13,000X faster than supercomputers.

The White House denied the stake speculation:

“The Commerce Department is not currently negotiating equity stakes with quantum computing companies,” the spokesperson said in a statement.

POPS & DROPS

Top Stocktwits News Stories 🗞

West Pharmaceutical raised full-year guidance on strong GLP-1 component demand.

Microsoft unveiled new Copilot features including voice mode.

Tesla, IonQ, Molina led top moves as earnings and guidance drove sharp swings.

Integer Holdings fell 32% after cutting 2025 revenue and EPS guidance.

OpenAI acquired Mac-focused UI startup to boost ChatGPT desktop tools.

Mortgage rates fell to 6.19%, boosting home sales.

Viking Therapeutics rose 8% after Morgan Stanley set bullish price target.

Super Micro fell 8% after slashing Q1 revenue outlook.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Stocktoberfest Recap!! 🍻

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: CPI (8:30 AM), Hourly Earnings YoY (8:30 AM), Import Price Index (8:30 AM), Housing Starts (8:30 AM), Unemployment Rate (8:30 AM), Industrial Production YoY (9:15 AM), Atlanta Fed GDPNow (1:00 PM), TIC Net Long-Term Transactions (4:00 PM) 📊

Pre-Market Earnings: American Express ($AXP), SLB ($SLB), Ally Financial ($ALLY), Regions Finl ($RF), Huntington Bancshares ($HBAN), and Truist Finl ($TFC).🛏️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍