NEWS

Rate Cuts Ramp Stocks Globally

Source: Tenor.com

U.S. stocks soared to new all-time highs in a broad-based global rally. Investors and traders have seemingly adopted an optimistic view of the Fed kicking off its easing cycle with a 50 bps bang. Defensive stocks lagged on the day, with tech and other cyclical sectors shining. 👀

Today's issue covers FedEx’s latest earnings delivery, global economic news you can use, and major partnership announcements from PayPal and Amazon, Darden Restaurants and Uber, and others. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with technology (+2.95%) leading and utilities (-0.61%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,714 | +1.70% |

Nasdaq | 18,014 | +2.51% |

Russell 2000 | 2,250 | +2.00% |

Dow Jones | 42,025 | +1.26% |

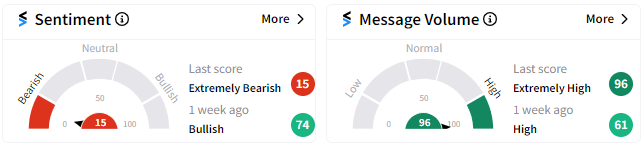

Most bullish/bearish symbols on Stocktwits at the close: 📈 $RZLV, $ZEO, $GSK, $PYPL, $QURE 📉 $KSPI, $SKX, $PGNY, $ARQT, $CIFR*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

FedEx’s Latest Earnings Delivery 📦

FedEx delivered its first-quarter earnings for FY 2025, but the package came with a few dents. Earnings per share (EPS) fell, and the company downgraded its forecast for the year. Here’s the breakdown of what landed. 🚛

EPS:

$3.21 (GAAP), $3.60 (adjusted)

Down from $4.23 (GAAP), $4.55 (adjusted) last year

Revenue:

$21.6 billion (flat from $21.7 billion in FY 2024)

Operating Income:

$1.08 billion (GAAP), $1.21 billion (adjusted)

Down from $1.49 billion (GAAP), $1.59 billion (adjusted)

Operating Margin:

5.0% (GAAP), 5.6% (adjusted)

Down from 6.8% (GAAP), 7.3% (adjusted)

Net Income:

$0.79 billion (GAAP), $0.89 billion (adjusted)

Down from $1.08 billion (GAAP), $1.16 billion (adjusted)

FedEx’s First-Class Struggles

This quarter’s delivery was weighed down by a shift in customer demand, with less priority mail and more deferred services. Throw in higher operating costs and one fewer day of operations, and it’s clear why these results weren’t exactly overnight success material. ⚓

FedEx’s DRIVE cost-cutting initiative helped cushion the blow, but the heavy lifting still lies ahead.

FedEx did manage to complete a $1 billion share buyback during the quarter, giving EPS a slight boost. They’re planning for another $1.5 billion repurchase later in fiscal 2025. 💵

Outlook: Slower Delivery Ahead

FedEx revised its full-year outlook, which is now a bit more like ground shipping than express:

Earnings per share (adjusted):

$17.90 to $18.90, down from $18.25 to $20.25

Excluding optimization costs, EPS is expected to be $20.00 to $21.00, down from $20.00 to $22.00

Revenue growth:

Low single digits, downgraded from low-to-mid single digits

FedEx is trying to re-route itself with its cost-cutting efforts, but for now, it’s clear that the journey ahead might take longer than expected. 🦥

SPONSORED

Interested in AI investments? Don’t Skip this

Significant capital raises in AI, driven by robust private sector interest, position this little-known NASDAQ small cap company to be at the center of a major investment opportunity. Rezolve AI Ltd (NASDAQ: RZLV) has recognized a big problem in the e-commerce industry and is delivering a cutting-edge AI solution for it.

This Gen AI-powered sales engine has the potential to tremendously improve search, advice, and revenue generation for digital retail merchants! Its platform transforms a merchant’s online store, their call-centers, their social media interactions and even in-store kiosks into personal, conversational, and efficient online shopping experiences. This is expected to increase orders and reduce costs.

The company’s clear monetization strategy and attractive financial model could make it a stand-out prospect for investors. With several partnerships already secured and even an agreement with the Kingdom of Saudi Arabia, this organization is aiming to establish itself as a key player in the global AI arena.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMY

Thursday’s Economic Data Dump 📋

It was a busy day of economic news, but let's start with several other central banks ' decisions while we’re riding high on the Fed’s interest rate cuts. ✂

The Bank of England (BoE) followed up its August 25 bp cut with a pause, keeping its benchmark rate at 5%, and signaled to markets that it’s taking a ‘gradual approach’ to this cutting cycle. It was a more decisive and hawkish vote than the market anticipated, with 8-1 voting in favor of the hold.

Although headline inflation remains near the BoE’s 2% target, services inflation (which accounts for 80% of the U.K. economy) reaccelerated in August to 5.60%. Meanwhile, economic growth remains just above the flatline, causing the bank to walk a difficult line of keeping rates high enough to slow inflation but low enough to support the economy. 😐

Turkey’s central bank maintained its benchmark interest rate of 50% for the sixth month. It had previously hiked rates dramatically from May 2023 through March 2024 to fight off the rapid inflation caused partly by its previous low-rates policy.

Notably, the bank’s statement said it remains “highly attentive to inflation risks” but removed a reference to potential tightening, signaling to the market that further hikes beyond 50% are unlikely.

Annual inflation fell below 52% in August from its 75% peak in May, with the government expecting a fall to 42% by year-end. If that target is met, the central bank may begin easing rates, but it will likely take a cautious approach to avoid stoking inflation’s wrath again. 🔻

South Africa also joined the rate cut club, reducing rates by 25 bp to 8% and taking a measured tone in its outlook. It says that although inflation had fallen faster than anticipated, risks to the outlook remain. For the last three years, annual inflation has been at the top of the central bank’s target band but is now showing progress, making the case for some easing. 🤏

Moving to the U.S., initial jobless claims pushed to a four-month low as the labor market continues to show resilience. Meanwhile, the Philadelphia Fed’s factory gauge popped back into growth territory during September after seven months in the contraction zone. 🏭

Lastly, existing home sales fell 4.20% YoY and 2.50% MoM in August, more than anticipated, as high prices and low inventories offset falling interest rates. The median price of an existing home sold rose 3.1% YoY to a new record of $416,700. 🏘

COMPANY NEWS

PayPal Partners With Amazon Amid Turnaround Push 🤝

Investors clowned a bit on payments giant PayPal yesterday for its logo and branding refresh, which took a 'modern and simplistic’ approach that we’ve seen many U.S. brands embrace in recent years. 😆

However, the stock has popped to its highest level since April 2023 as more investors begin to ‘buy-in' to the company’s turnaround story. Adding to the momentum was news that Amazon has added PayPal as a payment option to ‘Buy with Prime,’ an area of Amazon’s business that is growing rapidly.

Bears say this is a niche business offering that won’t move the needle for PayPal, but bulls say this integration is evidence that the new management team is focused on the right things and building clear momentum in the marketplace for the PayPal brand. ⚔

The Stocktwits Community is siding with the bulls on this one, as sentiment pushes into ‘extremely bullish’ territory from the ‘neutral’ zone it’s been stuck in for much of the last month.

Source: Stocktwits.com

Meanwhile, Darden Restaurants is also jumping after sharing its own partnership news. The restaurant chain owner announced a delivery agreement with Uber to kick off a pilot program at some Olive Garden locations in late 2024 before rolling out to all U.S. 900 locations by May 2025. 🥡

Details of the deal were not shared, but investors view this as an attractive new sales channel for a company that’s struggled to generate sustained top-line growth over the last year.

The news overshadowed a first-quarter sales and profit miss driven by a QoQ decline in customer traffic, particularly at its fine dining chains, which fell 6% YoY. For context, that’s more than double Olive Garden’s 2.9% same-store sales decline. 😬

With guests asking for a delivery option, management hopes this new partnership can help boost sales until the macro environment improves enough to support in-store traffic growth.

Despite today’s price pop, the Stocktwits community remains skeptical it will move the needle, with sentiment currently in ‘extremely bearish territory.’ 😒

Source: Stocktwits.com

Lastly, it’s worth noting that Mobileye Global continued its rebound from all-time lows, rising another 15% today after Intel confirmed it had no plans to divest its majority stake in the company. 🙅

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Japan Interest Rate Decision (12:00 am ET), ECB President Lagarde Speech (11:00 am ET), and Fed Harker Speech (2:00 pm ET). 📊

Pre-Market Earnings: VinFast Auto ($VFS). 🛏️

After-Hour Earnings: None — enjoy your weekend! 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋