Presented by

CLOSING BELL

Record Day After Fed

The market fell and clawed its way back Thursday, the S&P 500 starting out just below fresh highs, and depending on who you ask, it hit a close at a fresh record over the 6,900 mark following Wednesday’s rate cut that everyone saw coming.

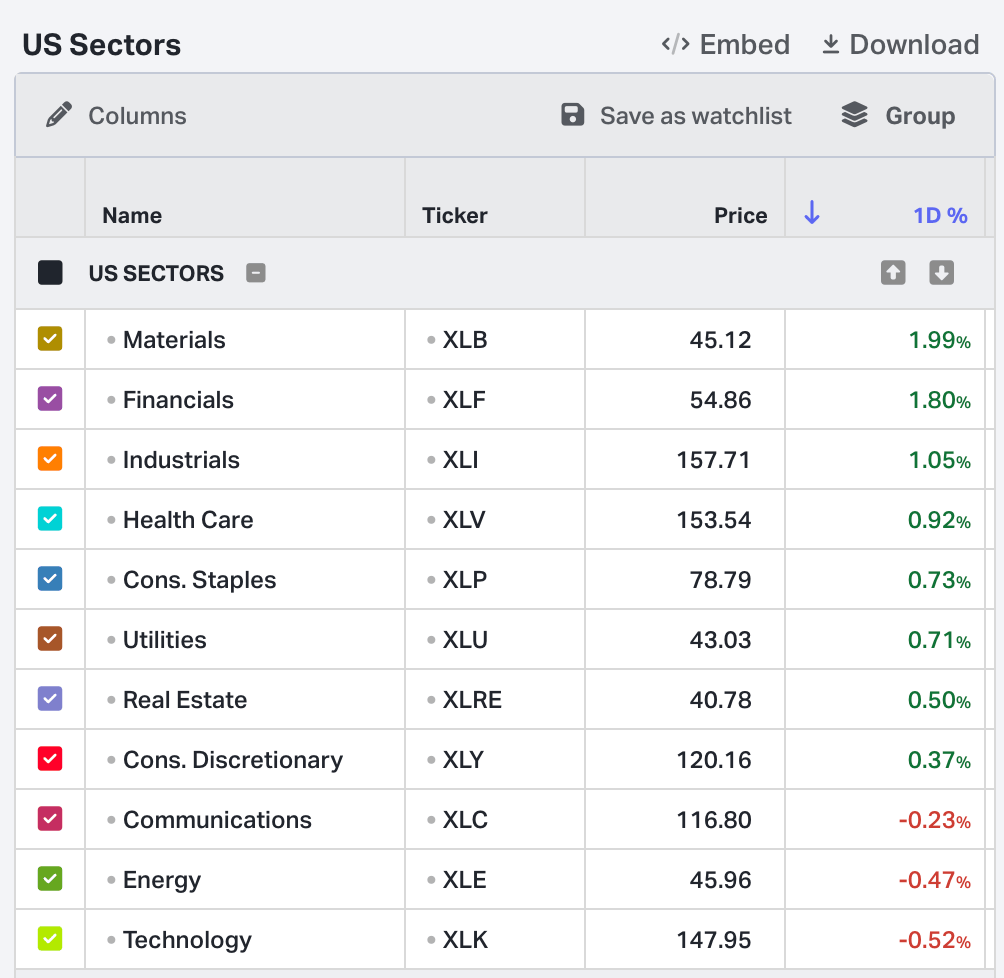

The Dow and Russell also hit record highs, boosted by Financials and Materials stocks, but they left behind big tech.

The tech news pulling the sector in the red was a story of exhaustion. Oracle was the most recent victim, reporting Thursday results near and above estimates, only to fall. The software giant showed 34% growth in cloud revenue to like $8B, but to fufill its $500B order book, it needs to build 30 data centers, FAST. It’s taking on loads of debt, and its earnings reaction yanked tech lower Thursday as traders asked themselves, do we really believe them?

After the bell, Thursday shares of Broadcom were climbing, at first glance bringing tech some joy, though with its post-market report.

And don’t you worry, it’s still the 12 days of Silver and the precious metal is flying higher like it's 1979. 📰

AFTER THE BELL

Retail Beats While AI Flounders 🐟

Coming off the third Fed rate cut, and going into the heavy Christmas retail buying season, everyone is waiting to watch how the American buyer is holding up. The tone is tense, especially because AI darling stocks are getting hit with heavy ‘who cares’ eye rolls this earnings season.

Broadcom $AVGO ( ▼ 1.47% ) 🤖 did its best to break through the lame-o response the market gave to Oracle, shattering reported revenue of $18 billion and adjusted EPS of $1.95 per share. The massive beat was driven by a 74% year-over-year surge in AI semiconductor revenue. Free cash flow grew to 41% of revenue at $7.4.

The company issued strong guidance, forecasting that its AI semiconductor revenue will double year over year in Q1 to $8.2B. But an hour after it issued this report, the stock started to pull back. Investors are still worried about delivering on their massive AI build-out plans.

Costco Wholesale $COST ( ▲ 1.26% ) 🛒 : beat profit expectations, but the stock reaction in the post-market was slow. The buy-in bulk store reported adjusted earnings of $4.50 per share against the consensus of $4.27 per share. Total net sales came in at $65.98 billion, which was slightly below the $67 billion forecast, and digital sales jumped 20.5%.

The company confirmed an increase in its membership fees contributed to a strong rise in membership fee income. It’s easy to make more money when you charge more, but comparable sales climbed little more than expected, 6.4% vs. 6%.

Lululemon Athletica $LULU ( ▲ 0.78% ) 🧘: beat on both the top and bottom lines, reporting adjusted earnings of $2.59 per share. Revenue rose 7% to $2.6 billion, topping the $2.4 billion forecast. The yoga pants maker faced pressure from founder Chip Wilson to change its board and restore its winning attitude.

The company issued softer-than-expected guidance for the holiday quarter, but was flying 11%. Why? They announced that its long-time CEO Calvin Mcdonald will step down in January 2026. He did a great job tripling revenue since 2018, but since then faced roadblocks. The firm is also buying back $1B more in stock.

Restoration Hardware RH 🛋️ $RH ( ▲ 0.54% ): The luxury home furnishings retailer RH reported a mixed quarter, but was up big time in the post-market, with adjusted earnings per share of $2.30, which comfortably beat. However, revenue of $875 million came in slightly below the $883 million forecast.

RH gave cautious guidance for the full year, Chief Gary Friedman said furniture is facing a weak housing market and high interest rates that pressure big-ticket, luxury home purchases. Still, Management maintained its full-year free cash flow guidance of $250 million to $300 million.

SPONSORED

The Same Signal That Came Before Netflix’s 59,000% Run

Something big just happened here at The Motley Fool. You see, market beating stock ideas aren’t new to our co-founder Tom Gardner. Tom Gardner’s investing service, Stock Advisor, has been recommending stocks since 2002. And the average return of a recommendation from Stock Advisor is 1,002%.

But every so often, Tom and his team issue a rare ‘Double Down’ recommendation: a chance for investors who missed the boat on a great stock to get in again…and a chance for investors who did buy to add to their gains.

After all, previous ‘Double Down’ picks include:

— Netflix, up +57,588% since we doubled down on 12/17/2004

— Nvidia, up +47,246% since we doubled down on 12/18/2009

— Apple, up +5,149% since we doubled down on 6/20/2008

And today, you can access a special report that includes Tom's favorite Double Down stock, plus two more Double Down bonus picks.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

AI NEWS

Big Day For ChatGPT, Guess Code Red Paid Off 🚨

OpenAI has intensified the AI arms race by introducing GPT-5.2, its latest and greatest auto-complete AI engine.

The release directly follows intense competition from Google's Gemini 3 that dropped on Nov. 18, which had prompted CEO Sam Altman to whip his team into shape and initiate "code red." Three variants of GPT-5.2 are now rolling out to paid ChatGPT users, focusing on multi-step professional tasks like building spreadsheets and debugging complex code.

Altman posted a comparison of various LLM benchmark tests that no one has heard of, showing his model was leading by the slimmest of margins. Take that, haters.

It wasn’t the only big news for OpenAI. Walt Disney Co. $DIS ( ▲ 1.57% ) said it is trading $1 billion equity investment in OpenAI, for the rights to 200 characters across the Disney, Marvel, Star Wars IP Mouse-o-Sphere. The giant media company also said it bought options for future equity purchases. Honestly, for the amount of AI slop that OpenAI now has the right to create using Disney’s major selling point as a media company, it looks like an insanely bad deal:

Content Generation: Disney+ subscribers and fans will be able to generate and share social videos featuring over 200 Disney, Marvel, Pixar, and Star Wars characters using the Sora AI video generator. Curated selections of Sora-generated videos will also be available for viewing on Disney+.

Enterprise Adoption: Disney will deploy ChatGPT for its employees internally and utilize OpenAI's APIs to build new products, tools, and experiences, including enhancements for the Disney+ streaming service.

If you can’t compete with Warner Bros’ insane valuation bidding, might as well churn out AI slop videos of Minnie Mouse, I guess? 🐭

IN PARTNERSHIP WITH

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Oracle stock fell following Q2 revenue miss.

Axil Capital stock rocketed 150% due to Walmart angle.

Rezolute fell 90% after latest drug trial results failed.

JP Morgan used public blockchain for the first time issuing debt.

Robinhood fell 8% as November volumes dropped.

SMX stock surged 50% on recycled cotton tracking pilot.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

🚀 TRUE ODDS: Betting on AI, Chiefs Upsets, and the Netflix Trap 💥

Welcome to the inaugural episode of True Odds, the podcast dedicated to the new frontier of the "degenerate economy," where hosts Mike Bolling and Joey Solitro find value where sports, finance, and pop culture violently collide.

In this explosive premiere, we dive deep into the most volatile markets on Polymarket

The Oracle Trap: Traders are warned against the earnings season's biggest danger: Oracle.

NFL Upset Alert: We break down why the 67% favorite Kansas City Chiefs are on upset alert against the Chargers, arguing that Mahomes is struggling and the value is on fading the struggling champs.

CFP Value Plays: While the public hammers Ohio State, we make a compelling case for Georgia's championship defense and look for a massive payout on the Oregon Ducks in the College Football Playoff bracket.

Case Files: The Netflix Merger: The $82.7 Billion Netflix / Warner Bros. merger faces a "hostile environment" due to competing bids and regulatory blocks, leading us to debate why betting "No" on the deal closing by 2026 is the smartest move.

You cannot afford to miss this breakdown of where the True Odds lie: from the gridiron to the heart of the "degenerate economy"!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: U.S. Baker Hughes Oil Rig Count (1:00 PM). 📊

Pre-Market Earnings: Rent the Runway ($RENT).

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍