NEWS

Retail Data Remains A Drag

The U.S. consumer remains employed and ready to spend, adding to the market’s recently-renewed inflation fears. Additionally, Middle East tensions continue to weigh on risk appetite, particularly as individual stocks start to report results. Let’s see what you missed. 👀

Today's issue covers Tesla and Trump Media breakdowns, Salesforce’s slump dragging down software stocks, and more from the day. 📰

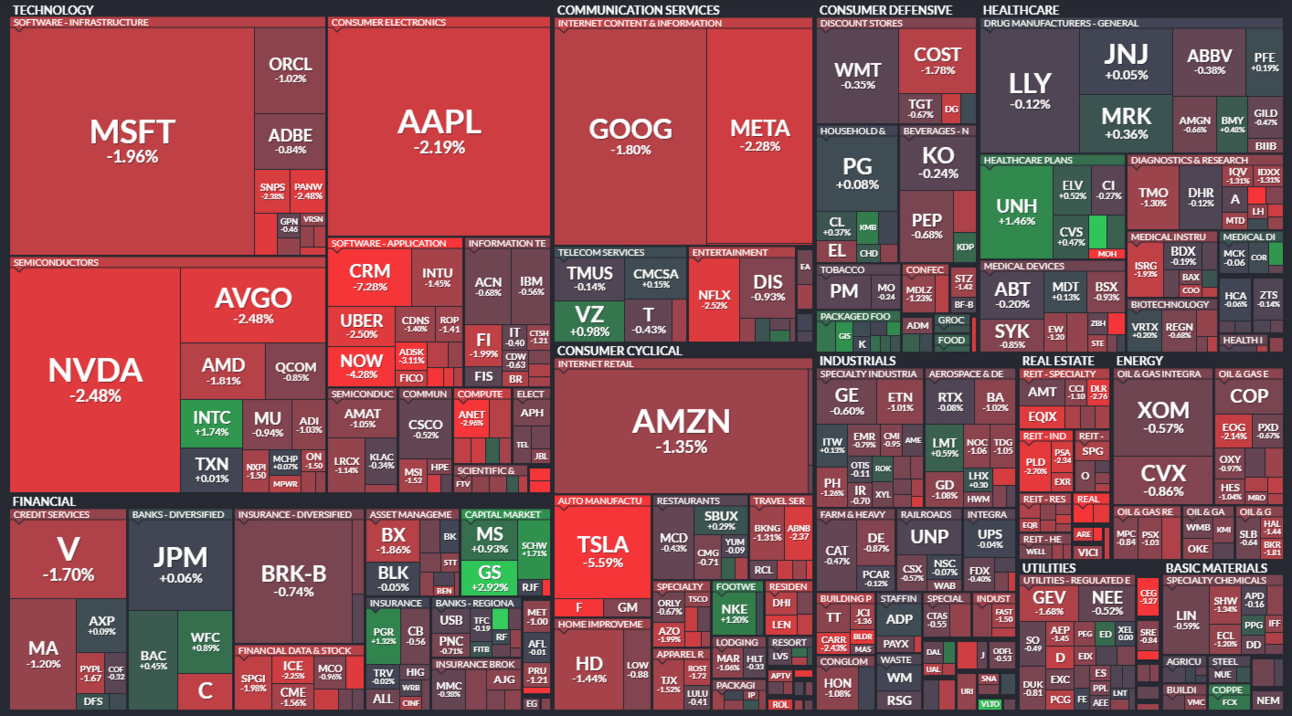

Here's today's heat map:

0 of 11 sectors closed green. Healthcare (-0.20%) led, & technology (-1.90%) lagged. 💔

U.S. retail sales rose more than expected in March, jumping 0.70% and adding to investors’ renewed inflation fears. We know that U.S. consumers will continue to spend if they have money, so as long as the labor market remains tight-ish and wage growth outpaces inflation, this strength will likely continue. 🛍️

New York manufacturing activity rose in April but remained in negative territory, as new orders and shipments declined sharply while unfilled orders shrunk. 🏭

The NAHB Housing Market Index was flat in April as rising mortgage rates pressured builder sentiment. However, the group’s expectation that rates will moderate in the second half of 2024 buoyed sentiment. 🏘️

Base metals experienced a bump after the London Metal Exchange (LME) banned Russian-original metal following the U.K. and U.S.’s new sanctions. Speaking of mining, Piedmont Lithium shared surged 16% after receiving mining permit approval for its Carolina Lithium project. ⚒️

Italian cable maker Prysmian acquired smaller U.S. rival Encore Wire for $4.20 billion, looking to capitalize on the sector’s troubles and expand its presence in the larger and more attractive American Market. 📡

Blackstone shares popped and then dropped on news that it will buy a site in northern England, where it will build Europe’s largest data center ever. 🏗️

Medical Properties Trust popped 19% on news it will sell majority interests in five Utah hospitals to a new joint venture for $886 million. 🏥

And Snap One shares soared 29% on news that home automation company Resideo Technologies will acquire it for $1.40 billion ($10.75 per share). 💰

Other active symbols: $HUBC (+20.18%), $KAVL (+135.96%), $MRNS (-82.71%), $TPET (+22.09%), $AMC (-6.79%), & $CGC (-10.51%). 🔥

Here are the closing prices:

S&P 500 | 5,062 | -1.20% |

Nasdaq | 15,885 | -1.79% |

Russell 2000 | 1,976 | -1.37% |

Dow Jones | 37,735 | -0.65% |

COMPANY NEWS

Salesforce Slump Drags Software Sector Lower

Software giant Salesforce was in the spotlight today, falling sharply on reports that it’s in talks to buy Informatica. 📰

The AI-powered cloud data management company is worth roughly $10 billion and would be Salesforce’s largest acquisition since buying Slack for $28 billion during the height of the pandemic. 💸

Neither company commented on the reports, but the market is shooting first and asking questions later (as usual).

From a technical perspective, Salesforce shares failed to break above their 2021 highs, as did the popular Software ETF $IGV. With $CRM being the second largest holding in the ETF (~9%), it’s no surprise their charts look nearly identical. 🤔

With that said, the pullback from all-time highs has gotten traders’ and investors’ attention. Given this sector helped power the market higher, its relative weakness is notable. Whether or not it’s an omen of further weakness to come remains to be seen. But it’s definitely on people’s radars now. 👀

COMPANY NEWS

Tesla And Trump Tumble To Fresh Lows

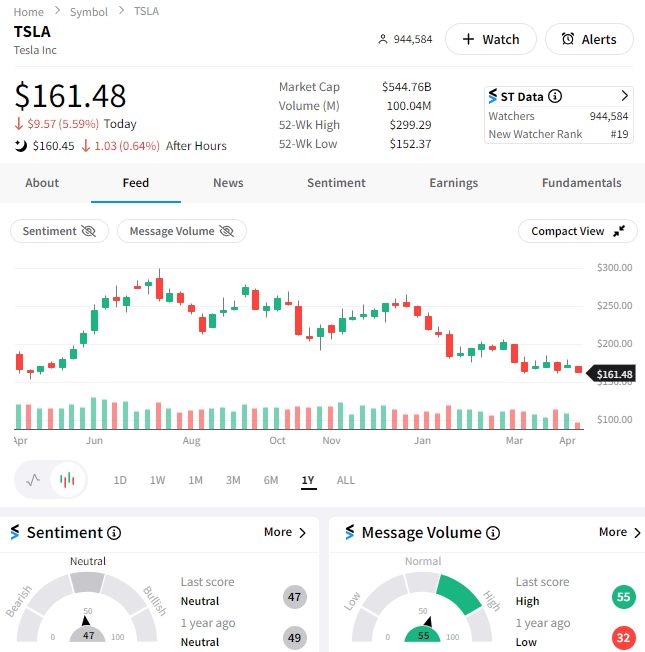

Two of the most highly-followed stocks of the year continue to tumble as their fundamental pictures deteriorate further. 📉

Starting with Tesla, an internal memo obtained by Electrek indicated to employees that 10% of the company’s global workforce is being let go.

It follows the company’s first annual decline in vehicle deliveries since 2020, as slumping electric vehicle (EV) demand and price wars with its competitors weighed on both its top and bottom lines.

Last quarter, Musk made it clear that there’s no easy fix for the company's (and industry's) current headwinds. 😬

Instead, it’s continuing to push towards bringing the cost of its vehicles down enough to profitably reach a mass market customer base while also investing in long-term bets on full self-driving, robotaxis, and more.

Today’s job cuts sent Tesla shares down about 6% to their YTD lows as investors and traders debated the business’s fundamental backdrop. 🪫

Meanwhile, Trump Media and Technology continues to behave as a meme stock, dumping another 18% on news that it’s issuing more shares to allow existing investors to exercise stock warrants. 📝

Since beginning trading on March 26th, the stock has fallen more than 62% because it lacks a fundamental story. It loses tens of millions of dollars per year on just a few million in revenues.

We’ve seen it time and time again. When a business cannot make money from its operations, management (and existing in-the-money shareholders) will take as much money as they can from public markets by issuing equity until they cannot issue it anymore. Retail investors are their exit liquidity. 💸

Until there’s a clear plan for Truth Social to make money, this “meme stock” will continue to trade as a Donald Trump proxy with the known risk that additional share offerings can (and will likely) come as long as the stock price remains elevated by memedom. 🤷

Regardless of their performance going forward, these stocks will remain heavily followed and debated as their cult-like followings battle it out with the naysayers. As usual, the tape will determine who’s right…eventually. ⌛

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

Bullets From The Day

🚫 YouTube’s ad-blocker crackdown extends to third-party apps. The video platform is stepping up its efforts to stop users from avoiding ads when viewing on a mobile device. The company wrote that users accessing videos through a third-party ad-blocking app may encounter buffering issues or see an error message that prevents them from viewing the content entirely. It appears the company also updated its Terms of Service to cut off any apps using its API that would inhibit its ability to properly serve ads. The Verge has more.

👍 Spot crypto ETFs get regulator approval in Hong Kong. With U.S. regulators giving the go-ahead for spot Bitcoin ETFs to be listed, other countries are taking that as an opportunity to update their regulations as well. With that said, analysts are still debating just how impactful this will be for the underlying assets, given that overseas markets are smaller in size. One analyst stated there’s potential for Hong Kong spot Bitcoin ETFs to gather $25 billion in assets, but others have pushed back, saying there are several strong reasons it’s likely to remain stuck in the few hundred million range. More from Axios.

🤖 X unveils its new plan to curb bots on the platform. Elon Musk has tried a number of methods to ensure only real people are using his social media platform, with mixed success. His new plan may be a game-changer, but it will come at the cost of user growth. That’s because he wants to charge a small fee for new X users to enable posting on their account OR allow them to post after a three-month waiting period. As usual, it seems Musk was workshopping this idea in real-time on the platform, so few other details are currently available. TechCrunch has more.

Links That Don’t Suck

💰 Taxes are a drag... but finding top trade ideas shouldn’t be. Get 1 year of MarketDiem for just $20*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍