NEWS

Revisions Don’t Change Bulls’ Decisions

Source: Tenor.com

Scary headlines about job growth revisions were offset by positive earnings results and dovish FOMC Minutes, giving bulls the confidence to keep on buying. Earnings continue to drive individual stock moves as summer trading volumes slump. Let’s see what you missed. 👀

Today's issue covers a recap of the Fed Minutes and jobs revisions, a retailer roundup of Target, TJX, and Macy’s, and why Zoom is booming and Snowflake is melting. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with consumer discretionary (+1.26%) leading and real estate (-0.16%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,621 | +0.42% |

Nasdaq | 17,919 | +0.57% |

Russell 2000 | 2,171 | +1.32% |

Dow Jones | 40,890 | +0.14% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ZUO, $EAST, $PRCT, $GDS, $NEON 📉 $COTY, $AGIO, $WBA, $AIEV, $BA*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Fed Minutes Confirm Cuts Ahead 📝

Given the recent labor market and inflation data, most market participants believe the Fed should have cut rates in July. And July’s FOMC Minutes showed they might not have been far off base. 🤔

“The vast majority” of participants at the July 30-31 meeting “observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.” The question now is whether the Fed will cut 25 or 50 bps.

Several members already believe a July cut would’ve been appropriate, so some analysts believe a 50 bp cut could happen if the data continues to come in soft between now and then. 🔮

Today’s nonfarm payroll growth helped that case, with the Bureau of Labor Statistics saying job growth was nearly 30% below initially reported (818,000 fewer jobs) than the 2.90 million from April 2023 through March 2024.

These revisions imply monthly job gains of 174,000 instead of 242,000, indicating a strong (but not as strong as initially indicated) labor market.

At the sector level, the biggest downward revision came in professional and business services (-358,000). Other areas revised lower included leisure and hospitality (-150,000), manufacturing (-115,000), and trade, transportation, and utilities (-104,000). 📊

With that said, the labor market remains strong given the recent uptick in unemployment rate has been driven by people returning to the workforce rather than a surge in layoffs or other separations.

The Fed had been looking for slow growth, and that’s what it’s got. Eyes are on Jackson Hole tomorrow to see if Jerome Powell tips his hand any further about the upcoming September meeting. 👀

EARNINGS

Zoom Booms While Snowflake Melts 👀

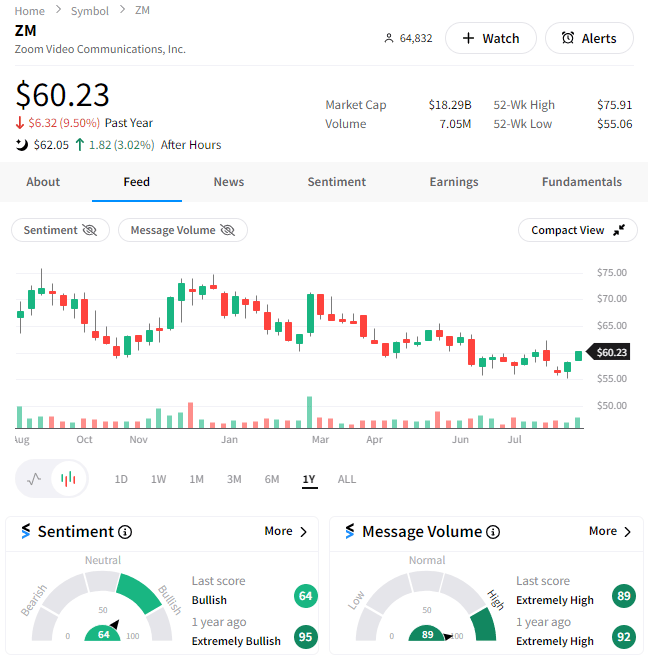

Pandemic darling Zoom has struggled to gain traction, but some compelling earnings data has shares rebounding from all-time lows. 🧑💻

Management said the company “saw strength” in large accounts and “resilience” in its online business, helping it provide guidance ahead of Wall Street expectations. Additionally, its adjusted earnings per share of $1.39 and revenue of $1.16 billion exceeded expectations.

The results were slightly better than anticipated, but investors are happy to see earnings accelerating amid tepid revenue growth. Stocktwits sentiment has pushed back into ‘bullish’ territory as investors and traders look to see if it can maintain any upside momentum. 🐂

Source: Stocktwits.com

Meanwhile, software company Snowflake beat expectations for its latest quarter and raised its guidance, but a potential issue with the company’s outlook gave the bears an edge after hours. ⚠️

The company’s full-year outlook for $3.356 billion in product revenue implies significant deceleration compared to its first-half product growth. This comes despite CEO Sridhar Ramaswamy saying, “The quarter was hallmarked by innovation and product delivery and great traction in the early stages of our new AI products.”

Today’s news did not help shares rebound from all-time lows or convince the Stocktwits community that a turnaround is ahead. Stocktwits sentiment remains in ‘neutral’ territory as investors debate the results. 🐻

Source: Stocktwits.com

STOCKTWITS & 11thESTATE PARTNERSHIP

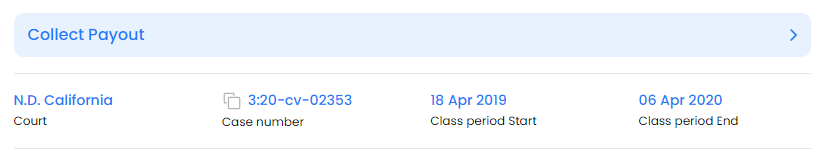

Claim Your Piece Of Zoom’s $150m Payout 💵

Zoom has reached a $150 million settlement with investors to settle a class action lawsuit over privacy concerns.

Back in 2020, Zoom was accused of hiding problems with its software encryption, vulnerability to hackers, and sharing personal information with third parties. Much news has been reported on significant flaws in Zoom's data privacy and security measures. Following this, $ZM significantly fell, and Zoom faced a lawsuit from investors.

Now Zoom decided to pay the affected shareholders to avoid further litigation.

EARNINGS

A Retail Recap: Target, TJX, And Macy’s 🛍️

Several retailers reported today; let’s recap. 👇

Big-box retailer Target topped expectations, reporting earnings per share of $2.57 vs. $2.18 and revenues of $25.45 billion vs. $25.21 billion.

Management now expects comparable sales for the full year to range from flat to up 2%, saying the lower half of that range is most likely. However, it raised full-year profit guidance from $8.60-$9.60 to $9.00-$9.70. 🔺

Digital sales drove most of the positive sales gains, rising 8.70% as more customers used same-day services like curbside pickup and home delivery. Comparable store sales were up just 0.70%.

The company continues to manage in an uncertain and volatile consumer environment, and that’s enough for investors who had low expectations going in. As a result, Stocktwits sentiment pushed to one-year highs in ‘extremely bullish’ territory alongside today’s 11% surge, suggesting the community is looking for further upside. 🤑

Source: Stocktwits.com

Meanwhile, discount retailer TJX Companies rose 6% to new all-time highs as consumers continued to look for deals in the discretionary goods space. 🛒

The company raised its full-year guidance after posting comparable store sales growth of 4%, “entirely driven by an increase in customer transactions.”

U.S. strength drove the results, with Europe’s performance disappointing management. However, the company is still investing in international growth by taking a 35% ownership stake in Dubai-based retailer Brands for Less. 🌍

Stocktwits sentiment remains in ‘extremely bullish’ territory as investors expect consumers’ focus on discounts to continue in an uncertain economy.

Lastly, we should mention department store giant Macy’s, which cut its sales forecast once again. With a buyout off the table, management’s main job is ‘right-sizing’ its business by closing 150 namesake stores and focusing on brands like Bluemercury that are growing well. 🏬

Sales remain the core issue for Macy’s, with CEO Tony Spring saying that customers aren’t spending as freely across all of Macy’s brands. That includes higher-end Bloomingdale’s, which had previously held up better than its low-to-mid-income store.

Shares fell 13% on the day, but Stocktwits sentiment surprisingly sits in ‘extremely bullish’ territory as the community debates the bull case. 🤔

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Chicago Fed Activity Index (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), S&P Global Composite PMI (9:45 am ET), Existing Home Sales (10:00 am ET), and Kansas Fed Composite Index (11:00 am ET).

Pre-Market Earnings: Baidu ($BIDU), EHang Holdings ($EH), Bilibili ($BILI), iQYI ($IQ), Weibo ($WB), Canadian Solar ($CSIQ), Peloton Interactive ($PTON), BJ’s Wholesale Club ($BJ), and Advanced Auto Parts ($AAP). 🛏️

After-Hour Earnings: Cava ($CAVA), Workday ($WDAY), Intuit ($INTU), Bill Holdings (BILL), Ross Stores ($ROST), and Red Robin Gourmet Burger ($RRGB). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🎯 Stop guessing, start predicting. Learn the #1 software to find trades to pinpoint bullish reversals.*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋