NEWS

Risk-Taking Behavior Rages On

Despite the major indexes taking a breather, investors and traders continue to pile on risk below the surface. Sectors like biotech are surging while Bitcoin blasts past $55,000 as money rotates into new opportunities. Let's see what you missed. 👀

Today's issue covers Zoom avoiding doom again, sellers unleashing on Unity, and the biotech sector's fresh breakout. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's today's heat map:

3 of 11 sectors closed green. Energy (+0.35%) led, & utilities (-1.97%) lagged. 💚

New home sales rose 1.5% YoY after three straight months of downward revisions, though still lower than economists forecast. The median sale price of a new home fell YoY for the fifth consecutive month to $420,700. Meanwhile, the Dallas Fed manufacturing index rose in February but remains in contraction territory as business activity remains volatile. 🏘️

Domino's Pizza shares jumped 6% after the restaurant chain raised its dividend by 25% and buyback program by $1 billion. U.S. same-store sales growth and an earnings beat helped offset the company's slight revenue miss. 🍕

Pet food company Freshpet continues its rebound, rising 20% after its revenue and EBIDTA numbers topped analyst expectations. It joins the growing trend of beaten-down stocks recovering as their business fundamentals improve. 🐕

Healthcare payment tech company R1 RCM soared 25% on news that private equity firm New Mountain Capital wants to take it private for $13.75 per share ($5.80 billion). And Altice U.S. soared 36% after Bloomberg indicated that Charter Communications is eying a takeover combining the two struggling telecom companies. 🤝

Electric vehicle stocks caught a bid today after Chinese carmaker Li Auto posted its first annual net profit. However, it did forecast softer sales ahead following a surge in revenue last quarter. ⚡

Other symbols active on the streams: $ROOT (+34.20%), $LUNR (-34.62%), $SOUN (+9.83%), $HIMS (+24.63%), $PANW (+7.33%), $HOLO (+81.54%), $LMND (+11.90%), & $MARA (+21.68%). 🔥

Here are the closing prices:

S&P 500 | 5,070 | -0.38% |

Nasdaq | 15,976 | -0.13% |

Russell 2000 | 2,029 | +0.61% |

Dow Jones | 39,069 | -0.16% |

EARNINGS

Zoom Avoids Doom (Again)

Zoom Video Communications hasn't made headlines for many good reasons lately, scraping the bottom of its range as a public company as investors look for other opportunities. However, the stock is jumping today on better-than-expected results, so let's take a look. 👇

The video chat software vendor's adjusted earnings per share of $1.22 on $1.15 billion in revenues topped expectations of $1.15 and $1.13 billion. Revenue growth remains anemic, rising just 3% YoY, but the company's cost-cutting has helped it drive positive earnings vs. last year's loss.

As for management's plans to drive growth, CEO Eric Yuan said, "We're committed to democratizing AI accessibility, offering it to all our customers regardless of business size, included at no extra charge with a paid license." What that actually means in practice remains unclear, but like other struggling tech companies, Zoom is looking to get in on the AI boom. 📈

The chart below shows that $ZM shares have been finding buyers in the low $60s range during its entire time as a public company. Whether or not that will continue in the long term remains to be seen, but for now, the stock is once again bouncing 10% after hours. 🤷

As for the Stocktwits community, the jury is still out on Zoom. Sentiment is sitting exactly in neutral territory as bulls and bears fiercely debate the company's future.

Got an opinion? Join the conversation and help settle the debate once and for all! 🗫

STOCKTWITS CONTENT

Help Us Reach 1k Subs On YouTube! 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart guy Aaron Jackson every week on "Momentum Monday."

In this week's episode, the group discusses:

Why Nvidia is still a buy despite its massive run 📈

Rivian, electric vehicle stocks, and the ARK Invest disaster 🪫

The Stocktwits community's favorite sectors 🔥

Top stock (and coin) picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

EARNINGS

Sellers Unleash On Unity

Video game software developer Unity probably wishes it could reload its last saved checkpoint after reporting another quarter of lackluster earnings. 👾

Although revenues of $609 million topped expectations of $451 million, management noted revenue would have been $510 million if its deferred revenues were not released. Meanwhile, the company's net loss of $0.66 was narrower than last year's $0.82 but still much higher than analysts' $0.46 per share expectation. 🔺

Management told investors it's in the middle of a "two-phase company reset that we expect will enable Unity to sustainably win with customers and shareholders." The portfolio and cost structure part is mostly completed, so the company is shifting back to driving revenue growth.

With that said, it will take time for its efforts to pay off, with the company forecasting just $415 to $420 million in first-quarter revenues. Analysts had anticipated $534 million in revenue and were also thrown off by the company, saying its non-strategic business portfolio would no longer be a meaningful source of revenue. 👎

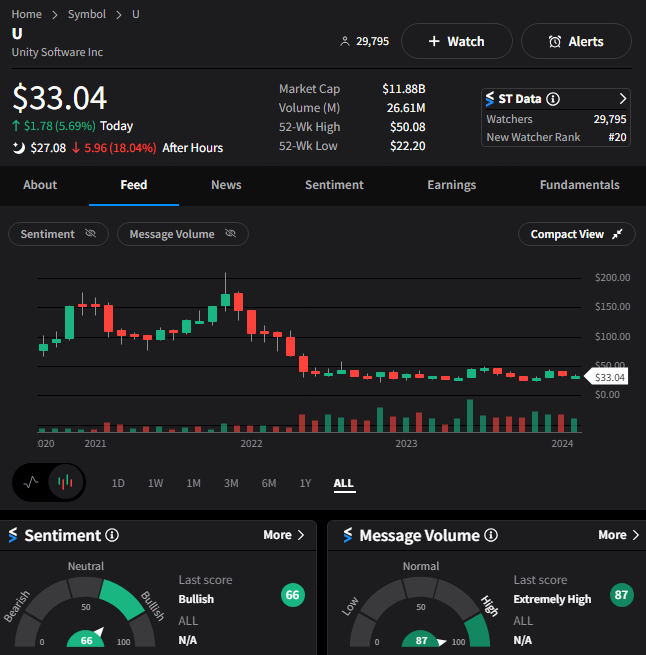

Overall, Unity's projections and tone failed to restore confidence with shareholders. $U shares are currently down 18% after hours, though interestingly, our sentiment data suggests Stocktwits users turned more bullish on the company today. We'll have to wait and see if they're right. 🤷

Stocktwits Spotlight

One of the key themes we continue to discuss is the surge in biotech stocks. Today's example was Krystal Biotech, which soared 40% after reporting better-than-expected results and helping boost the entire sector. But since not everyone wants to play individual stocks in the space, ETFs like $XBI and $IBB continue to top the trending streams. 🧫

On that note, Stocktwits user Ricardo Mattos was quick to point out the breakout occurring in the $XBI ETF to nearly two-year highs. His chart shows the upward move happening in "real-time" and suggests that there's more strength to come in the months and quarters ahead. 📈

If you want to keep an eye on this chart's progress and see more swing trading setups, follow Ricky_makes_moves on Stocktwits! 👀

Bullets From The Day

🤖 OpenAI competitor Mistral AI releases its chat assistant. The Paris-based startup launched its new flagship large language model, Mistral Large, with reasoning capabilities that rival other top competitors like GPT-4 and Claude 2. It's also launching its alternative to ChatGPT with a new service called Le Chat, already available in beta. TechCrunch has more.

🤑 Stock market moguls cash in during record highs. With the stock market at record highs, billionaires like Mark Zuckerberg, Jeff Bezos, and Jamie Dimon are selling more stock than usual. However, analysts say these sales should not be read into too much, given they're well-established companies. With that said, analysts are still looking at executive sales from unprofitable companies as a "red flag" since it may signal management's overall lack of confidence. More from Axios.

🚫 The FTC is suing to block history's largest supermarket merger. The Federal Trade Commission (FTC) is going after the $25 billion deal that would combine Kroger and Albertsons, alleging it would lead to higher prices, store closures, and job losses. The merger announced in 2022 attempted to combine the fifth and tenth largest retailers in the country at a time when inflation has driven grocery prices into the forefront of the conversation. CNN Business has more.

📝 KKR confirms a deal to acquire VMware's end-user computing biz. Merger and acquisition activity has picked up this year, continuing today as private equity firm KKR announced its latest deal. It's paying $4 billion to acquire VMware Workspace One and VMware Horizon from Broadcom. It plans to implement an employee ownership program, allowing employees to own equity in the new company alongside it. More from TechCrunch.

👨💼 Citigroup snags JPMorgan banker as its executive reshuffle continues. The global bank has appointed Viswas Raghavan from JPMorgan Chase as its new head of banking, causing shockwaves given he was just promoted to head of global investment banking. He's expected to join Citigroup this summer, with JPMorgan pivoting by naming Doug Petno and Filippo Gori as co-heads of global banking. With Citi going through its largest reorganization in decades, it hopes this hire can help get it back on the right track. CNBC has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.