NEWS

Russell 2000’s Breakout Buyers Get Hustled

Big tech stocks had a mixed session today, but under the surface, sellers targeted names down the market cap scale as interest rates jumped. Let’s see what else you missed. 👀

Today's issue covers a potential “rug pull” in small-cap stocks, Adobe’s soft sales forecast, and a long-term perspective on Tesla shares. 📰

Here's today's heat map:

2 of 11 sectors closed green. Energy (+1.03%) led, & real estate (-1.41%) lagged. 💚

The headline producer price index saw its largest move since September 2023, with higher energy and food prices driving a 1.60% YoY increase. Retail sales also rose less than expected, jumping 0.6% in February. 🔺

Despite the U.S. economy slowing so far in the first quarter, the labor market continues to hold up well, with initial jobless claims barely budging WoW. 💼

Sports retailer Dick’s Sporting Goods soared 15% after its holiday-quarter earnings and revenue beat expectations, allowing the company to boost its dividend along with its upbeat forecast. 🏀

Dollar General followed Dollar Tree lower despite providing an upbeat 2024 sales forecast as consumers shop for cheaper groceries. Still, analysts say it’s unclear if Dollar Tree’s solid execution is enough to offset the broader industry headwinds weighing on results. 💵

Cigarette maker Altria raised $2.40 billion by sharing AB InBev Shares, reducing its stake from 10% to about 8% and using the fresh cash for share buybacks to support its slumping share price. 🚬

Lithium America’s stock rose 5% on news that the U.S. Department of Energy is planning to lend the company $2.26 billion to build Nevada’s Thacker Pass lithium project. This move supports efforts to reduce dependence on lithium supplies from China, the world’s largest processor of the key battery input. ⚒️

Cardlytics is the latest beaten-down stock to pop on earnings. The advertising platform popped 37% after its full-year adjusted EBITDA turned positive for the first time since 2019. It also offered strong current-quarter guidance. 💳

Other symbols active on the streams: $RIVN (-8.71%), $RUM (-8.84%), $AFRM (-13.84%), $ULTA (-6.01%), $MDGL (+11.46%), $PGY (-25.53%), $SKLZ (-10.11%), $APM (+56.35%), $PRST (+34.06%), & $FET.X (+11.00%). 🔥

Here are the closing prices:

S&P 500 | 5,150 | -0.29% |

Nasdaq | 16,129 | -0.30% |

Russell 2000 | 2,031 | -1.96% |

Dow Jones | 38,906 | -0.35% |

STOCKS

Small-Caps’ Potential “Rug Pull”

Since crypto is taking over the financial world these days, we’ll use some of their lingo as we discuss a potential bearish setup forming in the small-cap Russell 2000. 😜

While large and mega-cap stocks have dominated the headlines and index performance, mid-cap stocks have found their way back to all-time highs over the past few weeks…leaving just the small-cap area of the market to follow suit.

Well, with speculation running rampant and hopes of several rate cuts from The Fed, it looked like the Russell 2000 index was finally going to stage a breakout of its own last week. But the last few days of action are proving that this upward move is facing more resistance than initially anticipated. 🤔

As the chart below shows, the Russell 2000 ETF ($IWM) punched above its December highs near 205-206 late last week and then stalled out. With prices falling back below that area and also breaking an uptrend line that’s been intact for the last five months, technical analysts are warning that this “failed breakout” could lead to a sharp downward reversal if not fixed soon.

In terms of “fixing” the situation, traders suggest prices would need to quickly reclaim that 205-206 level in the coming day or two. 🔺

As for what’s driving the weakness, a sharp selloff in the health care, technology, financial, and industrial sectors is weighing on the index’s performance. Given the strong weighting toward “cyclical” areas of the market and the smaller size of the companies in the index, higher interest rates tend to hurt these stocks far more than large-cap stocks.

And with a week of hotter-than-anticipated inflation readings, the market is adjusting its rate cut expectations once again, with treasury yields rising sharply over the last few days. 📊

We’ll have to wait and see if this is a temporary pullback or the start of a larger selloff. But if interest rates continue to rise, many expect this small-cap market segment to continue its string of underperformance. 👎

STOCKTWITS CONTENT

New Trends With Friends & Macbook Giveaway 👀

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

In this week's episode, the friends discuss:

Crypto: Meme coins as an established asset class and crypto ETF action hitting records 🤑

Traditional Markets: Precious metals on the move as money rotates into consumer staples and energy 🛡️

Social: The changing social media landscape, creator economy, and taking control of personal data 🤳

Giveaway: Secure your chance to win a Macbook Pro on March 17 by entering here 🚨

EARNINGS

Adobe Shares Go Soft

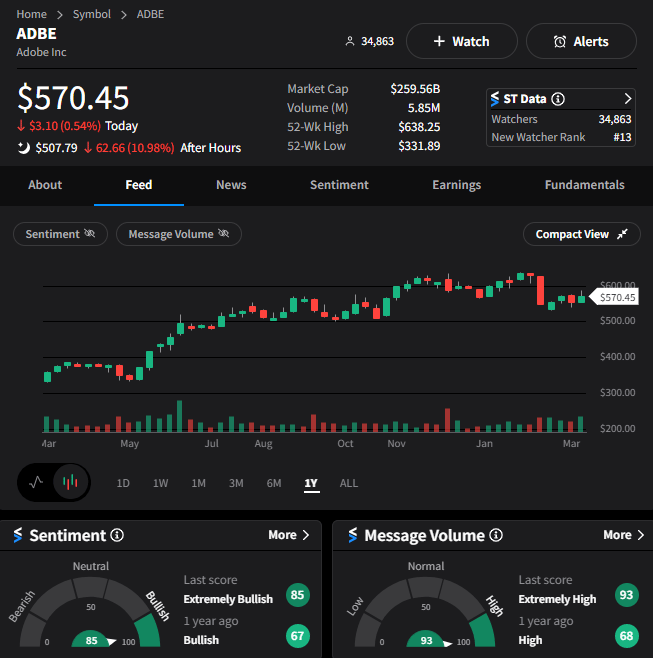

Those hoping software giant Adobe would experience an “AI earnings boost” like many of its peers did were left severely disappointed by today’s results.

Although the company’s adjusted earnings per share of $4.48 and revenues of $5.18 billion topped expectations, its forward guidance left a lot to be desired. 😟

Executives forecasted second-quarter adjusted earnings per share of $4.35 to $4.40 (vs. $4.38 est.) and revenues of $5.25 to $5.30 billion, which fell short of the $5.31 billion anticipated by analysts. 🔻

Additionally, the company’s abandoned $20 billion acquisition of design software startup Figma has investors concerned about what will drive revenue growth going forward.

While Adobe tried to smooth things over with a $25 billion share buyback program, $ADBE shares are falling 11% after hours. 💸

Notably, the Stocktwits community may be looking to buy the dip as sentiment is still in “extremely bullish” territory while investors discuss the results. We’ll see if that resilience continues in the days and weeks ahead. 🐂

STOCKTWITS CONTENT

A Can’t-Miss Market Event 👀

We will be live with the one and only Tom Lee of Fundstrat & Bitwise CEO Hunter Horsley to discuss all things markets & crypto on Tuesday, March 19th at 3PM EST! 🗓️

Beluga Founder Sonny Singh will be joining as well to moderate this marketing-moving conversation. Save your spot by clicking here.

Stocktwits Spotlight

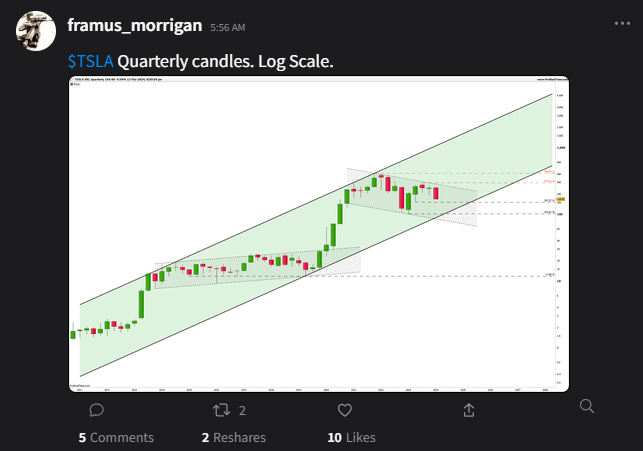

While the market continues to sour on Tesla and other electric vehicle makers, others are viewing this weakness as a potential opportunity to accumulate shares on the dip. However, “buying the dip” is never as easy as it seems in hindsight, so investors and traders are taking many different approaches toward the stock right now. 😬

For example, Stocktwits user Framus Morrigan shared his view of a longer-term trend channel that suggests the $100 area in Tesla could be a solid place for the stock to find support. That would represent another 35-40% downside from current levels and likely cause sentiment to become even more bearish than it currently is. 🎯

We’ll have to wait and see if prices do eventually reach that level. but this is a solid reminder to have a longer-term view of assets you’re interested in, especially when the short-term noise is extremely loud.

For updates on this longer-term view and more analysis like this, follow framus_morrigan on Stocktwits! 👀

Bullets From The Day

🕵️ EU regulators open probe into AliExpress. The European Commission began a formal investigation into the international e-commerce website run by Chinese tech giant Alibaba. The probe is part of the region’s landmark Digital Services Act, which came into effect this month and looks to keep big tech companies from around the globe in check on things ranging from misinformation to anti-competitive practices. CNBC has more.

🤔 Steven Mnuchin is looking to…buy TikTok? The former Treasury Secretary is assembling a team of investors to bid for the social media giant just a day after the House passed a measure to ban the Chinese-owned app from U.S. shores. While the company is likely unprofitable, it’s worth a lot of money and is a “great business,” according to Mnuchin and his backers. More from CNN Business.

🏨 Hilton Hotels makes its first brand acquisition since 1999. The international travel giant is making a big bet on college towns by purchasing Graduate Hotels from Adventurous Journeys Capital Partners for $210 million. The brand operates 400-500 hotels globally, primarily in locations near major colleges and universities in the U.S. and U.K. Reuters has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍