NEWS

Searing Semis

The S&P 500 and the NASDAQ hit new all-time highs again. Traders and investors are getting ready for a whirlwind week: Fed Chair Powell speaks Tuesday and Wednesday, PPI and Michigan Consumer Sentiment on Friday, but Thursday is the day everyone’s watching. Why? Inflation data.

Also, your regular Daily Rip writer Mr. Tom Bruni is out this week. So you’re stuck with me (Jon Morgan), the author of our crypto newsletter The Litepaper. Let’s see what you missed. 👀

Today's issue covers semiconductors spiking and Boeings latest blunder. 📰

Here's today's heat map:

5 of 11 sectors closed green. Technology (+0.72%) led, & communications services (-1.01%) lagged. 💚

AMC’s CEO took to X and posted data about the record holiday weekend. Sentiment on the Stocktwits app flipped to extremely bulllish and AMC is up +8.32%. 🎞

Inflation expectations are a mixed bag. One-year inflation expectations dropped to 3.0% from 3.2%, but three-year inflation ticked up to 2.9% from 2.8%. Meanwhile, expectations for home price increases and other essentials like rent and food also fell. 🏠

Consumer credit is on the rise again, with total borrowing jumping $11.3 billion in May, the biggest gain in three months. Credit card debt surged by a 6.3% annual rate, while auto and student loans saw a more modest increase. 🛒

Container prices aren’t going the direction bulls wanted. ZIM is down -15.15% today and getting closer to its June lows. Shippers in general might be wading water for a while. Ouch. 🤕

The Employment Trends Index dipped to 110.27 from 111.44. The index suggests employment might cool in the second half of 2024, though it remains above pre-pandemic levels. Expect a modest slowdown rather than a crash. 📉

Gold's shine is fading as China skips gold purchases for the second month in a row. This news wiped out potential gains, signaling a rough patch for gold despite global economic uncertainties. 💰

In the crypto space, Ethereum's price steadies as all eyes are on the SEC's potential approval of spot ether ETFs. A decision could come as early as this week or next, possibly shaking up the market. 🚀

Other active symbols: $ZAPP (+18.61%), $INTC (+0.27%), $NKE (-3.15%), $CMG (-5.16%), $SBUX (-1.95%), $BEEM (-18.00%), and $PEP ($-1.38%) 🔥

Here are the closing prices:

S&P 500 | 5,572 | +0.10% |

Nasdaq | 18,403 | +0.28% |

Russell 2000 | 2,038 | +0.59% |

Dow Jones | 39,344 | -0.08% |

NEWS

Semis Surge ⚡

Cooling inflation, insane demand for chips to power AI, a dwindling supply, take your pick for a reason(s) why semiconductors are heating up today. 🌶

Today's market action saw some semiconductor giants making significant gains:

Solid Growth Across the Board

The Semiconductor Industry Association (SIA) reported that global semiconductor sales hit $49.1 billion in May, marking a 19.3% increase from the same month last year. 😱

This is the largest year-to-year growth since April 2022. On a monthly basis, sales jumped 4.1% from April’s $47.2 billion. John Neuffer, SIA president and CEO, highlighted that the global semiconductor market has consistently grown year-to-year, with the Americas leading the charge with a whopping 43.6% year-to-year sales increase.

Revenue Expectations Soar

The resurgence in demand is also reflected in the revenue projections for major players in the semiconductor industry. NVIDIA, for example, is expected to see its revenues spike, driven by the increasing demand for GPUs in AI applications.

Analysts project robust growth for companies like AMD and Broadcom as well, as they continue to innovate and capture market share in the expanding AI market. 🔋

STOCKTWITS & 11thESTATE PARTNERSHIP

Submit Your Alphabet Claim By July 25th!

$GOOG has agreed to a $350 million settlement with shareholders to resolve claims related to the security issues of Google+.

Back in 2018, Alphabet was accused of hiding a major security flaw in its Google+ social network. This exposed users' private data to third parties between 2015 and March 2018. Following this news, $GOOG fell significantly, and Alphabet faced a lawsuit from shareholders.

Now, Alphabet has decided to pay the affected shareholders to avoid further litigation.

NEWS

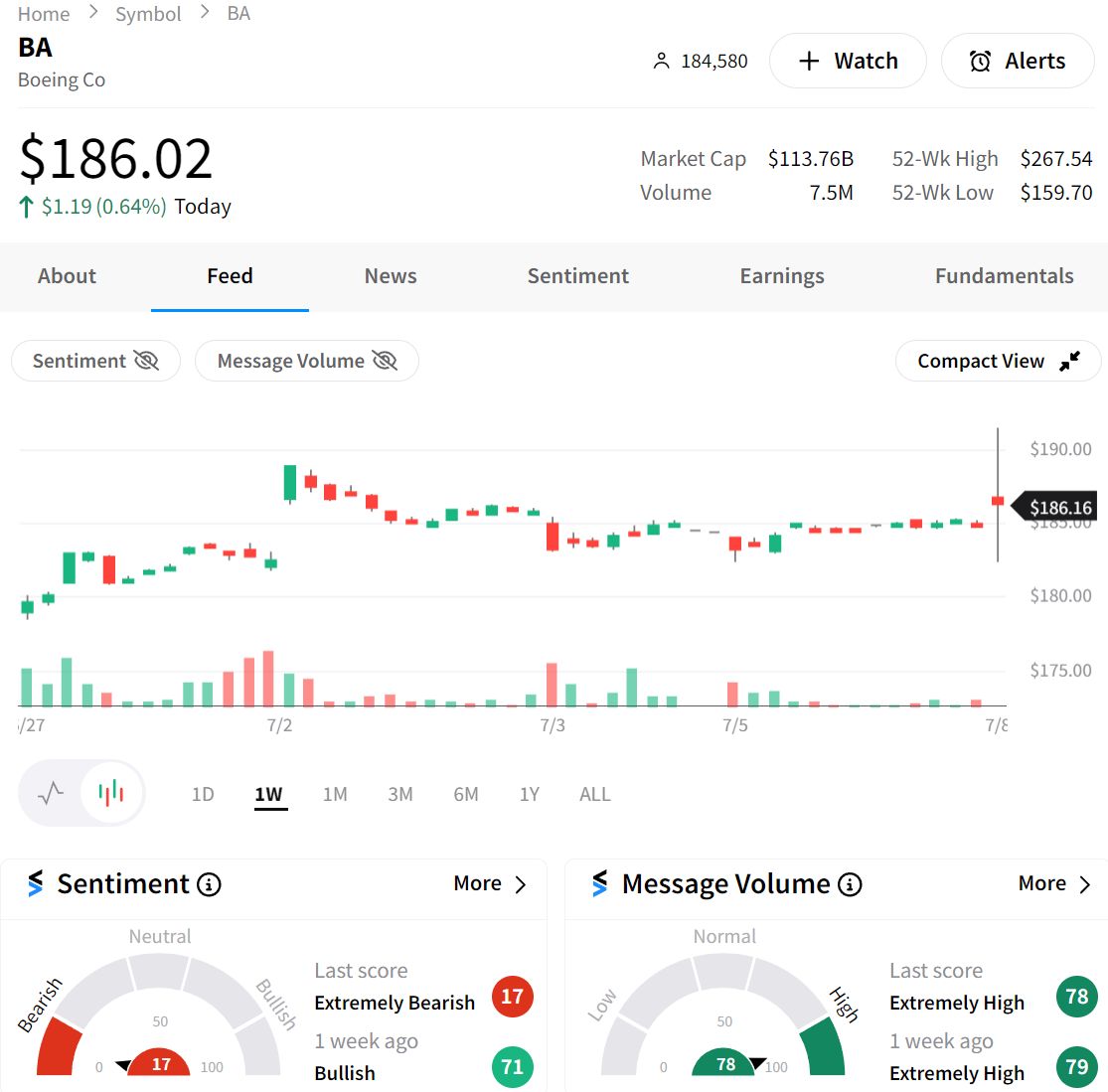

Pull Up, Pull Up, Pull Up ✈

There are dumpster fires and then there are whatever this future Netflix ($NFLX) documentary special that Boeing is going through. 🔥

Boeing ($BA) will plead guilty to a criminal fraud charge linked to the 737 MAX crashes. There was some super-secret deal between the DOJ and Boeing that makes the company pay a fine but they avoid a trial. Oh, and Boeing becomes a felon.

The DOJ also felt that a potential $487 million fine was a little much and axed it in half to $244 million. Why? BA already paid a big fine in a previous agreement in May ($2.5 billion plus another $244 million and $500 million for victim’s family). 🤦

Guess the DOJ has frequent customer discounts now? A judge needs to first approve the deal.

As if that wasn't enough, the FAA decided to pile on. Today, the FAA ordered inspections of 2,600 Boeing 737s over an issue with passenger oxygen masks. Apparently, these masks might not work during an emergency. 🚑

So, in a nutshell, this is what’s going on with Boeing:

Pay a $243.6 million fine: Down from a potential $487.2 million.

Federal judge approval: Required for the plea deal.

Independent compliance monitor: Oversee Boeing for three years.

Invest $455 million: Into compliance and safety programs.

Board meetings with crash victims' families: For public shaming.

FAA inspections: Inspect and fix faulty oxygen masks on 2,600 Boeing 737s.

But this is far from over - attorneys for the victim’s families want the judge to give a big no the deal and, “simply set the matter for a public trial, so that all the facts surrounding the case will be aired in a fair and open forum before a jury.” 👨⚖

IN PARTNERSHIP WITH MONEYSHOW

Join Me At MoneyShow Toronto This September!

My presentation, “How To Use Social Sentiment To Profit In Markets,” will explain how investors and traders use Stocktwits’ unique social data to stay ahead of the market’s top trends. Register now, and I’ll see you there! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

Bullets From The Day

🏦 Investors are flocking to bond funds, raking in nearly $400 billion in the first half of 2024 as global central banks begin to cut interest rates. Actively managed funds are taking the lion's share of these inflows, showing a strong preference among investors. Despite the recent gains, bond indices like the Bloomberg U.S. Treasury 20+ Year bond index are still struggling with significant long-term losses. With the ECB already cutting rates and the Fed potentially following suit, the bond market's fortunes might be turning. More from MarketWatch.

🚗 Tesla's stock celebrated its ninth consecutive day of gains, adding a modest 0.5% on Monday, effectively erasing year-to-date losses. The rally is fueled by better-than-expected quarterly deliveries and a booming energy storage business. Meanwhile, other EV makers like Lucid ($LCID) and Chinese competitors are also reporting impressive delivery numbers. Analysts are eyeing Tesla's upcoming earnings report and robotaxi event, which could further boost the stock's perceived value in the AI and autonomous driving sectors. Yahoo!Finance has more.

🛫 The TSA screened over 3 million passengers in a single day for the first time ever on Sunday, marking a new milestone in post-pandemic travel. This record-breaking figure was expected during the July Fourth holiday weekend, reflecting the surge in travel demand. Despite the increase, travel costs like airline tickets and hotel prices have eased compared to last year. Airlines are anticipating strong summer profits, although they face rising complaints from passengers. From ABC News.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍