Presented by

CLOSING BELL

Sell America? Again?

Happy Tuesday! Tariffs are back and the markets are feeling it as Trump hit NATO Europe with fresh 10% levies and threats over the weekend. The new tariffs will start Feb 1, and get worse if the continent doesn’t pony up and let the U.S. take over Greenland for defense and mineral resources. 🌮

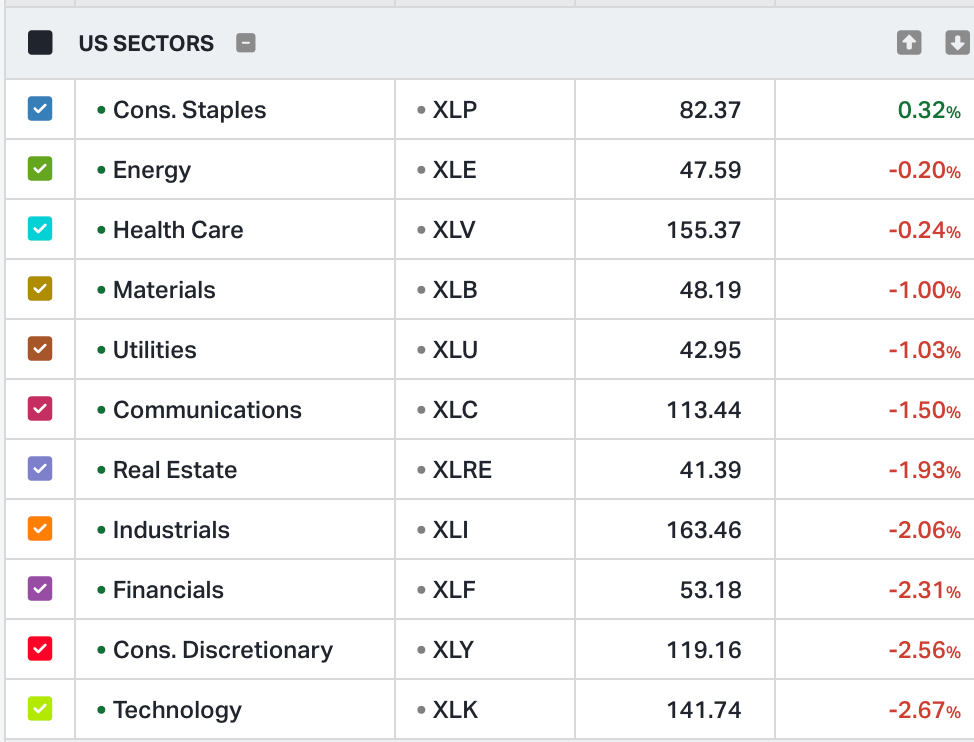

The major indices fell nearly 2% across the board, save the 1% drop in the Russell 2,000.

None of this is great news for record-high stock prices, already looking at inflation, bad hiring numbers, and high mortgage rates for reasons to start selling off.

The U.S. dollar is getting crushed and rates are rising as bonds across the board sell off. T-bills now have higher yields than when the Fed started cutting rates. The Danish pension fund sold $100M in U.S. Treasury’s. Japan’s 40-year bonds plunged, or rose rather to their highest since 2007, on concerns of government funding.

Turmoil is good news for metals though, silver is the absolute standout, soaring and closing in on $100 as investors scramble for safety. Meanwhile, energy is rebounding with crude leading the charge and natural gas prices surging 26% thanks to an Arctic freeze coming to a zip code near you. 🧊

Over in Davos, the World Economic Forum is in full swing. France’s Macron is warning of a world without rules while calling for more Chinese investment into Europe, and Trump posted his texts because Macron won’t join his peace club. Back home, housing is in focus as mortgage rates dipped below 6%, but home sellers are now outnumbering buyers by a record margin, giving buyers the strongest bargaining power since 2012.

AFTER THE BELL

The Streaming and Brokerage Beat

It was a historic day of volatility as the S&P 500 and Nasdaq both closed below their 50-day moving averages for the first time in weeks, marking the largest daily percentage drop since October. Here is the breakdown of the major after-hours earnings and corporate moves.

Netflix $NFLX ( ▲ 2.66% ) Netflix surpassed expectations with a record 325 million paid memberships and Q4 revenue of $12.05 billion. While the company posted a slight EPS beat at $0.56, its Q1 guidance of $0.76 EPS fell short of the $0.81 consensus, causing shares to fluctuate. Management projected 2026 revenue of $50.7B–$51.7B and noted that roughly $60 million in Q4 costs were tied to the bridge loans for the Warner Bros. Discovery acquisition. It saw a lower 1Q operating margin at 32.1%, compared to estimates wanting 34%. 📺

The stock was trending even outside of earnings potential, investors weighing the company's $83 billion acquisition of Warner Bros. Discovery. Netflix, in a click-measuring contest with Paramount Skydance over WBD, recently updated its offer to all cash to hopefully win shareholders approval of the boards favortie choice. Since the October rumor turned into a December decision to actually buy, the stock is down 30%.

Interactive Brokers $IBKR ( ▲ 0.53% ) reported a significant "beat-and-raise" quarter today, January 20, 2026, delivering an adjusted EPS of $0.65, beating the $0.59 analyst consensus. Total net revenue hit $1.64 billion, matching top-line expectations and marking a 15.4% year-over-year increase driven by strong commissions and stable interest income. The stock didn’t gain much ground in the post market.

United Airlines $UAL ( ▲ 5.06% ) fell in regular trade, but looked green at first look after its post market report beat Q4 estimates with an adjusted EPS of $3.10 on $15.4 billion in revenue. The drag came from a conservative Q1 2026 outlook, with the airline projecting an adjusted EPS of $1.00–$1.50, as it continues to navigate the logistical fallout from the late-2025 federal government shutdown. ✈️

SPONSORED BY THE MOTLEY FOOL

5 Stocks We Think Will Explode in 2026

If you could only recommend 5 stocks for 2026… what would they be?” That’s the question we asked our analysts recently. Because right now, the S&P is sitting at all-time highs. UBS says it could hit 7,500 by the end of 2026.

Meanwhile, Bill Gates is sounding the alarm, warning that many investments could be “dead ends." This is exactly the kind of market where Stock Advisor proves its worth. When the noise is loud. The risks are real. And the decisions actually matter. We’ve helped investors navigate crashes, bubbles, and chaos for over 20 years, averaging +958%* per recommendation. And now, after weeks of debate, poring over earnings and digging deep into the data… The analysts at The Motley Fool have locked in their 5 highest-conviction stocks for 2026 and beyond. And we’re giving it away to new members at no cost… along with a special discount.

*$99/year is a promotional price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

Motley Fool Stock Advisor returns are 975% as compared to the S&P 500 returns of 193% as of December 23, 2025. Past performance is not a guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

The Banking and Industrial Breakdown

Today’s morning earnings reports showcase a resilient banking sector and a housing market navigating affordability hurdles, while the industrial giant 3M faces a "sell the news" reaction to its 2026 outlook.

3M $MMM ( ▲ 0.07% ) beat Q4 estimates with an adjusted EPS of $1.83 on $6.0 billion in revenue, driven by margin expansion in its safety and industrial segments. However, shares tumbled over 4% as the company’s 2026 profit guidance of $8.50–$8.70 per share came in slightly below the Wall Street consensus of $8.61. 📉

U.S. Bancorp $USB ( ▼ 1.4% ) reported a 23% jump in quarterly profit, posting an EPS of $1.26 on record revenue of $7.37 billion. The results were fueled by a 3.3% rise in net interest income and strong fee growth, leading management to project a 4%–6% revenue increase for 2026 as it moves forward with its BTIG brokerage acquisition. 🏦

Fifth Third Bancorp $FITB ( ▼ 1.01% ) saw its stock gain nearly 2% after beating expectations with an adjusted EPS of $1.08. The bank achieved record net interest income for the full year and reported a 20% year-over-year rise in GAAP net income, bolstered by a 16% increase in assets under management and a pending merger with Comerica set to close in February. 💰

D.R. Horton $DHI ( ▼ 0.18% ) delivered a fiscal Q1 EPS beat of $2.03 on $6.9 billion in revenue, though both metrics were down year-over-year. Despite the beat, shares dipped in pre-market trading as management warned that affordability constraints and high buyer incentives will continue to pressure home sale margins through the remainder of 2026. 🏠

POPS & DROPS

Top Stocktwits News Stories 🗞

Top Wealth Group rose over 120%, to acquire wine trading group Airentity International for $125M.

Corvus Pharmaceuticals rose after positive clinical trial data.

Micron Technology rose after analysts hiked price targets.

Tesla fell below its 100-day moving average amid slowing demand concerns.

Moderna rose following positive five-year data for its skin cancer vaccine.

ImmunityBio rose after the FDA provided a path for its bladder cancer drug.

Nvidia fell as broad tech weakness and renewed tariff concerns weighed on semiconductor stocks.

INVO Fertility soared 350% on rumors of President Trump pushing for lower fertility treatment costs to boost birth rates.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Want Global Exposure? There’s an ETF for That

Take a sneak peek of our brand new podcast!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IEA Monthly Report (4:00 AM), U.S. President Trump Speaks (8:30 AM), Pending Home Sales + MoM (10:00 AM), Construction Spending MoM (10:00 AM), Atlanta Fed GDPNow (12:00 PM), 20-Year Bond Auction (1:00 PM). 📊

Earnings Previews:

Johnson & Johnson JNJ Analysts expect a 21% earnings jump to $2.50 EPS on $24.14 billion in revenue. Investors are watching for MedTech growth and strong uptake of Tremfya to offset revenue losses from the Stelara patent cliff.

Halliburton HAL Consensus points to a profit decline with $0.54 EPS on $5.4 billion in revenue. The focus is on whether cost-cutting and a shift toward digital oilfield services can sustain margins despite softer international demand.

Charles Schwab SCHW Schwab is projected to post $1.37 EPS on $6.24 billion in revenue, a 35% year-over-year increase. Market eyes are on its 2.80% net interest margin target and the strategic integration of its recent Forge Global acquisition.

Ally Financial ALLY Expectations sit at $1.02 EPS on $2.13 billion in revenue, a 30% profit boost. Investors are tracking auto-loan credit quality and a projected net interest margin expansion to 3.5%.

Wednesday After-Hours:

Richtech Robotics RR The AI-driven robotics firm is forecast to report a loss of $0.03 per share on $1.3 million in revenue. After its recent CES debut, the market wants to see if its ADAM bartender and Dex systems are landing real-world commercial contracts.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋