NEWS

Semis Buck Stocks’ Sluggish Trend

Source: Tenor.com

U.S. stocks sold off today, even as Nvidia and a few other tech giants stayed in the green. Despite the broader selloff, the Stocktwits community continues to find opportunities on the long side as the overall bullish tone remains. 👀

Today's issue covers Micron moving the semi sector, two big names’ new all-time highs, and why there may be trouble brewing in paradise (OpenAI). 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (+0.53%) leading and energy (-1.96%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,722 | -0.19% |

Nasdaq | 18,082 | +0.04% |

Russell 2000 | 2,197 | -1.19% |

Dow Jones | 41,915 | -0.70% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $KMX, $LSPD, $MU, $MDAI, $NNDM 📉 $SFIX, $CNXC, $TMDIF, $LUV, $QURE*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

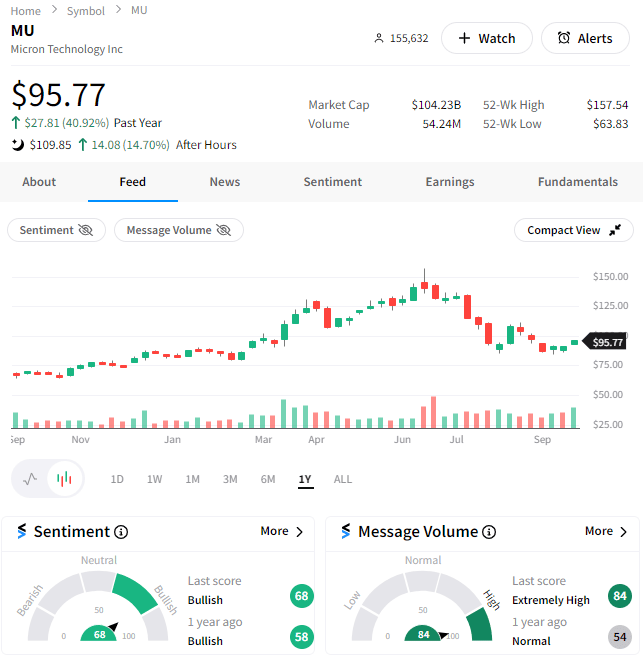

Micron Moves The Semi Sector 🌠

Investors came into today with some semiconductor scaries, hoping that Micron Technology wouldn’t disappoint and drag the group lower. Luckily for them, the company delivered and is adding momentum to the rebound that’s recently started across the semi industry. 👍

Analysts expected the memory-chip maker to deliver $7.65 billion in revenue, which it topped at $7.75 billion (up 14% QoQ and 93% YoY). Adjusted earnings per share of $1.18 also topped the $1.11 consensus estimate and compared to a significant loss this quarter last year.

As for guidance, management expects $8.50 to $8.90 billion in revenue for the first fiscal quarter, above the $8.30 billion Wall Street view. Its adjusted earnings guidance of $1.74 also topped the $1.52 consensus view. 🔮

Overall Micron CEO Sanjay Mehrotra said that artificial intelligence demand “drove a strong ramp of our data-center DRAM products and our industry-leading high-bandwidth memory.” Also, its NAND memory business topped $1 billion in quarterly revenue for the first time.

Investors were happy to hear that Micron is positioned to capitalize on the AI boom more than initially expected. Shares popped 15% after hours, and Stocktwits sentiment in ‘bullish’ territory suggests the community is looking for further upside in Micron and its peers. 🐂

Source: Stocktwits.com

SPONSORED

The Crypto Minis from Grayscale: BTC & ETH.

Considering an investment in crypto but looking to start small?

How about starting with a mini. A Grayscale Crypto Mini.

Grayscale Bitcoin Mini Trust (ticker: BTC)

Grayscale Ethereum Mini Trust (ticker: ETH)

The Trusts are not funds registered under the Investment Company Act of 1940, as amended (“1940 Act”), and are not subject to regulation under the 1940 act, unlike most exchange traded products or ETFs. An investment in the Trusts are subject to a high degree of risk and heightened volatility. Digital assets are not suitable for an investor that cannot afford the loss of the entire investment.

The Grayscale Crypto Minis offer:

Mini fee: BTC and ETH have the lowest fees of all the Bitcoin and Ethereum funds on the market.

Mini share price: BTC and ETH both have very low share prices, allowing investors to get extremely precise with their exposure.

Mini commitment: You don’t need an entire Bitcoin or thousands of dollars' worth of Ethereum to get crypto exposure — investing in BTC or ETH allows you to allocate as much or as little as you want to crypto.

Turns out, a Mini gets you a lot.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Flutter Flies & Lowes Leaps As Participation Broadens 📈

Although the stock market indexes were down today, we can always count on the Stocktwits community to find stocks bucking that trend.

Flutter Entertainment ($FLUT) surged to new all-time highs after raising its U.S. sportsbook market growth outlook through 2027 and saying its global TAM could hit $368 billion in gross gaming revenue by 2030. Additionally, it announced a $5 billion stock buyback plan. 🎰

Lowes Companies ($LOW) surprisingly beat Home Depot to new all-time highs, as rate-cut-related plays continue to catch a bid. As for today’s catalyst, Oppenheimer analyst Brian Nagel upgraded the stock from ‘Perform’ to ‘Outperform’ and raised his price target from $230 to $305. He cited “clearer skies ahead for home improvement” after a long sales slump. ⚒️

As the chart below shows, both stocks made new all-time highs as they attempted to emerge from multi-year bases. Technical analysts love this type of pattern because the risk is very well-defined, and it shows buyers’ willingness to own the stock at a price never paid before…

Source; TradingView.com

Speaking of all-time highs, Meta printed its own record today as investors digested the announcements from its ‘Meta Connect’ event. Zuckerberg provided updates on current products and initiatives while also giving investors a look into the future with its Orion AR glasses. 🤓

COMPANY NEWS

Is Trouble Brewing In Paradise? 🧐

Everyone is clamoring for a piece of the OpenAI pie, with the company nearing the largest VC fundraising round of all time…attempting to raise $6.50 billion at a $150 billion valuation. And it’s still oversubscribed! 😵💫

But while outsiders are trying desperately to get in, insiders continue to flee the company.

The latest executive exit is CTO Mira Murati, who announced today that she’s leaving the company after six-and-a-half years. In her message, she says she is stepping away “because I want to create the time and space to do my own explorations.” 👇

Explanation and optics around her resignation aside, the number of high-profile exits from the company during its controversial growth path is raising eyebrows. 🤨

OpenAI chief scientist and co-founder Illya Sutksever left in May to start a new firm dedicated to safer AI. Fellow OpenAI co-founder John Schuman left in August to join rival Anthropic. And OpenAI president and co-founder Greg Brockman is currently on extended leave.

The more this situation develops, the more it looks like a bet on OpenAI is a bet on Sam Altman and his ability to execute his vision by teaming with people who agree with it. 🤷

Time will tell, but for now, the industry is monitoring OpenAI closely to see how this “brain drain” plays out.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Durable Goods Orders (8:30 am ET), GDP Growth Rate Final Q2 (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), Fed Chair Powell Speech (9:20 am ET), Fed Barr Speech (10:30 am ET), Fed Kashkari Speech (1:00 pm ET), and Mexico Interest Rate Decision. 📊

Pre-Market Earnings: CarMax ($KMX), Accenture ($ACN), Ree Automotive ($REE), Moving iMage Technologies ($MITQ), and Jabil ($JBL). 🛏️

After-Hour Earnings: Costco Wholesale ($COST), BlackBerry ($BB), Aytu BioPharma ($AYTU), Vail Resorts ($MTN), and Scholastic ($SCHL). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: *BTC: Low cost based on gross expense ratio at 0.15%. Brokerage fees and other expenses may still apply. ETH: Low cost based on gross expense ratio at 0% for the first 6 months of trading for the first $2.0 billion. After the fund reaches $2.0 billion in assets or after 6-month waiver period, the fee will be 0.15%. Brokerage fees and other expenses may still apply. See prospectus for additional fee waiver information.

Please read the ETH and BTC prospectuses carefully before investing in the Trusts. Foreside Fund Services, LLC is the Marketing Agent for the Trusts. The Trusts holds Bitcoin or Ethereum; however, an investment in the Trusts is not a direct investment in Bitcoin or Ethereum. There is no guarantee that a market for the shares will be available which will adversely impact the liquidity of the Trusts.

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋