NEWS

Semis Suck The Air Out Of The Market

ASML’s earnings were the focus today, dragging the semiconductor space and broader technology sector lower with it. Bonds caught a bid, but that wasn’t enough of a tailwind to offset overall weakness. Let’s see what you missed. 👀

Today's issue covers semis sending tech into a tailspin, United Airlines soaring while Vinfast Auto plummets, and the energy chart on technical analysts’ radars. 📰

Here's today's heat map:

4 of 11 sectors closed green. Utilities (+2.07%) led, & technology (-1.46%) lagged. 💚

The German central bank chief said that a European Central Bank (ECB) rate cut in June looks increasingly likely as long as disinflation continues its trend. 🏦

Property-casualty insurer stock Travelers sunk more than 7% after posting its third quarterly miss out of four, despite raising its quarterly dividend to $1.05 per share. The combined ratio, which measures profitability, fell from 95.40% to 93.90% but still topped the consensus estimate by 70 bps. 🔻

Medical device maker ResMed slumped 6% on news that Eli Lilly’s Zepbound weight loss drug also showed promise in treating patients with obstructive sleep apnea. Lilly shares popped initially but closed essentially flat. 💊

JB Hunt Transport Services fell 8% after its quarterly profits and revenues significantly missed Wall Street’s expectations. 🚚

Software company Autodesk fell 6% after announcing it would delay its annual 10-K filing due to an ongoing internal investigation of its accounting practices. 🗓️

Other active symbols: $PLCE (+16.46%), $TSLA (-1.06%), $DJT (+15.59%), $WISA (+51.64%), $IZM (-88.26%), & $JAGX (-7.51%). 🔥

Here are the closing prices:

S&P 500 | 5,022 | -0.58% |

Nasdaq | 15,683 | -1.15% |

Russell 2000 | 1,948 | -0.99% |

Dow Jones | 37,753 | -0.12% |

EARNINGS

ASML Sinks The Semi Space

Semiconductors were supposed to be be the catalyst for the market's move higher, but instead, they led it lower. So what changed in the last 24 hours that’s got investors and traders changing their tune? 🤔

ASML Holding’s lackluster first-quarter results.

The critical supplier to semiconductor companies said its net sales fell 21.60% YoY and missed expectations, while net profit fell 37.40% and beat estimates. 🔻

Net bookings for the company’s machinery were down 4% YoY to 3.60 billion euros, falling by more than 60% compared to last quarter.

ASML's machines are required to manufacture the most advanced semiconductors globally, so a slowdown at ASML stoked fears that the broader space is setting up for a weak set of earnings. 😨

Weak demand for consumer electronics like smartphones and laptops caused a significant portion of the slowdown. But with companies like Samsung, Broadcom, and Dell all signaling a rebound in demand, hopes are that ASML and other suppliers will catch up shortly after. 📊

Executives previously said net sales for 2024 would be similar to 2023, reiterating that projection today. The continued economic uncertainty and product transitions expected in 2025 are causing its clients’ customers to hold off on spending. ⚠️

ASML CEO Peter Wennink highlighted this view, saying, “We see 2024 as a transition year with continued investments in both capacity ramp and technology, to be ready for the turn in the cycle.”

Overall, there’s little question over the company’s long-term prospects given the expected growth in global chip demand. What’s really driving the stock price is a disconnect between short-term expectations and the recent run-up the stock and overall sector have experienced.

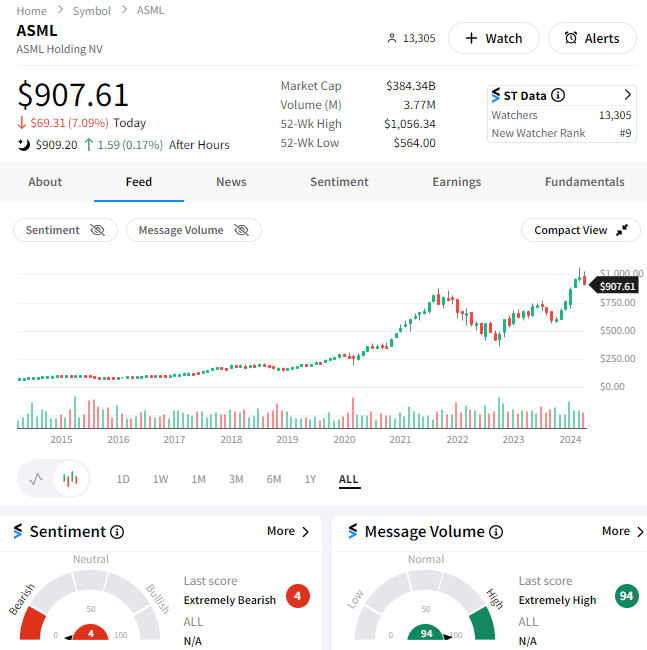

$ASML shares fell 7% on the day, heading for a restest of their 2021 highs. Meanwhile, Stocktwits sentiment pushed into “extremely bearish” territory as retail investors digested and debated today’s news. 🐻

EARNINGS

United Airlines Jumps While EVs’ Battery Drains

Today, it was the tale of two tapes for $UAL and $VFS, with United Airlines’ earnings pushing them higher and VinFast Auto’s leading them lower. 🙃

United Airlines adjusted loss per share of $0.15 was far narrower than the $0.57 loss expected, while revenues of $12.54 billion slightly beat estimates.

Expectations for this carrier had been pretty low, given their exposure to Boeing’s airplanes. But apparently, the company is managing the recent turmoil well enough to continue capitalizing on the travel boom.

Management has adjusted its fleet plan to better reflect the reality of what manufacturers can deliver, using what planes it can get its hands on to profitably grow its mid-continent hubs and profitable international network. ✈️

The company expects to receive just 61 of the 101 new narrow-body planes it initially forecasted and just a third of the 183 planes it had contracts for at the beginning of the year.

On the plus side, with fewer deliveries, it’ll be spending less money this year, reducing its annual capital expenditure estimate from $9 billion to $6.50 billion. As a result, it was able to maintain its full-year earnings forecast of $9 to $11 per share. 💰

While regulator scrutiny is likely to continue, the company is managing for now. That said, there is a continued risk of being so closely tied to Boeing that it’s impossible for the company to hedge out. As a result, investors will just have to keep that in the back of their minds as the next few quarters play out.

$UAL shares popped 17% on today’s news, keeping Stocktwits sentiment in “extremely bullish” territory where it’s been for much of the last week. 🐂

Meanwhile, electric vehicle (EV) troubles continued today as “meme stock” VinFast Auto plunged to new all-time lows. 🪫

The Vietnamese automaker’s adjusted loss per share of $0.26 was $0.04 wider than anticipated, while revenues of $303 million were more than 40% lower than anticipated. Its 9,689 quarterly deliveries were down 28% QoQ, with more than half of those being made to related parties. 😵💫

While management still expects to deliver 100,000 vehicles during 2024, the market is not feeling as confident in that prediction. Volumes are not expected to ramp up until the second half of the year and there remains significant uncertainty around industry demand and competition.

$VFS shares fell 11% as Stocktwits sentiment slipped into “extremely bearish” territory and message volume spiked. 😱

With the stock price falling below $5 recently, it’s likely the company will take some action to avoid being delisted from the primary U.S. exchanges. For now, the ‘big picture” remains bleak for publicly-traded EV companies, especially those who continue to miss their fundamental forecasts. 🤷

STOCKTWITS CONTENT

ICYMI: The Future’s Biggest Trends With ARK Invest’s Chief Futurist 🤖

We covered a ton of ground today with ARK Invest’s Chief Futurist, Brett Winton, at today’s live event. 👏

The conversation spanned across several hot topics, including:

ARK Invest’s five investment themes and how they all tie together

The rise of robotics and its impact on the economy and our lives

Tesla’s long-term outlook and full-self-driving (FSD) execution risk

How retail is gaining access to private companies like SpaceX

The Sci-Fi series that’s done the best job of predicting our future

If you missed it, you can listen to the replay here. And be sure to tweet us your thoughts on the conversation! 🎧

COMMODITIES

Can Energy Stocks Stick The Landing?

The rise in oil prices since December has brought many energy commodities and stock bulls out of the woodwork. 🛢️

But even with Middle East tensions rising almost daily, the price of U.S. crude oil failed to break through the mid-to-high 80s. The recent pullback in prices has pressured energy stocks, which are now back to a critical level.

The chart below shows the S&P 500’s energy sector ETF ($XLE), which is on technical analysts’ radars as it retests its multi-year breakout level near $90. 👀

Investors’ and traders’ question now is whether this pullback is routine or the start of a larger decline. Currently, the Stocktwits community’s sentiment reading on $XLE is bullish (68/100), suggesting they’ll use this dip to accumulate shares in anticipation of a longer-term move higher. 🛒

Technical analysts would generally agree with that approach, especially given that prices have spent the last two years consolidating before breaking out. And from a fundamental perspective, global tensions and economic strength present clear tailwinds for the price of oil and energy in general.

With that said, the market doesn’t always play nice with “clean” narratives like this one. As a result, we’ll have to wait and see if buyers step in at current levels (or at the 50-day moving average at $90) to protect this breakout and help shares continue their upward trend over the medium to long term. 📈

Bullets From The Day

🛒 Amazon enters the physical grocery cart game. After testing the tech in its own Fresh and Whole Foods locations, the tech giant will begin to offer smart grocery carts to third-party retailers. The recent scrutiny of its cashier-less checkout system has given itself and third parties a “strong conviction” that this smart cart technology has a place, especially in smaller stores with less staff. CNBC has more.

🚫 NBA bans player for life over online sports betting With the U.S. shifting from one extreme on sports betting (full ban) to the other (it’s everywhere), more issues are beginning to bubble to the surface. Raptor’s forward Jontay Porter’s lifetime ban from the league due to his involvement in online sports betting is the latest situation to raise red flags among betting companies, sports organizations, regulators, and other stakeholders. More from The Verge.

🎯 The FTC’s next antitrust target may be in the fashion space. The Federal Trade Commission (FTC) is considering blocking Tapestry’s $8.50 billion acquisition of Capri Holdings. The merger would bring together several top luxury brands, including Kate Spade, Versace, and Michael Kors. The commission is expected to meet next week to discuss the situation, but markets are reacting now, sending Capri shares sharply lower and Tapestry’s higher. Axios has more.

Links That Don’t Suck

🧑💻 Join IBD's free 2-hour trading workshop on 4/27 to learn the smarter way to buy and sell stocks*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍